Nitheesh NH

What’s the Story?

The US retail industry is in an era of unprecedented disruption and transformation. Following a large number of bankruptcy filings by traditional retailers in 2018 and 2019, retail failures have continued apace in 2020 and year-to-date 2021. Historically, US retailers have used the bankruptcy process to reorganize by reducing debt significantly and closing most of their stores. However, the updated US Bankruptcy Code, the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA), has substantially reduced the timeframe for a reorganization plan, making it more difficult for bankrupt firms to restructure debt and emerge from bankruptcies. Understanding the BAPCPA and other recently incorporated bankruptcy laws, such as the Small Business Reorganization Act (SBRA), is increasingly important owing to the recent surge in retail bankruptcies. In this report, we analyze the impact of the BAPCPA on today’s US retail bankruptcy outcomes and offer recommendations for how US retailers filing for bankruptcy can improve their prospects for a successful turnaround. We also provide a review of 2020 and year-to-date 2021 retail bankruptcies.Why It Matters

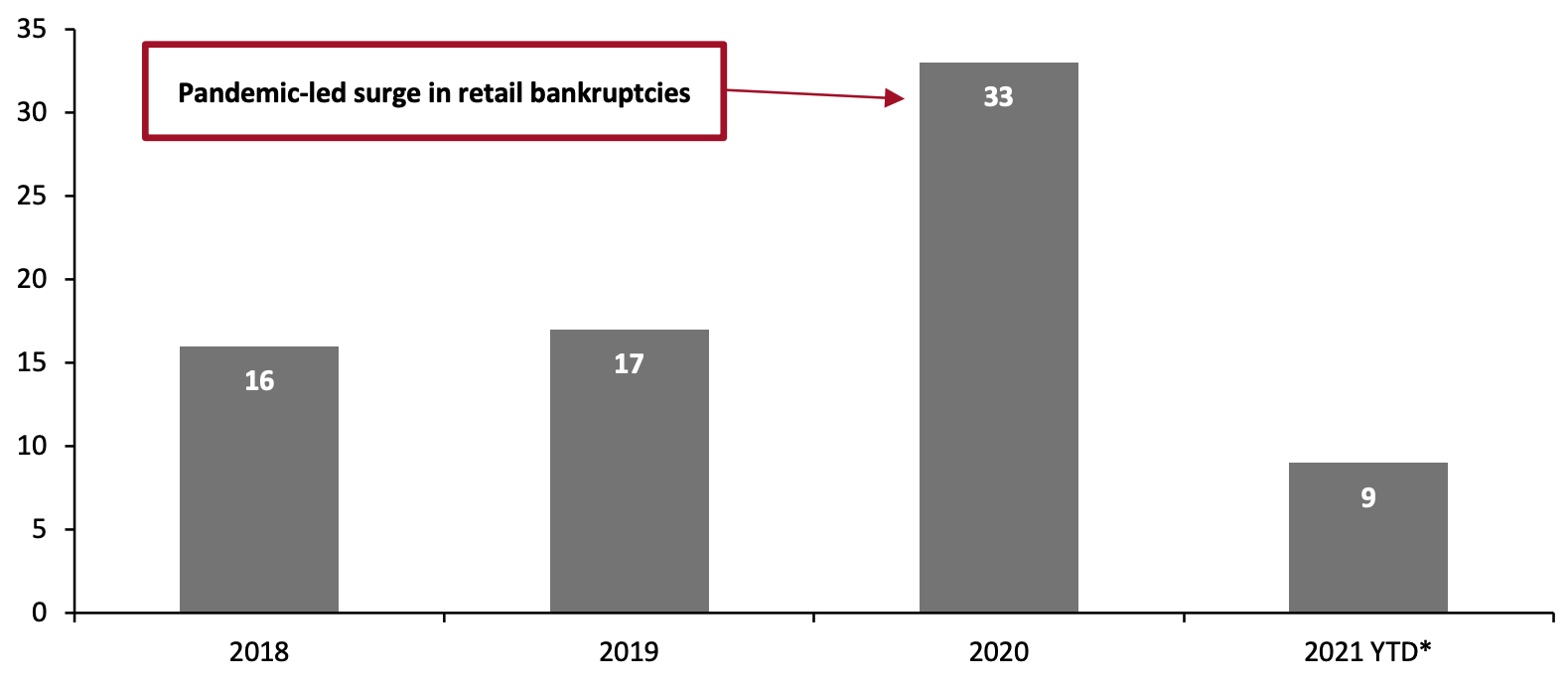

The combined effects of a challenging retail environment and the impact of the Covid-19 pandemic are causing significant financial distress for companies in the retail industry. In 2020, 33 major retailers (with liabilities of over $50 million) filed for bankruptcy. In 2021, nine major retailers have filed for bankruptcy as of May 31, 2021—although trends have slightly slowed compared to the same period in 2020, this year remains ahead of 2018 and 2019 levels. Figure 1. Total Number of Major US Retail Bankruptcies [caption id="attachment_128372" align="aligncenter" width="720"] *YTD as of May 31, 2021

*YTD as of May 31, 2021Source: Coresight Research[/caption] Bankruptcies have a significant bearing on the US retail industry, because more bankruptcies translate to more store closures. Mall landlords will face challenges in finding new tenants to occupy the space vacated by bankrupt retailers. Retailers should be familiar with the updated US Bankruptcy Code, including the BAPCPA, to evaluate potential impacts on bankruptcy outcomes and devise successful turnaround plans.

How Changes in US Bankruptcy Laws Impact Retailers: A Deep Dive

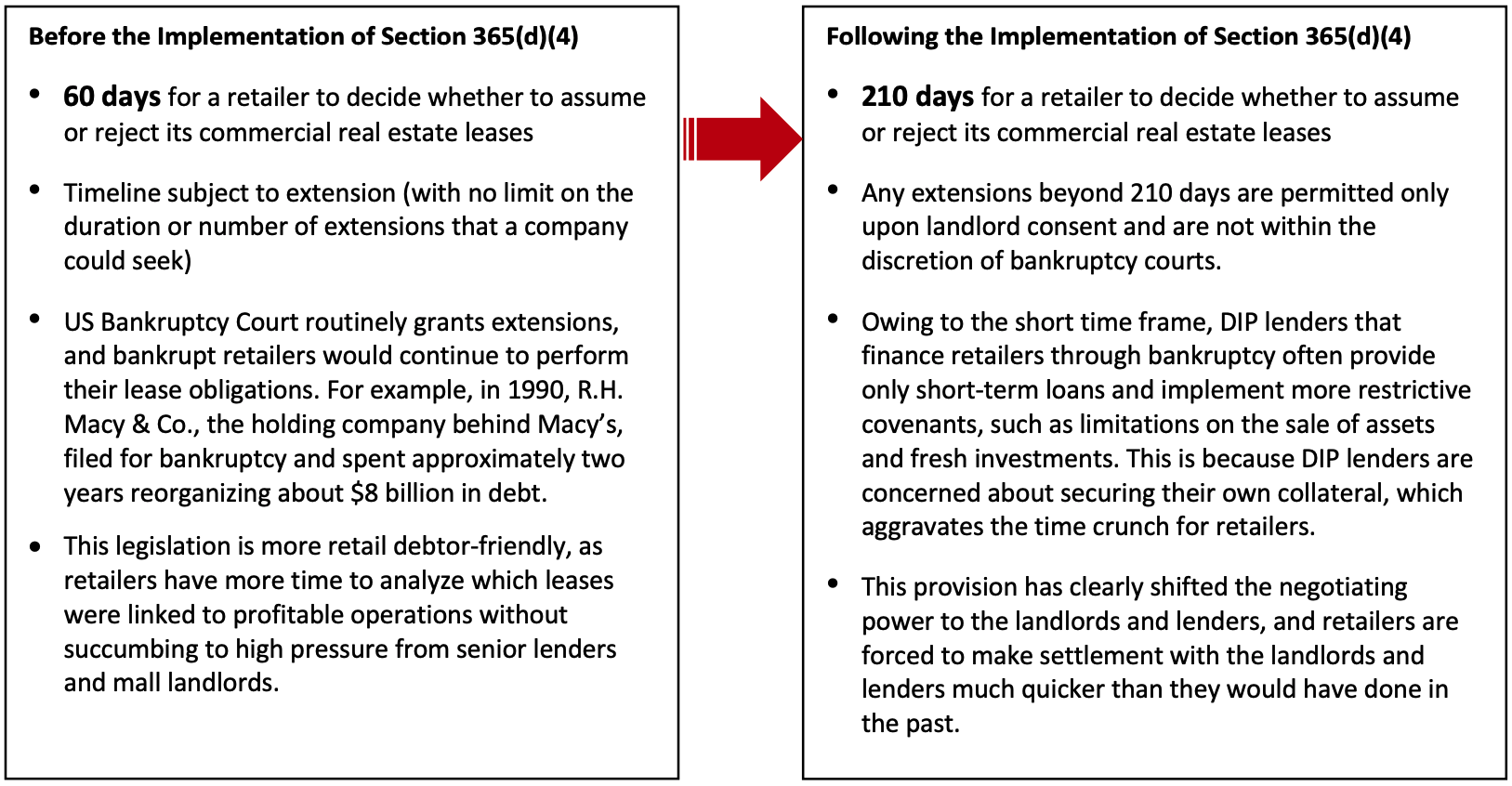

Changes to BAPCPA Legislation Before the implementation of BAPCPA on October 17, 2005, US retailers usually spent six months to two years in bankruptcy deciding which leases to accept and which to reject. However, the BAPCPA gives bankrupt retailers just 210 days to act on store leases. As it can take up to 90 days to hold a going-out-of-business (GOB) sale, retailers often have just 120 days to propose a reorganization plan. Two sections under the BAPCPA—Section 365(d)(4) and Section 503(b)(9)—are increasing the likelihood that retail bankruptcies end in liquidations. We discuss these two sections in detail below. 1. Section 365(d)(4) Section 365(d)(4) of the BAPCPA legislation deals with leases of commercial real estate property and states the amount of time bankrupt retailers have to accept or reject their lease portfolios. Bankrupt retailers with sizeable brick-and-mortar operations typically have significant lease obligations. It is important for them to differentiate the profitable and unprofitable retail locations when determining which store locations to shut down and which to retain. In Figure 2, we provide a comparison of provisions for bankrupt retailers before and after the implementation of BAPCPA Section 365(d)(4). Notably, following the new legislation, debtor-in-possession (DIP) lenders typically enforce a timeline that ensures all unwanted leases are rejected well in advance of the deadline. This is because rejecting capital leases before the deadline creates a general unsecured claim for mall landlords that is settled after the claims of the DIP lenders under the BAPCPA. If capital leases are rejected on the day of the deadline, mall landlords will have an administrative claim that sits above DIP lenders. As a result, more DIP lenders are tightening their terms, such as offering fewer new money advances, shorter time frames and more aggressive milestones in terms of sales, which are hindrances to a successful exit for the retailer and drive liquidation.- For example, when online retailer H.H. Gregg filed for Chapter 11 bankruptcy protection in March 2017, the DIP financing terms required the retailer to file a motion for a sales process within three days, select a stalking-horse bidder and organize a sale auction within 49 days—making it hard for H.H. Gregg to adjust its operations and realize exit opportunities.

Source: Coresight Research[/caption]

2. Section 503(b)(9)

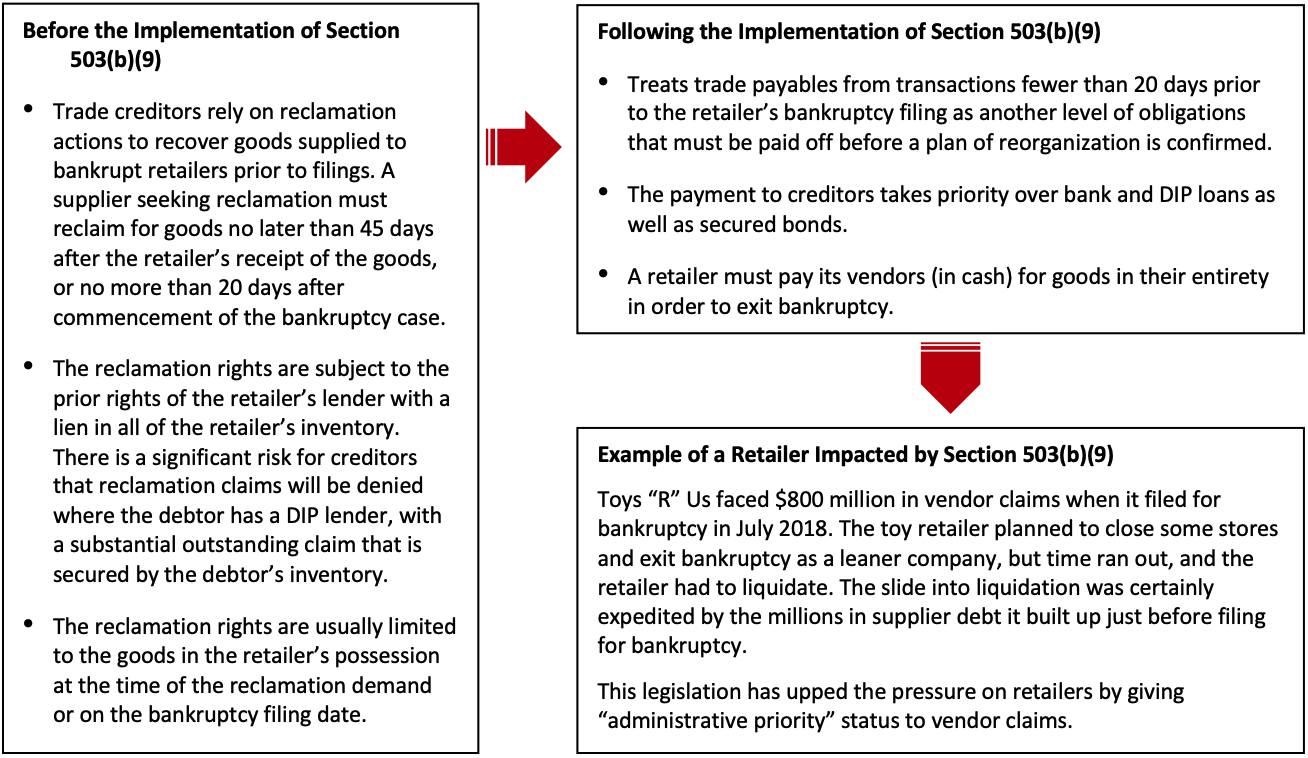

Section 503(b)(9) of BAPCPA legislation deals with the treatment of the supplier’s claims for the value of trade payables (goods/inventory supplied on credit) to a bankrupt retailer in the ordinary course of business.

While Section 365(d)(4) is important for retailers owing to the potential for larger liabilities relating to leases, Section 503(b)(9) is vital, because inventory typically represents a larger proportion of a retailer’s assets. In some situations, trade payables can be so large that they can play an outsized role in the operations, and vendors can influence the bankruptcy process through the status of their credit as administrative.

In Figure 3, we provide a comparison of provisions for bankrupt retailers before and after the implementation of BAPCPA Section 503(b)(9).

Figure 3. Section 503(b)(9) Legislation: Changes to Provisions for Bankrupt Retailers To Deal with Trade Payables’ Claims

[caption id="attachment_128374" align="aligncenter" width="720"]

Source: Coresight Research[/caption]

2. Section 503(b)(9)

Section 503(b)(9) of BAPCPA legislation deals with the treatment of the supplier’s claims for the value of trade payables (goods/inventory supplied on credit) to a bankrupt retailer in the ordinary course of business.

While Section 365(d)(4) is important for retailers owing to the potential for larger liabilities relating to leases, Section 503(b)(9) is vital, because inventory typically represents a larger proportion of a retailer’s assets. In some situations, trade payables can be so large that they can play an outsized role in the operations, and vendors can influence the bankruptcy process through the status of their credit as administrative.

In Figure 3, we provide a comparison of provisions for bankrupt retailers before and after the implementation of BAPCPA Section 503(b)(9).

Figure 3. Section 503(b)(9) Legislation: Changes to Provisions for Bankrupt Retailers To Deal with Trade Payables’ Claims

[caption id="attachment_128374" align="aligncenter" width="720"] Source: Coresight Research[/caption]

Analysis of Bankruptcy Outcomes

Pre- and Post BAPCPA

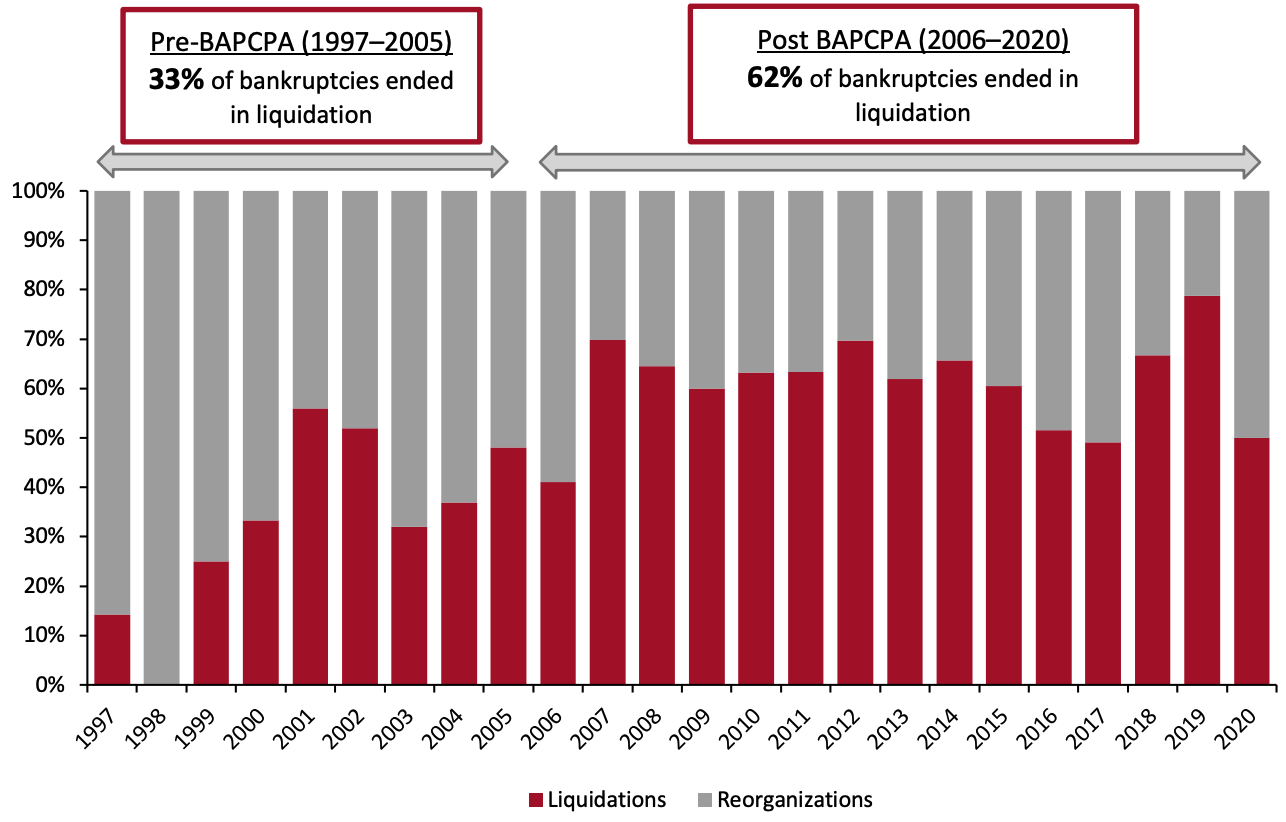

To understand the implications of BAPCPA legislation on US retailers, we drew retail bankruptcy outcomes data from S&P Capital IQ from between 1997 and 2020—before and after BAPCPA 2005 came into effect. In this and the following sections, we have taken into account all retail bankruptcy filings data, which is much higher than the bankruptcy filings shown in Figure 1 (which includes only those retailers with more than $50 million in liabilities).

We analyzed outcomes of 1,558 bankruptcy filings of retailers across the following categories: apparel, footwear and accessories; department stores; e-commerce; general merchandise; home goods; luxury; and personal care products.

S&P Capital IQ classifies retail bankruptcies’ outcomes into two categories: liquidation or GOB sale; and reorganization or emergence from bankruptcy. According to Coresight Research’s analysis, the proportion of US retail bankruptcies ending in liquidations were higher after the implementation of BAPCPA:

Source: Coresight Research[/caption]

Analysis of Bankruptcy Outcomes

Pre- and Post BAPCPA

To understand the implications of BAPCPA legislation on US retailers, we drew retail bankruptcy outcomes data from S&P Capital IQ from between 1997 and 2020—before and after BAPCPA 2005 came into effect. In this and the following sections, we have taken into account all retail bankruptcy filings data, which is much higher than the bankruptcy filings shown in Figure 1 (which includes only those retailers with more than $50 million in liabilities).

We analyzed outcomes of 1,558 bankruptcy filings of retailers across the following categories: apparel, footwear and accessories; department stores; e-commerce; general merchandise; home goods; luxury; and personal care products.

S&P Capital IQ classifies retail bankruptcies’ outcomes into two categories: liquidation or GOB sale; and reorganization or emergence from bankruptcy. According to Coresight Research’s analysis, the proportion of US retail bankruptcies ending in liquidations were higher after the implementation of BAPCPA:

- From 1997 to 2005 (pre-BAPCPA), about 33% of bankruptcy filings ended in liquidation or GOB sale, while 67% of bankruptcies saw retailers reorganize their operations/emerge from bankruptcy.

- Between 2006 and 2020 (post BAPCPA), about 62% of bankruptcies ended in liquidation or GOB sale, while 38% of bankruptcies saw retailers reorganize their operations/emerge from bankruptcy.

Source: S&P Capital IQ/Coresight Research[/caption]

2020 and Year-to-Date 2021

While 2020 was an exceptional year in terms of the total number of US retail bankruptcies (as we highlighted earlier), around half of all companies that filed for bankruptcy were looking to restructure/reorganize their business rather than liquidate their operations, according to Coresight Research’s analysis of S&P Capital IQ data.

The trend has continued so far in 2021: As of May 31, 2021, 50% of US retailers that have filed for bankruptcy are seeking reorganization.

In the past 12–15 months, retailers filed for bankruptcy because they needed help navigating the significant impacts of the pandemic and not necessarily due to weak fundamentals or business models. In 2020, more than 80% of major US retail bankruptcies were filed after lockdowns began and so may be attributed to the pandemic. We believe that the US government’s stimulus injections amid the pandemic steered more retailers to reorganize rather than liquidate.

Source: S&P Capital IQ/Coresight Research[/caption]

2020 and Year-to-Date 2021

While 2020 was an exceptional year in terms of the total number of US retail bankruptcies (as we highlighted earlier), around half of all companies that filed for bankruptcy were looking to restructure/reorganize their business rather than liquidate their operations, according to Coresight Research’s analysis of S&P Capital IQ data.

The trend has continued so far in 2021: As of May 31, 2021, 50% of US retailers that have filed for bankruptcy are seeking reorganization.

In the past 12–15 months, retailers filed for bankruptcy because they needed help navigating the significant impacts of the pandemic and not necessarily due to weak fundamentals or business models. In 2020, more than 80% of major US retail bankruptcies were filed after lockdowns began and so may be attributed to the pandemic. We believe that the US government’s stimulus injections amid the pandemic steered more retailers to reorganize rather than liquidate.

- When apparel retailer J.Crew filed for bankruptcy in May 2020, it did so with a restructuring plan that aimed to give the company more financial flexibility and reduce its debt. J.Crew emerged from bankruptcy within four months of filing. As part of the financial restructuring process, J.Crew had secured a $400 million loan from lenders. The retailer also secured a credit facility worth $400 million.

Source: Coresight Research[/caption]

On March 27, 2020, amid the pandemic, the government enacted the Coronavirus Aid, Relief and Economic Security (CARES) Act, which increased the eligibility limit of SBRA provision to include companies with up to $7.5 million in debt for one year, until March 27, 2021. On December 27, 2020, US Congress enacted the Consolidated Appropriations Act (CAA), which gave an additional $900 billion in pandemic relief to distressed companies and enacted a number of temporary amendments to the Bankruptcy Code, which are highlighted below:

Source: Coresight Research[/caption]

On March 27, 2020, amid the pandemic, the government enacted the Coronavirus Aid, Relief and Economic Security (CARES) Act, which increased the eligibility limit of SBRA provision to include companies with up to $7.5 million in debt for one year, until March 27, 2021. On December 27, 2020, US Congress enacted the Consolidated Appropriations Act (CAA), which gave an additional $900 billion in pandemic relief to distressed companies and enacted a number of temporary amendments to the Bankruptcy Code, which are highlighted below:

- The CAA authorizes bankrupt companies to obtain a low-interest Paycheck Protection Program (PPP) loans, which may be partly or fully forgiven provided the business keeps its employee wages and employee count stable.

- The CAA amends section 525 of CARES Act to specify that a bankrupt company is not deprived of the certain benefits due to its status as a debtor in bankruptcy, including the foreclosure moratorium and the forbearance of mortgage payments for multi-family-owned properties.

- Prior to the CAA, a bankrupt retailer would have to continue timely performing under its unexpired real estate property leases until such leases are assumed or rejected. Under the CAA, the retailer may have up to 300 days, including additional extension, to determine whether to assume or reject such leases.

- The CAA allows claims occurring from custom duties paid to the federal government on behalf of an importer, helping brokers and forwarders that pay the government for custom duties on behalf of clients.

- The CAA created a process by which creditors can file for amounts/damages incurred owing to the implementation of the CARES Act.

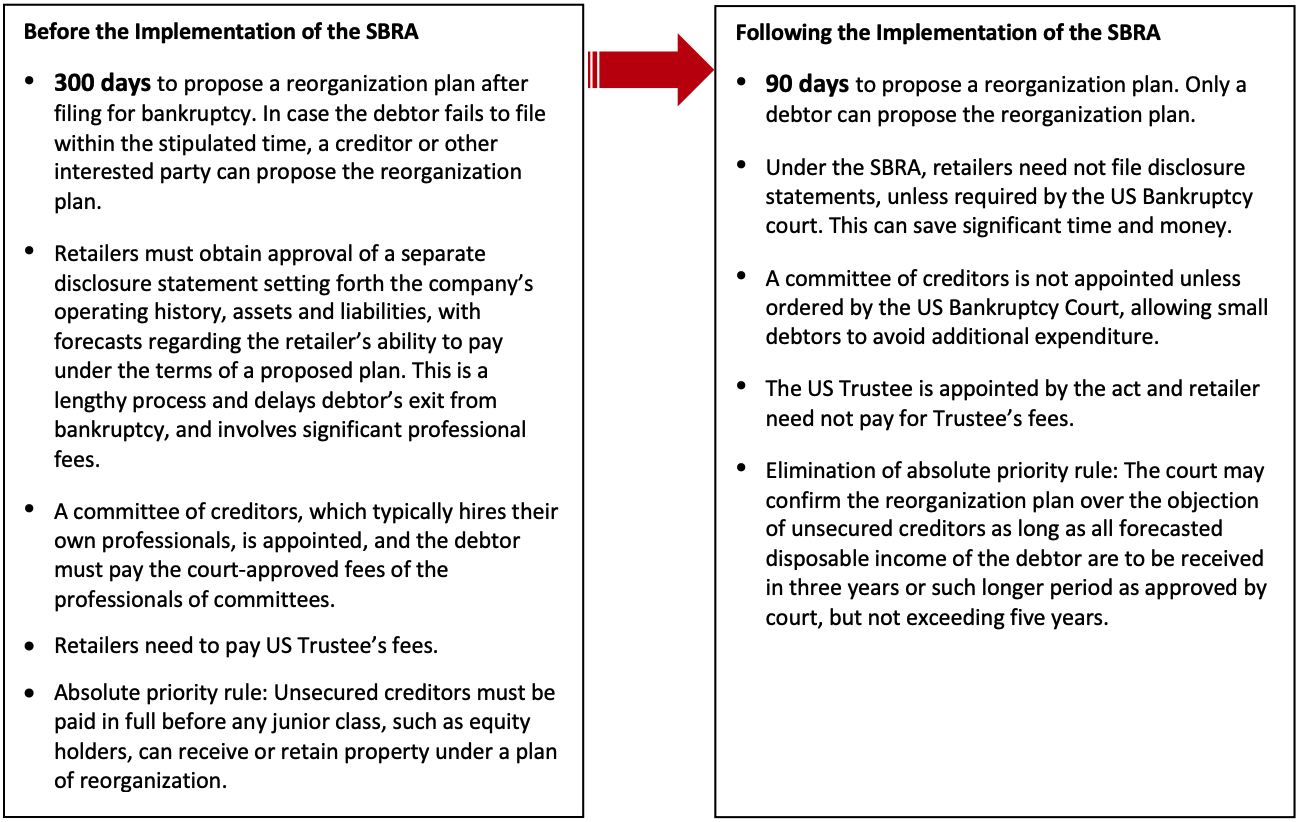

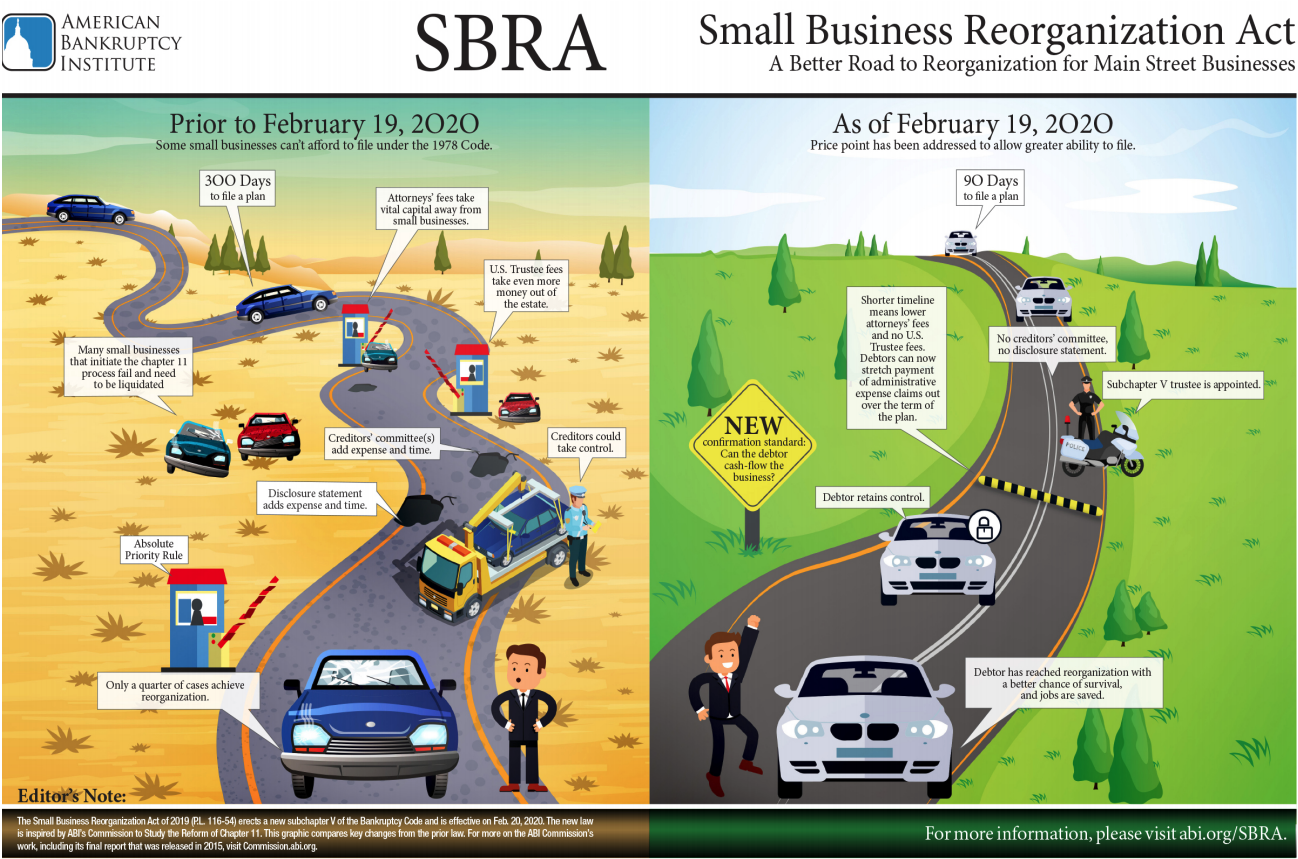

An illustration of reorganization plans before and after the implementation of the Small Business Reorganization Act

An illustration of reorganization plans before and after the implementation of the Small Business Reorganization ActSource: American Bankruptcy Institute[/caption] How Bankrupt Retailers Can Improve Their Prospects for a Successful Turnaround We believe that distressed retailers should consider taking three measures to improve their chances for a successful turnaround of their businesses. 1. Develop an Effective Action Plan To ensure successful restructuring, retailers should develop an effective action plan. If a retailer believes that bankruptcy filing is unavoidable, then preserving cash can provide the best leverage for an in-court turnaround, thereby reducing dependency on lenders for DIP financing and limiting the influence that lenders can exert to impose an infeasible bankruptcy timeline. If the retailer feels that there is the prospect of achieving an out-of-court turnaround, then it must devise a strategy based on store closures, merchandising transformation and marketing optimization. Furthermore, it is critical to develop a thorough understanding of the business’s liquidity position, debt covenants and other triggers of bankruptcy prior to the filing. 2. Gain a Sound Understanding of the Capital Markets As there are relatively few institutional investors willing to invest in distressed retail companies, retailers with credible and realistic restructuring plans in hand must begin a dialogue with key players in the capital markets well in advance of a bankruptcy filing becoming necessary. Furthermore, retailers should consult existing lenders, both to explore their lenders’ appetite and willingness to support a restructuring plan as well as to assess alternatives and pricing for probable DIP financing. The objective is to secure either support for a prearranged reorganization plan or a stalking-horse bidder prior to the point of the bankruptcy filing. 3. Negotiate with Landlords and Lenders for Additional Time and Implement Liquidity-Generating Initiatives Bankrupt retailers should buy time from lenders and landlords to achieve a successful restructuring or out-of-court turnaround. Timing of the retailer’s bankruptcy filing is also very important. Retailers can consult with lenders and landlords to choose the best time to file for bankruptcy, such as after the winter holidays, when retailers are likely to have more cash on hand that will reduce their dependency on DIP lenders. Retailers should also implement a variety of liquidity-generating initiatives such as the cutbacks in general and in administrative expenses, reduction of capital expenditures and optimization of their borrowing base. A Review of 2020 and Year-to-Date 2021 Major Retail Bankruptcies Last year was one of the toughest years in living memory for retail, with the coronavirus outbreak being the top factor forcing retailers into bankruptcy. The pandemic caused unprecedented challenges in terms of supply (stores being closed) and demand (reduced consumer spending), requiring retailers to negotiate with suppliers and landlords to tackle unforeseen inventory and liquidity issues, respectively. The other key factors driving bankruptcies were high debt levels, leveraged buyouts by private equity firms, burgeoning e-commerce and a shrinking middle class. In terms of major retailers (with debt of over $50 million), 33 retailers filed for bankruptcies in 2020, of which 15 have successfully reorganized themselves so far. Figure 6. The US: 2020 Major Retail Bankruptcies [wpdatatable id=1019]

Source: Company reports/Coresight Research

Trends have slightly improved in 2021, with only nine major retailers having filed for bankruptcy so far this year, as of May 31, 2021, of which one has already emerged. Figure 7. The US: Year-to-date 2021 Major Retail Bankruptcies [wpdatatable id=1020]Source: Company reports/Coresight Research

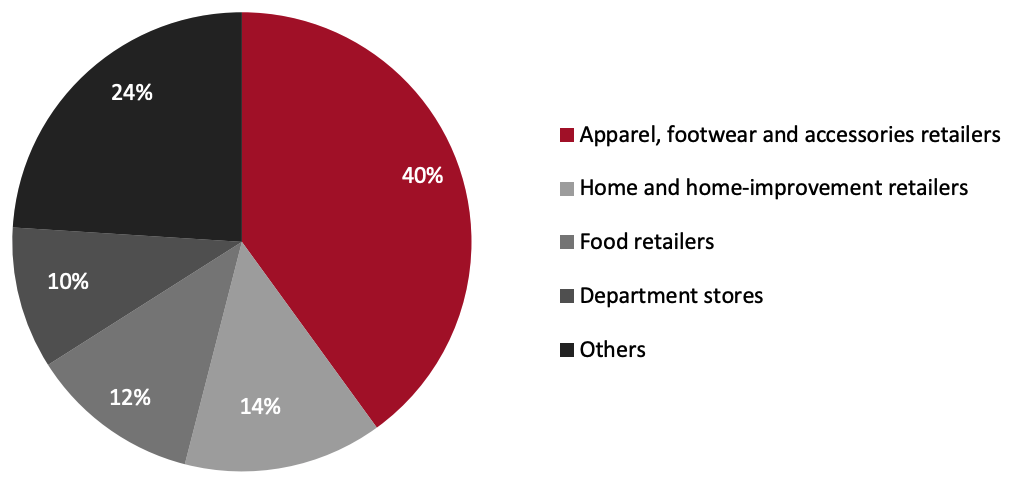

Apparel retail has proven to be one of sectors hit the hardest by the impacts of the Covid-19 pandemic in 2020 and year-to-date 2021, due to a slump in demand and, in several cases, high levels of retailer debt. Figure 8. The US: Major Retail Bankruptcies by Sector, January 1, 2020–May 31, 2021 [caption id="attachment_128378" align="aligncenter" width="720"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

What We Think

In 2021, we expect to see slightly lower number of retail bankruptcies, versus 2020, but higher compared to 2019 levels. Against the backdrop of a more restrictive Bankruptcy Code, such as Section 365(d)(4) and Section 503(b)(9) of the BAPCPA, successful retail restructuring will continue to be challenging. However, we expect reorganizations to slightly outpace liquidations in 2021, a departure from general trends after the implementation of BAPCPA 2005. We believe the second round of federal stimulus approved in December 2020 will have provided strong support to distressed retailers through the first half of 2021. Furthermore, third-round stimulus checks, approved in March 2021, have driven consumer spending across retail categories, including apparel. With the economy recovering in the second half of 2021 and into 2022, we expect more retailers to have to navigate through the operational burdens of Covid-19. Implications for Retailers and Brand Owners- Post the implementation of the BAPCPA, retail businesses’ restructurings have become tougher. More retailers should understand that plans to avoid a liquidation simply through an amendment to their existing debt facilities and/or a debt refinancing and store closures may not always materialize. We believe the negotiation of better terms with landlords and lenders, principally a longer maturity with their DIP lenders, can maximize the value of the bankruptcy estate. Furthermore, a proper understanding of DIP financing terms and restrictive covenants can help retailers to act early, decisively and strategically through the bankruptcy process.

- A retailer should conduct a comprehensive profitability analysis of stores well in advance of a bankruptcy filing, as well as initiate rent negotiations with landlords against the setting of a potential bankruptcy filing. This will enable retailers to make well-informed store closure decisions with a proper understanding of future lease expenses and thus achieve rent savings.

- Bankrupt retailers should buy time from landlords to decide on assumption or rejection of leases. Retailers should also take measures to enhance their liquidity position, such as curtailing capital expenditure.

- For a retailer looking to liquidate, it may make more sense to file in the months leading up to the holiday season that will provide a better opportunity to line up DIP financing from a lender keen to utilize the holiday shopping season to launch a rapid GOB sale. The steep discounts offered during the holiday season could permit retailer a short-term, relatively low-risk DIP loan from lender.On the other hand, if a retailer is looking to reorganize, it is more sensible to file bankruptcy after holiday sales, enabling the retailer to preserve cash to fund the cases. The use of cash collateral may reduce the need for additional DIP financing.

- Amid the current economic difficulties and the BAPCPA-imposed limitations on retailers’ time to deal with their leases, landlords should work cooperatively with the distressed retailers and look for feasible solutions that would work in the mutual interests of both the parties involved. For example, mall landlords could agree on deferrals of rent obligations and offer consent to additional time to assume or reject the capital leases; however, this should be applied on a case-to-case basis.

- Mall landlords need to consider their options carefully when dealing with distressed retailers. A mall landlord’s interest to participate in discussions with a bankrupt retailer may help them to modify the capital lease terms outside of the bankruptcy court process, which reduces the burden of the BAPCPA’s deadlines. To inform their path through those options, landlords must determine if they could find a replacement tenant in case bankrupt retailers reject their leases. The vacancy of the store could affect other leases and thus negatively impact mall landlord’s profitability.