Source: Company reports/Fung Global Retail & Technology

Fiscal 1Q17 Results

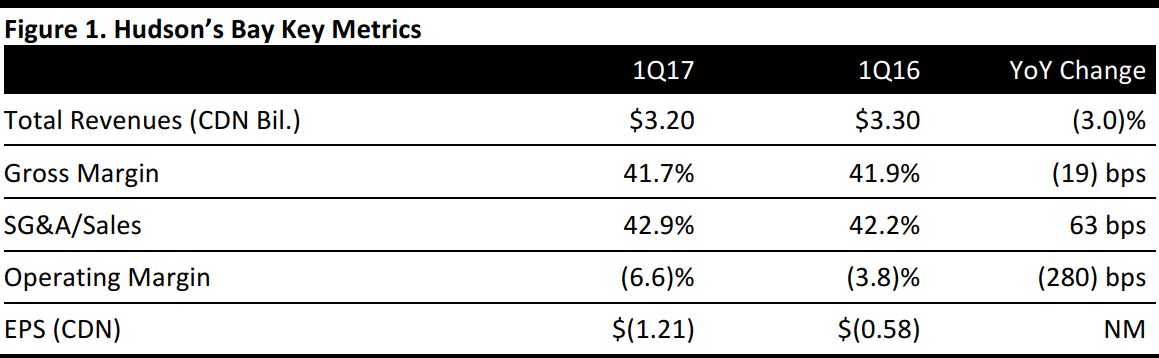

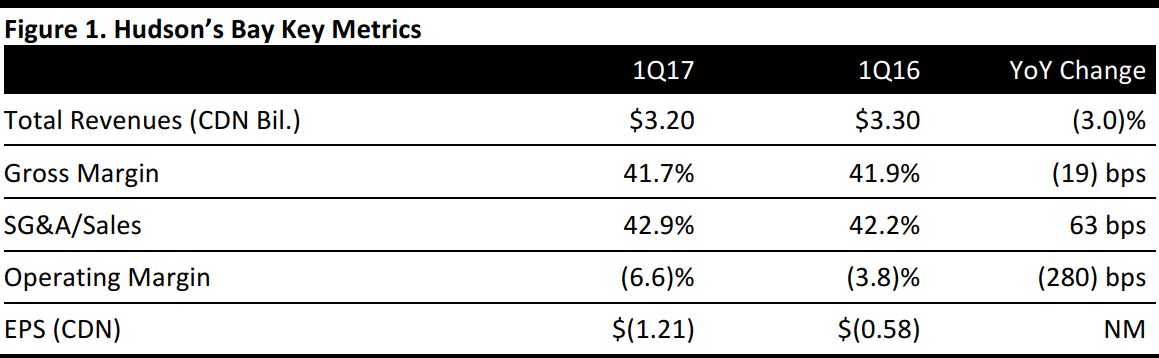

Hudson’s Bay reported fiscal 1Q17 revenue of C$3.20 billion, down 3.0% year over year and slightly below the C$3.26 billion consensus estimate. The decrease is related primarily to lower overall comparable sales of approximately C$94 million, as well as a negative C$31 million currency impact, a C$25 million impact from store closures, partially offset by the opening of four new Saks Fifth Avenue stores and 25 new Saks OFF 5TH stores, which contributed approximately C$50 million in sales.

Comparable sales were flat at HBC Europe and declined by 2.4% at DSG, 4.8% at Saks Fifth Avenue and 6.8% at HBC Off Price, on a constant-currency basis, for a consolidated comparable sales decline of 2.9%. Comparable sales were hurt by lower traffic across HBC’s banners, as well as a highly promotional retail environment.

Adjusted EPS was C$(1.21), versus C$(0.58) in the year-ago quarter and below the C$(0.75) consensus estimate.

The company reset its quarterly dividend to C$0.0125 per share, which is a significant cut from the C$0.05 per share it was paying out until 1Q17. The change in policy is part of Hudson’s Bay’s “ongoing initiatives to improve operations and cash flow to capitalize on future opportunities.”

Details from the Quarter

- HBC Europe: Lower overall traffic was offset by an increase in both conversion rate and average basket size, due to the fine-tuning of marketing activities and the introduction of new brands.

- DSG: Although comparable sales declined, sales increased at Hudson’s Bay, primarily driven by strong overall digital sales. Active and ladies’ shoes continued to perform, handbag sales declined and growth in home decreased.

- Saks Fifth Avenue: Lower comparable sales were primarily driven by lower traffic, a decline in international sales and a shift in the timing of two major promotional events.

- Saks OFF 5th: Lower traffic and Gilt primarily drove the comparable sales decline at HBC Off Price, and Gilt accounted for a major portion of the decline.

- Digital: Sales increased by 5.6% from the prior year, with comparable digital sales increasing by 5.4% on a constant-currency basis. Excluding Gilt, comps increased by 13.2% on a constant-currency basis.

Transformation Plan

Separately, the company announced a Transformation Plan for its North American operations designed to deliver a best-in-class, all-channel customer experience, including the following:

- More than C$350 million in annual savings when fully implemented

- Streamlining operations, increasing efficiencies and leveraging scale

- Dedicated leadership teams to focus on Hudson’s Bay in Canada and Lord & Taylor in the US

- A reduction of approximately 2,000 positions in North America

Other changes include the following:

- Department Store Group: Separate leadership teams have been established to run Hudson’s Bay and Home Outfitters in Canada and Lord & Taylor in the US.

- Digital: The company is fully integrating HBC Digital throughout for a seamless in-store and online shopping experience.

- Store Operations: HBC is currently realigning in-store sales coverage across its North American banners to better serve its customers, including implementing additional training for its store-based associates.

- Merchandising: HBC’s buying and planning teams were restructured to reduce layers, harmonize roles and expand responsibilities.

- Marketing: Support functions at HBC, including Digital Marketing, have now been centralized to allow for cohesive, all-channel marketing development across all banners.

- Procurement: The company expects to identify opportunities to leverage the size and scale of its business to generate significant savings over the next 12 months.

Management Changes

Hudson’s Bay President appointment: Separately, the company announced the appointment of Alison Coville as President of Hudson’s Bay. Coville has held leadership positions in merchandising with HBC since 2005, in areas including women’s, accessories, cosmetics, home and men’s. Prior to joining the company as a Divisional Merchandise Manager in 1999, she worked at T. Eaton Company, serving in roles including buying, store planning, marketing and national sales management.

Lord & Taylor President: The company also announced that Liz Rodbell, who had been serving as President of Hudson’s Bay and Lord & Taylor for the past three years, would continue in her role as President of Lord & Taylor.

Hudson’s Bay announced additional management changes in human resources, technology, corporate development, store planning & operations, communications and digital operations & procurement.

The company is continuing its search for a Chief Financial Officer.

Outlook

The company only provided an outlook for capital spending, expecting to invest C$450–C$550 million in FY17, compared to C$657 million in FY16.

Consensus estimates prior to the earnings report were for FY17 revenues of C$14.67 billion and EPS of C$(1.48), compared to C$14.46 billion and C$(0.83) in FY16.