Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

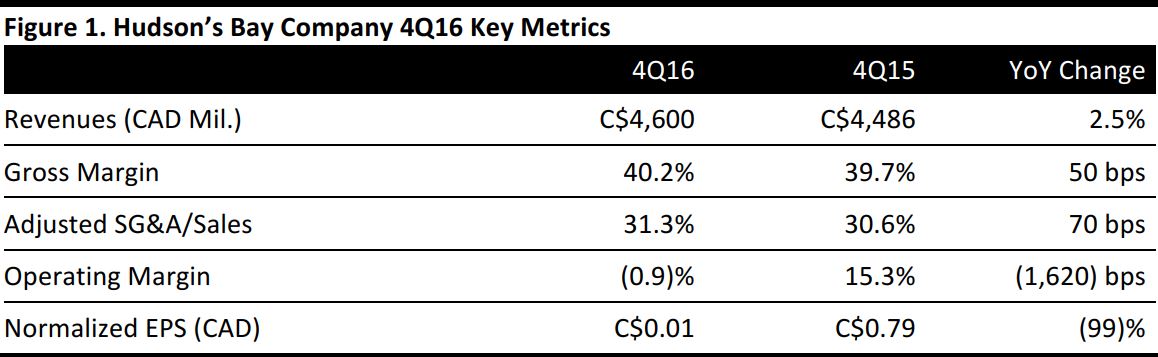

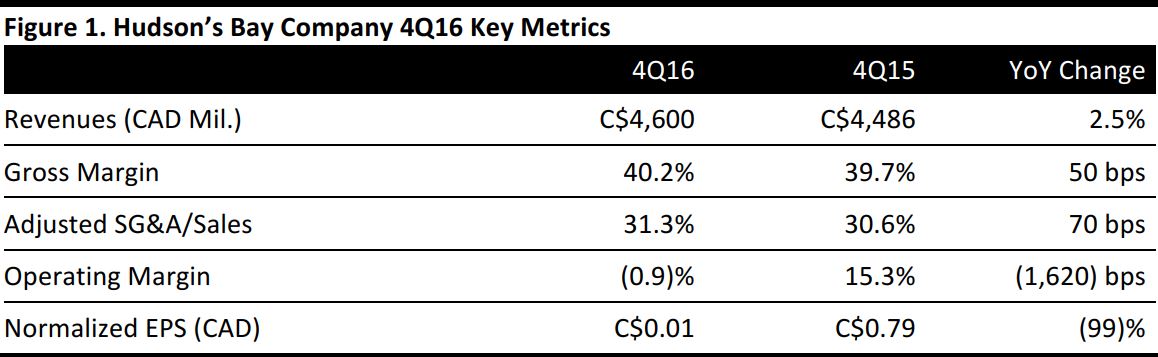

Fiscal 4Q16 Results

Hudson’s Bay Company reported fiscal 4Q16 normalized EPS of C$0.01, versus C$0.79 in the prior-year period. Revenue was C$4.6 billion, up 2.5% year over year. Digital sales grew by 52.8% year over year.

The slight sales growth was primarily driven by the addition of Gilt, which generated $177 million during the quarter, as well as by the addition of five Saks Fifth Avenue stores and 32 new Saks Off 5th stores, which contributed $123 million in sales. The additional sales were partially offset by a $110 million currency impact and lower comparable store sales, of $42 million.

Comps declined by 1.2% for the overall company, primarily due to high levels of markdowns. Comps grew by 0.6% at DSG (the Lord & Taylor, Hudson’s Bay and Home Outfitters banners) and by 0.1% at Saks Fifth Avenue. Those increases were offset by declines of 2% at HBC Europe (the Galeria Kaufhof, Galeria Inno and Sportarena banners) and 5.9% at HBC Off Price (the Saks Off 5th and Gilt banners). Sales at Gilt were affected by lower traffic. Sales at Saks Off 5th were negatively impacted by ongoing adjustments of assortment mix. Digital comps were up 13.3% on a constant currency basis. Under the department store banners, digital sales were up 20.9% for the quarter.

At the end of 4Q16, inventory decreased by C$28 million versus the prior-year period. The decrease was primarily due to currency effects and lower inventory at Saks Fifth Avenue, despite the opening of new stores.

FY16 Results

Hudson’s Bay Company’s FY16 sales were up 29.5% year over year, to C$14.5 billion, of which C$3 billion came from the additions of HBC Europe and Gilt. The remainder of the increase was driven by the opening of five Saks Fifth Avenue stores and 32 Saks Off 5th stores, which contributed C$320 million.

Full-year comps declined by 0.7%, or by 1.7% on a constant currency basis. By business segment, comps at DSG grew by 0.4%, with the growth offset by a 1.2% decline at HBC Europe, a 2.8% decline at Saks Fifth Avenue and a 7.4% decline at HBC Off Price.

At the end of the fiscal year, the company operated a total of 480 stores across all banners.

Outlook

Management detailed a cost-saving plan in its earnings release. It reiterated that the recently announced expense-cutting plan is expected to save C$75 million on an annualized basis. In addition, the company expects to rationalize and reallocate capital expenditures. For FY17, capital expenditures are expected to be C$150 million less than in the prior year. The spending will be focused on high-growth projects such as opportunities in Europe.

Hudson’s Bay Company is also in the process of optimizing assortments at its Saks Off 5th stores. The company expects to combine inventory at Saks Off 5th and Gilt by the end of the year. At Hudson’s Bay department stores and Lord & Taylor stores, the company plans to grow key categories such as active, dress and home. At Saks Fifth Avenue stores, the company will introduce buy-online, pick-up-in-store service in the fall.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology