Source: Company reports

1Q16 RESULTS

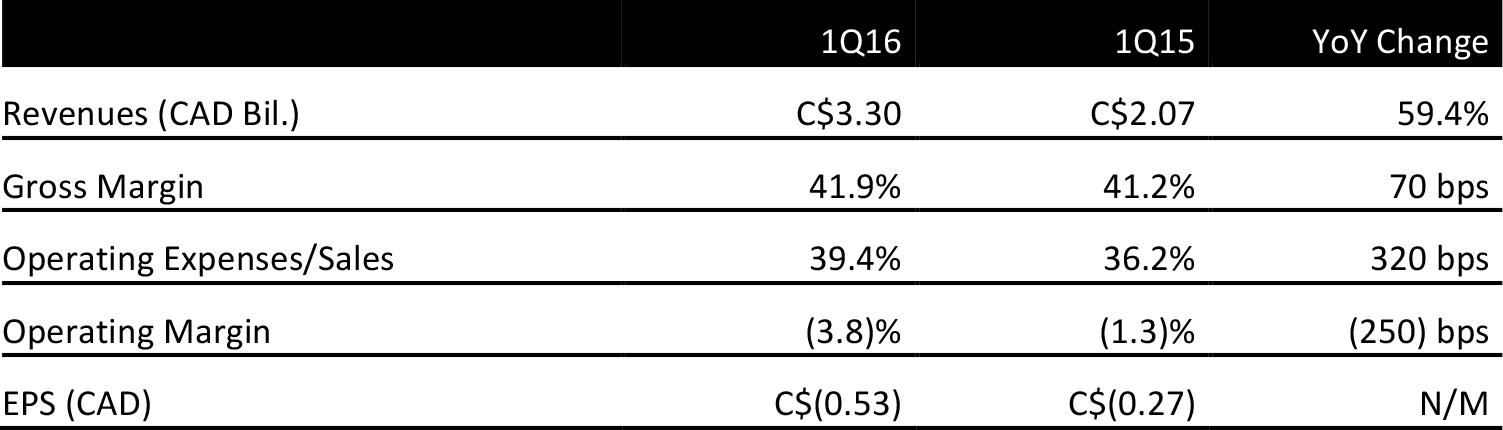

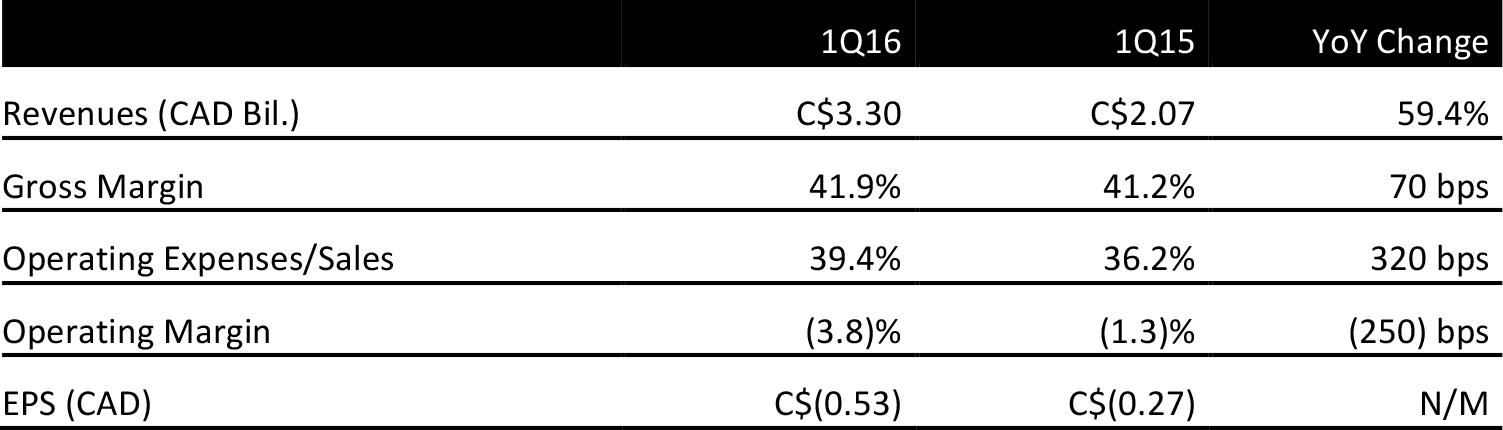

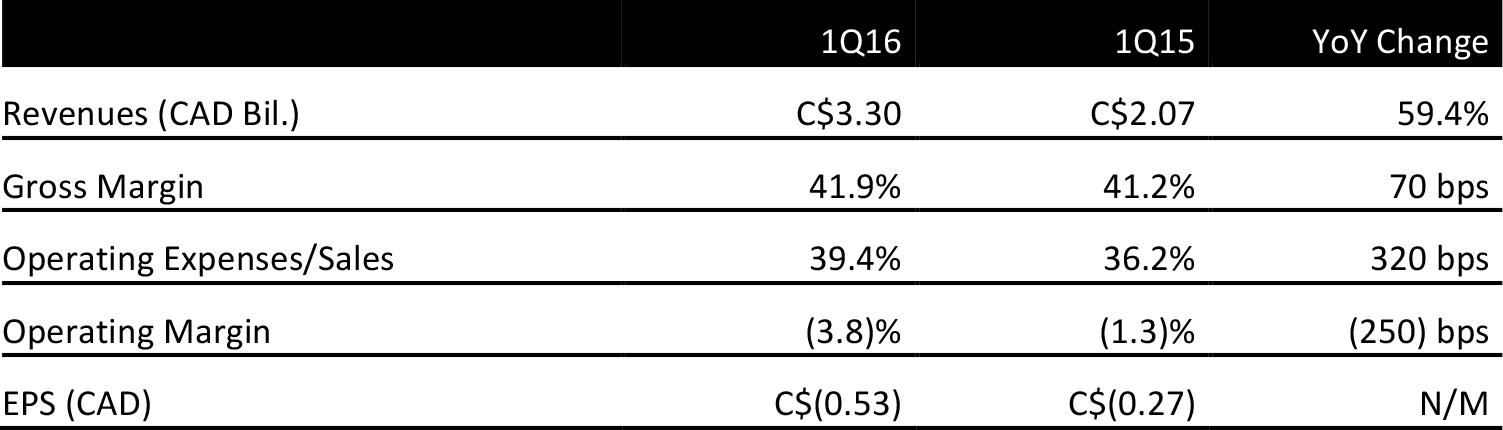

Hudson’s Bay Company reported 1Q16 revenues of C$3.3 billion, up 59.4% year over year, primarily as a result of the addition of HBC Europe and Gilt. The company also reported an increase in comparable sales of 4.4%.

Net loss was C$97 million compared to C$49 million in the year-ago period, largely due to the company’s real estate joint ventures, which tend to have a more significant impact early in the year. The company’s addition of HBC Europe caused normalized SG&A expenses to increase to C$1.3 billion.

During the quarter, the company opened its first Saks Fifth Avenue stores in Canada, along with its first four Saks OFF 5TH stores in Canada. An additional eight stores were opened in the US.

Hudson’s Bay announced a plan in 3Q15 to reduce SG&A expenses by C$75 million throughout its North American operations. The company is on track to either meet or exceed its goal, as it realized approximately C$28 million in savings during 1Q16.

Inventory at the end of 1Q16 increased by C$981 million compared to the year-ago quarter (when it was a reported C$1.2 billion) due to the addition of HBC Europe and foreign exchange rate fluctuations.

Reported EPS was C$(0.53) versus C$(0.27) in the year-ago quarter, and below the consensus estimate of C$(0.39).

2016 OUTLOOK

Hudson’s Bay confirmed its fiscal 2016 sales and earnings guidance. The company forecasted sales of C$14.9–C$15.9 billion, assuming overall comparable sales growth in the low single digits and calculated on a constant-currency basis. Over the full year, the company expects that it will make higher-than-normal investments in growth initiatives; these are expected to total C$750–C$850 million, or approximately 4.9%–5.5% of the midpoint sales outlook, and are expected to result in lower profit margins.