DIpil Das

[caption id="attachment_90637" align="aligncenter" width="699"] Source: Company reports/Coresight Research[/caption]

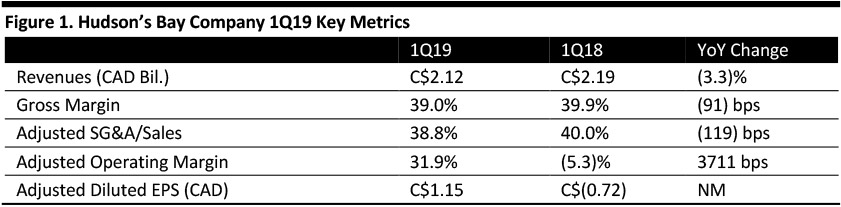

1Q19 Results

HBC 4Q18 revenues were C$2.9 billion, down 5.5% year over year and below the consensus estimate of C$3.18 billion. HBC reported adjusted EPS of C$1.15, up from the adjusted EPS of C$(0.72) in the year-ago period.

Operating income was $674 million in 1Q19 compared to $(115) million in the year ago quarter. The increase in 1Q19 was due to an $817 million gain on the sale of property attributed to the Lord & Taylor flagship building in New York City, resulting in an operating margin of 31.9% compared to (5.3)% a year ago.

The company reported adjusted EDITDAR of C$124 million, above the consensus estimate of C$94.5 million.

On June 10, 2019, Hudson’s Bay Company (HBC) announced that its board of directors had formed a special committee of independent directors to review a shareholder proposal to privatize the company. HBC also announced it had entered into an agreement to sell its real estate and retail operations in Germany for $1.5 billion (€1 billion).The company said the real estate sale will enable the company to strengthen its balance sheet through debt reduction and to focus on growth opportunities in North America through it Saks Fifth Avenue and Hudson’s Bay banner stores.

Comparable sales at Saks Fifth Avenue increased 2.4%. The growth was mostly driven by men’s and women’s designer and ready to wear. Consumers are responding to the remodelled main floor at the New York City flagship store, which opened in February 2019. The new main floor includes one-of-a-kind handbags that are exclusive to Saks. In summer 2019, the flagship store will open a new men’s shoe experience store.

Comparable sales at Hudson’s Bay decreased 4.3% in the first quarter. This was an improvement over the last quarter, when comparable sales decreased 5.2%. The company attributed the better performance to improved customer service at top stores and a more modern marketing mix. The company launched a new mobile app to improve the customer experience. And, HBC provides customers with a three-hour window when ordering on-line and picking up in-store to provide convenience for the consumer.

At Saks OFF 5TH, comparable sales increased 4.4%. Management highlighted it expanded tactics such as shifts in buying, marketing and its service model. Management highlighted that the organization wants to operate less like a small department store and more like its own version of an off-price retailer, “providing fashionable on-trend items at a great value.” This has helped to reach a broader audience and delivered new customer growth.

During 1Q19, HBC’s total store count remained unchanged from 4Q18 at 342 stores. In February, HBC announced it would close its Home Outfitters business. The company has 37 Home Outfitter locations throughout Canada and the closures are expected to be completed by the end of 2Q19. Liquidation sales have begun.

HBC also announced a review of its Saks OFF 5TH business, with an estimated closure of 20 stores. Since the review was announced, HBC has identified 15 stores to close on a rolling basis throughout 2019, with the majority closing at the end of the third quarter.

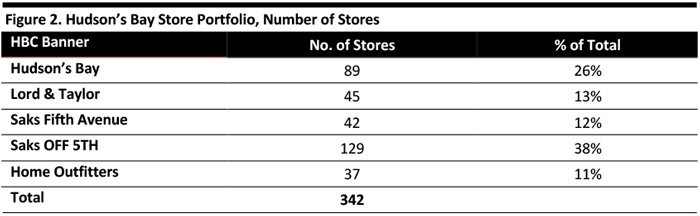

As of May 4, 2019, HBC’s store count by banner was as follows:

[caption id="attachment_90639" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

1Q19 Results

HBC 4Q18 revenues were C$2.9 billion, down 5.5% year over year and below the consensus estimate of C$3.18 billion. HBC reported adjusted EPS of C$1.15, up from the adjusted EPS of C$(0.72) in the year-ago period.

Operating income was $674 million in 1Q19 compared to $(115) million in the year ago quarter. The increase in 1Q19 was due to an $817 million gain on the sale of property attributed to the Lord & Taylor flagship building in New York City, resulting in an operating margin of 31.9% compared to (5.3)% a year ago.

The company reported adjusted EDITDAR of C$124 million, above the consensus estimate of C$94.5 million.

On June 10, 2019, Hudson’s Bay Company (HBC) announced that its board of directors had formed a special committee of independent directors to review a shareholder proposal to privatize the company. HBC also announced it had entered into an agreement to sell its real estate and retail operations in Germany for $1.5 billion (€1 billion).The company said the real estate sale will enable the company to strengthen its balance sheet through debt reduction and to focus on growth opportunities in North America through it Saks Fifth Avenue and Hudson’s Bay banner stores.

Comparable sales at Saks Fifth Avenue increased 2.4%. The growth was mostly driven by men’s and women’s designer and ready to wear. Consumers are responding to the remodelled main floor at the New York City flagship store, which opened in February 2019. The new main floor includes one-of-a-kind handbags that are exclusive to Saks. In summer 2019, the flagship store will open a new men’s shoe experience store.

Comparable sales at Hudson’s Bay decreased 4.3% in the first quarter. This was an improvement over the last quarter, when comparable sales decreased 5.2%. The company attributed the better performance to improved customer service at top stores and a more modern marketing mix. The company launched a new mobile app to improve the customer experience. And, HBC provides customers with a three-hour window when ordering on-line and picking up in-store to provide convenience for the consumer.

At Saks OFF 5TH, comparable sales increased 4.4%. Management highlighted it expanded tactics such as shifts in buying, marketing and its service model. Management highlighted that the organization wants to operate less like a small department store and more like its own version of an off-price retailer, “providing fashionable on-trend items at a great value.” This has helped to reach a broader audience and delivered new customer growth.

During 1Q19, HBC’s total store count remained unchanged from 4Q18 at 342 stores. In February, HBC announced it would close its Home Outfitters business. The company has 37 Home Outfitter locations throughout Canada and the closures are expected to be completed by the end of 2Q19. Liquidation sales have begun.

HBC also announced a review of its Saks OFF 5TH business, with an estimated closure of 20 stores. Since the review was announced, HBC has identified 15 stores to close on a rolling basis throughout 2019, with the majority closing at the end of the third quarter.

As of May 4, 2019, HBC’s store count by banner was as follows:

[caption id="attachment_90639" align="aligncenter" width="700"] Source: Company reports [/caption]

Outlook

The company did not offer 2Q19 or full-year guidance in its statement or on its analyst call. Management expects its cash flow position to remain unchanged; to be cash flow negative and close to flat.

Source: Company reports [/caption]

Outlook

The company did not offer 2Q19 or full-year guidance in its statement or on its analyst call. Management expects its cash flow position to remain unchanged; to be cash flow negative and close to flat.

Source: Company reports/Coresight Research[/caption]

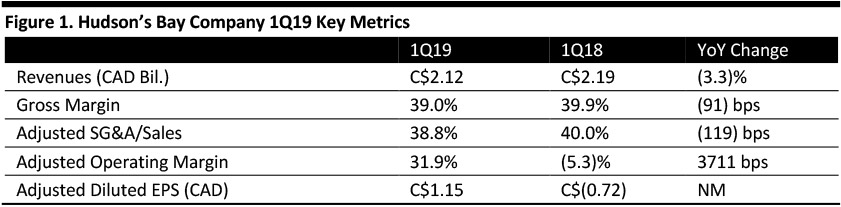

1Q19 Results

HBC 4Q18 revenues were C$2.9 billion, down 5.5% year over year and below the consensus estimate of C$3.18 billion. HBC reported adjusted EPS of C$1.15, up from the adjusted EPS of C$(0.72) in the year-ago period.

Operating income was $674 million in 1Q19 compared to $(115) million in the year ago quarter. The increase in 1Q19 was due to an $817 million gain on the sale of property attributed to the Lord & Taylor flagship building in New York City, resulting in an operating margin of 31.9% compared to (5.3)% a year ago.

The company reported adjusted EDITDAR of C$124 million, above the consensus estimate of C$94.5 million.

On June 10, 2019, Hudson’s Bay Company (HBC) announced that its board of directors had formed a special committee of independent directors to review a shareholder proposal to privatize the company. HBC also announced it had entered into an agreement to sell its real estate and retail operations in Germany for $1.5 billion (€1 billion).The company said the real estate sale will enable the company to strengthen its balance sheet through debt reduction and to focus on growth opportunities in North America through it Saks Fifth Avenue and Hudson’s Bay banner stores.

Comparable sales at Saks Fifth Avenue increased 2.4%. The growth was mostly driven by men’s and women’s designer and ready to wear. Consumers are responding to the remodelled main floor at the New York City flagship store, which opened in February 2019. The new main floor includes one-of-a-kind handbags that are exclusive to Saks. In summer 2019, the flagship store will open a new men’s shoe experience store.

Comparable sales at Hudson’s Bay decreased 4.3% in the first quarter. This was an improvement over the last quarter, when comparable sales decreased 5.2%. The company attributed the better performance to improved customer service at top stores and a more modern marketing mix. The company launched a new mobile app to improve the customer experience. And, HBC provides customers with a three-hour window when ordering on-line and picking up in-store to provide convenience for the consumer.

At Saks OFF 5TH, comparable sales increased 4.4%. Management highlighted it expanded tactics such as shifts in buying, marketing and its service model. Management highlighted that the organization wants to operate less like a small department store and more like its own version of an off-price retailer, “providing fashionable on-trend items at a great value.” This has helped to reach a broader audience and delivered new customer growth.

During 1Q19, HBC’s total store count remained unchanged from 4Q18 at 342 stores. In February, HBC announced it would close its Home Outfitters business. The company has 37 Home Outfitter locations throughout Canada and the closures are expected to be completed by the end of 2Q19. Liquidation sales have begun.

HBC also announced a review of its Saks OFF 5TH business, with an estimated closure of 20 stores. Since the review was announced, HBC has identified 15 stores to close on a rolling basis throughout 2019, with the majority closing at the end of the third quarter.

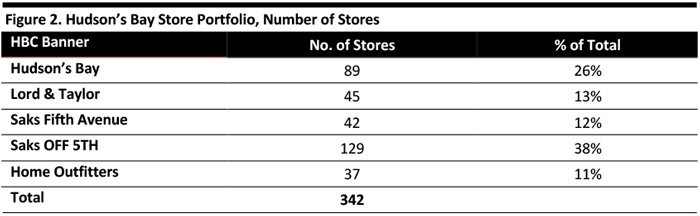

As of May 4, 2019, HBC’s store count by banner was as follows:

[caption id="attachment_90639" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

1Q19 Results

HBC 4Q18 revenues were C$2.9 billion, down 5.5% year over year and below the consensus estimate of C$3.18 billion. HBC reported adjusted EPS of C$1.15, up from the adjusted EPS of C$(0.72) in the year-ago period.

Operating income was $674 million in 1Q19 compared to $(115) million in the year ago quarter. The increase in 1Q19 was due to an $817 million gain on the sale of property attributed to the Lord & Taylor flagship building in New York City, resulting in an operating margin of 31.9% compared to (5.3)% a year ago.

The company reported adjusted EDITDAR of C$124 million, above the consensus estimate of C$94.5 million.

On June 10, 2019, Hudson’s Bay Company (HBC) announced that its board of directors had formed a special committee of independent directors to review a shareholder proposal to privatize the company. HBC also announced it had entered into an agreement to sell its real estate and retail operations in Germany for $1.5 billion (€1 billion).The company said the real estate sale will enable the company to strengthen its balance sheet through debt reduction and to focus on growth opportunities in North America through it Saks Fifth Avenue and Hudson’s Bay banner stores.

Comparable sales at Saks Fifth Avenue increased 2.4%. The growth was mostly driven by men’s and women’s designer and ready to wear. Consumers are responding to the remodelled main floor at the New York City flagship store, which opened in February 2019. The new main floor includes one-of-a-kind handbags that are exclusive to Saks. In summer 2019, the flagship store will open a new men’s shoe experience store.

Comparable sales at Hudson’s Bay decreased 4.3% in the first quarter. This was an improvement over the last quarter, when comparable sales decreased 5.2%. The company attributed the better performance to improved customer service at top stores and a more modern marketing mix. The company launched a new mobile app to improve the customer experience. And, HBC provides customers with a three-hour window when ordering on-line and picking up in-store to provide convenience for the consumer.

At Saks OFF 5TH, comparable sales increased 4.4%. Management highlighted it expanded tactics such as shifts in buying, marketing and its service model. Management highlighted that the organization wants to operate less like a small department store and more like its own version of an off-price retailer, “providing fashionable on-trend items at a great value.” This has helped to reach a broader audience and delivered new customer growth.

During 1Q19, HBC’s total store count remained unchanged from 4Q18 at 342 stores. In February, HBC announced it would close its Home Outfitters business. The company has 37 Home Outfitter locations throughout Canada and the closures are expected to be completed by the end of 2Q19. Liquidation sales have begun.

HBC also announced a review of its Saks OFF 5TH business, with an estimated closure of 20 stores. Since the review was announced, HBC has identified 15 stores to close on a rolling basis throughout 2019, with the majority closing at the end of the third quarter.

As of May 4, 2019, HBC’s store count by banner was as follows:

[caption id="attachment_90639" align="aligncenter" width="700"] Source: Company reports [/caption]

Outlook

The company did not offer 2Q19 or full-year guidance in its statement or on its analyst call. Management expects its cash flow position to remain unchanged; to be cash flow negative and close to flat.

Source: Company reports [/caption]

Outlook

The company did not offer 2Q19 or full-year guidance in its statement or on its analyst call. Management expects its cash flow position to remain unchanged; to be cash flow negative and close to flat.