DIpil Das

What’s the Story?

Amazon is rapidly expanding the footprint of its Amazon Fresh store format. Within just over six months of launching the format, the retailer has opened 12 Amazon Fresh stores in the US as of March 2021, with more locations in the pipeline. Moreover, Amazon recently announced that it would fold its Go Grocery format into Amazon Fresh, making Fresh the sole Amazon-branded supermarket banner. In this report, we discuss three key ways that the Amazon Fresh store format will impact US grocery retailers and the overall market.Why It Matters

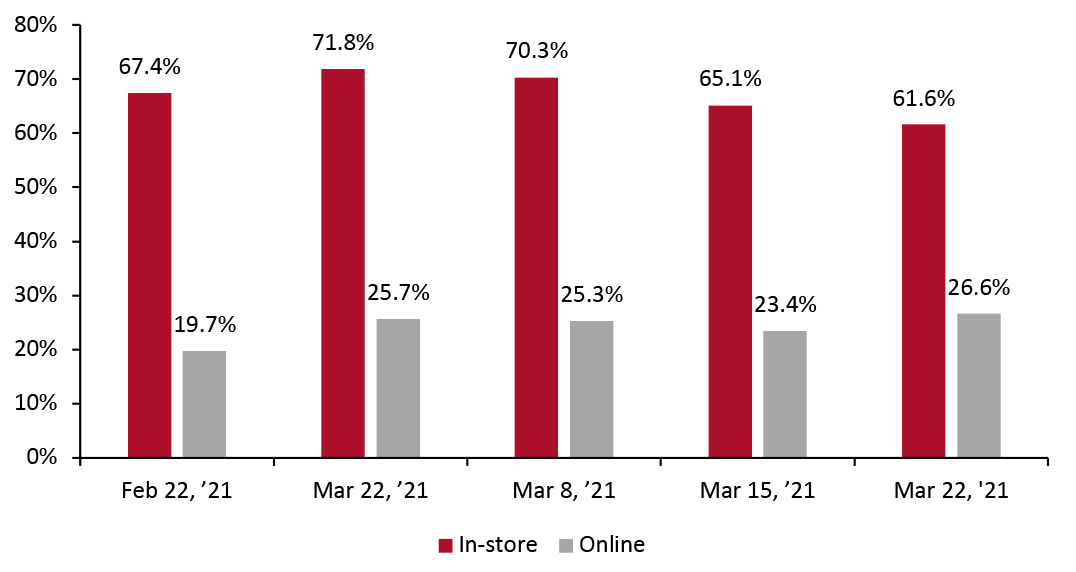

Despite the surge in grocery e-commerce seen in the US in 2020 and into 2021, grocery remains a predominantly offline sector and consumers that use e-commerce tend to be cross-channel shoppers. Coresight Research’s weekly US consumer surveys consistently find that around two-thirds of respondents buy food and beverages in stores.Figure 1. All Survey Respondents: Proportion That Had Bought Food or Beverages In-Store and Online in the Past Two Weeks (% of Respondents) [caption id="attachment_127554" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Amazon has recognized that it cannot win a significant share in grocery with a pure-play online model or with physical formats that cater to niche market segments. As of 2020, Amazon (the company—including Whole Foods Market) ranks tenth in the offline US grocery market with a 1.3% share, according to Euromonitor International.

To carve a meaningful share of the market and attract full-basket shoppers, the company is taking an aggressive approach with its brick-and-mortar strategy and targeting a wider consumer base with its Amazon Fresh offering.

Source: Coresight Research[/caption]

Amazon has recognized that it cannot win a significant share in grocery with a pure-play online model or with physical formats that cater to niche market segments. As of 2020, Amazon (the company—including Whole Foods Market) ranks tenth in the offline US grocery market with a 1.3% share, according to Euromonitor International.

To carve a meaningful share of the market and attract full-basket shoppers, the company is taking an aggressive approach with its brick-and-mortar strategy and targeting a wider consumer base with its Amazon Fresh offering.

Figure 2. US Offline Grocery Market Share in 2020 [wpdatatable id=975 table_view=regular]

Source: Euromonitor International Limited 2021 © All rights reserved

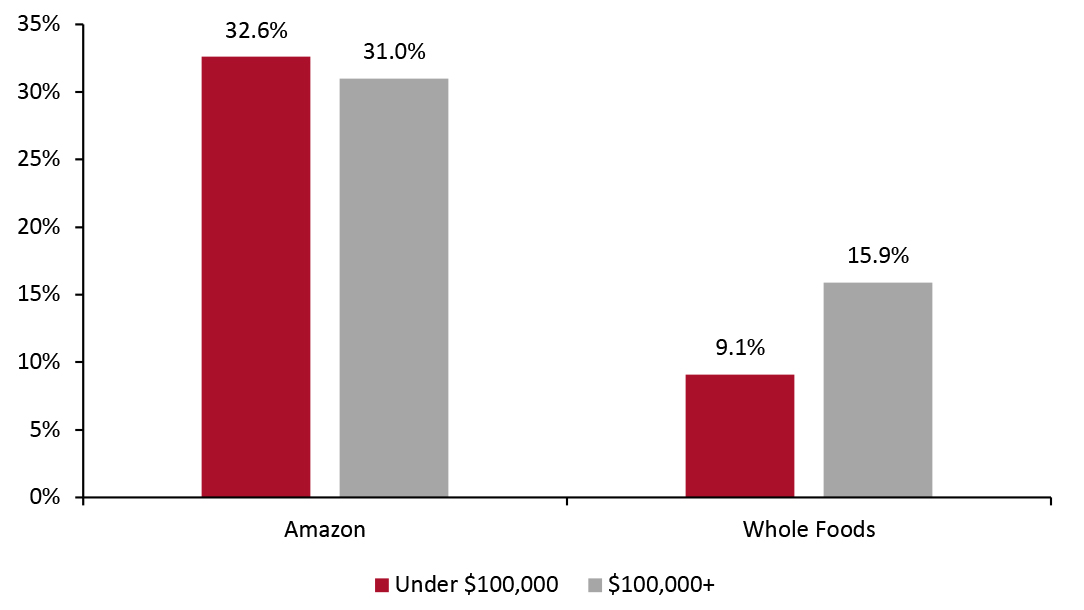

The Impact of Amazon Fresh on the US Grocery Market: In Detail

1. Price Competition Amazon has taken a four-pronged approach to brick-and-mortar grocery retailing in the US—it has 26 Amazon Go stores), two Amazon Go Grocery stores (one of which will be closed and one of which will soon be rebranded as Amazon Fresh), 12 Amazon Fresh stores and over 500 Whole Food stores as of March 2021. Prior to launching the Fresh chain, Amazon did not have a physical format to capture the same consumer base it attracts online. Amazon Go is primarily positioned to cater to young shoppers’ demand for greater convenience. The stores are small (less than 1,800 square feet), checkout-free convenience stores that primarily offer on-the-go food options in urban locations. On the other hand, Whole Foods, which was acquired by Amazon in 2017, caters to a niche segment, offering natural and organic products at typically higher price points. Although Whole Foods cut prices and added online ordering after the acquisition, the upscale chain has still struggled to re-invent itself as a mainstream destination. In a weekly US consumer survey undertaken on March 29, we found that Amazon.com attracts an even distribution of consumers by income group, while Whole Foods disproportionately attracts consumers in the survey’s top income group.Figure 3. Respondents Who had Bought Food from Amazon and Whole Foods in the Two Weeks Prior to March 29, 2021 (%) [caption id="attachment_127555" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

The Amazon Go and Whole Foods formats, therefore, hold limited relevance for mid-market, big-basket grocery shoppers as neither are positioned on value—even if Amazon expands the two chains, they will likely capture relatively few core big-shop customers from the company’s rival grocery retailers.

However, the introduction of Amazon Fresh poses a more serious threat to traditional retailers. Amazon Fresh claims to offer “lower prices consistently” and stocks a wide assortment of mainstream brands. It is targeted at low and middle-income shoppers who don’t frequent Whole Foods, as well as high-income customers looking for a bargain. Additionally, an extra 10% discount on selected items exclusively for Prime members will likely draw shoppers to Fresh stores.

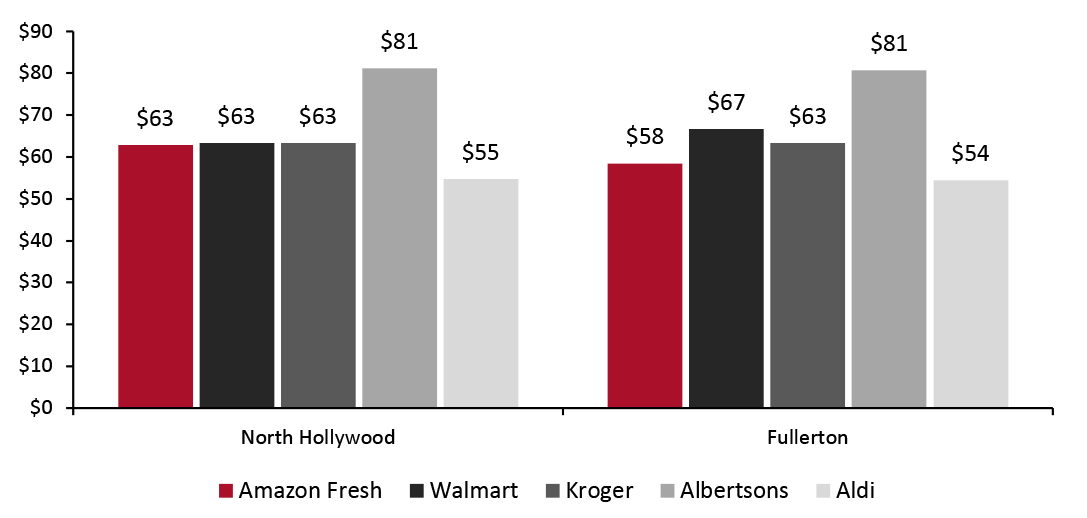

In May 2021, Coresight Research conducted online price checks for a basket of 10 comparable items at nearby Amazon Fresh competitors (in the same zip code region) at two locations—one in North Hollywood and one in Fullerton, California. The results indicate that Amazon Fresh is priced competitively with nearby Kroger and Walmart stores in the North Hollywood area but is priced lower than both in Fullerton. At both locations, Amazon Fresh is priced higher than Aldi, while undercutting Albertsons by over 20%.

Source: Coresight Research[/caption]

The Amazon Go and Whole Foods formats, therefore, hold limited relevance for mid-market, big-basket grocery shoppers as neither are positioned on value—even if Amazon expands the two chains, they will likely capture relatively few core big-shop customers from the company’s rival grocery retailers.

However, the introduction of Amazon Fresh poses a more serious threat to traditional retailers. Amazon Fresh claims to offer “lower prices consistently” and stocks a wide assortment of mainstream brands. It is targeted at low and middle-income shoppers who don’t frequent Whole Foods, as well as high-income customers looking for a bargain. Additionally, an extra 10% discount on selected items exclusively for Prime members will likely draw shoppers to Fresh stores.

In May 2021, Coresight Research conducted online price checks for a basket of 10 comparable items at nearby Amazon Fresh competitors (in the same zip code region) at two locations—one in North Hollywood and one in Fullerton, California. The results indicate that Amazon Fresh is priced competitively with nearby Kroger and Walmart stores in the North Hollywood area but is priced lower than both in Fullerton. At both locations, Amazon Fresh is priced higher than Aldi, while undercutting Albertsons by over 20%.

Figure 4. Absolute Price Comparisons: Amazon Fresh Basket Versus Competitors (May 2021) [caption id="attachment_127556" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Amazon Fresh’s focus on affordability will allow it to go head-to-head with traditional grocers, intensifying price competition in the near future. Given Amazon’s historical willingness to accept low profit margins for long-term gains, we believe that the company could gain significant grocery industry market share by undercutting established players on price.

2. Innovation Around In-Store Technology

Amazon Fresh stores rely heavily on technology to optimize customer experiences. The format has a particular focus on check-out free shopping—offering smart shopping carts, referred to as Dash Carts, that scan and weigh items while keeping a running total of purchases. Customers exit the store through a specific sensor-enabled lane that automatically charges their Amazon account for their groceries. The stores do have traditional checkouts and cashiers for customers that opt not to use a Dash Cart.

[caption id="attachment_127557" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Amazon Fresh’s focus on affordability will allow it to go head-to-head with traditional grocers, intensifying price competition in the near future. Given Amazon’s historical willingness to accept low profit margins for long-term gains, we believe that the company could gain significant grocery industry market share by undercutting established players on price.

2. Innovation Around In-Store Technology

Amazon Fresh stores rely heavily on technology to optimize customer experiences. The format has a particular focus on check-out free shopping—offering smart shopping carts, referred to as Dash Carts, that scan and weigh items while keeping a running total of purchases. Customers exit the store through a specific sensor-enabled lane that automatically charges their Amazon account for their groceries. The stores do have traditional checkouts and cashiers for customers that opt not to use a Dash Cart.

[caption id="attachment_127557" align="aligncenter" width="725"] A Dash Cart at an Amazon Fresh store

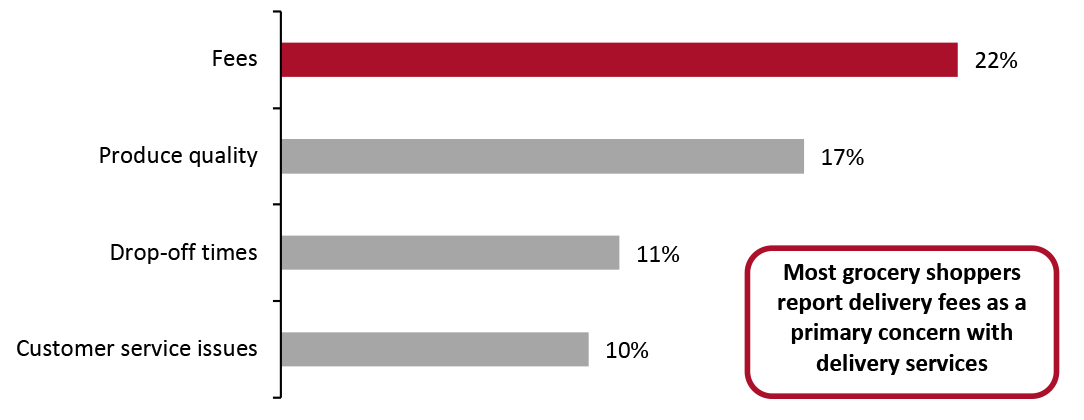

A Dash Cart at an Amazon Fresh store Source: Amazon [/caption] Moreover, Amazon has integrated its voice recognition technology into the Fresh format, enabling customers to navigate the store based on the location of items on their Alexa shopping lists. Consumers can use a Dash Cart of the Amazon app to access the product map that will help them to complete their shopping more quickly. Amazon Echo Show devices are also located conveniently around the store for consumers to ask Alexa for help. Stores use electronic shelf labels that can easily be updated to reflect price changes, and larger graphic displays offer product promotions, product reviews and shopper advice. Amazon’s utilization of technology will likely compel other retailers to adopt digital solutions and focus on shopping experiences instead of just products. Amid the pandemic in 2020, we saw many US retailers roll out different iterations of checkout-free technologies to eliminate lines, reduce touchpoints and speed up the overall shopping process. Similar to Amazon’s “Just Walk Out” technology used in Amazon Go stores, 7-Eleven and Giant Eagle are trialing or launching stores with automated checkouts. Moreover, aside from full store fit-outs, Kroger introduced a line of “KroGo” smart shopping carts, developed by Caper, at one of its stores in Cincinnati in January 2021. While the shift toward checkout-free grocery stores is proving gradual, Amazon’s innovations in the market provide another motivation for traditional stores to innovate. 3. Omnichannel Competition Amazon Fresh stores are located in densely populated suburban regions and are designed to serve as distribution hubs for online order fulfillment. Same-day grocery delivery and pickup services are offered directly from the store, and customers can pick up their orders at the counter or by parking in a designated pickup spot. Amazon has likely used internal data to analyze the density of Prime members per zip code and determine where to open more productive physical locations that expand its ability to serve its customers’ store-based grocery fulfillment needs. By choosing sites close to Prime members (who tend to shop more on Amazon) Amazon boosted its last-mile advantage, making both pickup and delivery easier by generating a higher order volume from the immediate trade area—which can translate to lower delivery costs. Amazon Fresh stores also serve as pickup and return sites for Amazon.com orders, improving convenience for Amazon online shoppers. Additionally, Fresh stores will enable Amazon to extend its free two-hour grocery delivery service to more Prime members at more locations. Currently, free grocery delivery services are available in selected US cities only. Many customers prefer delivery over other options, so long as it does not involve an added cost. According to a survey conducted by social media analytics company The Manifest in July 2020, almost one-quarter of US respondents find delivery and service fees to be the main challenge with using grocery delivery services. By offering free grocery delivery services at more locations, Amazon will potentially attract more online pickup business from other grocers.

Figure 5. Top Grocery Delivery Challenges (% of Respondents) [caption id="attachment_127558" align="aligncenter" width="725"]

Source: The Manifest[/caption]

Source: The Manifest[/caption]

What We Think

Although Covid-19 accelerated the shift to online shopping, Amazon’s bold move to open Fresh format stores amid the pandemic underscores its belief that physical stores will remain a key component of how consumers shop for groceries in the future. These digitally integrated stores will encourage customers to do more grocery shopping within the Amazon ecosystem, an important element in the company’s long-term strategy. Implications for Retailers- We believe Fresh stores will raise company awareness among customers on the basis that the Amazon Fresh service, which meets a broad range of online shopper needs, now also has a physical presence. This brick-and-mortar presence will give Amazon more comprehensive visibility and provide confidence—for those shoppers who need it—that when they are shopping online, they are ordering from a real grocery store and not just an online provider.

- In the long term, we see opportunities for Amazon to couple its Fresh stores with healthcare hubs, continuing its recent foray into healthcare and the pharmacy business. More healthcare options integrated into physical retail could help Amazon to compete with Walmart as the rival retailer expands its own health centers.

- Grocers must continually look at ways to reduce the cost of delivery or risk letting Amazon dominate the market segment.

- Retailers must prioritize investing in technologies such as smart checkout systems to keep up with the competition and improve the shopping experience in their brick-and-mortar stores.