Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

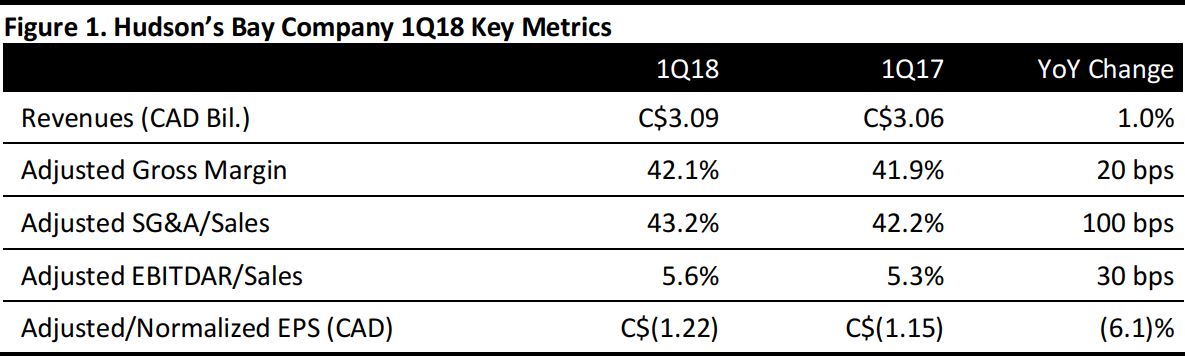

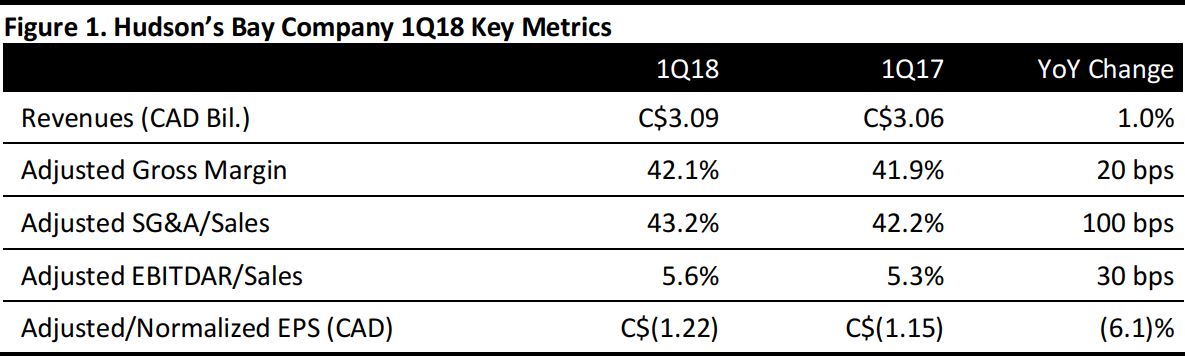

1Q18 Results

HBC reported 1Q18 adjusted EPS of C$(1.22), down from C$(1.15) in the year-ago period and below the C$(0.76) consensus estimate. Revenues were C$3.09 billion, up C$30 million, or 1.0%, year over year. Gilt, which represented less than 4% of the company’s FY17 sales, has been excluded from the sales figures.

Company comps were down 0.7% on a constant-currency basis, driven by a 6.6% decline at HBC Europe, a 3.5% decline at Saks OFF 5TH and a 0.6% decline at DSG (which refers, collectively, to the Hudson’s Bay, Lord & Taylor and Home Outfitters banners). These declines were partially offset by a 6.0% comp increase at Saks Fifth Avenue and a 7.7% increase in HBC’s digital business.

Gross margin as a percentage of revenue was 42.1%, up 20 basis points from the year-ago quarter. The company reported C$16 million in excess inventory related to the planned Lord & Taylor store closures and a C$4 million markdown charge related to the closure of two Lord & Taylor stores. Excluding these charges, gross profit would have improved by 90 basis points.

Adjusted EBITDAR was C$173 million, up C$11 million year over year, driven by solid performance from the company’s North American banners. Adjusted EBITDA declined by C$10 million, largely due to additional rent expense related to the company’s European expansion.

Details from the Quarter:

The company plans to close up to 10 Lord & Taylor stores through 2019, including the iconic flagship on Fifth Avenue in Manhattan.When HBC agreed to sell the building on Fifth Avenue to WeWork for US$850 million in October 2017, it had planned to keep a Lord & Taylor presence in the building. Management noted that it is increasing its focus on Lord & Taylor’s digital business as it optimizes and decreases the banner’s store footprint.

On Monday, HBC announced its sale of the Gilt Groupe to Boston-based flash-sale e-commerce site Rue La La for an undisclosed amount. HBC acquired Gilt in January 2016 for US$250 million. Management noted that the decision to divest Gilt will allow HBC to focus its resources on driving operating performance.Gilt represented less than 4% of the company’s total sales in 2017, and the divestiture is expected to improve adjusted EBITDA by C$10–C$15 million on an annualized basis.

In Europe, the company is working on improving its marketing and merchandising, and management noted that inventory had weighed on performance in the region. Europe accounts for almost half of the company’s total store space.

HBC is also seeking new ways to connect with customers. It recently signed a deal to sell Lord & Taylor items through a dedicated space on Walmart’s e-commerce site.

Outlook

The company reaffirmed plans to decelerate capital spending in FY18 from the prior year and said that it expects investments to total C$450–C$500 million, compared with C$599 million in 2017. HBC plans to reduce its overall inventory levels, and it expects that reduction, combined with reduced net capital investments and the expected sale of its Lord & Taylor flagship, to improve cash flow from operations and free cash flow in FY18.

Management noted that there is significant opportunity to improve topline sales at HBC Europe and to stabilize operations at HBC’s off-price businesses.

The company did not provide FY18 revenue or EPS estimates. The consensus estimate calls for full-year revenue of C$14.37 billion, implying 0.15% growth year over year, and for full-year EPS of C$(1.82), compared with FY17 adjusted EPS of C$(2.16).

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research