Nitheesh NH

[caption id="attachment_82757" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

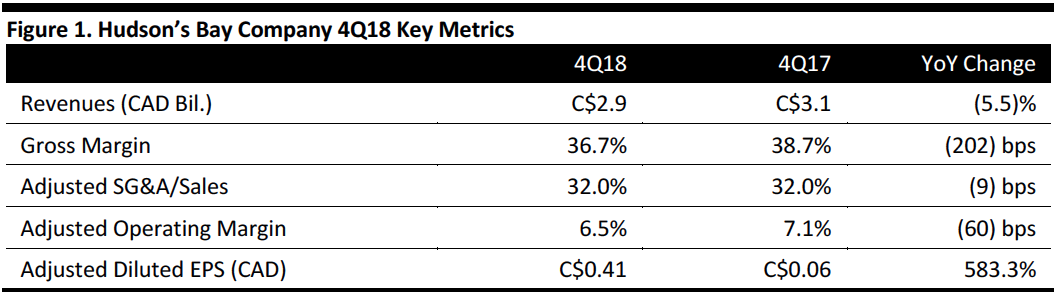

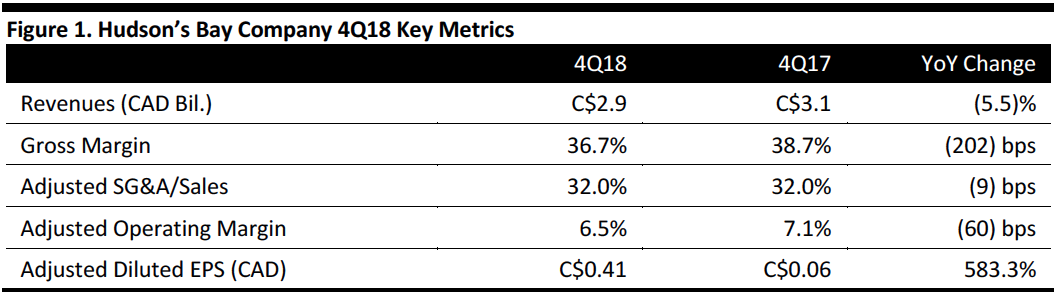

4Q18 Results

HBC 4Q18 revenues were C$2.9 billion, down 5.5% year over year and below the consensus estimate of C$3.18 billion.

HBC reported adjusted EPS of C$0.41, up from C$0.06 in the year-ago period. The jump was accounted by adjustments: Total adjustments for 4Q18 were C$324 million compared to C$(167) million in the year-ago period. Normalized net earnings, which include adjustments for a number of one-off items, totalled C$98 million in 4Q18 compared to C$13 million in the year-ago period. In 4Q18, the company reported a statutory net loss of C$226 million in continuing operations compared to net profit of C$180 million in the year-ago period. The company’s 4Q18 adjustments included a C$90 million deduction related to the sale of joint ventures, and gains totaling C$414 million which included adjustments related to Lord & Taylor and Home Outfitter closures, and adjustments to the European department store group.

The company reported adjusted EDITDAR of C$384 million, above the consensus estimate of C$362 million. Management said that the company returned to a positive cash flow position and is working on financial discipline while making strategic investments in technology, marketing, digital and stores.

Comparable sales at Saks Fifth Avenue increased by 3.9%. This was Saks Fifth Avenue’s seventh consecutive quarter of positive comparable sales, and this growth was mostly driven by stores outside of New York City as its flagship store remained under renovation. Management commented that construction work at its flagship store negatively affected 4Q18 results, but that the company reached a milestone in February 2019 with the opening of the store’s new main floor which includes one of the largest luxury handbags assortments in the world. Management reported that it has seen an increase in traffic and sales on the main floor and in its renovated second-floor beauty department.

Comparable sales at DSG (which includes Hudson’s Bay stores, Lord & Taylor and Home Outfitters) decreased by 5.2%. Management commented that Hudson’s Bay store performance was not up to its expectations, with customers purchasing lower-priced merchandise, which unfavorably impacted basket size. The company said that merchandise selection is an area of opportunity, and the company is addressing the challenge in 2019 by changing its buying strategy. The company reported that it is in the process of searching for a new President of Hudson's Bay.

Comparable sales at Saks OFF 5TH stores decreased by 2.1%. Management commented that it has adjusted its strategy at Saks OFF 5TH to operate less like a small department store and more like a an off-price retailer, providing fashionable, on-trend items to give customers “the thrill of the find.”

Digital comparable sales grew 8.7%. The company is making improvements to personalize homepages and improve site speed and navigation. At Saks Fifth Avenue, the company is implementing online recommendations based on previous purchases and style preferences.

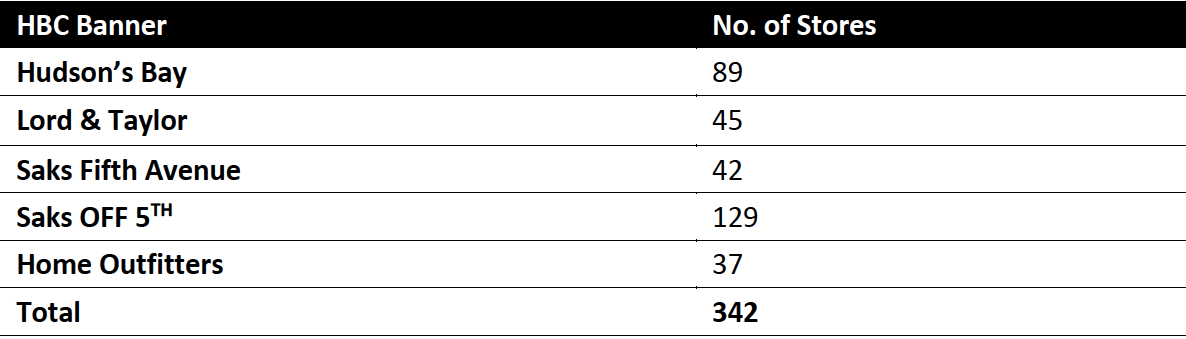

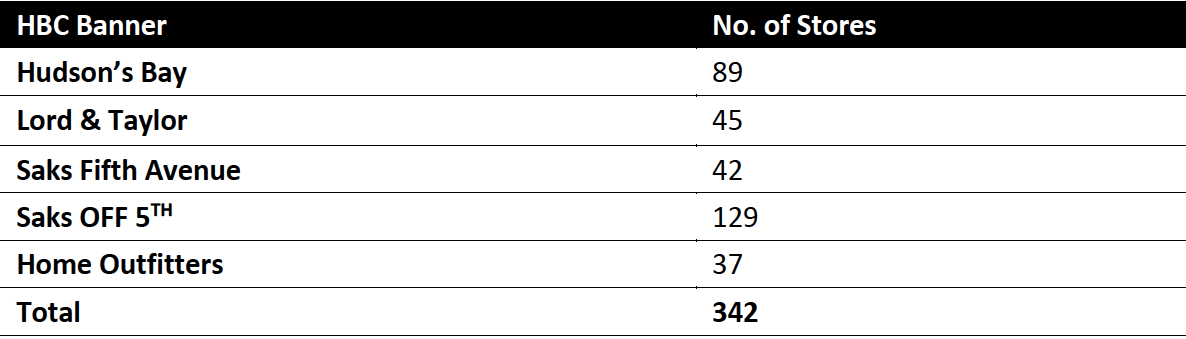

During 4Q18, HBC’s total store count reduced from 350 stores to 342 stores. On February 21, 2018, the company announced the closure of its Home Outfitters business. The company has 37 Home Outfitter locations throughout Canada. The company reported that Home Outfitter store closings have begun, and are expected to be completed by the end of 2Q19.

HBC also announced a review of its Saks OFF 5TH business, with an estimated closure of 20 stores. Management reported the closure of the Saks OFF 5TH stores will help to improve the company’s operational efficiency.

As of February 2, 2019, HBC’s store count by banner was as follows:

[caption id="attachment_82758" align="aligncenter" width="640"]

Source: Company reports/Coresight Research[/caption]

4Q18 Results

HBC 4Q18 revenues were C$2.9 billion, down 5.5% year over year and below the consensus estimate of C$3.18 billion.

HBC reported adjusted EPS of C$0.41, up from C$0.06 in the year-ago period. The jump was accounted by adjustments: Total adjustments for 4Q18 were C$324 million compared to C$(167) million in the year-ago period. Normalized net earnings, which include adjustments for a number of one-off items, totalled C$98 million in 4Q18 compared to C$13 million in the year-ago period. In 4Q18, the company reported a statutory net loss of C$226 million in continuing operations compared to net profit of C$180 million in the year-ago period. The company’s 4Q18 adjustments included a C$90 million deduction related to the sale of joint ventures, and gains totaling C$414 million which included adjustments related to Lord & Taylor and Home Outfitter closures, and adjustments to the European department store group.

The company reported adjusted EDITDAR of C$384 million, above the consensus estimate of C$362 million. Management said that the company returned to a positive cash flow position and is working on financial discipline while making strategic investments in technology, marketing, digital and stores.

Comparable sales at Saks Fifth Avenue increased by 3.9%. This was Saks Fifth Avenue’s seventh consecutive quarter of positive comparable sales, and this growth was mostly driven by stores outside of New York City as its flagship store remained under renovation. Management commented that construction work at its flagship store negatively affected 4Q18 results, but that the company reached a milestone in February 2019 with the opening of the store’s new main floor which includes one of the largest luxury handbags assortments in the world. Management reported that it has seen an increase in traffic and sales on the main floor and in its renovated second-floor beauty department.

Comparable sales at DSG (which includes Hudson’s Bay stores, Lord & Taylor and Home Outfitters) decreased by 5.2%. Management commented that Hudson’s Bay store performance was not up to its expectations, with customers purchasing lower-priced merchandise, which unfavorably impacted basket size. The company said that merchandise selection is an area of opportunity, and the company is addressing the challenge in 2019 by changing its buying strategy. The company reported that it is in the process of searching for a new President of Hudson's Bay.

Comparable sales at Saks OFF 5TH stores decreased by 2.1%. Management commented that it has adjusted its strategy at Saks OFF 5TH to operate less like a small department store and more like a an off-price retailer, providing fashionable, on-trend items to give customers “the thrill of the find.”

Digital comparable sales grew 8.7%. The company is making improvements to personalize homepages and improve site speed and navigation. At Saks Fifth Avenue, the company is implementing online recommendations based on previous purchases and style preferences.

During 4Q18, HBC’s total store count reduced from 350 stores to 342 stores. On February 21, 2018, the company announced the closure of its Home Outfitters business. The company has 37 Home Outfitter locations throughout Canada. The company reported that Home Outfitter store closings have begun, and are expected to be completed by the end of 2Q19.

HBC also announced a review of its Saks OFF 5TH business, with an estimated closure of 20 stores. Management reported the closure of the Saks OFF 5TH stores will help to improve the company’s operational efficiency.

As of February 2, 2019, HBC’s store count by banner was as follows:

[caption id="attachment_82758" align="aligncenter" width="640"] Source: Company reports[/caption]

The company reported that going forward, it is switching its financial reporting to US GAAP. For the full fiscal year, revenues decreased 1.2% to C$9.37 billion.

Outlook

The company did not offer 1Q19 or full-year guidance in its statement or on its analyst call.

Source: Company reports[/caption]

The company reported that going forward, it is switching its financial reporting to US GAAP. For the full fiscal year, revenues decreased 1.2% to C$9.37 billion.

Outlook

The company did not offer 1Q19 or full-year guidance in its statement or on its analyst call.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

HBC 4Q18 revenues were C$2.9 billion, down 5.5% year over year and below the consensus estimate of C$3.18 billion.

HBC reported adjusted EPS of C$0.41, up from C$0.06 in the year-ago period. The jump was accounted by adjustments: Total adjustments for 4Q18 were C$324 million compared to C$(167) million in the year-ago period. Normalized net earnings, which include adjustments for a number of one-off items, totalled C$98 million in 4Q18 compared to C$13 million in the year-ago period. In 4Q18, the company reported a statutory net loss of C$226 million in continuing operations compared to net profit of C$180 million in the year-ago period. The company’s 4Q18 adjustments included a C$90 million deduction related to the sale of joint ventures, and gains totaling C$414 million which included adjustments related to Lord & Taylor and Home Outfitter closures, and adjustments to the European department store group.

The company reported adjusted EDITDAR of C$384 million, above the consensus estimate of C$362 million. Management said that the company returned to a positive cash flow position and is working on financial discipline while making strategic investments in technology, marketing, digital and stores.

Comparable sales at Saks Fifth Avenue increased by 3.9%. This was Saks Fifth Avenue’s seventh consecutive quarter of positive comparable sales, and this growth was mostly driven by stores outside of New York City as its flagship store remained under renovation. Management commented that construction work at its flagship store negatively affected 4Q18 results, but that the company reached a milestone in February 2019 with the opening of the store’s new main floor which includes one of the largest luxury handbags assortments in the world. Management reported that it has seen an increase in traffic and sales on the main floor and in its renovated second-floor beauty department.

Comparable sales at DSG (which includes Hudson’s Bay stores, Lord & Taylor and Home Outfitters) decreased by 5.2%. Management commented that Hudson’s Bay store performance was not up to its expectations, with customers purchasing lower-priced merchandise, which unfavorably impacted basket size. The company said that merchandise selection is an area of opportunity, and the company is addressing the challenge in 2019 by changing its buying strategy. The company reported that it is in the process of searching for a new President of Hudson's Bay.

Comparable sales at Saks OFF 5TH stores decreased by 2.1%. Management commented that it has adjusted its strategy at Saks OFF 5TH to operate less like a small department store and more like a an off-price retailer, providing fashionable, on-trend items to give customers “the thrill of the find.”

Digital comparable sales grew 8.7%. The company is making improvements to personalize homepages and improve site speed and navigation. At Saks Fifth Avenue, the company is implementing online recommendations based on previous purchases and style preferences.

During 4Q18, HBC’s total store count reduced from 350 stores to 342 stores. On February 21, 2018, the company announced the closure of its Home Outfitters business. The company has 37 Home Outfitter locations throughout Canada. The company reported that Home Outfitter store closings have begun, and are expected to be completed by the end of 2Q19.

HBC also announced a review of its Saks OFF 5TH business, with an estimated closure of 20 stores. Management reported the closure of the Saks OFF 5TH stores will help to improve the company’s operational efficiency.

As of February 2, 2019, HBC’s store count by banner was as follows:

[caption id="attachment_82758" align="aligncenter" width="640"]

Source: Company reports/Coresight Research[/caption]

4Q18 Results

HBC 4Q18 revenues were C$2.9 billion, down 5.5% year over year and below the consensus estimate of C$3.18 billion.

HBC reported adjusted EPS of C$0.41, up from C$0.06 in the year-ago period. The jump was accounted by adjustments: Total adjustments for 4Q18 were C$324 million compared to C$(167) million in the year-ago period. Normalized net earnings, which include adjustments for a number of one-off items, totalled C$98 million in 4Q18 compared to C$13 million in the year-ago period. In 4Q18, the company reported a statutory net loss of C$226 million in continuing operations compared to net profit of C$180 million in the year-ago period. The company’s 4Q18 adjustments included a C$90 million deduction related to the sale of joint ventures, and gains totaling C$414 million which included adjustments related to Lord & Taylor and Home Outfitter closures, and adjustments to the European department store group.

The company reported adjusted EDITDAR of C$384 million, above the consensus estimate of C$362 million. Management said that the company returned to a positive cash flow position and is working on financial discipline while making strategic investments in technology, marketing, digital and stores.

Comparable sales at Saks Fifth Avenue increased by 3.9%. This was Saks Fifth Avenue’s seventh consecutive quarter of positive comparable sales, and this growth was mostly driven by stores outside of New York City as its flagship store remained under renovation. Management commented that construction work at its flagship store negatively affected 4Q18 results, but that the company reached a milestone in February 2019 with the opening of the store’s new main floor which includes one of the largest luxury handbags assortments in the world. Management reported that it has seen an increase in traffic and sales on the main floor and in its renovated second-floor beauty department.

Comparable sales at DSG (which includes Hudson’s Bay stores, Lord & Taylor and Home Outfitters) decreased by 5.2%. Management commented that Hudson’s Bay store performance was not up to its expectations, with customers purchasing lower-priced merchandise, which unfavorably impacted basket size. The company said that merchandise selection is an area of opportunity, and the company is addressing the challenge in 2019 by changing its buying strategy. The company reported that it is in the process of searching for a new President of Hudson's Bay.

Comparable sales at Saks OFF 5TH stores decreased by 2.1%. Management commented that it has adjusted its strategy at Saks OFF 5TH to operate less like a small department store and more like a an off-price retailer, providing fashionable, on-trend items to give customers “the thrill of the find.”

Digital comparable sales grew 8.7%. The company is making improvements to personalize homepages and improve site speed and navigation. At Saks Fifth Avenue, the company is implementing online recommendations based on previous purchases and style preferences.

During 4Q18, HBC’s total store count reduced from 350 stores to 342 stores. On February 21, 2018, the company announced the closure of its Home Outfitters business. The company has 37 Home Outfitter locations throughout Canada. The company reported that Home Outfitter store closings have begun, and are expected to be completed by the end of 2Q19.

HBC also announced a review of its Saks OFF 5TH business, with an estimated closure of 20 stores. Management reported the closure of the Saks OFF 5TH stores will help to improve the company’s operational efficiency.

As of February 2, 2019, HBC’s store count by banner was as follows:

[caption id="attachment_82758" align="aligncenter" width="640"] Source: Company reports[/caption]

The company reported that going forward, it is switching its financial reporting to US GAAP. For the full fiscal year, revenues decreased 1.2% to C$9.37 billion.

Outlook

The company did not offer 1Q19 or full-year guidance in its statement or on its analyst call.

Source: Company reports[/caption]

The company reported that going forward, it is switching its financial reporting to US GAAP. For the full fiscal year, revenues decreased 1.2% to C$9.37 billion.

Outlook

The company did not offer 1Q19 or full-year guidance in its statement or on its analyst call.