DIpil Das

On March 3, 2020, HBC completed its privatization transaction. On February 28, HBC received court approval from the Ontario Superior Court of Justice on the arrangements for HBC to become a private company owned by certain continuing shareholders. The company’s other shareholders receive $11.00 per share in cash.

The company’s common shares are expected to be delisted from the Toronto Stock Exchange at the close of trading on March 4, 2020.

Management Changes

As part of its privatization, HBC also announced management changes. CEO Helena Foulkes will step down, effective March 13, 2020. Foulkes served as HBC CEO since February 19, 2018.

Richard Baker, currently Governor and Executive Chairman, will take on the CEO role while retaining his existing responsibilities.

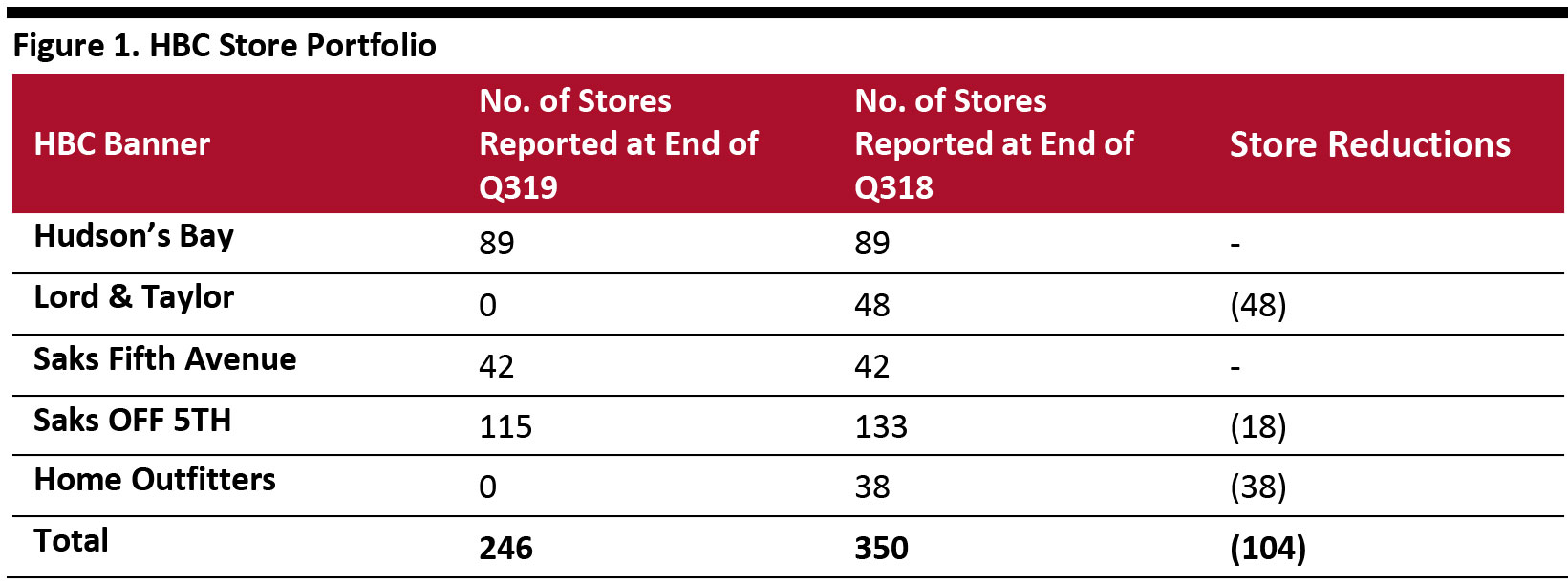

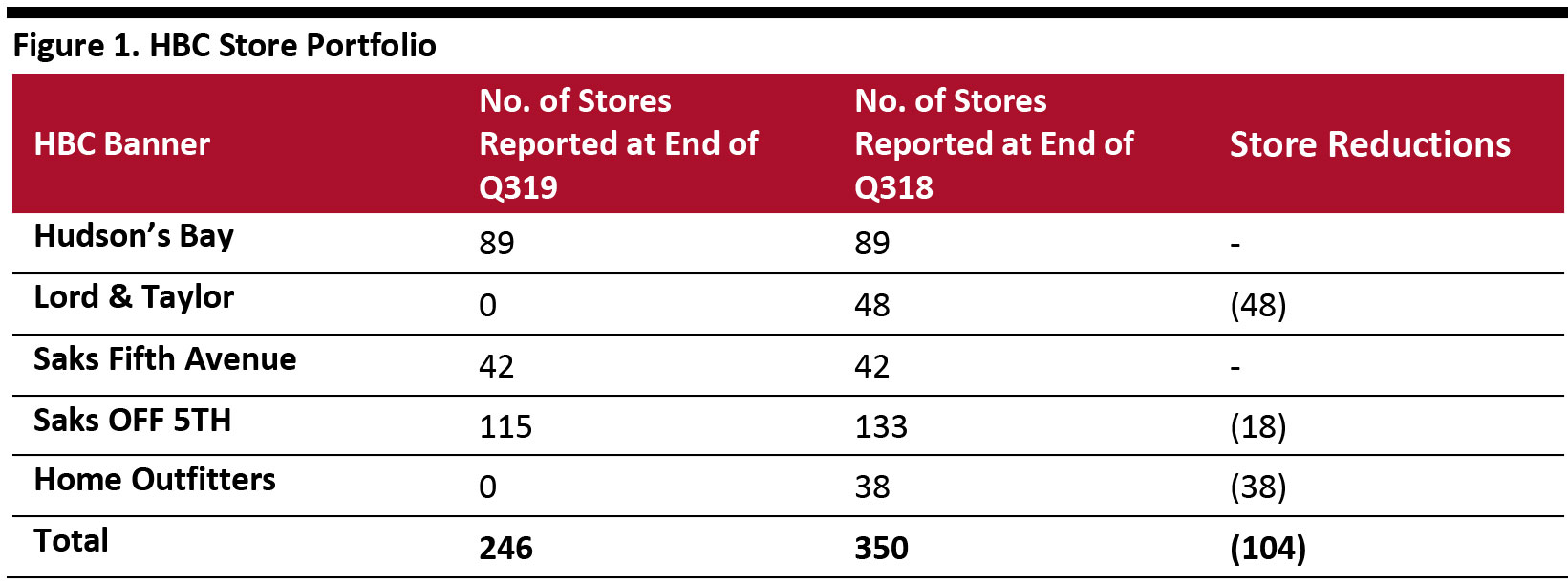

HBC Store Portfolio Rightsized by 30% Year over Year

In 2019, HBC rightsized its store portfolio, shrinking by about 30%, which has included closing underperforming businesses and locations and selling assets. These are some highlights:

Portfolio as of Q3, December 10, 2019

Portfolio as of Q3, December 10, 2019

Source: Company reports [/caption] HBC Strategy as a Private Company Over the past year, the company has been moving towards privatizing the company. On its Q319 earnings call, management said it intended to keep the company’s strategy the same as a private company: make investments to drive growth, enhance the customer experience across all channels, reduce operating costs and complexity and continue to fix the fundamentals and capitalize on the value of its real estate. On its Q219 earnings call, management said its “go-forward” portfolio included distinct segments with its top priorities in luxury (which drives over half of HBC sales overall), making focused investments to drive growth at Saks and Hudson’s Bay, enhancing the customer experience and reducing operating costs and complexity.

- On February 11, 2019, HBC sold its New York City Lord & Taylor flagship store on Fifth Avenue for a $850 million (C$1.1 billion).

- On June 10, 2019, HBC announced it had entered into an agreement to sell its real estate in Germany for $1.5 billion (€1 billion).

- On August 28, 2019, HBC and fashion rental subscription service Le Tote announced a $100 million agreement for Le Tote to acquire Lord & Taylor.

Portfolio as of Q3, December 10, 2019

Portfolio as of Q3, December 10, 2019 Source: Company reports [/caption] HBC Strategy as a Private Company Over the past year, the company has been moving towards privatizing the company. On its Q319 earnings call, management said it intended to keep the company’s strategy the same as a private company: make investments to drive growth, enhance the customer experience across all channels, reduce operating costs and complexity and continue to fix the fundamentals and capitalize on the value of its real estate. On its Q219 earnings call, management said its “go-forward” portfolio included distinct segments with its top priorities in luxury (which drives over half of HBC sales overall), making focused investments to drive growth at Saks and Hudson’s Bay, enhancing the customer experience and reducing operating costs and complexity.