Nitheesh NH

The Coresight Research team was in Las Vegas, attending and participating in the International Council of Shopping Centers (ICSC) 2019 RECon event, which ran May 19-22.

RECon is the world’s largest global gathering of retail real estate professionals, with leading developers, owners, brokers and retailers all coming together under one roof.

In this report, we review five insights on reinventing brick-and-mortar retail from RECon 2019. First, we briefly discuss the context.

Context: The mall is not dead, but it is being reincarnated

Landlords (and especially mall owners) are coming under renewed pressure in 2019: The slowdown in store closures we saw in 2018 has reversed and closures are again on the rise. By week 15 of 2019, announced closures had exceeded the total for all of 2018. We recorded 5,864 closures and 3,239 openings for the full year 2018. Year to date, US retailers have announced they will close 6,378 stores – and Coresight Research estimates US store closures could hit 12,000 by the end of the year.

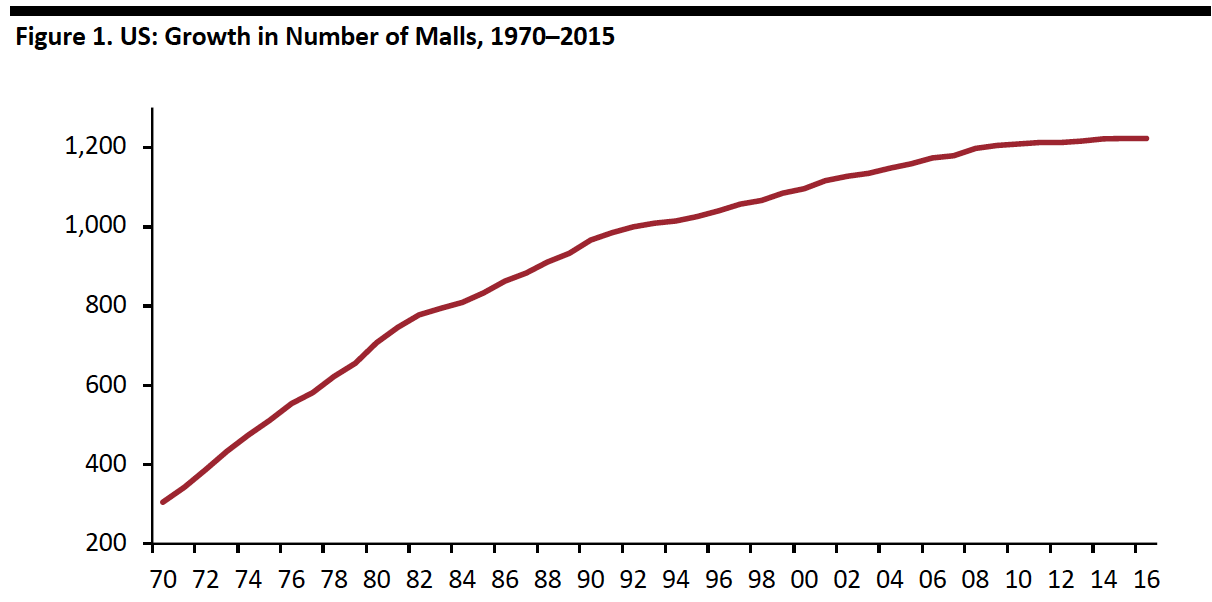

The US is over-retailed, with 23.5 square feet of retail per person, compared to 16.4 square feet in Canada and 11.1 square feet in Australia, according to Morningstar, and this saturation exhibits itself in the proliferation of shopping malls.

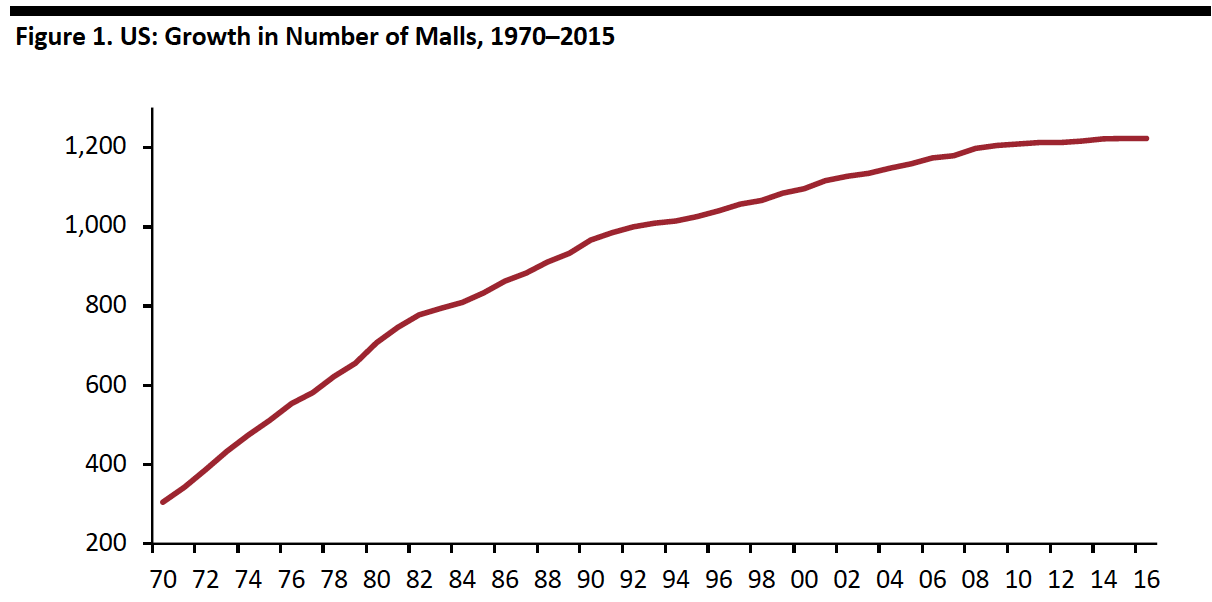

Over the past 45 years, the number of malls in the US grew 300%. According to the International Council of Shopping Centers (ICSC), there are currently 1,221 malls in the US versus just 305 in 1970. Although the pace of mall development has slowed, there remains an abundance of malls in the US.

[caption id="attachment_90272" align="aligncenter" width="700"] Source: ICSC[/caption]

Below, we discuss five insights on retail reinvention that we heard at RECon 2019.

1. Digital natives get physical

At this year’s RECon, we heard a lot more conversation about partnerships – and we’re seeing landlords and traditional brick-and-mortar stores teaming up with digitally native brands to create unique shopping experiences. Physical retail is embracing rotating pop-ups for digital platforms.

This is a win-win: Digital natives are coming to realize that a physical presence is key to success, but most have little understanding of how to manage physical space, let alone contend with long-term leases and other fixed costs. Traditional brick-and-mortar shops and malls working with digital pop-ups and installations benefit from a steadily changing experience that can encourage shoppers to keep coming back.

Simon, Macerich, Starwood and Triple Five Group have all established formats to feature digital brands in their malls. The idea is to break down the barriers that make it difficult for startups to secure retail space.

2. Embracing new tenants to make malls one-stop shopping

We’re also seeing an increased focus on non-traditional tenants for mall landlords as they look for innovative ways to draw in more customers and keep them inside the mall longer by turning it into a one-stop destination for everything. We’re seeing malls take on more nonretail tenants such as fitness centers, banks, medical practices, yoga studios and others to give consumers more reasons to come to the mall.

3. Luxury brands are investing in physical stores to enhance customer experience

Luxury is more about experience than product. Brand value is the key differentiator. But differentiation has become one of the biggest problems for luxury brands in this ever-changing landscape.

The physical store remains an important touchpoint for shoppers to experience luxury brands and high-end brands are investing in physical stores to enhance the customer experience. At RECon, we heard that luxury brands are expanding in some second-tier US cities where mall experiences have been improved.

4. AI will play a key role in the future of retail

Coresight Research CEO and Founder Deborah Weinswig moderated a panel discussion looking at how retailers are using AI to win. She was joined by Carlos Alberini, CEO and Director of Guess, Inc; Todd Kahn, President, Chief Administrative Officer and Chief Legal Officer at Tapestry, Inc; and, David Gottlieb, Managing Director, Americas, Trax.

Retailer spending on AI is projected to grow from $2 billion in 2017 to $7.3 billion by 2022. What is so appealing about AI that it is attracting so much retail investment? AI is akin to giving the computer a human-like brain, so AI-powered devices can learn, make decisions and solve problems.

[caption id="attachment_90220" align="aligncenter" width="720"]

Source: ICSC[/caption]

Below, we discuss five insights on retail reinvention that we heard at RECon 2019.

1. Digital natives get physical

At this year’s RECon, we heard a lot more conversation about partnerships – and we’re seeing landlords and traditional brick-and-mortar stores teaming up with digitally native brands to create unique shopping experiences. Physical retail is embracing rotating pop-ups for digital platforms.

This is a win-win: Digital natives are coming to realize that a physical presence is key to success, but most have little understanding of how to manage physical space, let alone contend with long-term leases and other fixed costs. Traditional brick-and-mortar shops and malls working with digital pop-ups and installations benefit from a steadily changing experience that can encourage shoppers to keep coming back.

Simon, Macerich, Starwood and Triple Five Group have all established formats to feature digital brands in their malls. The idea is to break down the barriers that make it difficult for startups to secure retail space.

2. Embracing new tenants to make malls one-stop shopping

We’re also seeing an increased focus on non-traditional tenants for mall landlords as they look for innovative ways to draw in more customers and keep them inside the mall longer by turning it into a one-stop destination for everything. We’re seeing malls take on more nonretail tenants such as fitness centers, banks, medical practices, yoga studios and others to give consumers more reasons to come to the mall.

3. Luxury brands are investing in physical stores to enhance customer experience

Luxury is more about experience than product. Brand value is the key differentiator. But differentiation has become one of the biggest problems for luxury brands in this ever-changing landscape.

The physical store remains an important touchpoint for shoppers to experience luxury brands and high-end brands are investing in physical stores to enhance the customer experience. At RECon, we heard that luxury brands are expanding in some second-tier US cities where mall experiences have been improved.

4. AI will play a key role in the future of retail

Coresight Research CEO and Founder Deborah Weinswig moderated a panel discussion looking at how retailers are using AI to win. She was joined by Carlos Alberini, CEO and Director of Guess, Inc; Todd Kahn, President, Chief Administrative Officer and Chief Legal Officer at Tapestry, Inc; and, David Gottlieb, Managing Director, Americas, Trax.

Retailer spending on AI is projected to grow from $2 billion in 2017 to $7.3 billion by 2022. What is so appealing about AI that it is attracting so much retail investment? AI is akin to giving the computer a human-like brain, so AI-powered devices can learn, make decisions and solve problems.

[caption id="attachment_90220" align="aligncenter" width="720"] Coresight Research CEO and Founder Deborah Weinswig kicks off a panel discussion on AI applications in retail with (from left to right) Carlos Alberini, CEO and Director of Guess, Inc.; Todd Kahn, President, Chief Administrative Officer and Chief Legal Officer at Tapestry, Inc.; and, David Gottlieb, Managing Director, Americas, Trax.

Coresight Research CEO and Founder Deborah Weinswig kicks off a panel discussion on AI applications in retail with (from left to right) Carlos Alberini, CEO and Director of Guess, Inc.; Todd Kahn, President, Chief Administrative Officer and Chief Legal Officer at Tapestry, Inc.; and, David Gottlieb, Managing Director, Americas, Trax.

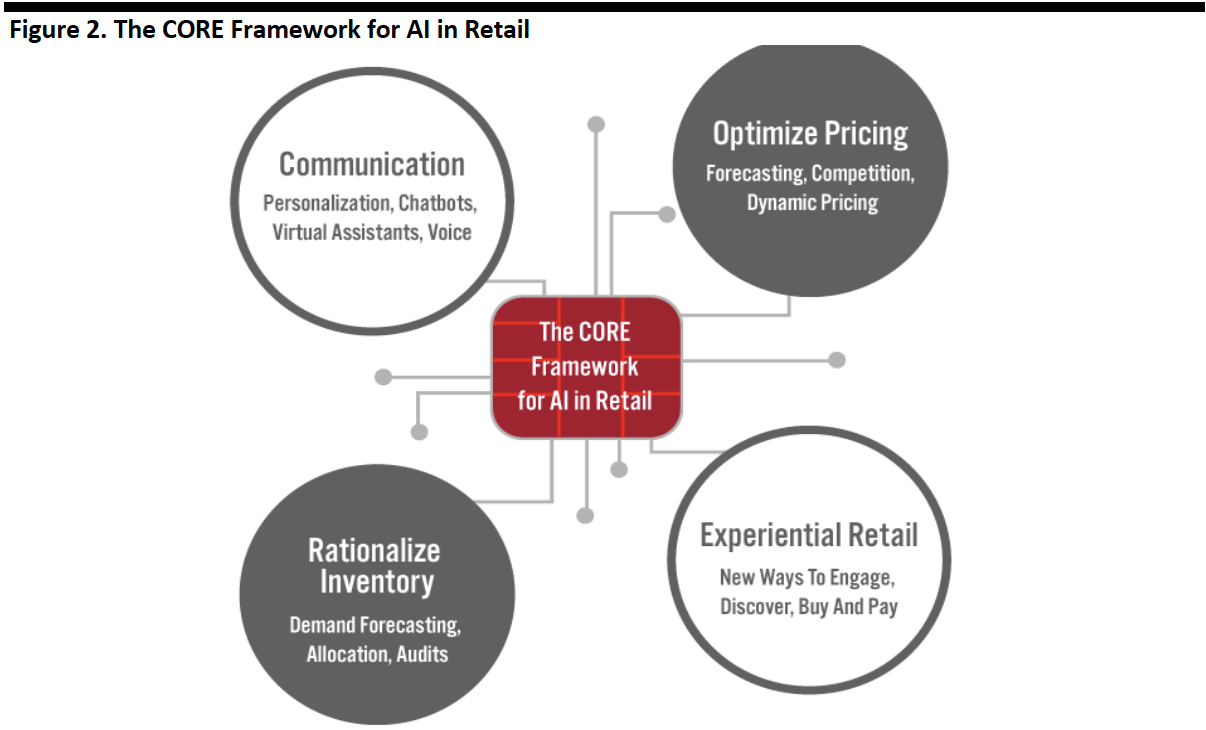

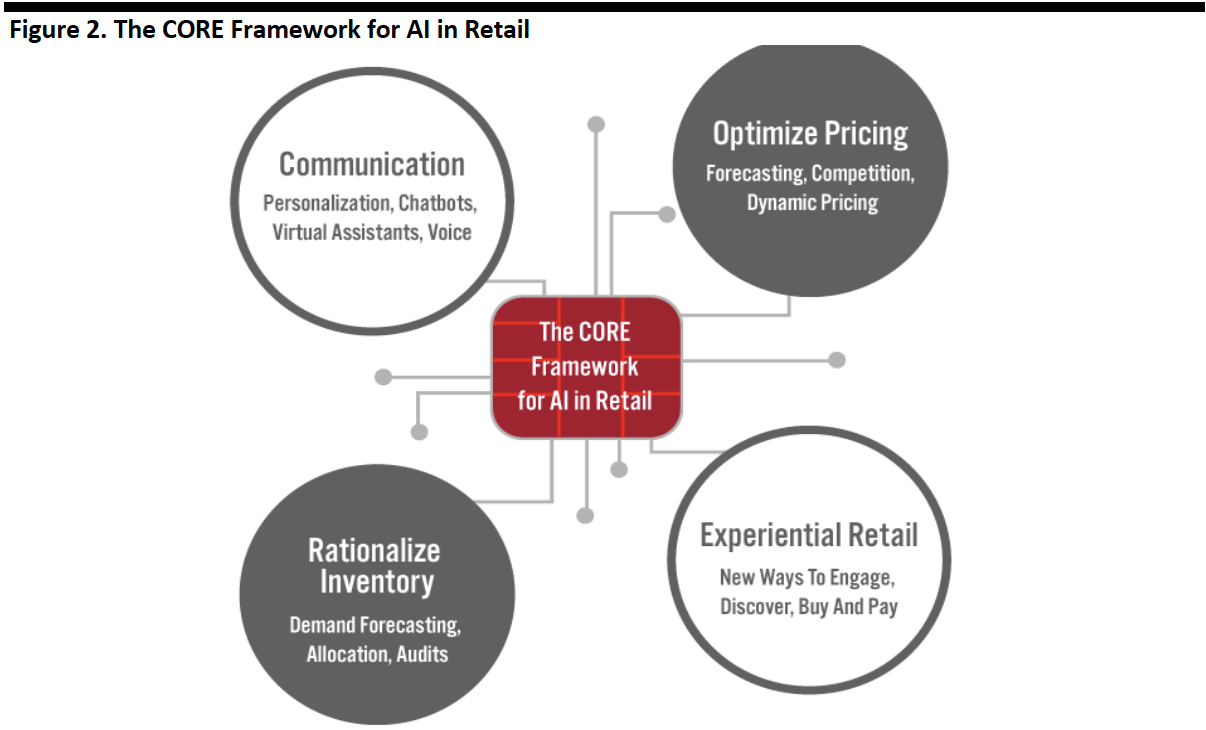

Source: Coresight Research[/caption] AI is the foundation of real capabilities that are already being used to drive better business performance and a better shopper experience. As we have previously discussed, our proprietary CORE framework highlights the potential application of AI in four areas of retail. We show these in the four quadrants below. [caption id="attachment_90273" align="aligncenter" width="700"] Source: Coresight Research[/caption]

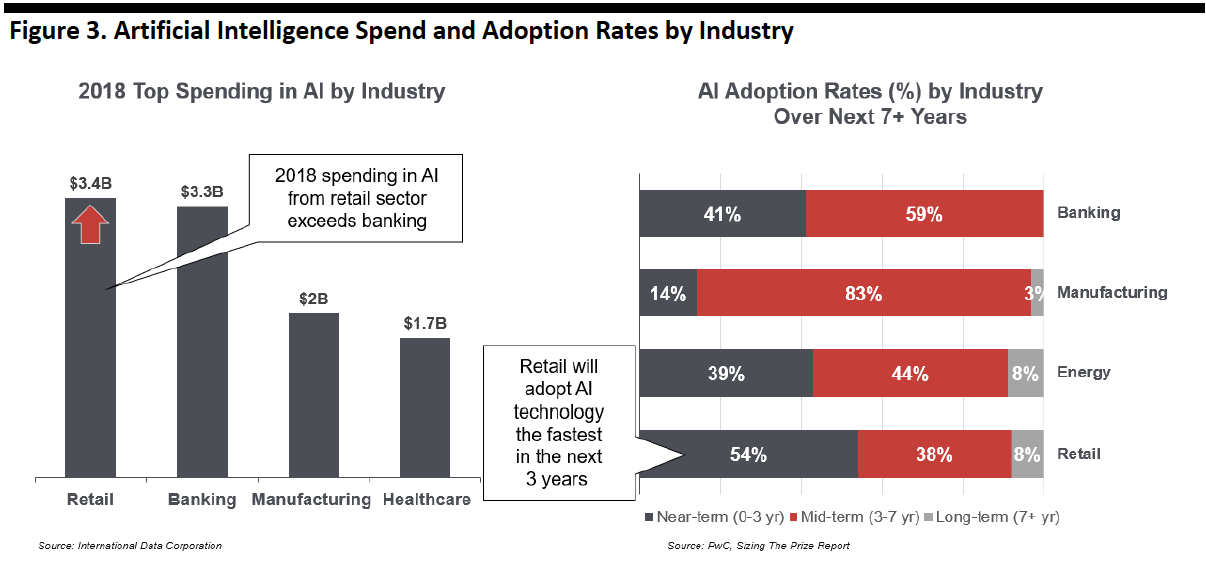

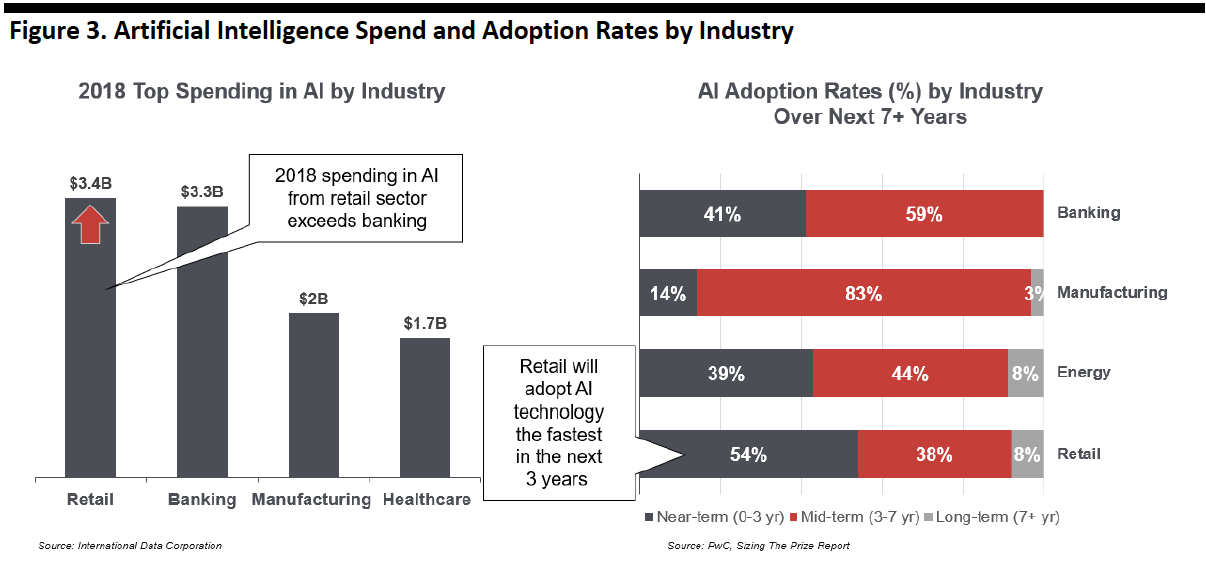

Given the potential to solve so many problems, reduce friction and drive conversion, it’s no wonder we’re seeing so much investment in AI. As shown below:

Source: Coresight Research[/caption]

Given the potential to solve so many problems, reduce friction and drive conversion, it’s no wonder we’re seeing so much investment in AI. As shown below:

Source: International Data Corporation, PWC[/caption]

These are some of the things you need to know about AI in 2019:

Source: International Data Corporation, PWC[/caption]

These are some of the things you need to know about AI in 2019:

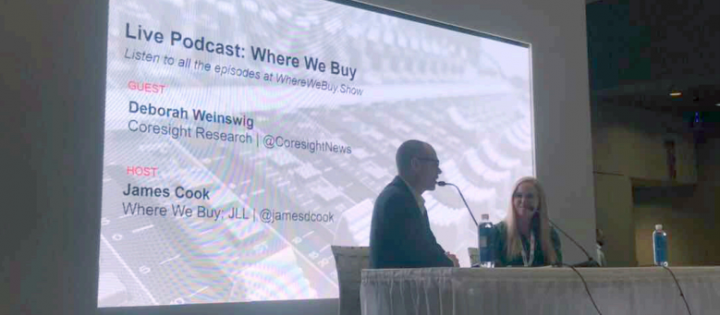

Coresight Research CEO and Founder Deborah Weinswig talks with James Cook, Americas Director of Research, Retail with JLL for a segment in Cook’s podcast series Where We Buy.

Coresight Research CEO and Founder Deborah Weinswig talks with James Cook, Americas Director of Research, Retail with JLL for a segment in Cook’s podcast series Where We Buy.

Source: Coresight Research[/caption]

Source: ICSC[/caption]

Below, we discuss five insights on retail reinvention that we heard at RECon 2019.

1. Digital natives get physical

At this year’s RECon, we heard a lot more conversation about partnerships – and we’re seeing landlords and traditional brick-and-mortar stores teaming up with digitally native brands to create unique shopping experiences. Physical retail is embracing rotating pop-ups for digital platforms.

This is a win-win: Digital natives are coming to realize that a physical presence is key to success, but most have little understanding of how to manage physical space, let alone contend with long-term leases and other fixed costs. Traditional brick-and-mortar shops and malls working with digital pop-ups and installations benefit from a steadily changing experience that can encourage shoppers to keep coming back.

Simon, Macerich, Starwood and Triple Five Group have all established formats to feature digital brands in their malls. The idea is to break down the barriers that make it difficult for startups to secure retail space.

2. Embracing new tenants to make malls one-stop shopping

We’re also seeing an increased focus on non-traditional tenants for mall landlords as they look for innovative ways to draw in more customers and keep them inside the mall longer by turning it into a one-stop destination for everything. We’re seeing malls take on more nonretail tenants such as fitness centers, banks, medical practices, yoga studios and others to give consumers more reasons to come to the mall.

3. Luxury brands are investing in physical stores to enhance customer experience

Luxury is more about experience than product. Brand value is the key differentiator. But differentiation has become one of the biggest problems for luxury brands in this ever-changing landscape.

The physical store remains an important touchpoint for shoppers to experience luxury brands and high-end brands are investing in physical stores to enhance the customer experience. At RECon, we heard that luxury brands are expanding in some second-tier US cities where mall experiences have been improved.

4. AI will play a key role in the future of retail

Coresight Research CEO and Founder Deborah Weinswig moderated a panel discussion looking at how retailers are using AI to win. She was joined by Carlos Alberini, CEO and Director of Guess, Inc; Todd Kahn, President, Chief Administrative Officer and Chief Legal Officer at Tapestry, Inc; and, David Gottlieb, Managing Director, Americas, Trax.

Retailer spending on AI is projected to grow from $2 billion in 2017 to $7.3 billion by 2022. What is so appealing about AI that it is attracting so much retail investment? AI is akin to giving the computer a human-like brain, so AI-powered devices can learn, make decisions and solve problems.

[caption id="attachment_90220" align="aligncenter" width="720"]

Source: ICSC[/caption]

Below, we discuss five insights on retail reinvention that we heard at RECon 2019.

1. Digital natives get physical

At this year’s RECon, we heard a lot more conversation about partnerships – and we’re seeing landlords and traditional brick-and-mortar stores teaming up with digitally native brands to create unique shopping experiences. Physical retail is embracing rotating pop-ups for digital platforms.

This is a win-win: Digital natives are coming to realize that a physical presence is key to success, but most have little understanding of how to manage physical space, let alone contend with long-term leases and other fixed costs. Traditional brick-and-mortar shops and malls working with digital pop-ups and installations benefit from a steadily changing experience that can encourage shoppers to keep coming back.

Simon, Macerich, Starwood and Triple Five Group have all established formats to feature digital brands in their malls. The idea is to break down the barriers that make it difficult for startups to secure retail space.

2. Embracing new tenants to make malls one-stop shopping

We’re also seeing an increased focus on non-traditional tenants for mall landlords as they look for innovative ways to draw in more customers and keep them inside the mall longer by turning it into a one-stop destination for everything. We’re seeing malls take on more nonretail tenants such as fitness centers, banks, medical practices, yoga studios and others to give consumers more reasons to come to the mall.

3. Luxury brands are investing in physical stores to enhance customer experience

Luxury is more about experience than product. Brand value is the key differentiator. But differentiation has become one of the biggest problems for luxury brands in this ever-changing landscape.

The physical store remains an important touchpoint for shoppers to experience luxury brands and high-end brands are investing in physical stores to enhance the customer experience. At RECon, we heard that luxury brands are expanding in some second-tier US cities where mall experiences have been improved.

4. AI will play a key role in the future of retail

Coresight Research CEO and Founder Deborah Weinswig moderated a panel discussion looking at how retailers are using AI to win. She was joined by Carlos Alberini, CEO and Director of Guess, Inc; Todd Kahn, President, Chief Administrative Officer and Chief Legal Officer at Tapestry, Inc; and, David Gottlieb, Managing Director, Americas, Trax.

Retailer spending on AI is projected to grow from $2 billion in 2017 to $7.3 billion by 2022. What is so appealing about AI that it is attracting so much retail investment? AI is akin to giving the computer a human-like brain, so AI-powered devices can learn, make decisions and solve problems.

[caption id="attachment_90220" align="aligncenter" width="720"] Coresight Research CEO and Founder Deborah Weinswig kicks off a panel discussion on AI applications in retail with (from left to right) Carlos Alberini, CEO and Director of Guess, Inc.; Todd Kahn, President, Chief Administrative Officer and Chief Legal Officer at Tapestry, Inc.; and, David Gottlieb, Managing Director, Americas, Trax.

Coresight Research CEO and Founder Deborah Weinswig kicks off a panel discussion on AI applications in retail with (from left to right) Carlos Alberini, CEO and Director of Guess, Inc.; Todd Kahn, President, Chief Administrative Officer and Chief Legal Officer at Tapestry, Inc.; and, David Gottlieb, Managing Director, Americas, Trax.Source: Coresight Research[/caption] AI is the foundation of real capabilities that are already being used to drive better business performance and a better shopper experience. As we have previously discussed, our proprietary CORE framework highlights the potential application of AI in four areas of retail. We show these in the four quadrants below. [caption id="attachment_90273" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Given the potential to solve so many problems, reduce friction and drive conversion, it’s no wonder we’re seeing so much investment in AI. As shown below:

Source: Coresight Research[/caption]

Given the potential to solve so many problems, reduce friction and drive conversion, it’s no wonder we’re seeing so much investment in AI. As shown below:

- Retail investment in AI is now greater than that of the banking sector.

- Retail is set to adopt AI faster than other industries in the next three years.

Source: International Data Corporation, PWC[/caption]

These are some of the things you need to know about AI in 2019:

Source: International Data Corporation, PWC[/caption]

These are some of the things you need to know about AI in 2019:

- AI will become retailers’ go-to technology to strip friction from brick-and-mortar retail.

- Consumers will come to expect more smart retail experiences, enabled by AI.

- Western retailers will increasingly adopt China’s New Retail as consumers in the US and Europe catch up to China’s heavy preference for digital, and especially mobile, shopping.

Coresight Research CEO and Founder Deborah Weinswig talks with James Cook, Americas Director of Research, Retail with JLL for a segment in Cook’s podcast series Where We Buy.

Coresight Research CEO and Founder Deborah Weinswig talks with James Cook, Americas Director of Research, Retail with JLL for a segment in Cook’s podcast series Where We Buy.Source: Coresight Research[/caption]