DIpil Das

[caption id="attachment_95116" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Fiscal 3Q19 Results

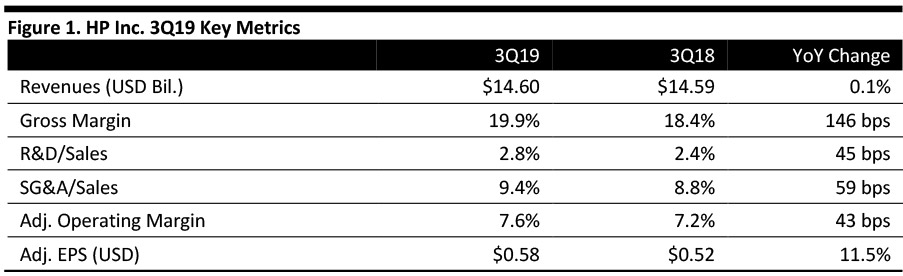

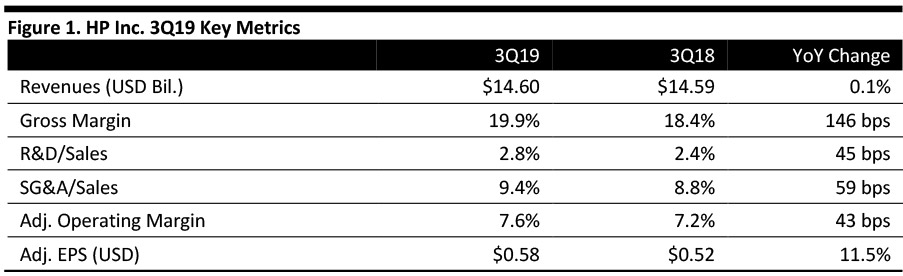

HP reported fiscal 3Q19 revenues of $14.60 billion, flat year over year, in line with the $14.62 billion consensus estimate.

Adjusted EPS was $0.58, up 11.5% year over year and beating the $0.55 consensus estimate.

Segment Performance

Source: Company reports/Coresight Research[/caption]

Fiscal 3Q19 Results

HP reported fiscal 3Q19 revenues of $14.60 billion, flat year over year, in line with the $14.62 billion consensus estimate.

Adjusted EPS was $0.58, up 11.5% year over year and beating the $0.55 consensus estimate.

Segment Performance

Source: Company reports/Coresight Research[/caption]

Fiscal 3Q19 Results

HP reported fiscal 3Q19 revenues of $14.60 billion, flat year over year, in line with the $14.62 billion consensus estimate.

Adjusted EPS was $0.58, up 11.5% year over year and beating the $0.55 consensus estimate.

Segment Performance

Source: Company reports/Coresight Research[/caption]

Fiscal 3Q19 Results

HP reported fiscal 3Q19 revenues of $14.60 billion, flat year over year, in line with the $14.62 billion consensus estimate.

Adjusted EPS was $0.58, up 11.5% year over year and beating the $0.55 consensus estimate.

Segment Performance

- Personal systems revenues were $8.9 billion, up 1.8% year over year.

- Printing revenues were $5.1 billion, down 2.4% year over year.

- Personal systems: HP launched more than 40 new innovations in the quarter, and the company continues to invest in key priorities including new products, services and solutions.

- Commercial hardware: The company is developing products to meet the needs of an increasingly mobile workforce, launching the latest EliteBook x360 lineup in the quarter, which includes convertibles with up to 24 hours of battery life. Management also commented that HP continues to expand its security and leadership position across its segments.

- Personal systems: Management aims to drive an aggressive forward-looking agenda to reinvent the way people work, live and play, enhancing its products, supply chain and go-to-market strategy to capture ongoing demand and navigate industry dynamics.

- Print: Revenues were down, driven by supplies, yet HP believes it outperformed the market in an increasingly challenging environment. In the contractual market, the company continues to make progress leveraging its differentiated technology and IP to capture opportunities. HP continues to gain traction and scale, aided by the smooth integration of Samsung Printing into the portfolio. The contractual office and consumer industry portfolio grew revenue double digits in the quarter. In graphics, HP continues to see adoption of its technology as customers increasingly go digital, and the new HP Stitch portfolio is being positively received by customers. In the quarter, the company introduced HP Neverstop Laser, a printer for small business owners in emerging markets.

- Supplies: Management has been aggressively addressing this business and claims progress relative to the strategic and operational initiatives outlined previously. HP is growing its contractual businesses and adapting its business models.

- 3D Printing: HP opened a 150,000-square-foot 3D Printing Center of Excellence in Barcelona. The company also continues to drive installations with industrial grade customers and is seeing early traction for its Multi Jet Fusion 5200 solution. Customers are embracing new data and software capabilities to achieve new levels of industrial manufacturing predictability, reliability, efficiency and quality.