HBC Plans to Close 10 Lord & Taylor Stores, Including Manhattan Flagship

On June 5, Canadian retail group Hudson’s Bay Company (HBC) announced that it plans to close up to 10 Lord & Taylor stores through 2019. The closures will include the iconic Lord & Taylor flagship store on Fifth Avenue in Manhattan.

In October 2017, HBC sold the Fifth Avenue building that is home to the Lord & Taylor flagship to shared workspace company WeWork. The Fifth Avenue store is expected to close by the end of this year. Lord & Taylor is the oldest department store company in the US and its Fifth Avenue store has been in operation for 104 years. As of May 5, 2018, Lord & Taylor operated 48 stores.

HBC CEO Helena Foulkes stated that plans to downsize Lord & Taylor’s store network are a first step toward driving increased profitability, and that the company is taking advantage of having a smaller store footprint to rethink the model and focus on Lord & Taylor’s digital business, which has consistently grown by double digits. HBC began a partnership with Walmart.com on May 16, and a Lord & Taylor digital store went live on the Walmart site last week.

The decision to shrink the Lord & Taylor store footprint was announced as part of strategic actions HBC is taking to improve the group’s profitability by focusing on businesses that show the greatest potential to impact results. As part of this strategy, the company will divest of online shopping company Gilt, which is expected to be sold to flash-sales e-commerce site Rue La La.

HBC reported that comparable sales declined by 0.7% in the first quarter of 2018 and that operating loss totaled C$238 million during the period.

HBC Sells Gilt Groupe to Rue La La

On June 4, HBC agreed to sell flash-sales website Gilt Groupe to rival Rue La La. Rue La La seeks to create one large flash-sales entity called Rue Gilt Groupe. The combined group is expected to be the fourth-largest player in the flash-sales space, according to Rue La La CEO Mark McWeeny (following QVC’s Zulily, Vente-Privée in Europe and Vipshop in China).

Founded in 2007, Gilt Groupe specializes in selling designer goods at deep discounts. Financial terms of the deal were not disclosed, but sources familiar with the deal believe the price to be below $100 million. Hudson’s Bay acquired Gilt in early 2016 for $250 million after the company had raised $280 million from investors and, at one point, was valued at more than $1 billion by venture capitalists.

The Rue Gilt Groupe

Rue La La is owned by e-commerce company Kynetic, which also owns sports licensing firm Fanatics. Michael Rubin, Founder and CEO of Kynetic, previously sold GSI Commerce to eBay for $2.4 billion. Boston-based Rue La La was acquired by Kynetic in 2011. Rue La La sells designer clothes, beauty products and home décor products, and has seen high single-digit growth in that time, according to the company.

Gilt and Rue La La are similar in size in terms of revenues, McWeeny said. The latter reportedly posts annual sales of about $400 million.Together, the Rue Gilt Groupe will have over 20 million members and is expected to reach $1 billion in sales, according to McWeeny. The new entity plans to target the off-price channel by leveraging its customer data and focusing on mobile sales, which comprise more than 60% of the business.

The two brands plan to operate independently of each other. Rue will continue selling both high-and low-end products,while Gilt will focus more on higher-end products, reaching more affluent consumers. The shared infrastructure will allow for better relationships with vendors, McWeeny said.

Gilt Acquisition Failed to Provide Digital Boost to Off-Price Business

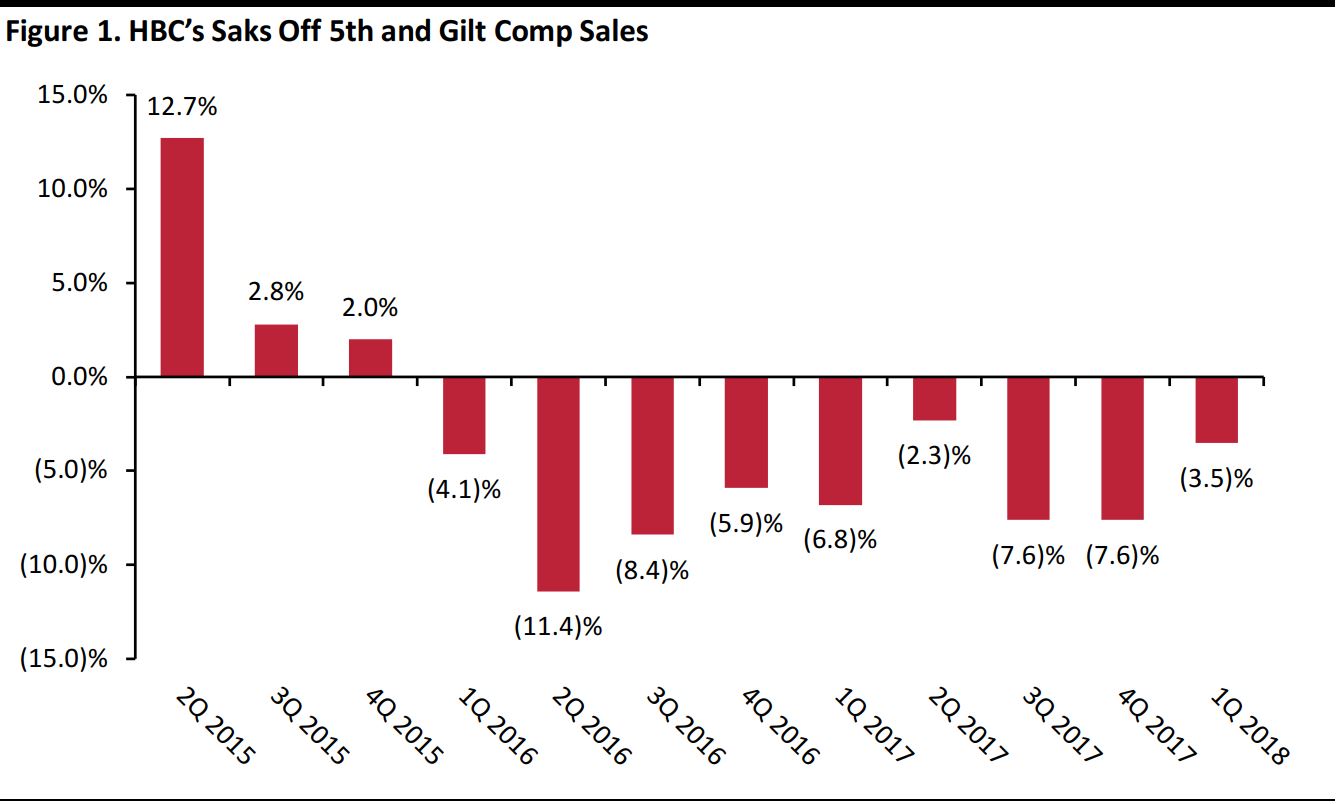

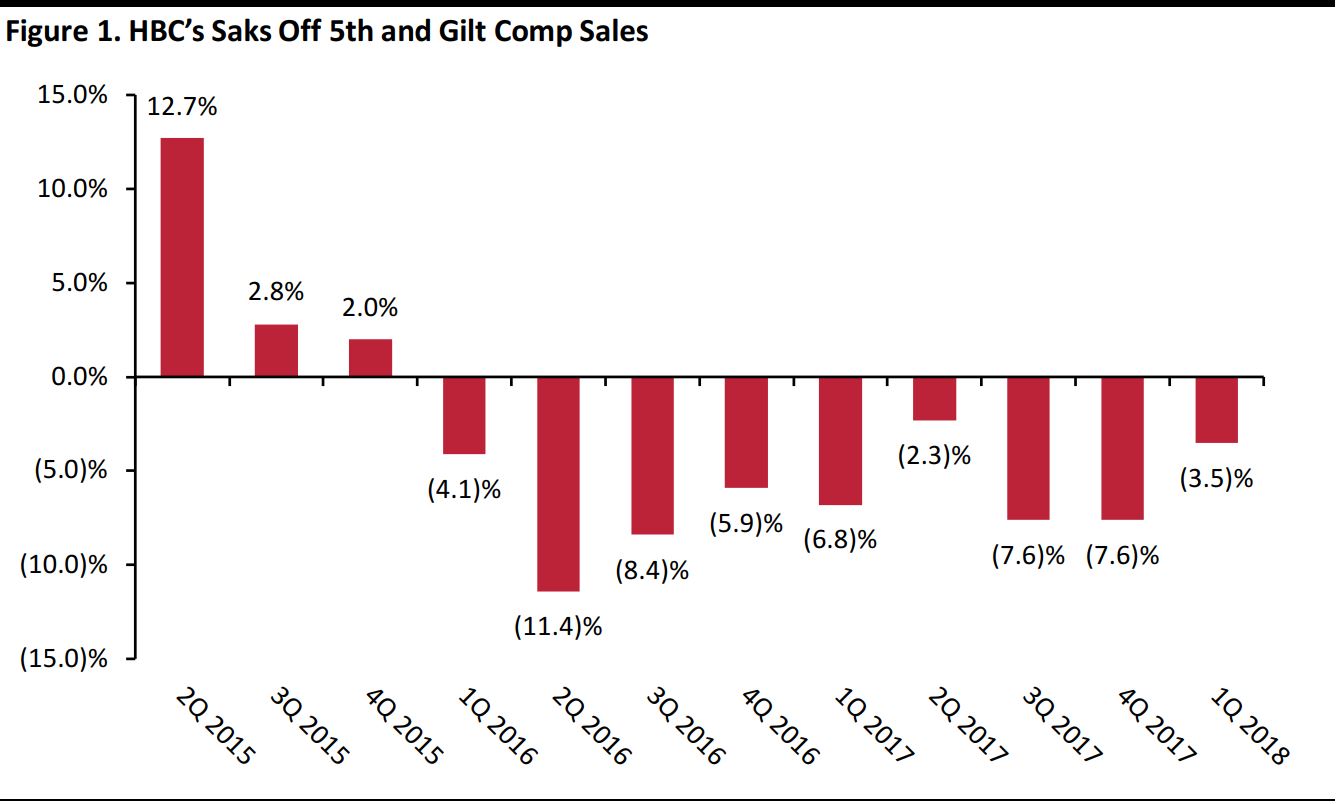

In a statement released about the sale, HBC said it bought Gilt in 2016 to bolster its online sales of its Saks Off 5th division.However, Gilt has weighed on its digital sales; the company said digital sales would have grown by 9% in the quarter ended February 2018—not the reported 2.8%—had Gilt been excluded. Prior to HBC’s quarterly results reported on Tuesday, Gilt used to be grouped in quarterly comp sales results with Saks Off 5th, and as this chart shows, that division has been struggling for some time.

Source: Coresight Research

Source: Coresight Research

Gilt represented less than 4% of HBC’s total sales in 2017, and HBC estimates the divestiture should improve adjusted EBITDA by C$10–C$15 million on an annualized basis.

Rise and Fall of the Flash-Sale Business Model

Gilt Groupe, along with other flash-sales sites (such as Groupon, HauteLook and Rue La La) gained significant popularity in the late 2000s when brands and designers needed to sell their excess merchandise.However, flash-sales companies in the US have struggled in recent years, as retail companies have tightened control of inventory and traditional retailers have begun offering greater discounts to drive traffic.

Gilt and several of its peers have changed hands in recent years at a fraction of their onetime billion-dollar valuations.We expect to start to see both new models and experiences at discount-driven flash-sales websites.

Source: Coresight Research

Source: Coresight Research