DIpil Das

What’s the Story?

We expect to see a sharp increase in consumers traveling in the US over the summer this year, primarily domestically since international travel restrictions may still apply. This will immediately boost spending on souvenir gifts, apparel and luxury, while indirectly boosting overall spending by low-income consumers who depend on the tourism industry for work, in time for the holiday season.Why It Matters

The travel industry has been hit hard by the global Covid-19 pandemic: Air travel declined by more than 90% at the peak of the crisis, according to data from the Transportation Security Administration (TSA), and restaurants and bars in areas that depend on tourism have been especially impacted. Millions of Americans who rely on the travel industry for their livelihoods have therefore struggled over the past year. A rebound in spending on travel over the summer and beyond will help bolster the economy as a whole, likely providing a boost to already strong retail spending.How Travel Will Bounce Back and What This Means for Retail: A Deep Dive

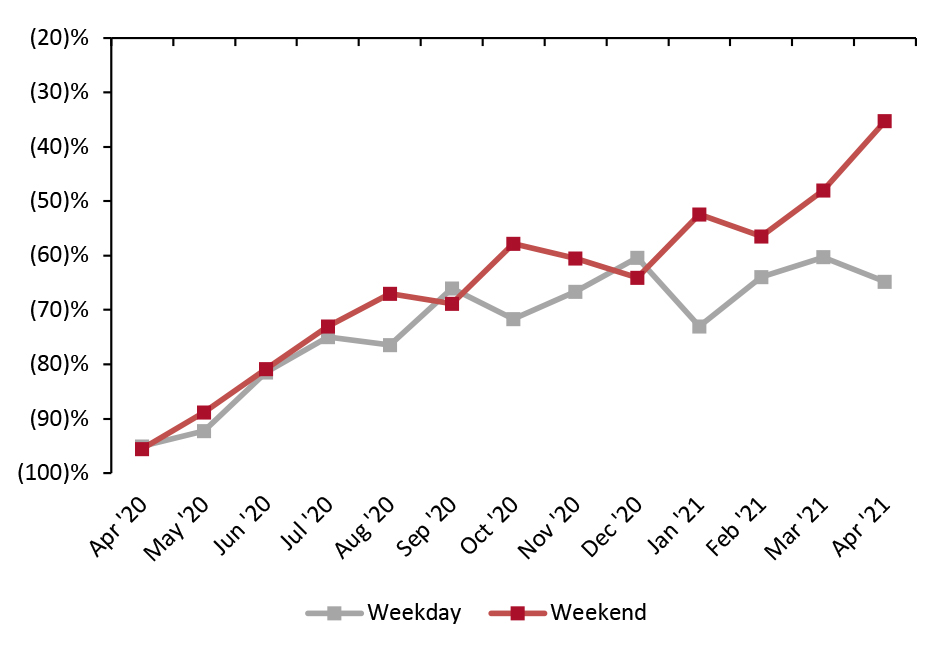

As vaccinations continue at a fast pace in the US, the travel industry is likely to see a comeback, driven by consumers eager to travel after a year of limited mobility. Pent-up spending power, particularly among high-income consumers, should ensure that the travel comeback is a strong one. Herd Immunity Will Open the Floodgates for Travel Spending Despite some vaccine distribution challenges, the US is well on its way to herd immunity through a combination of vaccinations and natural resistance to the virus achieved by those who have recently recovered from Covid-19. At the current pace of vaccination, the US may reach the 80% herd-immunity threshold by June, with more than half of the country possessing at least some level of immunity to the virus as early as the middle of spring. However, the recent pause of the Johnson & Johnson vaccine rollout could delay this slightly. The combination of herd immunity, warm weather and pent-up spending will reduce consumers’ hesitancy to travel. By holiday 2021, we expect most consumers to feel comfortable traveling for vacation and to visit their families. Consumers Will Begin To Travel Even Before Herd Immunity Prior to achieving herd immunity, we are likely to see many consumers begin to travel more, albeit still at lower rates than pre-pandemic. Consumers are already increasing their air travel, particularly on weekends—indicating that leisure travel is recovering at a quicker rate than business travel (see Figure 1).Figure 1. US Air Travel: Weekend* vs. Weekday Change (YoY %) [caption id="attachment_126074" align="aligncenter" width="725"]

*Weekend includes Friday, Saturday, Sunday and Monday

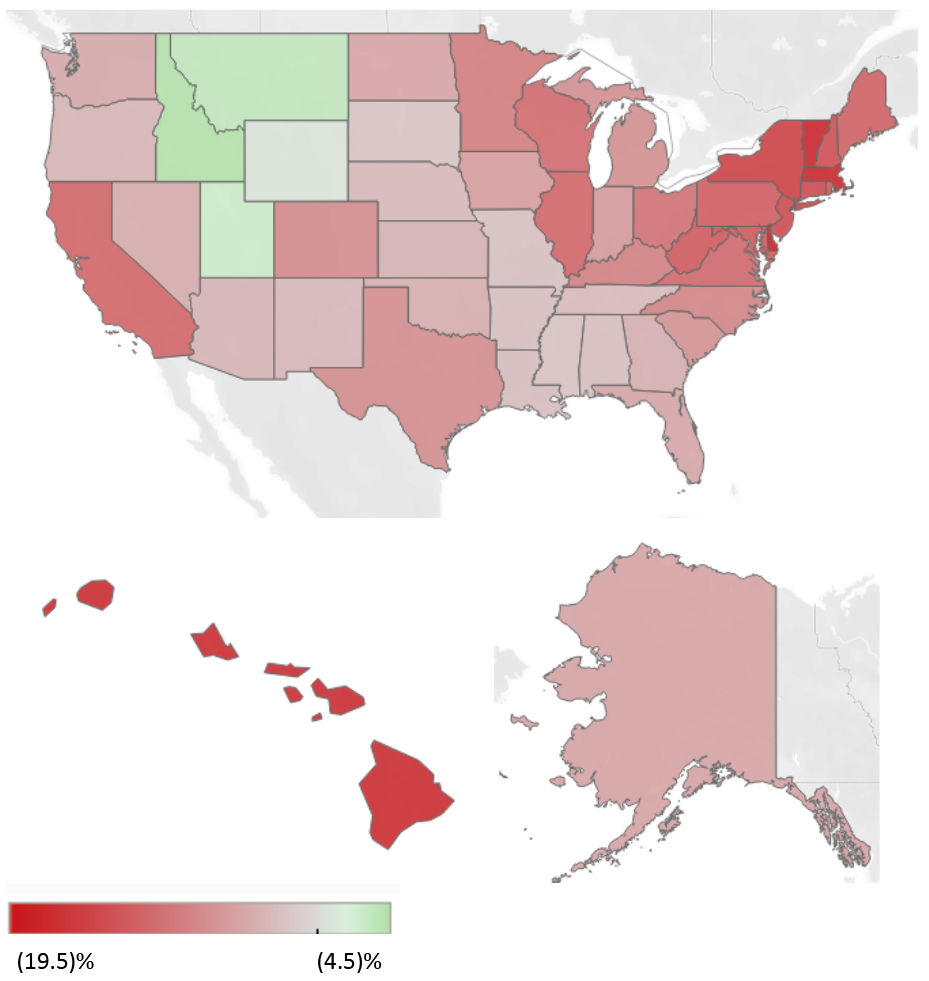

*Weekend includes Friday, Saturday, Sunday and Monday Source: TSA/Coresight Research [/caption] The relatively steady improvement in leisure travel reflects an unresponsiveness to infection rates, as the number of Covid-19 cases has recently risen in some areas of the US. This suggests that virus fatigue can also contribute to an increase in travel. This spring, the combination of continuing virus fatigue and increasing vaccinations should see travel rates further recover. The ongoing reopening of major leisure attractions is also encouraging consumers to get back to travel before the herd-immunity threshold is reached. In New York, a state with some of the nation’s most stringent pandemic-related guidelines, sports venues that can hold more than 1,500 people indoors or 2,500 outdoors could reopen from April 1, with a 20% capacity limit on indoor arenas and 20% capacity limit on outdoor stadiums. While that means sports fans will have to continue to wait to experience a sellout crowd at Yankee Stadium, it does begin to make the city more attractive to visitors. As museums and other cultural attractions follow similar protocols, consumers will have more incentive to travel this spring. Resurgence in Travel Will Vary by Geography The return to traveling will eventually permeate all corners of the US, but it is likely to begin in places where public concern over Covid-19 is less pronounced. We have already begun to see these geographical distinctions play out: As of January 2021, the latest month for which US road traffic data is available, consumers in the South took to the roads at much higher rates than their peers on the coasts and in the Midwest. Road traffic in the Northeast remained the hardest hit in January, falling more than 16% year over year, likely as a result of consumers in that region generally harboring greater concerns over the virus and state and local governments imposing tighter restrictions. By contrast, in the Gulf South, the region encompassing states between Texas and Kentucky, traffic fell by less than 8% year over year. The recent lifting of virus-related restrictions in Texas and of mask mandates in Mississippi indicate that these geographic differences in road-traffic volume are likely to continue through the spring of 2021.

Figure 2. US Road-Traffic Volume by Geography, January 2021 (YoY % Change) [caption id="attachment_126075" align="aligncenter" width="725"]

Source: Federal Highway Administration/Coresight Research[/caption]

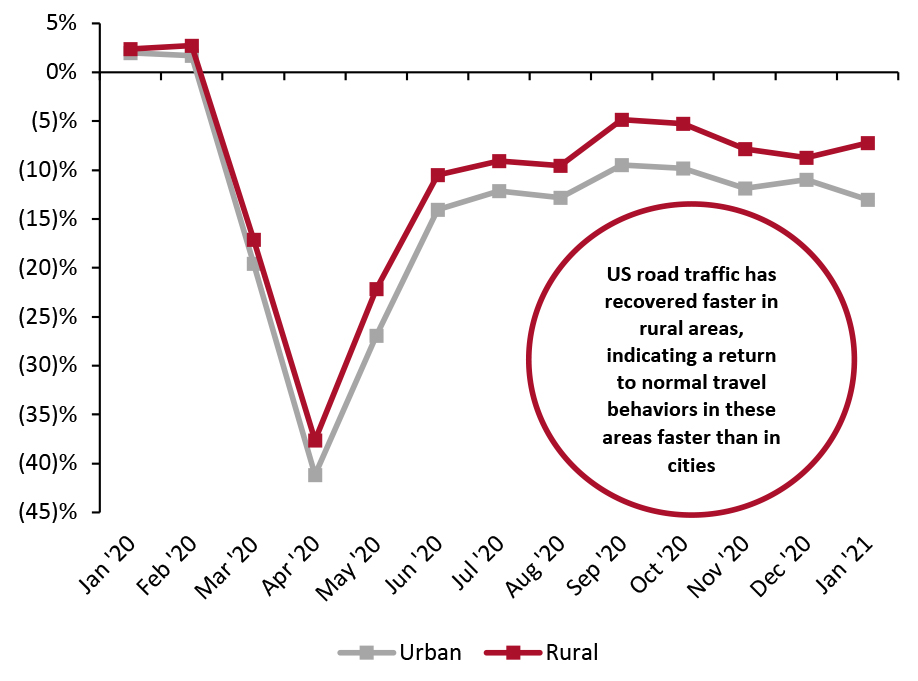

Furthermore, there are distinctions between recovery in travel in urban and rural areas. As shown in the figure below, rural traffic has recovered substantially more than urban traffic since their initial drops at the outset of the pandemic in the US. Urban traffic was down by 13.0% year over year in December 2020, while rural traffic was down by just 7.2%.

Source: Federal Highway Administration/Coresight Research[/caption]

Furthermore, there are distinctions between recovery in travel in urban and rural areas. As shown in the figure below, rural traffic has recovered substantially more than urban traffic since their initial drops at the outset of the pandemic in the US. Urban traffic was down by 13.0% year over year in December 2020, while rural traffic was down by just 7.2%.

Figure 3. US Road-Traffic Volume: Urban vs. Rural (YoY % Change) [caption id="attachment_126076" align="aligncenter" width="725"]

Source: Federal Highway Administration/Coresight Research[/caption]

Big cities tend to pose greater health threats due to increased spread of Covid-19 in densely populated areas, making them less likely to attract more travelers and shoppers until herd immunity is reached. Regional and less-urban destinations may benefit from consumers being cautious of visiting megalopolises, and spending in the spring is likely to continue to be more geographically fragmented.

However, by late summer this year, we expect most of the geographical differences to fade. If 80% immunity can be reached by June, we expect consumers to return to visiting traditional tourist destinations at that point, and for cities with even the tightest virus-related regulations to ease their policies.

A continued decline in international travel due to the potential continuation of restrictions could delay the return of traffic in global tourist destinations such as New York for slightly longer, but domestic travel and spending will likely even out in plenty of time for the holiday season.

International Travelers Will Return More Slowly

International travel will be as dependent on international vaccination efforts as it is on the campaign within the US. The US is at the forefront of vaccination efforts, trailing only five countries in doses administered as a percentage of population, notably Israel and the UK, as of March 31, according to data collected by The New York Times.

Fortunately for the US, visitors from the UK are its third-most common inbound tourists, and the most common from overseas. In 2019, more than 5% of total international travel to the US was accounted for by tourists from the UK. Strong vaccination execution in both countries should revive tourism between the two sooner than any other transnational relationship.

Despite the success of the UK, many other countries that the US traditionally relies on for international tourism are lagging behind. In 2019, Canada and Mexico made up 49% of all inbound tourism to the US, according to the US Travel Association. Each of these countries is vaccinating at a slower pace than their common neighbor, although Canada has recently accelerated vaccination efforts. As of April 15, Canada has administered doses to just 22% of its population, while Mexico has distributed 9.8 shots per 100 people (data was not available on the number of fully versus. partially vaccinated citizens)—far below the 37% partial vaccination rate achieved by the US, according to data compiled by The New York Times. Tighter travel controls within North America may continue until each country has controlled the outbreak, which may postpone a recovery in international travel in the region until fall or later.

Travel from China is trickier to forecast. While the country is vaccinating slowly, its social distancing and lockdown measures have managed to severely limit the spread of the virus in the country. China accounted for 7% of all US inbound tourism in 2019, the third-most represented overseas country. Chinese consumers also disproportionately spend on luxury goods in the US, so ensuring a return to normal travel relations between the two countries will be of paramount importance to luxury retailers in the US, particularly in major cities such as New York and Los Angeles.

Retailers Catering to Leisure Travelers Can Expect a Resurgence

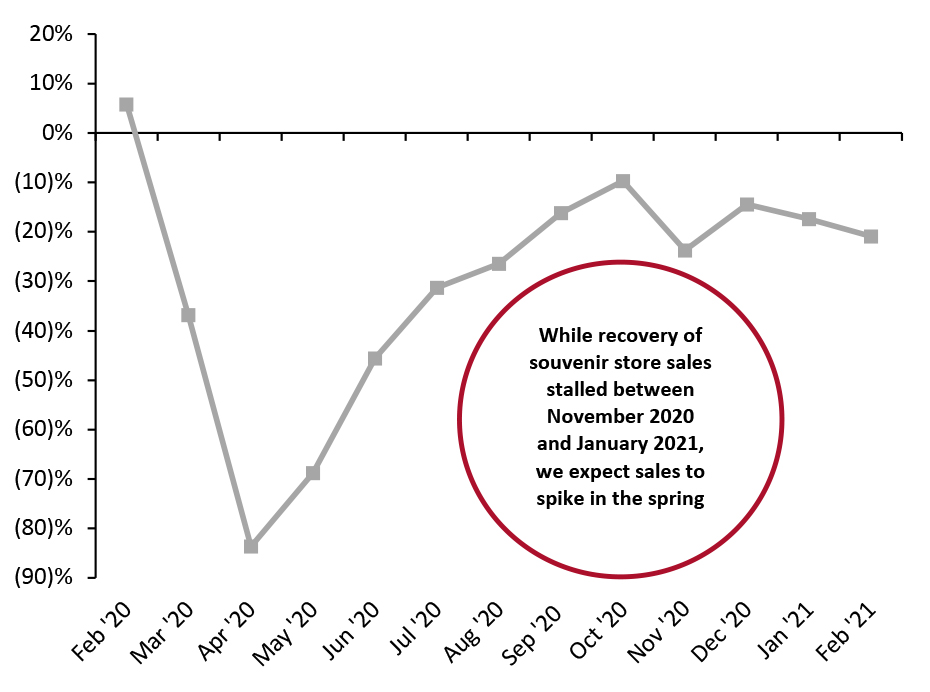

Retailers that cater to leisure travelers will see a noticeable pickup in traffic this summer versus the early part of the year—but at different paces. The most obvious beneficiaries will be retailers that cater directly and almost exclusively to tourists: gift, novelty and souvenir stores. These retailers’ sales took a drastic hit at the beginning of the pandemic, falling more than 80% year over year in April, but have since been on a largely steady path of recovery.

By October 2020, sales at these retailers were down by less than 10% year over year, according to US Census Bureau data. While sales growth dropped off again in the final two months of the year, the decrease can largely be chalked up to rising virus case numbers and strong comparatives in tourism the prior year. For the same reasons, January and February 2021 spending in tourism-related retail also lagged, but we expect it to pick up substantially beginning in March as vaccinations lower case rates.

Source: Federal Highway Administration/Coresight Research[/caption]

Big cities tend to pose greater health threats due to increased spread of Covid-19 in densely populated areas, making them less likely to attract more travelers and shoppers until herd immunity is reached. Regional and less-urban destinations may benefit from consumers being cautious of visiting megalopolises, and spending in the spring is likely to continue to be more geographically fragmented.

However, by late summer this year, we expect most of the geographical differences to fade. If 80% immunity can be reached by June, we expect consumers to return to visiting traditional tourist destinations at that point, and for cities with even the tightest virus-related regulations to ease their policies.

A continued decline in international travel due to the potential continuation of restrictions could delay the return of traffic in global tourist destinations such as New York for slightly longer, but domestic travel and spending will likely even out in plenty of time for the holiday season.

International Travelers Will Return More Slowly

International travel will be as dependent on international vaccination efforts as it is on the campaign within the US. The US is at the forefront of vaccination efforts, trailing only five countries in doses administered as a percentage of population, notably Israel and the UK, as of March 31, according to data collected by The New York Times.

Fortunately for the US, visitors from the UK are its third-most common inbound tourists, and the most common from overseas. In 2019, more than 5% of total international travel to the US was accounted for by tourists from the UK. Strong vaccination execution in both countries should revive tourism between the two sooner than any other transnational relationship.

Despite the success of the UK, many other countries that the US traditionally relies on for international tourism are lagging behind. In 2019, Canada and Mexico made up 49% of all inbound tourism to the US, according to the US Travel Association. Each of these countries is vaccinating at a slower pace than their common neighbor, although Canada has recently accelerated vaccination efforts. As of April 15, Canada has administered doses to just 22% of its population, while Mexico has distributed 9.8 shots per 100 people (data was not available on the number of fully versus. partially vaccinated citizens)—far below the 37% partial vaccination rate achieved by the US, according to data compiled by The New York Times. Tighter travel controls within North America may continue until each country has controlled the outbreak, which may postpone a recovery in international travel in the region until fall or later.

Travel from China is trickier to forecast. While the country is vaccinating slowly, its social distancing and lockdown measures have managed to severely limit the spread of the virus in the country. China accounted for 7% of all US inbound tourism in 2019, the third-most represented overseas country. Chinese consumers also disproportionately spend on luxury goods in the US, so ensuring a return to normal travel relations between the two countries will be of paramount importance to luxury retailers in the US, particularly in major cities such as New York and Los Angeles.

Retailers Catering to Leisure Travelers Can Expect a Resurgence

Retailers that cater to leisure travelers will see a noticeable pickup in traffic this summer versus the early part of the year—but at different paces. The most obvious beneficiaries will be retailers that cater directly and almost exclusively to tourists: gift, novelty and souvenir stores. These retailers’ sales took a drastic hit at the beginning of the pandemic, falling more than 80% year over year in April, but have since been on a largely steady path of recovery.

By October 2020, sales at these retailers were down by less than 10% year over year, according to US Census Bureau data. While sales growth dropped off again in the final two months of the year, the decrease can largely be chalked up to rising virus case numbers and strong comparatives in tourism the prior year. For the same reasons, January and February 2021 spending in tourism-related retail also lagged, but we expect it to pick up substantially beginning in March as vaccinations lower case rates.

Figure 4. US Gift, Novelty and Souvenir Store Sales (YoY % Change) [caption id="attachment_126077" align="aligncenter" width="725"]

Source: US Census Bureau[/caption]

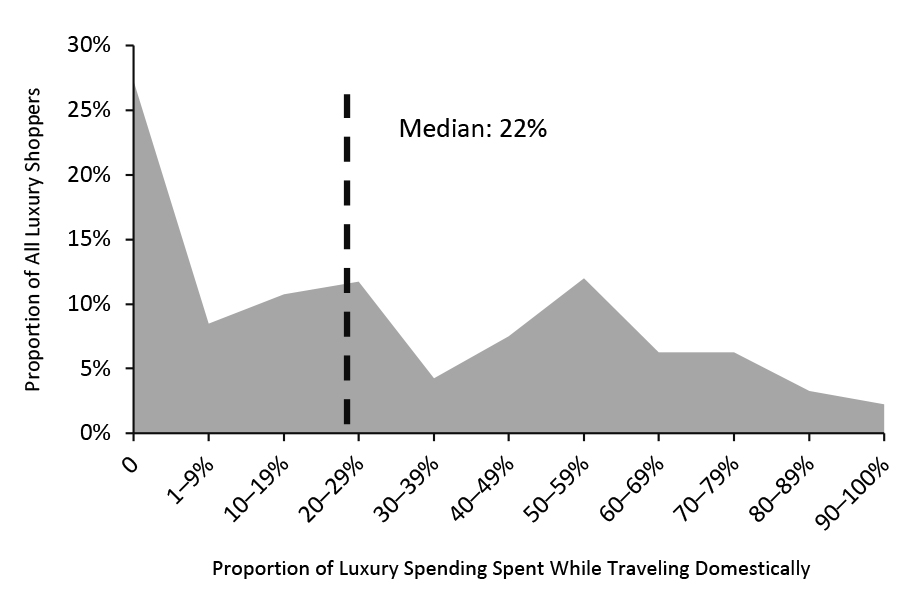

Luxury retail should also see significant growth as travel picks up, even before international travel fully resumes. US consumers tend to spend heavily on luxury while traveling domestically, according to the results of a survey we conducted in June 2020 on luxury retail. As indicated by the figure below, the median US consumer spends 22% of their overall luxury budget while traveling domestically.

Source: US Census Bureau[/caption]

Luxury retail should also see significant growth as travel picks up, even before international travel fully resumes. US consumers tend to spend heavily on luxury while traveling domestically, according to the results of a survey we conducted in June 2020 on luxury retail. As indicated by the figure below, the median US consumer spends 22% of their overall luxury budget while traveling domestically.

Figure 5. US Luxury Shoppers: What Percentage of Their Total Luxury Spending Is Spent While Traveling Domestically (% of Respondents) [caption id="attachment_126078" align="aligncenter" width="725"]

Base: US consumers aged 18+ who had purchased luxury products in the past 12 months

Base: US consumers aged 18+ who had purchased luxury products in the past 12 months Source: Coresight Research [/caption] As luxury retailers see a major boost, so will travel retail formats—stores in airports and other travel centers that see direct benefits from increases in travelers. We estimated in 2019 that US airport retail accounted for $44 billion in sales. In 2020, we estimate that sales fell to around $17 billion—a more than 60% year-over-year drop. As of April 15, 2021, US air travel was already back to about 60% of pre-pandemic levels. Even if travel recovers no further this year, that would translate to growth of nearly $10 billion in airport retail sales in 2021 versus 2020. More likely is that travel will rebound significantly over the summer, leading to an even bigger rebound in travel retail. These retailers will initially mostly benefit outside of big cities that are typically some of the largest tourist draws in the country. Warm weather and outdoor activities will be a key driver of tourism in the spring and early summer. Retailers at beach destinations may see the strongest sales in 2021, although perhaps not the strongest growth due to solid comparatives in 2020. Beach locations in areas with looser pandemic-led restrictions saw surges in visitors looking to get together in outdoor environments last year: Florida saw a 53% increase in beach goers during Memorial Day 2020 (in May), while Alabama and Louisiana both saw beach visitation numbers more than double, according to data from Unacast. Clearly, consumers in regions with fewer restrictions are willing to visit beaches and spend on associated goods and services. However, room for growth in the beach retail market remains in areas that were initially hit harder by the virus and remain more cautious about reopening. New England and California both saw declines of more than 40% in visitors to beaches on Memorial Day last year. In 2021, as beaches reopen everywhere but some indoor activities remain risky through at least early summer, consumers will likely flock to beaches and other outdoor destinations and spend heavily on retail there.

Figure 6. Three Stages of Travel Recovery in the US [caption id="attachment_126079" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Retailers Targeting Business Travelers Will Continue To Struggle

Retailers that cater to business travelers are unlikely to ever see a return to spending levels seen prior to the pandemic. The rise of online meeting platforms and other digital tools for business communication has made much of corporate travel unnecessary, and companies are likely to continue to take advantage of these digital mediums to reduce transportation costs and boost efficiency.

In 2019, we estimate that business travel generated approximately $1.1 trillion in economic output and supported a total of 2.5 million American jobs, based on data from the US Travel Association. Of that economic output, about $334.4 billion came from direct spending, of which we estimate about $16 billion was spent on retail goods. In 2020, that retail spending was likely cut down to around $6 billion. In 2021, if business travel continues to recover at the rate it has since its nadir in April 2020, we expect retail spending associated with business travel to total about $8 billion—down 50% from 2019 levels. This recovery will likely be uneven, depending on the type of business travel. Regional travel that employees can do in their own car or a rental vehicle is likely to return significantly before air travel.

The Travel Rebound Will Put More Money in the Pockets of Low-Income Consumers

Prior to the pandemic, the travel industry in the US employed roughly one in 10 Americans, according to data from the World Travel and Tourism Council (WTTC). Catastrophic declines in travel in 2020 led to more than 7 million jobs in the industry being adversely affected, according to the WTTC. This has contributed to eroded spending by many low-wage workers in the industry as well as high unemployment among these workers, which persists even a year after the outbreak in the US.

A rebound in travel would boost spending within the industry, but it would also inject more cash and improve the velocity of money in the economy as a whole. The unequal impacts of the pandemic have seen high-income consumers save heavily and remain secure in their investments and employment, while low-income workers, often in the service and travel industry, have lost their jobs and been forced to rely on government stimulus to cover purchases of essentials. A recovery in travel spending will redistribute some of the savings built up by high-income individuals to lower-income consumers, who are likely to spend at a faster rate than their high-income counterparts.

However, dollar and discount stores could be on the wrong side of this trend in the long term. While these stores are thriving now as many consumers pinch pennies while they remain out of work, the return of travel—a major provider of blue-collar jobs—could put enough money in the pockets of current dollar store customers for them to trade up to stores selling at slightly higher price points. Dollar stores are currently expanding rapidly—they account for more than one-third of all store openings that we have tracked so far in 2021—but could be overexpanding by extrapolating a trend that is unlikely to be so pronounced in a post-vaccine world. It is also worth noting, however, that these stores were expanding aggressively even prior to the pandemic.

Source: Coresight Research[/caption]

Retailers Targeting Business Travelers Will Continue To Struggle

Retailers that cater to business travelers are unlikely to ever see a return to spending levels seen prior to the pandemic. The rise of online meeting platforms and other digital tools for business communication has made much of corporate travel unnecessary, and companies are likely to continue to take advantage of these digital mediums to reduce transportation costs and boost efficiency.

In 2019, we estimate that business travel generated approximately $1.1 trillion in economic output and supported a total of 2.5 million American jobs, based on data from the US Travel Association. Of that economic output, about $334.4 billion came from direct spending, of which we estimate about $16 billion was spent on retail goods. In 2020, that retail spending was likely cut down to around $6 billion. In 2021, if business travel continues to recover at the rate it has since its nadir in April 2020, we expect retail spending associated with business travel to total about $8 billion—down 50% from 2019 levels. This recovery will likely be uneven, depending on the type of business travel. Regional travel that employees can do in their own car or a rental vehicle is likely to return significantly before air travel.

The Travel Rebound Will Put More Money in the Pockets of Low-Income Consumers

Prior to the pandemic, the travel industry in the US employed roughly one in 10 Americans, according to data from the World Travel and Tourism Council (WTTC). Catastrophic declines in travel in 2020 led to more than 7 million jobs in the industry being adversely affected, according to the WTTC. This has contributed to eroded spending by many low-wage workers in the industry as well as high unemployment among these workers, which persists even a year after the outbreak in the US.

A rebound in travel would boost spending within the industry, but it would also inject more cash and improve the velocity of money in the economy as a whole. The unequal impacts of the pandemic have seen high-income consumers save heavily and remain secure in their investments and employment, while low-income workers, often in the service and travel industry, have lost their jobs and been forced to rely on government stimulus to cover purchases of essentials. A recovery in travel spending will redistribute some of the savings built up by high-income individuals to lower-income consumers, who are likely to spend at a faster rate than their high-income counterparts.

However, dollar and discount stores could be on the wrong side of this trend in the long term. While these stores are thriving now as many consumers pinch pennies while they remain out of work, the return of travel—a major provider of blue-collar jobs—could put enough money in the pockets of current dollar store customers for them to trade up to stores selling at slightly higher price points. Dollar stores are currently expanding rapidly—they account for more than one-third of all store openings that we have tracked so far in 2021—but could be overexpanding by extrapolating a trend that is unlikely to be so pronounced in a post-vaccine world. It is also worth noting, however, that these stores were expanding aggressively even prior to the pandemic.

What We Think

Consumers traveled at record low rates in 2020 and continue to be hesitant to take major vacations in 2021. However, a resurgence has slowly begun, and a more drastic bounceback is likely coming over the summer. The service industry is likely to benefit from this perhaps more than retail, but retail sectors that have been hard hit by the decline in tourism will welcome gains after a tough year. Implications for Brands/Retailers- Retailers can expect to see a rise in spending on luxury, souvenirs, and at travel retail formats at regional destinations as consumers largely keep travel close to home.

- Southern areas of the US have seen travel and mobility recover to close to pre-crisis rates. In the near future, retailers looking to cater to tourists should thrive in this region.

- For now, retailers must continue to steer clear of relying on flagship locations in major cities for sales: International travel to the metropolises these stores call home will be the last to recover.

- A return to travel will indirectly boost spending by low-income workers, many of whom rely on the industry for employment. Retailers and brands will do well to monitor the tourism industry as a proxy for when spending will bounce back among these consumers.