Source: Company reports/Coresight Research

Fiscal 2Q18 Results

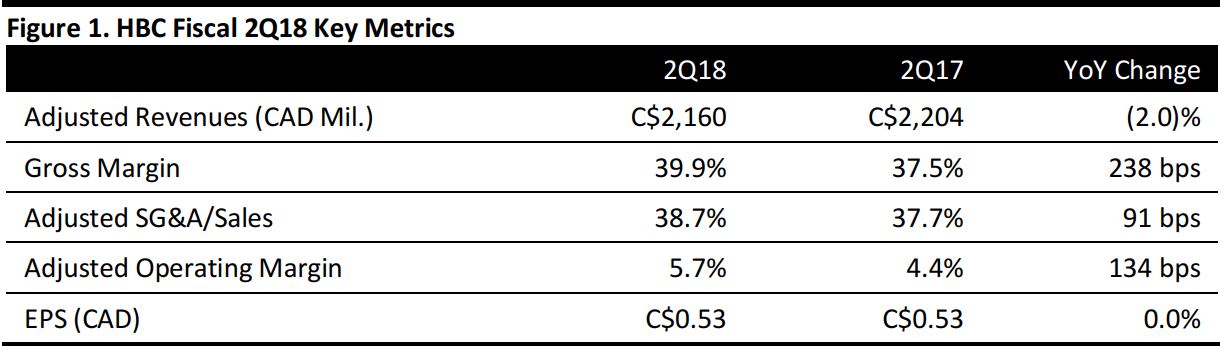

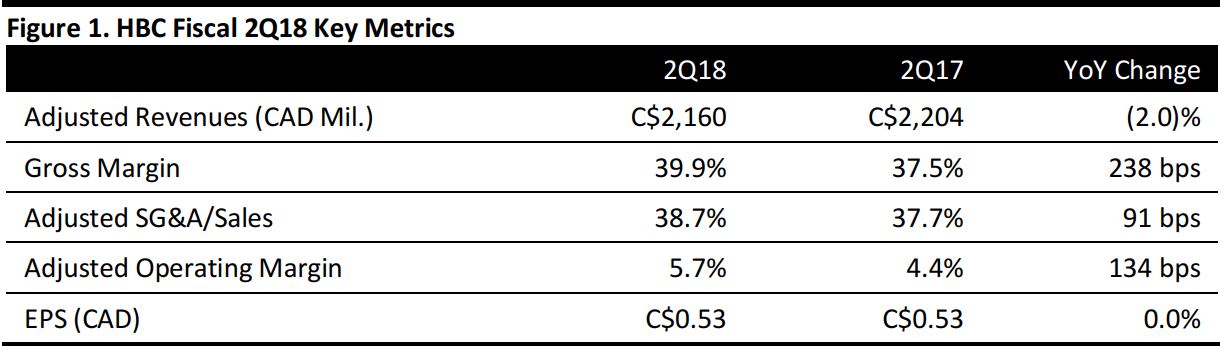

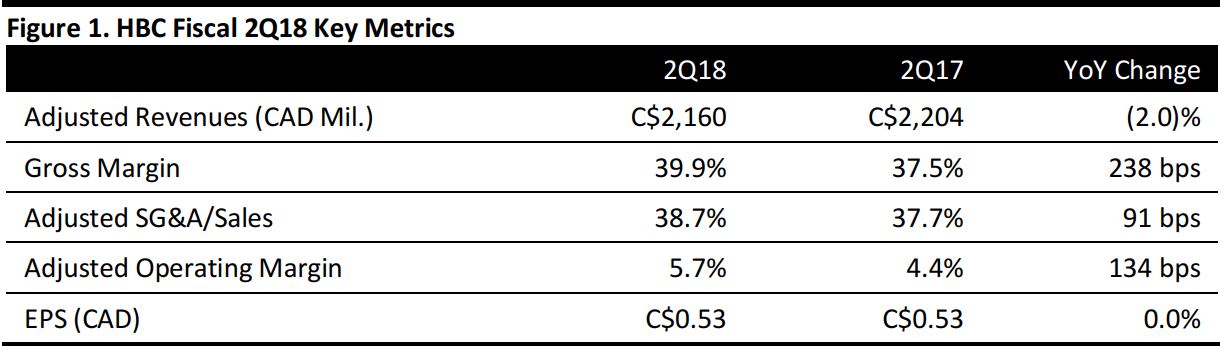

HBC reported fiscal 2Q18 adjusted revenues of C$2,160 million, down 2.0% year over year. Adjusted EPS was $0.53, beating the consensus estimate of $0.57 and even with the consensus estimate of $0.53 from the year-ago quarter. The company’s adjusted metrics exclude HBC Europe, which are classified as discontinued operations due to a newly announced merger with Karstadt.

Total comparable sales declined by 0.4% in 2Q18 versus a 0.7% decline in the prior quarter. The exclusion of the HBC Europe operation supported this improved performance.

By segment, Saks Fifth Avenue comparable sales were up 6.7%, DSG (which includes Hudson’s Bay, Lord & Taylor and Home Outfitters) comparable sales decreased by 3.8%, and Saks Off Fifth comparable sales decreased by 7.6%.

During the second quarter, HBC closed two Home Outfitter stores. The company ended the quarter with 350 total stores including 89 Hudson’s Bay stores, 48 Lord & Taylor stores, 42 Saks Fifth Avenue stores, 132 Saks Off Fifth stores, and 39 Home Outfitters stores.

On Tuesday, the company announced plans to merge HBC Europe with Germany’s Karstadt by entering into an agreement with SIGNA Retail to combine the two brands to create “an iconic retailer.” HBC Europe's retail operations will merge with SIGNA's Karstadt Warenhaus GmbH, and HBC will take a 49.99% interest in the combined businesses. The company expects this partnership to create more than $1.1 billion in real estate value for the company and generate cash to improve liquidity.

Outlook

The company did not provide quantitative guidance for FY18, nor did the company offer guidance on its 1Q18 earnings call.