Source: Company reports/FGRT

Source: Company reports/FGRT

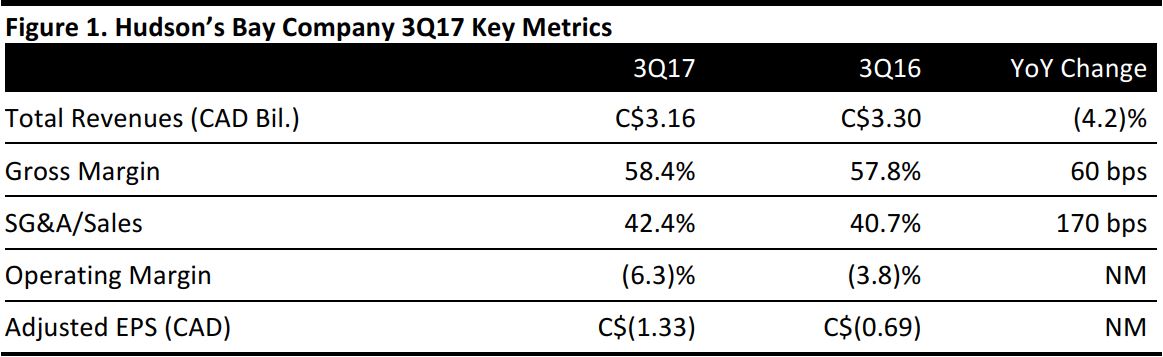

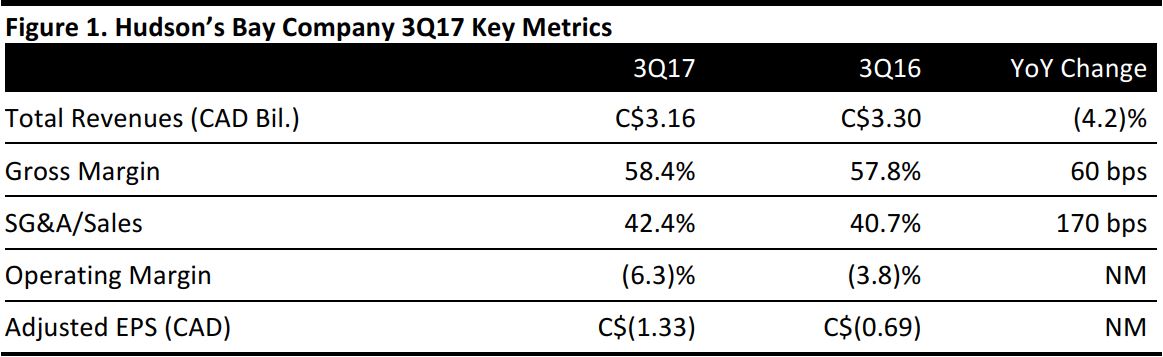

3Q17 Results

Hudson’s Bay Company reported 3Q17 revenues of C$3.2 billion, down 4.2% year over year and slightly below the C$3.4 billion consensus estimate. Adjusted EPS was C$(1.33), versus C$(0.69) in the year-ago quarter and below the C$(0.74) consensus estimate. The overall results from the quarter did not meet management’s expectations.

The sales decrease was primarily related to lower overall comparable sales, which totaled approximately C$104 million, a negative currency impact of C$64 million and a C$34 million impact from store closures. The negative effects were partially offset by the opening of new stores, which contributed approximately C$61 million in sales.

Total comps were down 3.2% year over year on a constant-currency basis. Comps were down 3% at HBC Europe and down 3.7% at DSG on a constant-currency basis. Comps at Saks Fifth Avenue increased by 0.2% during the quarter, which represented the second consecutive quarter of growth for the banner. Comps were hurt by lower traffic across the company’s banners, some operational challenges and some negative impact from the hurricanes in Texas, Florida and Puerto Rico. A workforce reduction in the second quarter resulted in some operational disruption in the company’s marketing and merchandising departments in the third quarter.

On a constant-currency basis, digital sales increased by 2.1%, or by 9% excluding Gilt. The company continues to work on the transition to sell inventory from Saks OFF 5TH on Gilt.com. Inventory at the end of 3Q17 declined by C$64 million year over year, driven by fewer comparable stores and the impact of foreign exchange.

Outlook

Hudson’s Bay Company’s transformation plan remains on track to deliver annual cost savings of C$350 million. Total capital expenditure for FY17 is expected to be C$575–C$625 million versus C$657 million in FY16. The company expects to significantly reduce its capital expenditure in FY18.

The company continues to look for ways to reposition its physical retail space following the sale of its Lord & Taylor store on New York’s Fifth Avenue to WeWork. It is looking at opening Topshop and Sephora stores-within-stores and opening food halls as ways to drive traffic to its stores.

Source: Company reports/FGRT

Source: Company reports/FGRT