Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

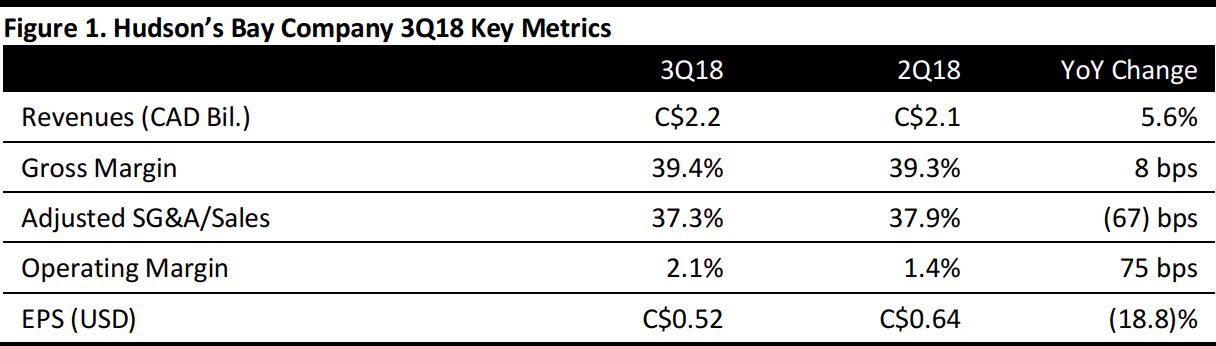

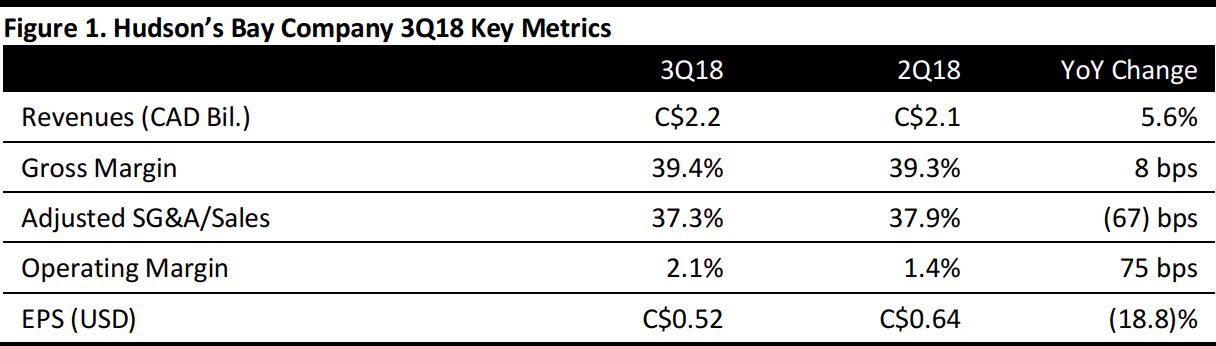

3Q18 Results

HBC reported 3Q18 revenues of C$2.2 billion, up 5.6% from the year ago quarter of C$2.1 billion. Adjusted EPS was C$0.52,below the year ago quarter of C$0.64. The company reported adjusted EDITDA of $C63 million compared to the consensus estimate of C$54.2.

Total comparable sales increased 2.9%. Adjusting for the shift of Hudson’s Bay’s “Bay Days” promotional event into the third quarter from the fourth quarter, comparable sales increased 1.2%.

By business, comparable sales at Saks Fifth Avenue increased 7.3%. The company reported Saks Fifth Avenue is helping drive overall results, reporting its sixth consecutive quarter of positive comparable sales. The company attributed the performance to its differentiated fashion offering, increased customer engagement and personalization. Management said that it is emphasizing ease of service, styling and personalized interactions.

Comparable sales at DSG (which includes Hudson’s Bay stores, Lord & Taylor and Home Outfitters) increased 0.9% and, adjusting for the “Bay Days” promotional shift, comparable sales at DSG declined 2.4%. Saks OFF Fifth stores comparable sales decreased 2.3%.

Management reported that, over the past year, its objectives have been to simplify its business, strengthen retail operations and “unlock the value” of HBC's real estate holdings. To meet these objectives, HBC sold Gilt, an online designer website with daily featured deals, completed the sale of its Lord & Taylor flagship building, entered into an agreement to sell its controlling interest in HBC Europe and formed a strategic partnership for its European businesses. In September 2018, HBC entered into an agreement With Austria’s Signa Holding to merge HBC Europe operations with Signa’s Karstadt, with HBC taking a 49.99% interest in the combined businesses which include GaleriaKaufhof and Karstadt, as well as other HBC and Signa banners to create a new retailer.

HBC will use proceeds from European transactions to reduce the company’s debt, repaying US$175 million of a US$500 million loan. The company reported it will use proceeds from transactions related to the sale of the Lord & Taylor flagship building and the sale of a 50% interest in 18 wholly-owned German properties to Signa to repay approximately $2 billion in debt during the fourth quarter.

HBC reported that the renovation of its New York City Saks Fifth Avenue flagship remains on track. In early 2019, the Saks store will unveil a new first floor with a handbag presentation and a “vault concept,” which is a jewelry experience,located on the lower level. The store will also include L'Avenue at Saks, a new restaurant (its only location outside of Paris). The company expects that L’Avenue at Saks will attract a new audience of shoppers.Earlier this year, the company opened a new beauty experience on the second floor, which management said has exceeded expectations.

During the third quarter, HBC opened one Hudson’s Bay store in Montreal, Quebec, and one Saks OFF 5

TH store in Calgary, Alberta. The company closed one Hudson’s Bay store in Montreal, Quebec, and one Home Outfitters store in Halifax, Nova Scotia. The company ended the quarter with 350 total stores including 89 Hudson’s Bay stores, 48 Lord & Taylor stores, 42 Saks Fifth Avenue stores, 133 Saks Off Fifth stores and 38 Home Outfitters stores.

Outlook

The company did not provide quantitative guidance for FY18.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research