Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

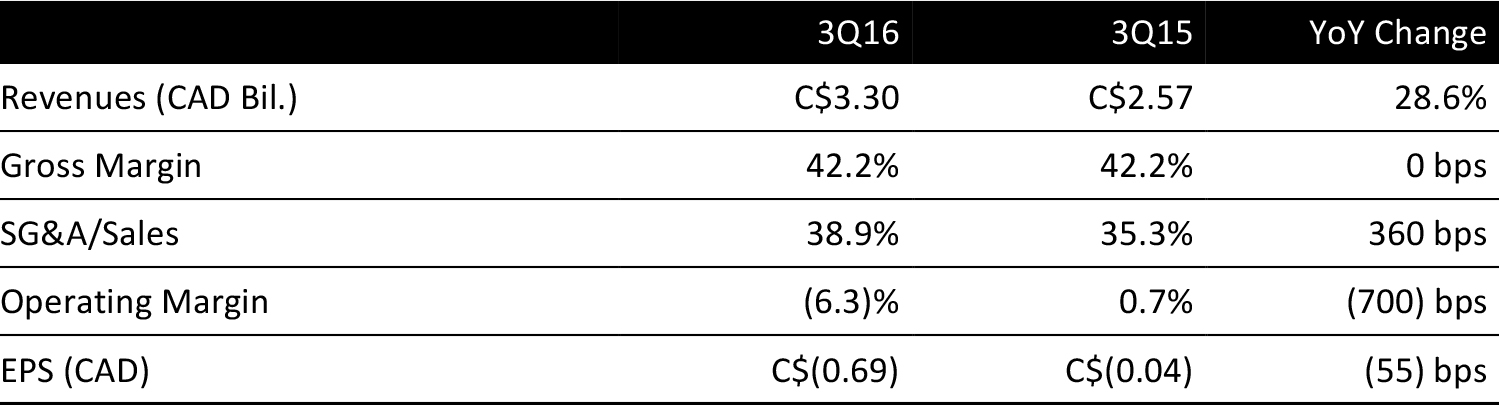

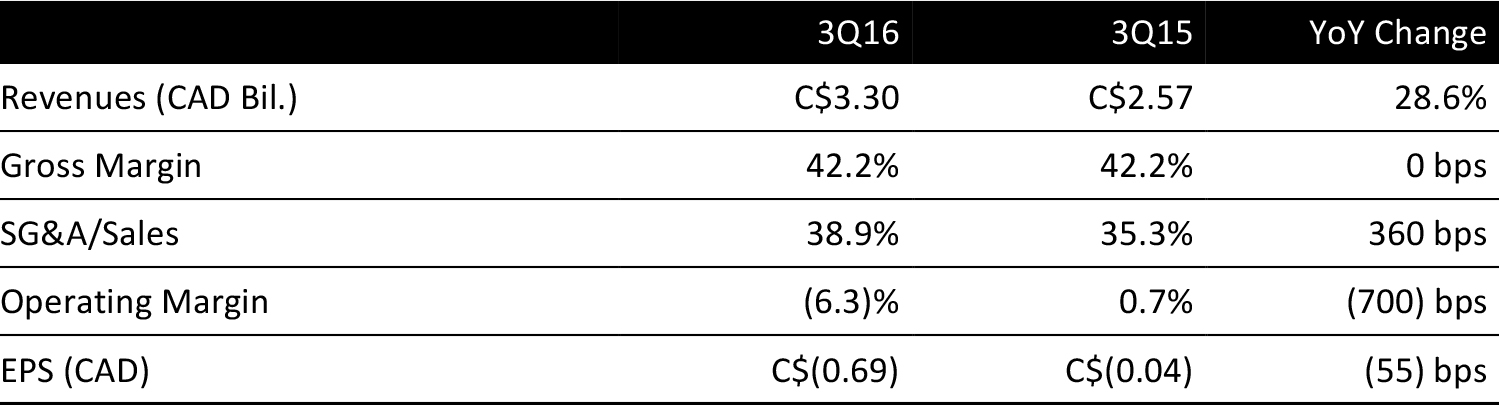

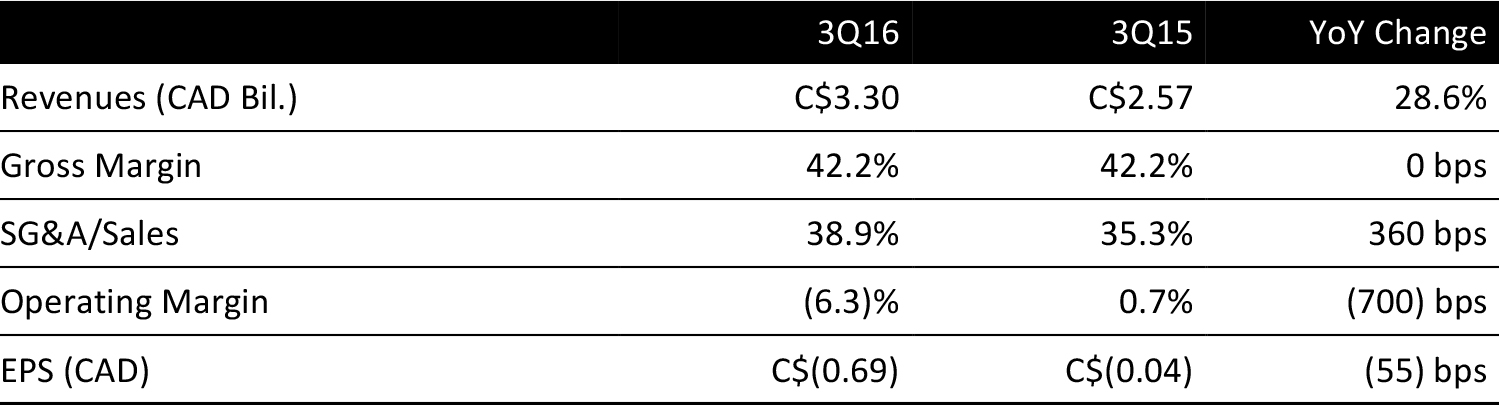

Hudson’s Bay Company reported 3Q16 revenues of C$3.3 billion, up 28.6% year over year but below the consensus estimate of C$3.4 billion. EPS was C$(0.69), missing the consensus estimate of C$0.24 and down from C$(0.04) in the year-ago period.

Consolidated retail sales for the quarter were C$9,855 million, up 47.6% from 3Q15, primarily due to the addition of HBC Europe and Gilt. Total comparable sales declined by 3.6%. By business segment, comps grew by 0.2% at the Department Store Group, but were offset by a 0.9% decline at HBC Europe, an 8% decline at HBC Off Price and a 4% decline at Saks Fifth Avenue. The company cited weakness in women’s apparel, department stores and the luxury sector as contributing to the low comp results across banners.

Digital sales increased by 73%, and total digital comparable sales increased by 5.4% on a constant-currency basis. Due to a heightened focus on inventory management, inventory levels decreased by 2% year over year on a comparable basis. To further support its e-commerce business, the company completed the installation of a robotic fulfillment center in Toronto.

During the quarter, the company opened five Saks OFF 5TH stores in Canada and two Saks Fifth Avenue stores and 12 Saks OFF 5TH stores in the US. The company operated a total of 485 stores at the end of the third quarter.

�OUTLOOK

Hudson’s Bay’s management feels confident about holiday 2016, given early results from Black Friday and recent customer responses. The company noted that digital sales have been particularly strong.

The company expects to see flat to low-single-digit comps for the fourth quarter, consistent with previous guidance. For the full fiscal year, the company expects to generate total sales of C$14.5–C$14.9 billion, with adjusted EBITDA of C$700–C$785 million. The company plans a total of C$700–C$750 million in capital investments, net of landlord incentives. This represents 4.8%–5.1% of the midpoint of the sales outlook.