Nitheesh NH

Introduction

Robotics is transforming the way retailers and big brands operate, making operations faster, more efficient and accurate. Leading industry players have been investing more in the technology, and we expect to see more robotics applications in retail in the near future. This report provides an overview of the application of robotics in retail, how investment in the technology by leading industry players has been growing and offer some notable examples of how large retailers, brands and technology companies have been working together to transform the different segments of the retail value chain.Robots Bring Greater Efficiency to Retail Operations

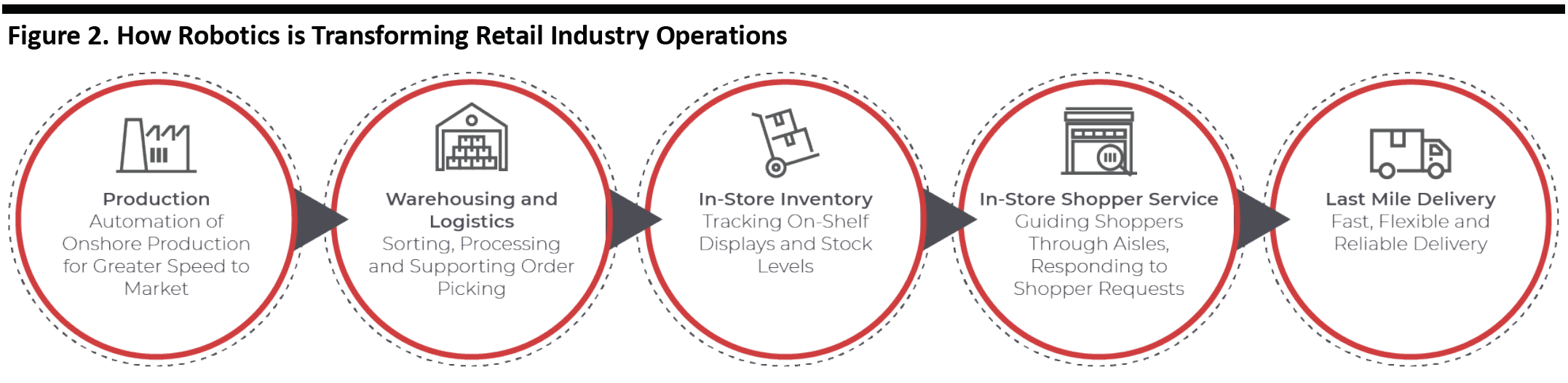

Robotics in the retail industry finds applications throughout the value chain, from production to distribution and last-mile delivery. Robotics in retail can significantly enhance the speed and efficiency of operations, boosting productivity, enhancing the consumer experience and delivering more accurate and reliable results. Automation using robots is enabling faster speed to market, greater customization, reduced costs and the shift of manufacturing closer to the end market. Further advancements and lower costs are making robotics more viable for the retail industry, encouraging adoption. Sales of logistics robotics (the most significant application in retail) increased 53% year over year to $3.7 billion in 2018 (latest), according to the International Federation of Robotics (IFR). The total annual value sales of service robots for professional use reached $9.2 billion globally in 2018 (the figure includes applications in logistics, medical and field robotics and defense), a 32% increase year over year, according to the IFR. Larger players are leading the way in both research and development (R&D) and investment in the technology. For example, companies such as Amazon, Alibaba and JD.com are investing significantly in robots to upgrade their logistics operations:- Amazon acquired warehouse robotics company Canvas Technology, TechCrunch reported in April 2019. Amazon has been investing in robotics since 2012 when the Internet giant acquired robotics company Kiva Systems, from which its Amazon Robotics division was generated in 2015.

- Alibaba announced an RMB100 billion ($14 billion) investment over five years in robotics for warehousing and logistics, The Wall Street Journal reported in late 2017.

- JD.com invests $1.7 billion annually in technology, the Nikkei Asian Review reported in July 2019, including in warehousing and logistics robotics and autonomous vehicles for last-mile delivery.

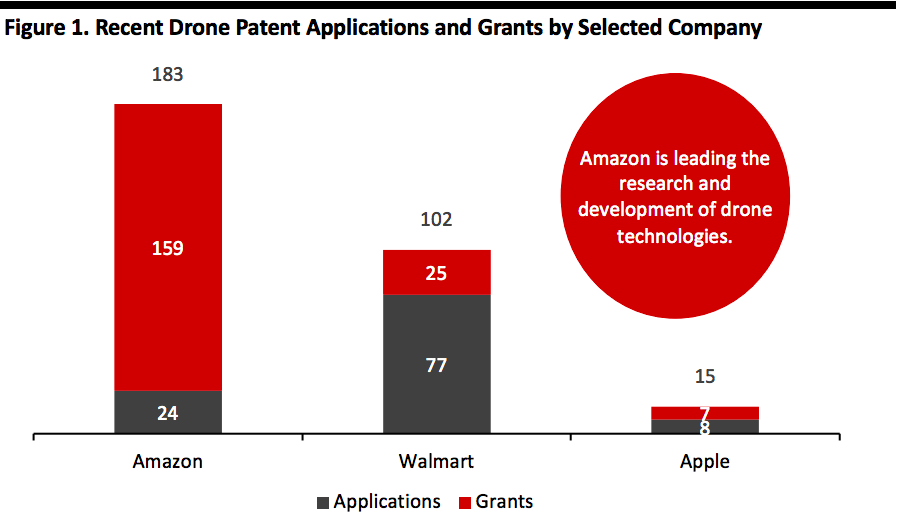

Drone patent applications and grants by selected major retail-related companies in the 12-month period ended October 9, 2019

Drone patent applications and grants by selected major retail-related companies in the 12-month period ended October 9, 2019Source: Grata Data[/caption]

Robotics in Retail

Robotics can already be used throughout the retail value chain, from production to last-mile delivery. Figure 2 shows how robotics is transforming the retail value chain. [caption id="attachment_98742" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Below, we describe more in greater detail how robotics is changing the different stages of the retail value chain, along with notable examples of how large brands, retailers and technology startups have been using the technology.

Production

Increasing labor costs and greater demand for speed to market is making the application of robotics in apparel production more attractive. More companies have started to assess rebalancing the sourcing mix using onshoring and nearshoring production through automation.

As we outlined in a recent report on apparel sourcing, robotics can increase the efficiency and agility of operations, reduce operational costs, improve speed to market, hedge against rising labor costs in core offshore markets, better respond to changes in consumer demand, and enable product customization and on-demand manufacturing.

Source: Coresight Research[/caption]

Below, we describe more in greater detail how robotics is changing the different stages of the retail value chain, along with notable examples of how large brands, retailers and technology startups have been using the technology.

Production

Increasing labor costs and greater demand for speed to market is making the application of robotics in apparel production more attractive. More companies have started to assess rebalancing the sourcing mix using onshoring and nearshoring production through automation.

As we outlined in a recent report on apparel sourcing, robotics can increase the efficiency and agility of operations, reduce operational costs, improve speed to market, hedge against rising labor costs in core offshore markets, better respond to changes in consumer demand, and enable product customization and on-demand manufacturing.

- Grabit: Bay Area startup Grabit is developing a technology that uses electroadhesion to handle fabrics. Using technology that channels static cling to act as a magnet to enable automatic handling, the company built an auto-layering robot capable of handling textiles, automating and speeding garment production. According to the company, Grabit’s technology increases manufacturers’ productivity twenty-fold. Sportswear giant Nike acquired a minority stake in Grabit in 2013 and started to install the company’s technology in factories in China and Mexico, Bloomberg reported in August 2017. Hong Kong textile giant Esquel Group also invested in Grabit, the South China Morning Post reported in late 2018. The partnership with Grabit is part of Esquel’s strategic approach to production cycle automation. The investment comes three years after Esquel opened a factory in Jiumeiqiao, China, using automation to cut labor costs.

- Softwear Automation: US tech firm Softwear developed Sewbot, a fully autonomous workline that can complete a T-shirt in half the time required by manual sewing, according to the company’s website. Sourcing and supply chain management giant Li & Fung is collaborating with Softwear to develop a fully digitized apparel and textile supply chain, the sourcing firm announced in May 2018. Technologies such as Softwear’s sewing robots will enable manufacturers to deliver better productivity and efficiency, according to Li & Fung. The partnership with Softwear Automation is part of the sourcing firm’s strategy to create the apparel supply chain of the future, which the company sees as characterized by speed, innovation and digitalization.

- Adidas SpeedFactory: Sportswear giant Adidas is piloting automation in its product sourcing cycle with what the company calls SpeedFactory facilities that make tailored, limited edition, high-end sneakers. SpeedFactory is a completely automated production facility whose flexible model challenges traditional centralized production to make products close to the consumer, the company announced on July 2016. At the time of writing, two SpeedFactory facilities were operational, one in Bavaria, Germany, near the Adidas headquarters, and the second in Atlanta, Georgia. The Atlanta facility produces AM4NYC (Adidas Made for New York City) sneakers, a product specifically designed for New York City consumers, Business Insider reported in April 2018. SpeedFactory facilities are likely to complement traditional offshore production facilities, to give the company more flexible and faster production for custom items or swift replenishment of fast-selling products.

Adidas SpeedFactory

Adidas SpeedFactorySource: SpeedFactory[/caption] Warehousing and Logistics Omnichannel requires warehousing and logistics operations to be fast, efficient and accurate. Retailers need to be able to move around and stock wider ranges of SKUs to make items available to shoppers across channels. Robotics automation in warehousing and logistics helps companies improve greater operational speed and efficiency. Companies use robotics for sorting, processing and order picking. More companies are adopting a combination of large out-of-town distribution centers (DCs) and smaller, highly automated DCs in urban locations for faster fulfilment.

- Cainiao: The logistics firm majority-owned by Alibaba, opened a warehouse with over 700 robots in October 2018 to get ready for Singles’ Day the following month. The robots automatically picked up parcels and delivered them to another part of the warehouse, to be collected by the last-mile delivery firm. Cainiao said the robotic warehouse brought significant time savings (but did not quantify those savings).

- JD.com: The second largest e-commerce retailer in China collaborated with Mujin — a Japan-based robotics startup — to automate JD’s 40,000 square foot warehouse in Shanghai. The facility, which began operations in June 2018, uses 20 Mujin industrial robots that do all warehousing functions such as packing, moving and loading packages, CNBC reported on October 30, 2018.

- Amazon Pegasus: At the Machine Learning, Automation, Robotics and Space (MARS) conference in Las Vegas in June 2019, Amazon unveiled Pegasus, a new sorting system. Pegasus was developed in collaboration with autonomous warehouse robotics startup Canvas (acquired by Amazon).

Amazon’s Pegasus robot

Amazon’s Pegasus robot Source: Amazon[/caption] In-Store Inventory The role of the store is evolving to become more of a showroom, a marketing tool, a place for experiencing the products and even an integral part of the retailer’s supply chain. Seeking to draw more online shoppers into the store, more retailers have been adopting buy online, pick up in store (BOPIS) models. Alibaba’s concept of New Retail would transform the store into a fulfillment center for online orders, as it does in its Freshippo grocery chain. This makes it more important than ever to have a clear picture of inventory levels across the entire store network. Robotic automation helps retailers monitor real-time in-store inventory levels and act swiftly to minimize the risk of out of stocks (OOS). With robots taking care of routine tasks such as stock level and shelf activity monitoring, retailers can increase operations effectiveness and cut costs by freeing up store associate time for more value-added activities such as customer assistance.

- Walmart: The retail giant has been working with San Francisco robotics company Bossa Nova to deploy robots that move around store aisles to check on-shelf displays and inventory levels in real-time. The retailer started testing the technology in 2017, initially planning to use it in 50 stores, and in 2019 expanded use in to 350 stores, Forbes reported in April 2019.

- Trax and Fetch Robotics: leading computer vision and shelf analytics provider Trax joined forces with robotics company Fetch Robotics to develop a technology that combines autonomous robots and image recognition to enable retailers to monitor shelf activity in real-time and convert the data into actionable insight.

- Australian supermarket chain Woolworths Groupis partnering with tech company Takeoff Technologies to implement automated micro fulfillment capabilities at three of the retailer’s locations over the next 12 months, to help meet growing online shopping volumes, the company announced in August 2019.

- Israel grocery chain Rami Levy is working with Tech Company CommonSense Roboticsto build an underground automated warehouse, the technology firm announced in July 2019. The facility will enable the grocer to fulfill delivery orders in less than an hour. The center also leverages robotic sorting systems and AI, to prepare items for delivery even more quickly.

CommonSense Robotics micro fulfillment center

CommonSense Robotics micro fulfillment centerSource: CommonSense Robotics[/caption] In-Store Shopper Service Stores are becoming go-to places for shoppers to have an experience – not to just buy a product, and robots are finding applications as an innovative and engaging way to interact with shoppers.

- Pepper: Launched by multinational conglomerate SoftBank Robotics in 2015 through a collaboration with technology company Aldebaran, Pepper is a humanoid robot with AI-powered customer service capabilities that interacts with shoppers to tackle routine information requests, such as where an item is located in the store. Pepper is already deployed in stores shopping malls, airports and even banks. In December 2019, SoftBank Robotics will open Pepper Parlour in the Shibuya district of Tokyo – a restaurant fully operated by Pepper robots.

- LoweBot: Home-improvement retailer Lowe’s introduced the retail service robot LoweBot in 2016, a collaboration with technology company Fellow. LoweBot helps shoppers with simple tasks such as finding their way around the store and addressing basic requests such as locating a product.

- Watsons: Health and beauty retailer Watsons is using robots in selected stores in China to provide navigation services to consumers. The robots can answer consumers questions regarding the products and can also lead consumers to the products they are looking for. Consumers can join the loyalty program automatically by scanning a QR code on the robot.

- FlyZoo Hotel: In 2019, Alibaba opened FlyZoo Hotel in Hangzhou, a hotel that makes extensive use of technology including AI and facial recognition to remove friction from processes such as booking, check-in and access to the booked room. Autonomous robots manage perks such as room service deliveries.

Room service robot at FlyZoo Hotel

Room service robot at FlyZoo HotelSource: Coresight Research[/caption] Last-Mile Delivery Omnichannel requires successful retailers to be able to serve shoppers when, where and the way they want, in what Chinese e-commerce giant JD.com defines as “boundaryless retail.” In this context, last-mile delivery becomes a key factor, and robotics can significantly improve the efficiency, speed and flexibility of last-mile delivery. Chinese e-commerce and technology retailers have been particularly active in this sector, as online commerce delivery is very dynamic in China. The US is also showing interesting developments in the automation of last mile, with technology companies such as Starship Technologies, Marble and Nuro developing delivery robots.

- JD.com: JD.com applied robotics to last-mile delivery with the deployment of autonomous home-delivery robots. The machines are equipped with cameras and sensors and AI to interact with shoppers. Customers unlock the compartment containing the items they purchased using facial recognition. JD.com started using robot delivery vehicles in November 2018, according to IoT News. As of July 2019, the company had deployed robot delivery vehicles in over 10 cities in China, according to the Nikkei Asian Review.

- Segway: Segway-Ninebot has been investing in delivery robots. In August 2019, the company released its second-generation delivery robot for indoor use, the Segway S2, and an outdoor delivery robot, Segway X1, according to Nikkei Asian Review. In 2018, the company launched Segway S1 through a tie-up with Chinese food delivery companies Meituan-Dianping and Ele.me.

- Cainiao’s G Plus: Alibaba’s logistics arm Cainiao launched G Plus, a driverless delivery robot that can carry multiple packs, has a compartment that can store fresh food and can travel longer distances than the previous generation of autonomous vehicles. G Plus was unveiled at the Alibaba’s 2018 Global Smart Logistic Summit.

Cainiao’s last-mile delivery vehicle

Cainiao’s last-mile delivery vehicleSource: Roboticsandautomationnews.com[/caption]