DIpil Das

[caption id="attachment_96237" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

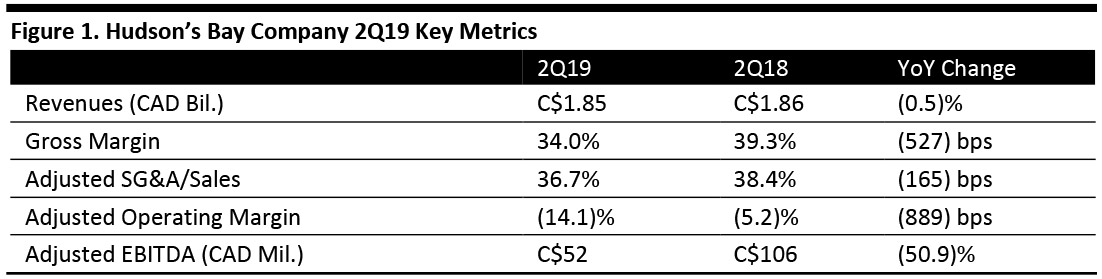

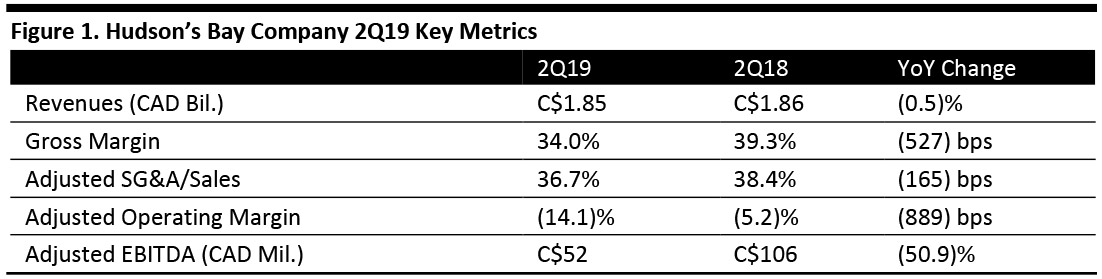

HBC reported 2Q19 revenues of C$1.85 billion, down 0.5% year over year and below the consensus estimate of C$2.13 billion. The company reported adjusted 2Q19 EBITDA of C$52 million, lower than the consenus estimate of $55.7 million and down 50.9% from the year-ago period. Management said its second quarter North America retail financial performance was a setback, with an adjusted EBITDA loss of $5 million.

For the quarter, comparable sales overall were down 0.4%, better than the consensus estimate of down by 0.7%. By banner:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

HBC reported 2Q19 revenues of C$1.85 billion, down 0.5% year over year and below the consensus estimate of C$2.13 billion. The company reported adjusted 2Q19 EBITDA of C$52 million, lower than the consenus estimate of $55.7 million and down 50.9% from the year-ago period. Management said its second quarter North America retail financial performance was a setback, with an adjusted EBITDA loss of $5 million.

For the quarter, comparable sales overall were down 0.4%, better than the consensus estimate of down by 0.7%. By banner:

Source: Company reports [/caption]

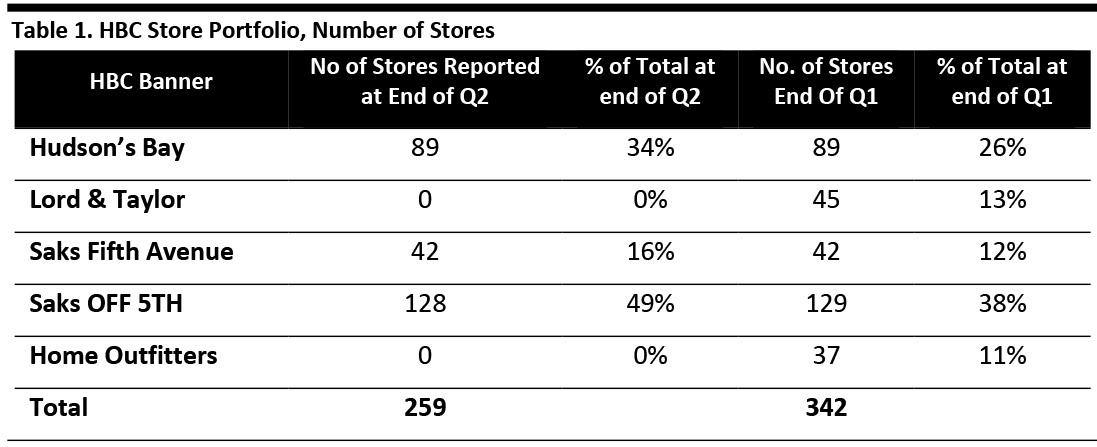

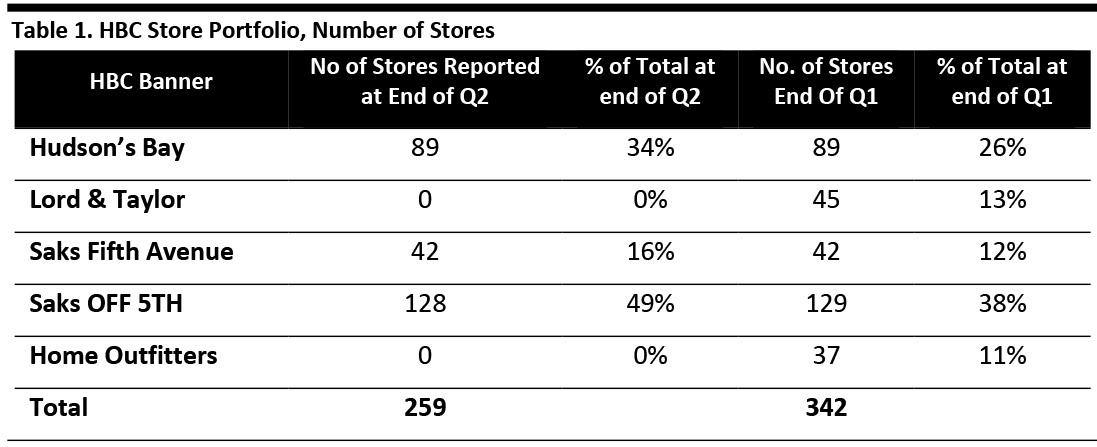

The company reported going forward it will focus on three distinct areas with nearly half of its sales in luxury, more than one third of its sales in Canada and 15% in off-price. Its top priorities remain investing to drive growth at Saks and Hudson’s Bay while enhancing the customer experience across all channels.

Outlook

The company did not offer 3Q19 or full-year guidance in its statement or on its analyst call.

Source: Company reports [/caption]

The company reported going forward it will focus on three distinct areas with nearly half of its sales in luxury, more than one third of its sales in Canada and 15% in off-price. Its top priorities remain investing to drive growth at Saks and Hudson’s Bay while enhancing the customer experience across all channels.

Outlook

The company did not offer 3Q19 or full-year guidance in its statement or on its analyst call.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

HBC reported 2Q19 revenues of C$1.85 billion, down 0.5% year over year and below the consensus estimate of C$2.13 billion. The company reported adjusted 2Q19 EBITDA of C$52 million, lower than the consenus estimate of $55.7 million and down 50.9% from the year-ago period. Management said its second quarter North America retail financial performance was a setback, with an adjusted EBITDA loss of $5 million.

For the quarter, comparable sales overall were down 0.4%, better than the consensus estimate of down by 0.7%. By banner:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

HBC reported 2Q19 revenues of C$1.85 billion, down 0.5% year over year and below the consensus estimate of C$2.13 billion. The company reported adjusted 2Q19 EBITDA of C$52 million, lower than the consenus estimate of $55.7 million and down 50.9% from the year-ago period. Management said its second quarter North America retail financial performance was a setback, with an adjusted EBITDA loss of $5 million.

For the quarter, comparable sales overall were down 0.4%, better than the consensus estimate of down by 0.7%. By banner:

- Saks Fifth Avenue comps were up 0.6%. Growth categories included men’s, women’s ready-to-wear, handbags and beauty.

- Hudson’s Bay comps decreased 3.4% in the second quarter, showing an improvement from the first quarter decline of 4.3%. Management reported it is working to correct previous merchandise choices and modernizing its marketing mix.

- Comparable sales at Saks OFF 5TH increased 3.4%. The banner is in the early stages of a new strategy which includes shifts in its buying, marketing and service model. The company reported gains in sales of jewelry, women’s modern clothing and men’s classic apparel.

Source: Company reports [/caption]

The company reported going forward it will focus on three distinct areas with nearly half of its sales in luxury, more than one third of its sales in Canada and 15% in off-price. Its top priorities remain investing to drive growth at Saks and Hudson’s Bay while enhancing the customer experience across all channels.

Outlook

The company did not offer 3Q19 or full-year guidance in its statement or on its analyst call.

Source: Company reports [/caption]

The company reported going forward it will focus on three distinct areas with nearly half of its sales in luxury, more than one third of its sales in Canada and 15% in off-price. Its top priorities remain investing to drive growth at Saks and Hudson’s Bay while enhancing the customer experience across all channels.

Outlook

The company did not offer 3Q19 or full-year guidance in its statement or on its analyst call.