DIpil Das

[caption id="attachment_98117" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

3Q19 Results

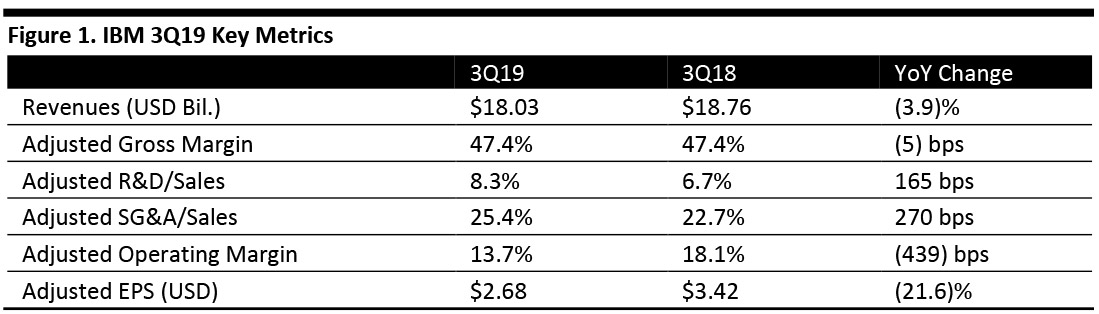

IBM reported 3Q19 revenues of $18.03 billion, down 3.9% year over year and below the $18.22 billion consensus estimate.

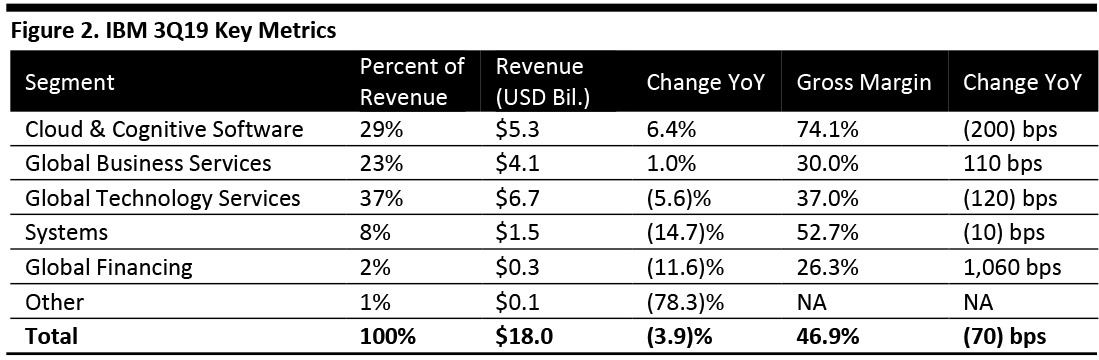

Management highlighted strong performance in cloud, data/AI, security and digital, led by the Cloud & Cognitive Software and Global Business Services segments. The company also highlighted momentum in hybrid cloud, including Red Hat.

Adjusted EPS was $2.68, down 21.6% from the year-ago quarter and beating the consensus of $2.66. GAAP EPS from continuing operations was $1.87, compared to $2.94 in the year-ago quarter.

Red Hat Update

Source: Company reports/Coresight Research[/caption]

3Q19 Results

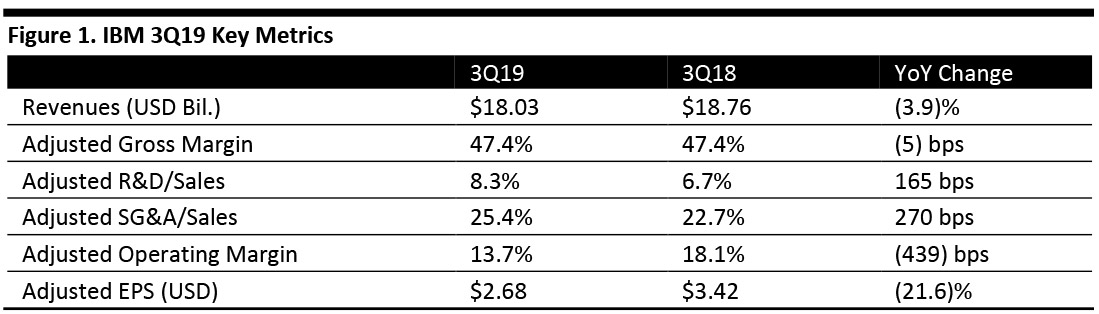

IBM reported 3Q19 revenues of $18.03 billion, down 3.9% year over year and below the $18.22 billion consensus estimate.

Management highlighted strong performance in cloud, data/AI, security and digital, led by the Cloud & Cognitive Software and Global Business Services segments. The company also highlighted momentum in hybrid cloud, including Red Hat.

Adjusted EPS was $2.68, down 21.6% from the year-ago quarter and beating the consensus of $2.66. GAAP EPS from continuing operations was $1.87, compared to $2.94 in the year-ago quarter.

Red Hat Update

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Note: Gross margins are GAAP [/caption] Cloud & Cognitive Software (including Red Hat)

Source: Company reports/Coresight Research[/caption]

3Q19 Results

IBM reported 3Q19 revenues of $18.03 billion, down 3.9% year over year and below the $18.22 billion consensus estimate.

Management highlighted strong performance in cloud, data/AI, security and digital, led by the Cloud & Cognitive Software and Global Business Services segments. The company also highlighted momentum in hybrid cloud, including Red Hat.

Adjusted EPS was $2.68, down 21.6% from the year-ago quarter and beating the consensus of $2.66. GAAP EPS from continuing operations was $1.87, compared to $2.94 in the year-ago quarter.

Red Hat Update

Source: Company reports/Coresight Research[/caption]

3Q19 Results

IBM reported 3Q19 revenues of $18.03 billion, down 3.9% year over year and below the $18.22 billion consensus estimate.

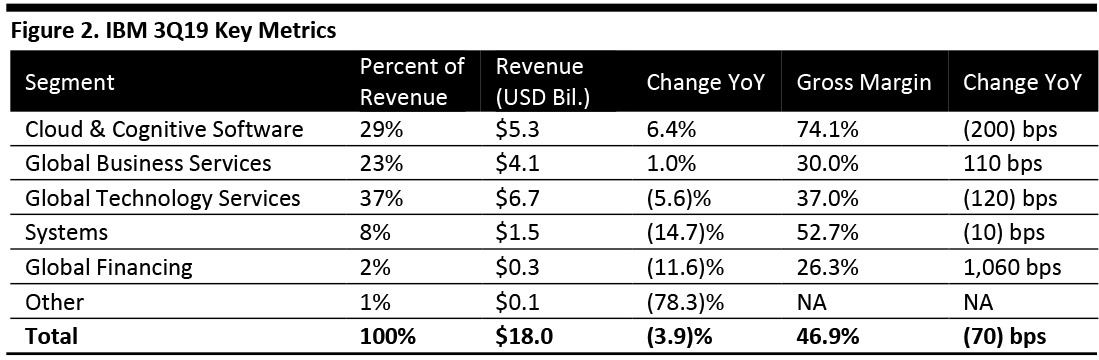

Management highlighted strong performance in cloud, data/AI, security and digital, led by the Cloud & Cognitive Software and Global Business Services segments. The company also highlighted momentum in hybrid cloud, including Red Hat.

Adjusted EPS was $2.68, down 21.6% from the year-ago quarter and beating the consensus of $2.66. GAAP EPS from continuing operations was $1.87, compared to $2.94 in the year-ago quarter.

Red Hat Update

- Revenues grew 19% as reported and 20% adjusted for currency.

- The unit signed more than 20 deals in 3Q19 (which fall within the Global Business segment).

- Red Hat recorded double digit growth in Infrastructure, led by the Red Hat Linux operating system (RHEL), in addition to continued strong growth in App Dev emerging technology, led by OpenShift and Ansible.

- The unit is offering innovation by leveraging the Linux operating system, containers and Kubernetes (an open-source software orchestration system).

- Red Hat is also adding new OpenShift clients, expanding with existing Red Hat clients and aggressively hiring to address client demand. Employee attrition is stable.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Note: Gross margins are GAAP [/caption] Cloud & Cognitive Software (including Red Hat)

- Growth was led by led by security, IoT, data, AI platforms and hybrid cloud.

- IBM recorded $20 billion in cloud revenue over the last 12 months and more than 60% growth in cloud signings.

- Cloud and data platforms grew 17% (up 19% adjusting for currency).

- Cognitive applications grew 4% (up 6% adjusting for currency).

- Transaction processing platforms declined 5% (down 4% adjusting for currency).

- Revenues grew 1.0% (up 2.2 % adjusting for currency), led by growth in consulting, up 4% (up 5% adjusting for currency).

- Revenues declined 14.7% (down 13.8% adjusting for currency), due to the end of the product cycle for the IBM z14 enterprise computing platform. The new IBM z15 began shipping in the last week of September. IBM is launching a cloud-native, modernized software portfolio.

- Revenues declined 11.7% (down 10.7% adjusting for currency), reflecting the wind-down of OEM commercial financing.