Source: Company reports

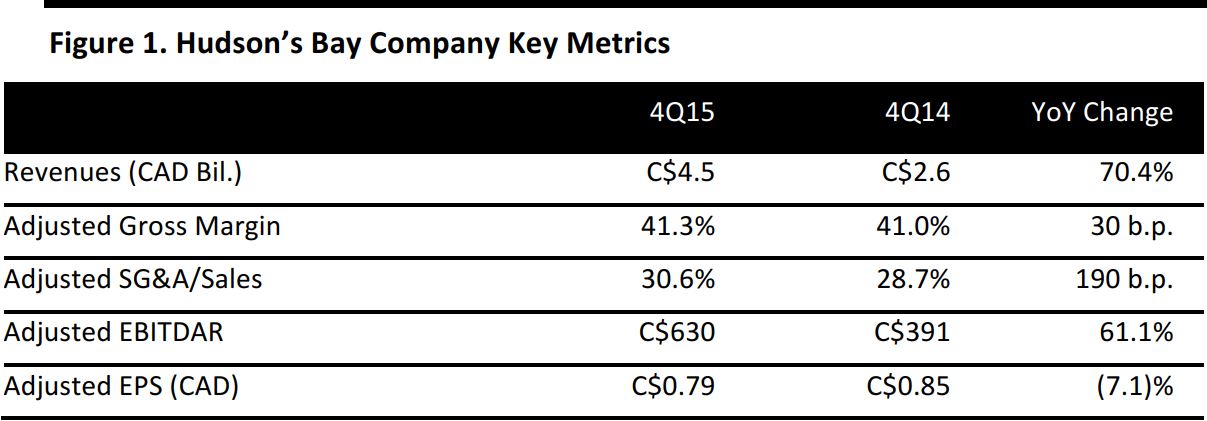

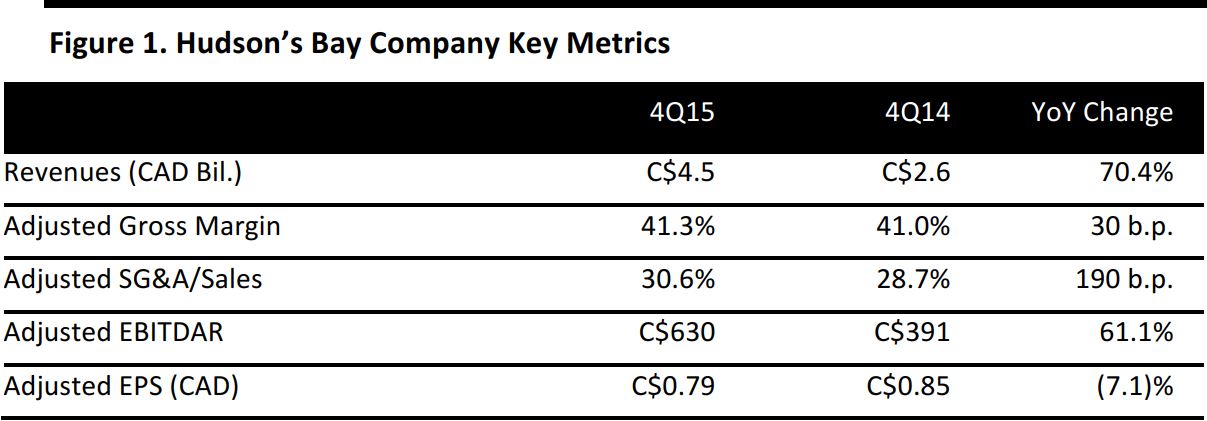

Hudson’s Bay Company reported 4Q15 normalized diluted EPS of C$0.79. EBITDA in the quarter was C$455.0 million versus consensus of C$441.8 million.

Total revenues were C$4.5 billion versus consensus of C$4.3 billion. The company’s 70.4% year-over-year increase in revenues was driven by the GALERIA acquisition. On a constant-currency basis, comps were up 1.8%, as previously reported. Comps were up 4.0% at the department stores group, up 2.0% at Saks Off 5th and up 0.4% at HBC Europe. These increases were partially offset by a decline of 1.2% at Saks Fifth Avenue. Year over year, total digital sales increased by 61.6% and comparable digital sales increased by 22.8% on a constant-currency basis.

Sales growth in the department store segment was driven by womenswear and home. Categories of strength at Saks Fifth Avenue included menswear and cosmetics, while women’s ready to wear showed weakness. At Saks Off 5th, accessories and footwear drove growth. At HBC Europe, beauty and accessories led merchandise sales growth.

Full-year guidance calls for adjusted EBITDA of C$800–C$950 million, as the company reaffirmed prior guidance. Sales are expected to be C$14.9–C$15.9 billion, up from prior guidance of C$14.2–C$15.2 billion, reflecting the Gilt acquisition. Guidance assumes that comps will increase by a low-single-digit rate on a constant-currency basis. Capex is expected to be higher than normal at roughly C$750–C$850 million, which is approximately 4.9%–5.5% of sales guidance.

The company was able to generate new savings of C$60 million in 2015 related to the acquisition of Saks and the North American realignment.