DIpil Das

[caption id="attachment_93134" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

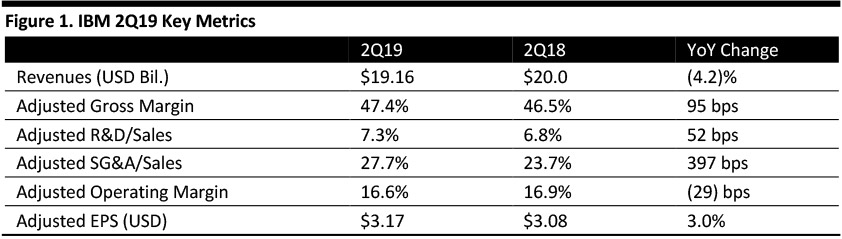

IBM reported 2Q19 revenues of $19.16 billion, down 4.2% year over year and in line with the consensus estimate. Management highlighted growth in software, consulting and cloud revenue, in addition to continued margin expansion.

The 100-bps expansion in the GAAP gross margin was the largest expansion in more than five years. SG&A expenses from several charges were essentially neutral to total expense and to profit growth in the quarter.

Adjusted EPS was $3.17, up 3.0% from the year-ago quarter and beating consensus of $3.08. GAAP EPS from continuing operations was $2.81, compared to $2.61 in the year-ago quarter.

IBM closed the acquisition of Red Hat on July 9.

Management commented that IBM continued to grow in the high-value areas of the business, led by strong performance in the cloud and cognitive software segment. The completion of the Red Hat acquisition is expected to create the industry’s only true open hybrid multi-cloud platform, strengthening IBM’s leadership position and helping clients succeed in their digital reinventions.

Results by Segment

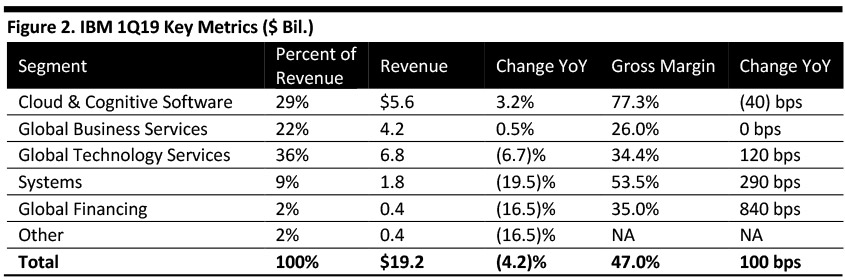

Segment performance was as follows:

[caption id="attachment_93135" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

IBM reported 2Q19 revenues of $19.16 billion, down 4.2% year over year and in line with the consensus estimate. Management highlighted growth in software, consulting and cloud revenue, in addition to continued margin expansion.

The 100-bps expansion in the GAAP gross margin was the largest expansion in more than five years. SG&A expenses from several charges were essentially neutral to total expense and to profit growth in the quarter.

Adjusted EPS was $3.17, up 3.0% from the year-ago quarter and beating consensus of $3.08. GAAP EPS from continuing operations was $2.81, compared to $2.61 in the year-ago quarter.

IBM closed the acquisition of Red Hat on July 9.

Management commented that IBM continued to grow in the high-value areas of the business, led by strong performance in the cloud and cognitive software segment. The completion of the Red Hat acquisition is expected to create the industry’s only true open hybrid multi-cloud platform, strengthening IBM’s leadership position and helping clients succeed in their digital reinventions.

Results by Segment

Segment performance was as follows:

[caption id="attachment_93135" align="aligncenter" width="700"] Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Note: Gross margins are GAAP [/caption] Cloud & Cognitive Software

Source: Company reports/Coresight Research[/caption]

2Q19 Results

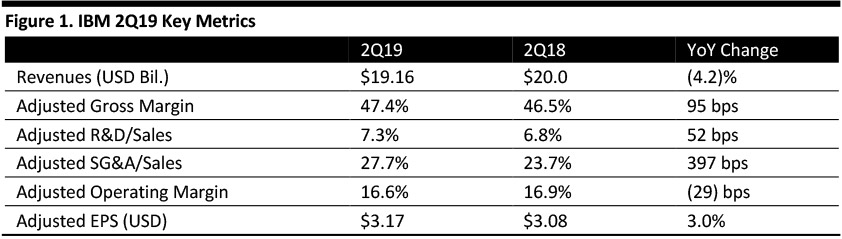

IBM reported 2Q19 revenues of $19.16 billion, down 4.2% year over year and in line with the consensus estimate. Management highlighted growth in software, consulting and cloud revenue, in addition to continued margin expansion.

The 100-bps expansion in the GAAP gross margin was the largest expansion in more than five years. SG&A expenses from several charges were essentially neutral to total expense and to profit growth in the quarter.

Adjusted EPS was $3.17, up 3.0% from the year-ago quarter and beating consensus of $3.08. GAAP EPS from continuing operations was $2.81, compared to $2.61 in the year-ago quarter.

IBM closed the acquisition of Red Hat on July 9.

Management commented that IBM continued to grow in the high-value areas of the business, led by strong performance in the cloud and cognitive software segment. The completion of the Red Hat acquisition is expected to create the industry’s only true open hybrid multi-cloud platform, strengthening IBM’s leadership position and helping clients succeed in their digital reinventions.

Results by Segment

Segment performance was as follows:

[caption id="attachment_93135" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

IBM reported 2Q19 revenues of $19.16 billion, down 4.2% year over year and in line with the consensus estimate. Management highlighted growth in software, consulting and cloud revenue, in addition to continued margin expansion.

The 100-bps expansion in the GAAP gross margin was the largest expansion in more than five years. SG&A expenses from several charges were essentially neutral to total expense and to profit growth in the quarter.

Adjusted EPS was $3.17, up 3.0% from the year-ago quarter and beating consensus of $3.08. GAAP EPS from continuing operations was $2.81, compared to $2.61 in the year-ago quarter.

IBM closed the acquisition of Red Hat on July 9.

Management commented that IBM continued to grow in the high-value areas of the business, led by strong performance in the cloud and cognitive software segment. The completion of the Red Hat acquisition is expected to create the industry’s only true open hybrid multi-cloud platform, strengthening IBM’s leadership position and helping clients succeed in their digital reinventions.

Results by Segment

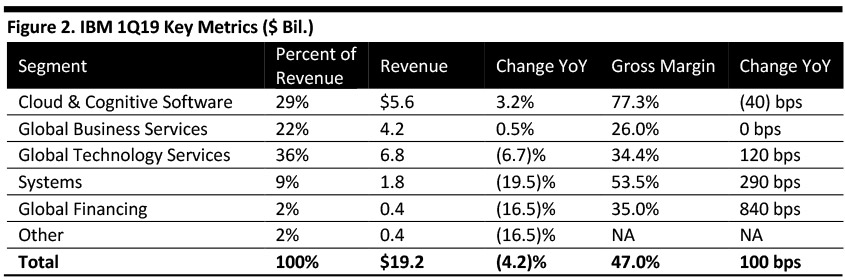

Segment performance was as follows:

[caption id="attachment_93135" align="aligncenter" width="700"] Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Note: Gross margins are GAAP [/caption] Cloud & Cognitive Software

- Cloud and data platforms grew 5% (up 7% adjusting for currency).

- Cognitive applications grew 3% (up 5% adjusting for currency).

- Transaction processing platforms grew 2% (up 4% adjusting for currency).

- Revenues grew 0.5% (up 3.4 % adjusting for currency), with broad-based strength led by growth in consulting, up 2% (up 5% adjusting for currency).

- Revenues declined 6.7% (down 3.5% adjusting for currency).

- Revenues declined 19.5% (down 18.0% adjusting for currency), with growth in Power, which more than offset the impact of product cycle changes in IBM Z and Storage.

- Revenues declined 11.0% (down 8.5% adjusting for currency), reflecting the wind-down of OEM commercial financing.

- Adjusted EPS of at least $13.90.

- GAAP EPS of at least $12.45.

- Free cash flow of approximately $12 billion.