DIpil Das

On June 10, 2019, Hudson’s Bay Company (HBC) announced that its Board of Directors had formed a special committee of independent directors to privatize the company at a price of C$9.45 per share, payable in cash. The group of HBC shareholders submitting the proposal to privatize the company disclosed that they collectively own approximately 57% of the outstanding common shares of HBC on an as-converted basis. This values the company at approximately $1.28 billion, a 48% premium to the closing stock price on June 7, 2019.

HBC also announced in a separate press release that it had entered into an agreement to sell its stake in its German real estate joint venture and divest its related retail joint venture to its partner, SIGNA, for $1.5 billion (€1 billion). HBC will exit Germany after being in the country for less than four years. HBC entered Germany with the acquisition of the Galeria Kaufhof department store chain and associated banners in 2015; it formed a joint venture with SIGNA in late 2018, which brought together the Galeria Kaufhof and Karstadt department store chains.

As part of the agreement, HBC will assume ownership of its Netherlands retail business and release SIGNA from its 50.01% share of obligations of Hudson’s Bay Netherlands.

Management commented that this opportunity will allow HBC to focus resources on its North American operations including its “best growth opportunities – Saks Fifth Avenue and Hudson’s Bay.”

These two announcements come on the heels of the company’s recent press releases regarding its store banner, Lord & Taylor: On May 6, 2019 HBC reported the company was reviewing strategic alternatives for department store Lord & Taylor, including a possible sale or merger. On February 11, 2019 Hudson’s Bay closed the sale of the building housing its New York City Lord & Taylor Flagship store on Fifth Avenue for a total transaction value of $850 million (C$1.1 billion).

In its fourth quarter and fiscal 2018 results, the company announced the closure of its Home Outfitters business and that the company was performing a review of Saks OFF 5TH, with an estimate of closing up to 20 locations in the US.

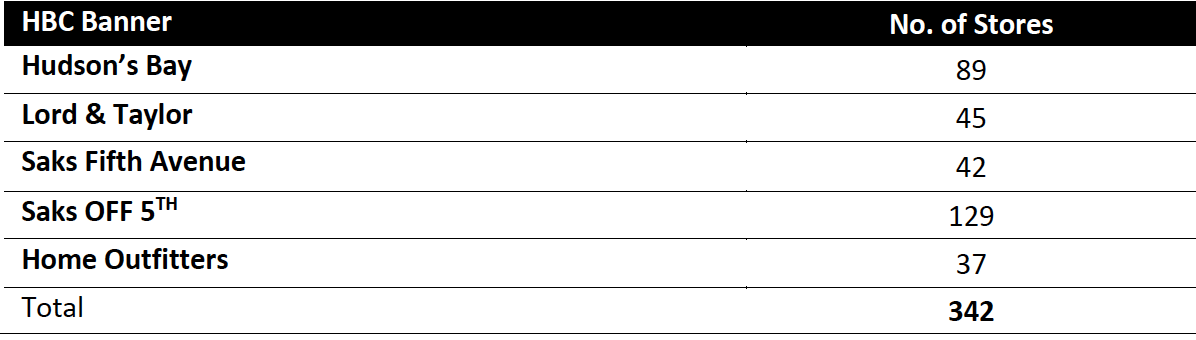

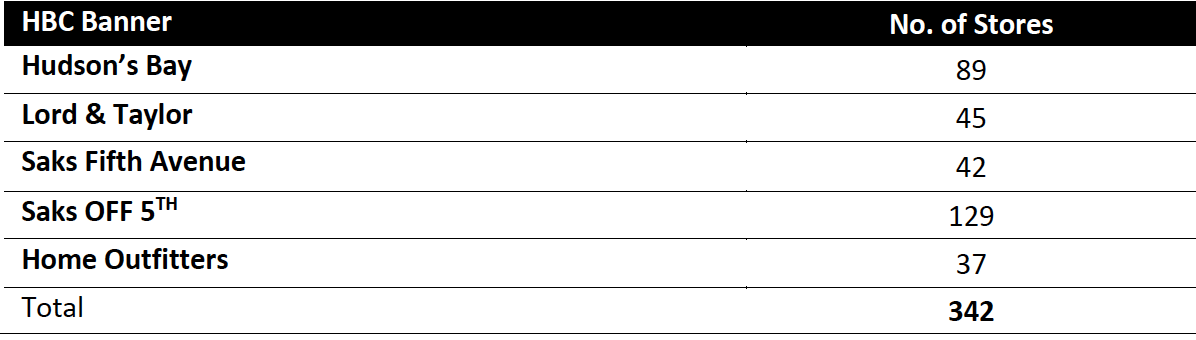

As of February 2, 2019 (the end of 4Q19), HBC’s store count by banner was as follows:

[caption id="attachment_90268" align="aligncenter" width="700"] Source: Company reports[/caption]

The company reports its 1Q19 earnings on June 13, 2019.

Source: Company reports[/caption]

The company reports its 1Q19 earnings on June 13, 2019.

Source: Company reports[/caption]

The company reports its 1Q19 earnings on June 13, 2019.

Source: Company reports[/caption]

The company reports its 1Q19 earnings on June 13, 2019.