DIpil Das

[caption id="attachment_84144" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

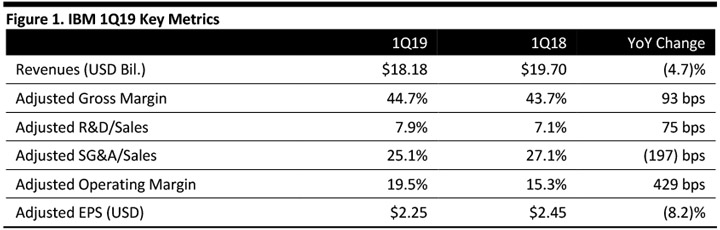

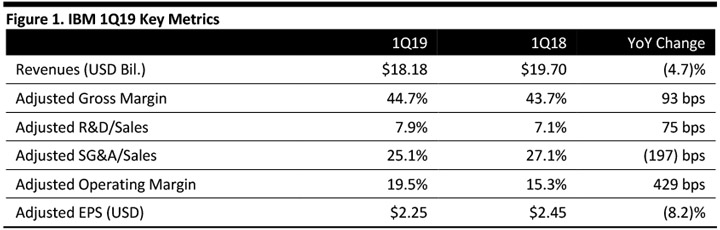

IBM reported 1Q19 revenues of $18.18 billion, down 4.7% year over year and missing the $18.47 billion consensus estimate. Management characterized the growth in cloud & cognitive software and global business services as strong, and reported accelerating growth in cloud revenue, which was up 12% in constant currency, and in “as-a-service” revenue was up 15% in constant currency.

The expansion in gross and pretax margins was led by services, whose gross margins increased 280 bps.

Adjusted EPS was $2.25, down from $2.45 billion the year-ago quarter and beating consensus by three cents. GAAP EPS from continuing operations was $1.79, compared to $1.82 in the year-ago quarter.

During the quarter, the company sold its mortgage-servicing business to Mr. Cooper Group. The company also plans to wind down its commercial financing operations starting in Q2 to conclude by the end of the year.

Management commented that cloud revenue growth accelerated in the quarter and that revenues grew in high-value areas, including cloud & cognitive software and consulting. Moreover, fundamental changes in the business resulted in greater operating leverage (as evidenced by improved operating margins), which was led by the services business.

Results by Segment

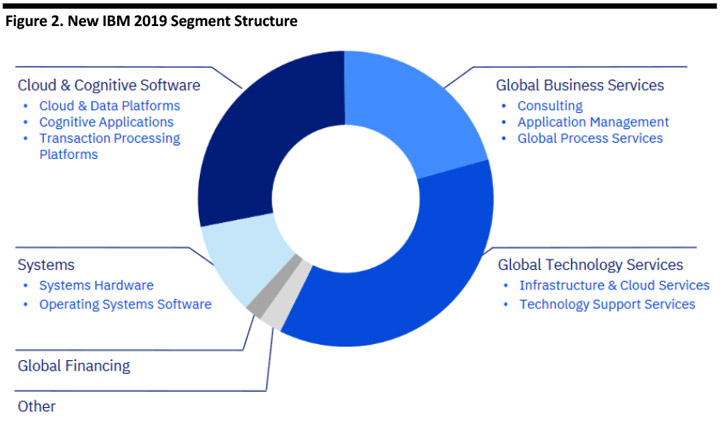

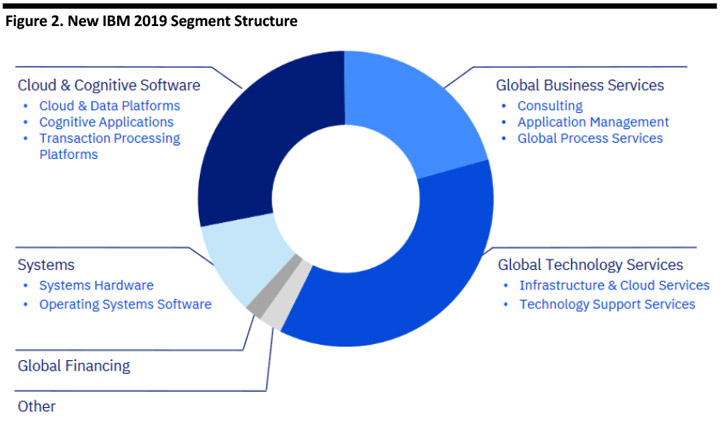

IBM changed its segment reporting starting 1Q19, as illustrated below. The company commented it had created the cloud & cognitive software segment to address clients’ evolving needs and to prepare for the acquisition of Red Hat. Management also said the “other” segment includes announced divested businesses and provides better visibility to ongoing operational performance. Further, the new structure reflects management system changes and aligns the portfolio to underlying business models.

[caption id="attachment_84145" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

1Q19 Results

IBM reported 1Q19 revenues of $18.18 billion, down 4.7% year over year and missing the $18.47 billion consensus estimate. Management characterized the growth in cloud & cognitive software and global business services as strong, and reported accelerating growth in cloud revenue, which was up 12% in constant currency, and in “as-a-service” revenue was up 15% in constant currency.

The expansion in gross and pretax margins was led by services, whose gross margins increased 280 bps.

Adjusted EPS was $2.25, down from $2.45 billion the year-ago quarter and beating consensus by three cents. GAAP EPS from continuing operations was $1.79, compared to $1.82 in the year-ago quarter.

During the quarter, the company sold its mortgage-servicing business to Mr. Cooper Group. The company also plans to wind down its commercial financing operations starting in Q2 to conclude by the end of the year.

Management commented that cloud revenue growth accelerated in the quarter and that revenues grew in high-value areas, including cloud & cognitive software and consulting. Moreover, fundamental changes in the business resulted in greater operating leverage (as evidenced by improved operating margins), which was led by the services business.

Results by Segment

IBM changed its segment reporting starting 1Q19, as illustrated below. The company commented it had created the cloud & cognitive software segment to address clients’ evolving needs and to prepare for the acquisition of Red Hat. Management also said the “other” segment includes announced divested businesses and provides better visibility to ongoing operational performance. Further, the new structure reflects management system changes and aligns the portfolio to underlying business models.

[caption id="attachment_84145" align="aligncenter" width="720"] Source: Company reports[/caption]

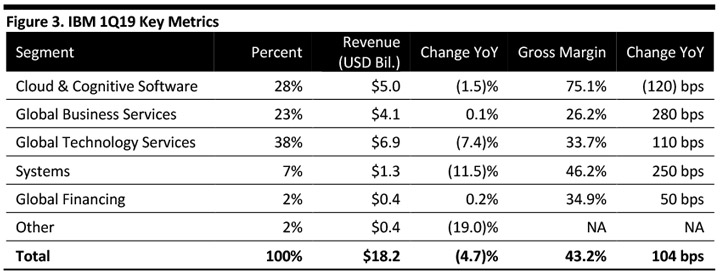

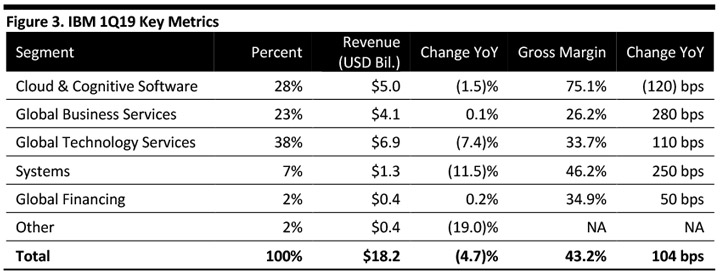

Segment performance is as follows:

[caption id="attachment_84146" align="aligncenter" width="720"]

Source: Company reports[/caption]

Segment performance is as follows:

[caption id="attachment_84146" align="aligncenter" width="720"] Note: Total gross margins are GAAP

Note: Total gross margins are GAAP

Source: Company reports/Coresight Research [/caption] Implications for Retail The newly created cloud & cognitive software segment combines software for hybrid cloud management with data and AI platforms and includes solutions for specific verticals and domains, such as retail. These platforms are also increasingly being infused with AI. Management also reported strong growth in verticals such as Watson Health, supply chain and weather. Outlook IBM reiterated its prior guidance for 2019. The difference between GAAP and adjusted EPS includes $0.76 per share in acquisition-related charges (including pre-closing charges for the pending Red Hat acquisition), $0.45 in non-operating retirement-related items and $0.24 in tax-reform impact.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

IBM reported 1Q19 revenues of $18.18 billion, down 4.7% year over year and missing the $18.47 billion consensus estimate. Management characterized the growth in cloud & cognitive software and global business services as strong, and reported accelerating growth in cloud revenue, which was up 12% in constant currency, and in “as-a-service” revenue was up 15% in constant currency.

The expansion in gross and pretax margins was led by services, whose gross margins increased 280 bps.

Adjusted EPS was $2.25, down from $2.45 billion the year-ago quarter and beating consensus by three cents. GAAP EPS from continuing operations was $1.79, compared to $1.82 in the year-ago quarter.

During the quarter, the company sold its mortgage-servicing business to Mr. Cooper Group. The company also plans to wind down its commercial financing operations starting in Q2 to conclude by the end of the year.

Management commented that cloud revenue growth accelerated in the quarter and that revenues grew in high-value areas, including cloud & cognitive software and consulting. Moreover, fundamental changes in the business resulted in greater operating leverage (as evidenced by improved operating margins), which was led by the services business.

Results by Segment

IBM changed its segment reporting starting 1Q19, as illustrated below. The company commented it had created the cloud & cognitive software segment to address clients’ evolving needs and to prepare for the acquisition of Red Hat. Management also said the “other” segment includes announced divested businesses and provides better visibility to ongoing operational performance. Further, the new structure reflects management system changes and aligns the portfolio to underlying business models.

[caption id="attachment_84145" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

1Q19 Results

IBM reported 1Q19 revenues of $18.18 billion, down 4.7% year over year and missing the $18.47 billion consensus estimate. Management characterized the growth in cloud & cognitive software and global business services as strong, and reported accelerating growth in cloud revenue, which was up 12% in constant currency, and in “as-a-service” revenue was up 15% in constant currency.

The expansion in gross and pretax margins was led by services, whose gross margins increased 280 bps.

Adjusted EPS was $2.25, down from $2.45 billion the year-ago quarter and beating consensus by three cents. GAAP EPS from continuing operations was $1.79, compared to $1.82 in the year-ago quarter.

During the quarter, the company sold its mortgage-servicing business to Mr. Cooper Group. The company also plans to wind down its commercial financing operations starting in Q2 to conclude by the end of the year.

Management commented that cloud revenue growth accelerated in the quarter and that revenues grew in high-value areas, including cloud & cognitive software and consulting. Moreover, fundamental changes in the business resulted in greater operating leverage (as evidenced by improved operating margins), which was led by the services business.

Results by Segment

IBM changed its segment reporting starting 1Q19, as illustrated below. The company commented it had created the cloud & cognitive software segment to address clients’ evolving needs and to prepare for the acquisition of Red Hat. Management also said the “other” segment includes announced divested businesses and provides better visibility to ongoing operational performance. Further, the new structure reflects management system changes and aligns the portfolio to underlying business models.

[caption id="attachment_84145" align="aligncenter" width="720"] Source: Company reports[/caption]

Segment performance is as follows:

[caption id="attachment_84146" align="aligncenter" width="720"]

Source: Company reports[/caption]

Segment performance is as follows:

[caption id="attachment_84146" align="aligncenter" width="720"] Note: Total gross margins are GAAP

Note: Total gross margins are GAAP Source: Company reports/Coresight Research [/caption] Implications for Retail The newly created cloud & cognitive software segment combines software for hybrid cloud management with data and AI platforms and includes solutions for specific verticals and domains, such as retail. These platforms are also increasingly being infused with AI. Management also reported strong growth in verticals such as Watson Health, supply chain and weather. Outlook IBM reiterated its prior guidance for 2019. The difference between GAAP and adjusted EPS includes $0.76 per share in acquisition-related charges (including pre-closing charges for the pending Red Hat acquisition), $0.45 in non-operating retirement-related items and $0.24 in tax-reform impact.

- Adjusted EPS of at least $13.90 (in line with the $13.91 consensus estimate).

- GAAP EPS of at least $12.45.

- Free cash flow of approximately $12 billion.