albert Chan

The Coresight Research team is in Las Vegas this week, attending and participating in the International Council of Shopping Centers (ICSC) 2019 RECon event, running May 19-22.

RECon is the world’s largest global gathering of retail real estate professionals, with leading developers, owners, brokers and retailers all coming together under one roof.

These are some of the highlights from day 1:

The mall is not dead, but it is being reincarnated

Landlords (and especially mall owners) are coming under renewed pressure in 2019: The slowdown in store closures we saw in 2018 has reversed and closures are again on the rise. By week 15 of 2019, announced closures had exceeded the total for all of 2018. We recorded 5,864 closures and 3,239 openings for the full year 2018. Year to date, US retailers have announced they will close 6,378 stores – and Coresight Research estimates US store closures could hit 12,000 by the end of the year.

What’s driving this?

The US is over-retailed, with 23.5 square feet of retail per person, compared to 16.4 square feet in Canada and 11.1 square feet in Australia, according to Morningstar, and this saturation exhibits itself in the proliferation of shopping malls.

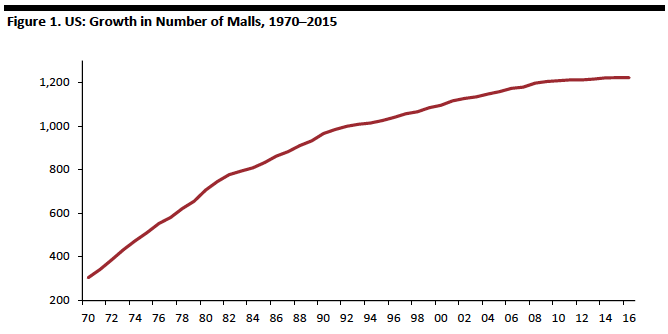

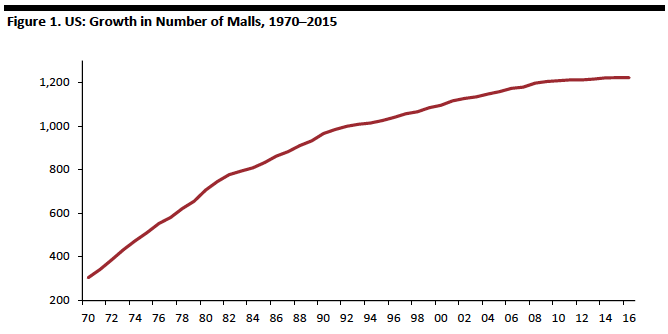

Over the past 45 years, the number of malls in the US grew 300%. According to the International Council of Shopping Centers (ICSC), there are currently 1,221 malls in the US versus just 305 in 1970. Although the pace of mall development has slowed, there remains an abundance of malls in the US.

[caption id="attachment_88576" align="aligncenter" width="668"] Source: ICSC[/caption]

Against this backdrop, malls and other landlords are looking for innovative solutions to keep up with fast-shifting consumer preferences. One opportunity noted at RECon is BOPUM (buy online, pick up in mall) which, if implemented with a customer service element, could support mall traffic.

Digital natives get physical

Digitally native brands are coming to realize that a physical presence is key to success, and landlords are courting them to join mixed retail initiatives from inception through installation. Simon, Macerich, Starwood and Triple Five Group have all established formats to feature digital brands in their malls. The idea is to break down the barriers that make it difficult for startups to secure retail space.

One example is Fourpost. With enough space to house at least 20-30 vendors, Fourpost offers "Studio Shops" which come equipped with everything a small startup needs to start a brick-and-mortar operation, such as fixtures, lighting, Wi-Fi – and most importantly, a short-term lease. The Fourpost model cuts upfront cost and eliminates the barrier of a long-term lease.

But, it’s all about the startup: Fourpost wants to make coming to the mall fun again, through its continually evolving assortment in the space, customers can see something different every time they come.

And, for the first time, we’ve have heard landlords talking about partnerships throughout the ecosystem – even with competitors.

Embracing new tenants to make malls one-stop shopping

We’re also seeing an increased focus on non-traditional tenants for mall landlords as they look for innovative ways to draw in more customers and keep them inside the mall longer by turning it into a one-stop destination for everything. We’re seeing malls take on more nonretail tenants such as fitness centers, banks, medical practices, yoga studios and others to give consumers more reasons to come to the mall.

Entertainment is also becoming increasingly important to drive mall traffic, such as VIP events, key opinion leader (KOL)/influencer events, and food and beverage activities.

Macerich is teaming up with coworking company Industrious to bring shared office spaces into some of its shopping centers, while Brookfield Properties Retail Group signed a deal with WeWork in 2017.

Simon Property Group has redeveloped closed mall department stores into hotels, fitness centers, entertainment centers and modern dining outlets.

Taubman centers has strategically added destination retailers and anchors such as Sea Life Aquarium, Legoland, RH Gallery, Round1, Sports Monster and Aquafield to its centers.

Luxury brands are investing in physical stores to enhance customer experience

Luxury is more about experience than product. Brand value is the key differentiator. But differentiation has become one of the biggest problems for luxury brands in this ever-changing landscape.

The physical store remains an important touchpoint for shoppers to experience luxury brands and high-end brands are investing in physical stores to enhance the customer experience. At RECon, we heard that luxury brands are expanding in some second-tier US cities where mall experiences have been improved.

At the same time, we’re seeing luxury embrace social values such as diversity and inclusion as well as sustainability. Limited runs, in particular, provide the experience element many young buyers look for, and can prove a traffic driver for physical stores.

Chinese consumers are a growing portion of US luxury

The Chinese tourist is a significant opportunity for all retail – but for luxury in particular. Chinese consumers are a growing segment in the US luxury market and so represent a significant opportunity. But understanding the evolving Chinese tourist is key to making the most of this opportunity: Retailers must offer suitable payment options and establish relevant social-media presences, and they must offer in-store experiences that resonate with Chinese travelers.

These are some other key things brands need to know:

Source: ICSC[/caption]

Against this backdrop, malls and other landlords are looking for innovative solutions to keep up with fast-shifting consumer preferences. One opportunity noted at RECon is BOPUM (buy online, pick up in mall) which, if implemented with a customer service element, could support mall traffic.

Digital natives get physical

Digitally native brands are coming to realize that a physical presence is key to success, and landlords are courting them to join mixed retail initiatives from inception through installation. Simon, Macerich, Starwood and Triple Five Group have all established formats to feature digital brands in their malls. The idea is to break down the barriers that make it difficult for startups to secure retail space.

One example is Fourpost. With enough space to house at least 20-30 vendors, Fourpost offers "Studio Shops" which come equipped with everything a small startup needs to start a brick-and-mortar operation, such as fixtures, lighting, Wi-Fi – and most importantly, a short-term lease. The Fourpost model cuts upfront cost and eliminates the barrier of a long-term lease.

But, it’s all about the startup: Fourpost wants to make coming to the mall fun again, through its continually evolving assortment in the space, customers can see something different every time they come.

And, for the first time, we’ve have heard landlords talking about partnerships throughout the ecosystem – even with competitors.

Embracing new tenants to make malls one-stop shopping

We’re also seeing an increased focus on non-traditional tenants for mall landlords as they look for innovative ways to draw in more customers and keep them inside the mall longer by turning it into a one-stop destination for everything. We’re seeing malls take on more nonretail tenants such as fitness centers, banks, medical practices, yoga studios and others to give consumers more reasons to come to the mall.

Entertainment is also becoming increasingly important to drive mall traffic, such as VIP events, key opinion leader (KOL)/influencer events, and food and beverage activities.

Macerich is teaming up with coworking company Industrious to bring shared office spaces into some of its shopping centers, while Brookfield Properties Retail Group signed a deal with WeWork in 2017.

Simon Property Group has redeveloped closed mall department stores into hotels, fitness centers, entertainment centers and modern dining outlets.

Taubman centers has strategically added destination retailers and anchors such as Sea Life Aquarium, Legoland, RH Gallery, Round1, Sports Monster and Aquafield to its centers.

Luxury brands are investing in physical stores to enhance customer experience

Luxury is more about experience than product. Brand value is the key differentiator. But differentiation has become one of the biggest problems for luxury brands in this ever-changing landscape.

The physical store remains an important touchpoint for shoppers to experience luxury brands and high-end brands are investing in physical stores to enhance the customer experience. At RECon, we heard that luxury brands are expanding in some second-tier US cities where mall experiences have been improved.

At the same time, we’re seeing luxury embrace social values such as diversity and inclusion as well as sustainability. Limited runs, in particular, provide the experience element many young buyers look for, and can prove a traffic driver for physical stores.

Chinese consumers are a growing portion of US luxury

The Chinese tourist is a significant opportunity for all retail – but for luxury in particular. Chinese consumers are a growing segment in the US luxury market and so represent a significant opportunity. But understanding the evolving Chinese tourist is key to making the most of this opportunity: Retailers must offer suitable payment options and establish relevant social-media presences, and they must offer in-store experiences that resonate with Chinese travelers.

These are some other key things brands need to know:

Source: ICSC[/caption]

Against this backdrop, malls and other landlords are looking for innovative solutions to keep up with fast-shifting consumer preferences. One opportunity noted at RECon is BOPUM (buy online, pick up in mall) which, if implemented with a customer service element, could support mall traffic.

Digital natives get physical

Digitally native brands are coming to realize that a physical presence is key to success, and landlords are courting them to join mixed retail initiatives from inception through installation. Simon, Macerich, Starwood and Triple Five Group have all established formats to feature digital brands in their malls. The idea is to break down the barriers that make it difficult for startups to secure retail space.

One example is Fourpost. With enough space to house at least 20-30 vendors, Fourpost offers "Studio Shops" which come equipped with everything a small startup needs to start a brick-and-mortar operation, such as fixtures, lighting, Wi-Fi – and most importantly, a short-term lease. The Fourpost model cuts upfront cost and eliminates the barrier of a long-term lease.

But, it’s all about the startup: Fourpost wants to make coming to the mall fun again, through its continually evolving assortment in the space, customers can see something different every time they come.

And, for the first time, we’ve have heard landlords talking about partnerships throughout the ecosystem – even with competitors.

Embracing new tenants to make malls one-stop shopping

We’re also seeing an increased focus on non-traditional tenants for mall landlords as they look for innovative ways to draw in more customers and keep them inside the mall longer by turning it into a one-stop destination for everything. We’re seeing malls take on more nonretail tenants such as fitness centers, banks, medical practices, yoga studios and others to give consumers more reasons to come to the mall.

Entertainment is also becoming increasingly important to drive mall traffic, such as VIP events, key opinion leader (KOL)/influencer events, and food and beverage activities.

Macerich is teaming up with coworking company Industrious to bring shared office spaces into some of its shopping centers, while Brookfield Properties Retail Group signed a deal with WeWork in 2017.

Simon Property Group has redeveloped closed mall department stores into hotels, fitness centers, entertainment centers and modern dining outlets.

Taubman centers has strategically added destination retailers and anchors such as Sea Life Aquarium, Legoland, RH Gallery, Round1, Sports Monster and Aquafield to its centers.

Luxury brands are investing in physical stores to enhance customer experience

Luxury is more about experience than product. Brand value is the key differentiator. But differentiation has become one of the biggest problems for luxury brands in this ever-changing landscape.

The physical store remains an important touchpoint for shoppers to experience luxury brands and high-end brands are investing in physical stores to enhance the customer experience. At RECon, we heard that luxury brands are expanding in some second-tier US cities where mall experiences have been improved.

At the same time, we’re seeing luxury embrace social values such as diversity and inclusion as well as sustainability. Limited runs, in particular, provide the experience element many young buyers look for, and can prove a traffic driver for physical stores.

Chinese consumers are a growing portion of US luxury

The Chinese tourist is a significant opportunity for all retail – but for luxury in particular. Chinese consumers are a growing segment in the US luxury market and so represent a significant opportunity. But understanding the evolving Chinese tourist is key to making the most of this opportunity: Retailers must offer suitable payment options and establish relevant social-media presences, and they must offer in-store experiences that resonate with Chinese travelers.

These are some other key things brands need to know:

Source: ICSC[/caption]

Against this backdrop, malls and other landlords are looking for innovative solutions to keep up with fast-shifting consumer preferences. One opportunity noted at RECon is BOPUM (buy online, pick up in mall) which, if implemented with a customer service element, could support mall traffic.

Digital natives get physical

Digitally native brands are coming to realize that a physical presence is key to success, and landlords are courting them to join mixed retail initiatives from inception through installation. Simon, Macerich, Starwood and Triple Five Group have all established formats to feature digital brands in their malls. The idea is to break down the barriers that make it difficult for startups to secure retail space.

One example is Fourpost. With enough space to house at least 20-30 vendors, Fourpost offers "Studio Shops" which come equipped with everything a small startup needs to start a brick-and-mortar operation, such as fixtures, lighting, Wi-Fi – and most importantly, a short-term lease. The Fourpost model cuts upfront cost and eliminates the barrier of a long-term lease.

But, it’s all about the startup: Fourpost wants to make coming to the mall fun again, through its continually evolving assortment in the space, customers can see something different every time they come.

And, for the first time, we’ve have heard landlords talking about partnerships throughout the ecosystem – even with competitors.

Embracing new tenants to make malls one-stop shopping

We’re also seeing an increased focus on non-traditional tenants for mall landlords as they look for innovative ways to draw in more customers and keep them inside the mall longer by turning it into a one-stop destination for everything. We’re seeing malls take on more nonretail tenants such as fitness centers, banks, medical practices, yoga studios and others to give consumers more reasons to come to the mall.

Entertainment is also becoming increasingly important to drive mall traffic, such as VIP events, key opinion leader (KOL)/influencer events, and food and beverage activities.

Macerich is teaming up with coworking company Industrious to bring shared office spaces into some of its shopping centers, while Brookfield Properties Retail Group signed a deal with WeWork in 2017.

Simon Property Group has redeveloped closed mall department stores into hotels, fitness centers, entertainment centers and modern dining outlets.

Taubman centers has strategically added destination retailers and anchors such as Sea Life Aquarium, Legoland, RH Gallery, Round1, Sports Monster and Aquafield to its centers.

Luxury brands are investing in physical stores to enhance customer experience

Luxury is more about experience than product. Brand value is the key differentiator. But differentiation has become one of the biggest problems for luxury brands in this ever-changing landscape.

The physical store remains an important touchpoint for shoppers to experience luxury brands and high-end brands are investing in physical stores to enhance the customer experience. At RECon, we heard that luxury brands are expanding in some second-tier US cities where mall experiences have been improved.

At the same time, we’re seeing luxury embrace social values such as diversity and inclusion as well as sustainability. Limited runs, in particular, provide the experience element many young buyers look for, and can prove a traffic driver for physical stores.

Chinese consumers are a growing portion of US luxury

The Chinese tourist is a significant opportunity for all retail – but for luxury in particular. Chinese consumers are a growing segment in the US luxury market and so represent a significant opportunity. But understanding the evolving Chinese tourist is key to making the most of this opportunity: Retailers must offer suitable payment options and establish relevant social-media presences, and they must offer in-store experiences that resonate with Chinese travelers.

These are some other key things brands need to know:

- Millennials are changing the nature of the Chinese outbound travel market. Younger travelers take more trips per year than average, and they take a more independent approach to booking travel arrangements. In addition, the number of young people traveling with friends is on the rise.

- Demand for overseas beauty purchases — especially prestige beauty products — remains solid, and we expect this to underpin international retail demand from Chinese travelers.

- Group travel remains popular, especially among residents of lower-tier cities. However, most travelers now opt to either make their own travel arrangements independently or book package tours. Fully independent travel is becoming more prevalent, led by residents of first-tier cities.

- Retailers and service providers must offer information, booking capability, shopping experiences and payment options via mobile, including through popular Chinese apps such as WeChat and Alipay.

- Adding independent and direct-to-consumer brands to their physical and online offerings.

- Deploying technology to enhance customer service in stores.

- Executing BOPIS (buy online, pick up in store) well at the store level.