Nitheesh NH

What’s the Story?

Uncovering potential savings in GNFR expenses has moved to the forefront as many companies encounter constrained profit margins coming out of the global Covid-19 pandemic. GNFR expenses, also known as indirect expenses, include OpEx and CapEx expenditures across areas such as marketing, facilities, IT, professional services, packaging, distribution and logistics. In this report, we analyze findings from a February 2021 Coresight Research survey of 220 retail and CPG executives in the US regarding awareness of GNFR expenses and measures taken to reduce these costs. We discuss how services and technology solution providers such as LogicSource can help businesses manage their indirect spending, and we highlight the criticality of access to accurate data in ensuring successful outcomes for GNFR initiatives.Why It Matters

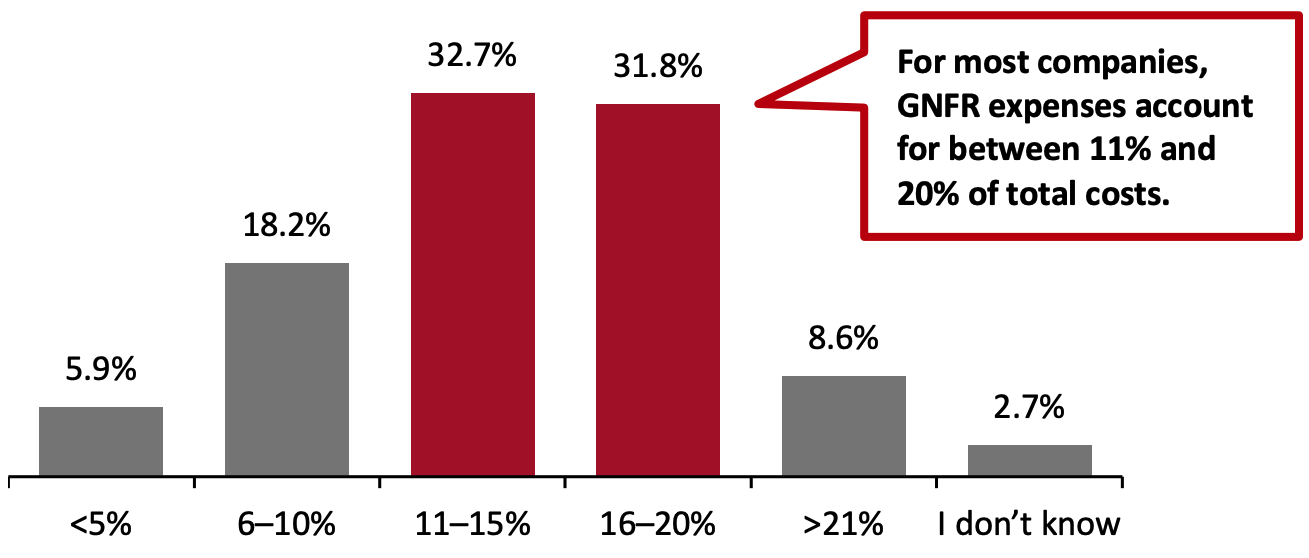

Every retail and CPG company, regardless of their business niche, incurs GNFR expense—related to the purchase of goods and services that are not for resale but are necessary in the course of business. These expenses are significant, and the majority of survey respondents (64.5%) reported GNFR spend equating to between 11.0% and 20.0% of their company’s annual revenue (see Figure 1 below). GNFR expenses offer a broad range of potential for profit improvement initiatives (our survey revealed a range of 3.0%–5.0% for over 50% of companies that had focused on GNFR, as we discuss later). Rapid access to accurate and comprehensive data was seen as core to the success of GNFR profit improvement initiatives in over 90% of responses from those with knowledge of the subject. Most retail and CPG companies do not have the level of data visibility required to take full advantage of GNFR savings. Partnering with a services and technology solutions provider provides companies with an accelerated path to data analytics capabilities and, ultimately, GNFR-related profit improvement.Uncovering GNFR Costs To Achieve Profitability

GNFR Management—An Avenue for Cost Savings During these challenging times, retailers and CPG companies are looking at ways to enhance their operational efficiencies and reduce costs. GNFR expenditures can amount to as much as 20.0% of revenue for retailers and CPG companies; these expenses offer significant opportunities for cost reduction and therefore profit improvement. Figure 1. Companies’ Overall GNFR Spending as Percentage of Total Costs (% of Respondents) [caption id="attachment_127724" align="aligncenter" width="700"] Base: 220 retail and CPG executives

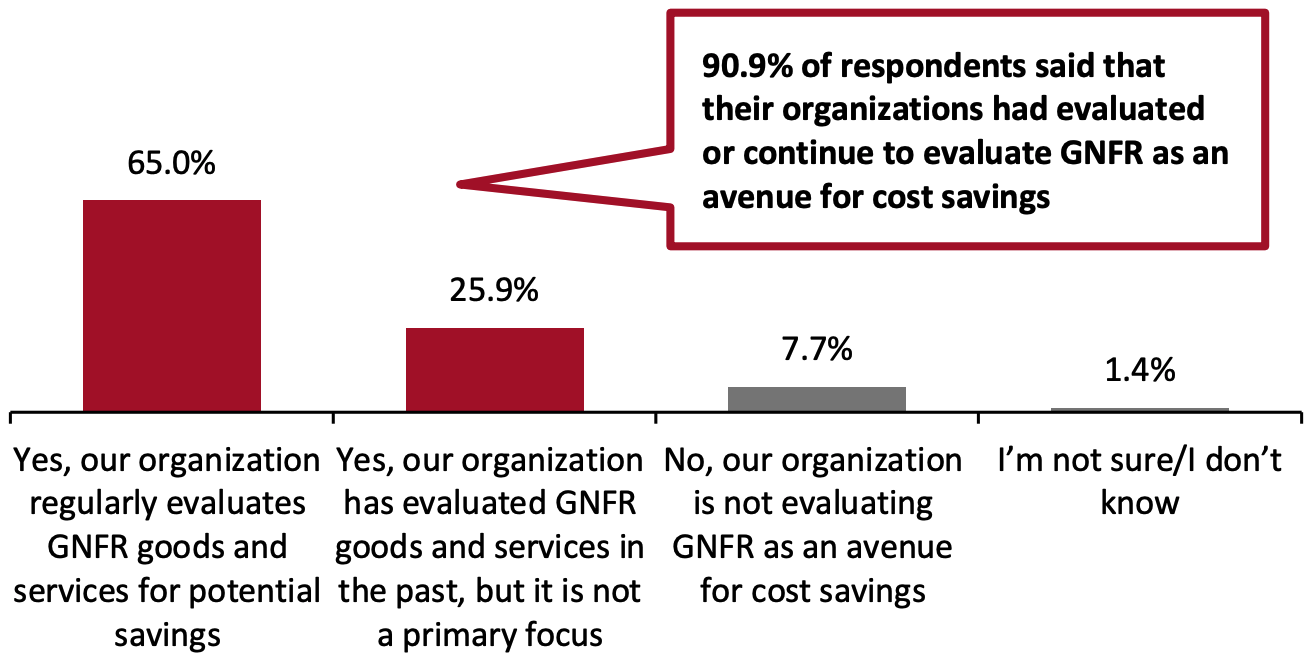

Base: 220 retail and CPG executivesSource: Coresight Research[/caption] Retailers and CPG companies are more aware of GNFR costs than ever before and are focusing on setting up holistic GNFR operating capabilities to manage these indirect expenses. Most of our survey respondents said that their businesses have evaluated GNFR as an avenue for cost savings in the past, with 65.0% reporting that they regularly evaluate these expenses (see Figure 2). Figure 2. Focus on GNFR Expenses for Potential Cost Savings (% of Respondents) [caption id="attachment_127726" align="aligncenter" width="700"]

Base: 220 retail and CPG executives

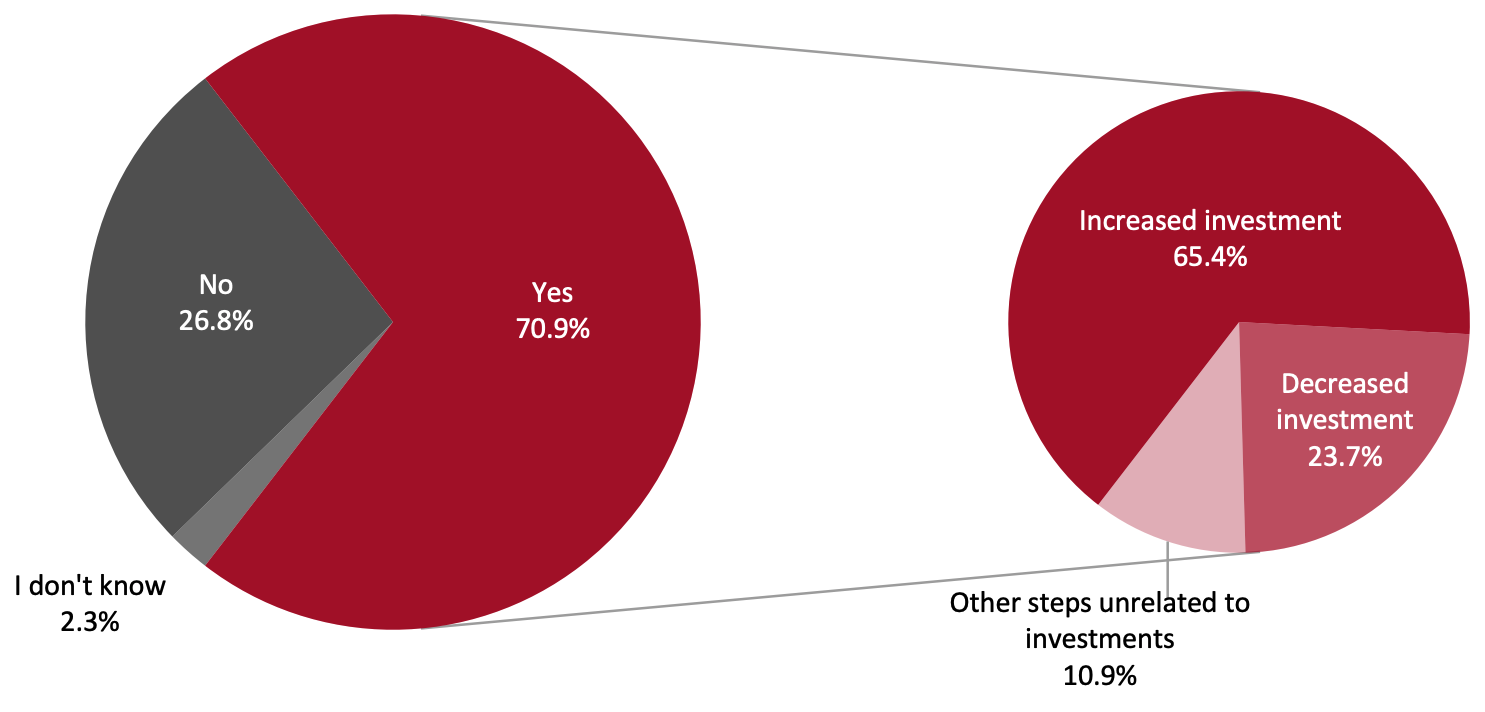

Base: 220 retail and CPG executivesSource: Coresight Research[/caption] Furthermore, our survey found out that 70.9% of retailers and CPG companies adopted additional measures to manage GNFR costs as a result of the pandemic.

- Of the total respondents who increased their investments in multiple areas to manage GNFR expenses (65.4%), the majority (57.8%) invested in building in-house capabilities and 52.9% of respondents invested in procurement resources for managing GNFR costs.

- Out of all the respondents who said that their companies decreased investment in GNFR cost management strategies (23.7%), the majority (62.2%) reported that this was a result of broader headcount reductions across all departments (including procurement and sourcing) during the pandemic, rather than GNFR-focused reductions.

Base: 220 retail and CPG executives

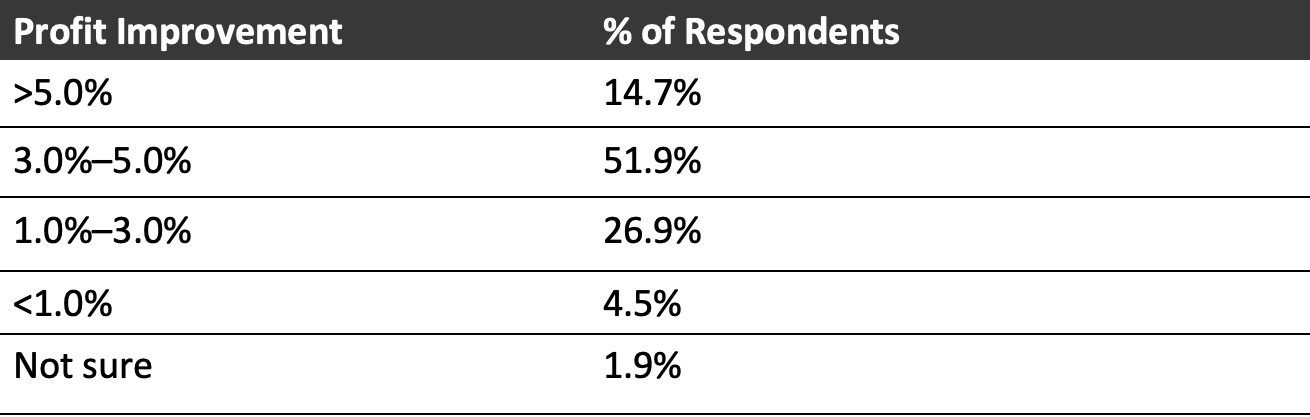

Base: 220 retail and CPG executivesSource: Coresight Research[/caption] Managing GNFR Expenses Helps in Lifting Profit Margins Focusing on GNFR expenses allows CPG and retail firms to enhance their operations and improve cost management and overall productivity, leading to an increase in profit margins. Of the total respondents who adopted additional measures to manage GNFR costs during Covid-19, more than half (51.9%) said that managing GNFR costs helped their businesses achieve 3.0%–5.0% profit improvement (Figure 4). Figure 4. Financial Impact of Saving GNFR Costs (% of Respondents) [caption id="attachment_127728" align="aligncenter" width="720"]

Base: 156 respondents whose organization had taken steps to manage GNFR costs

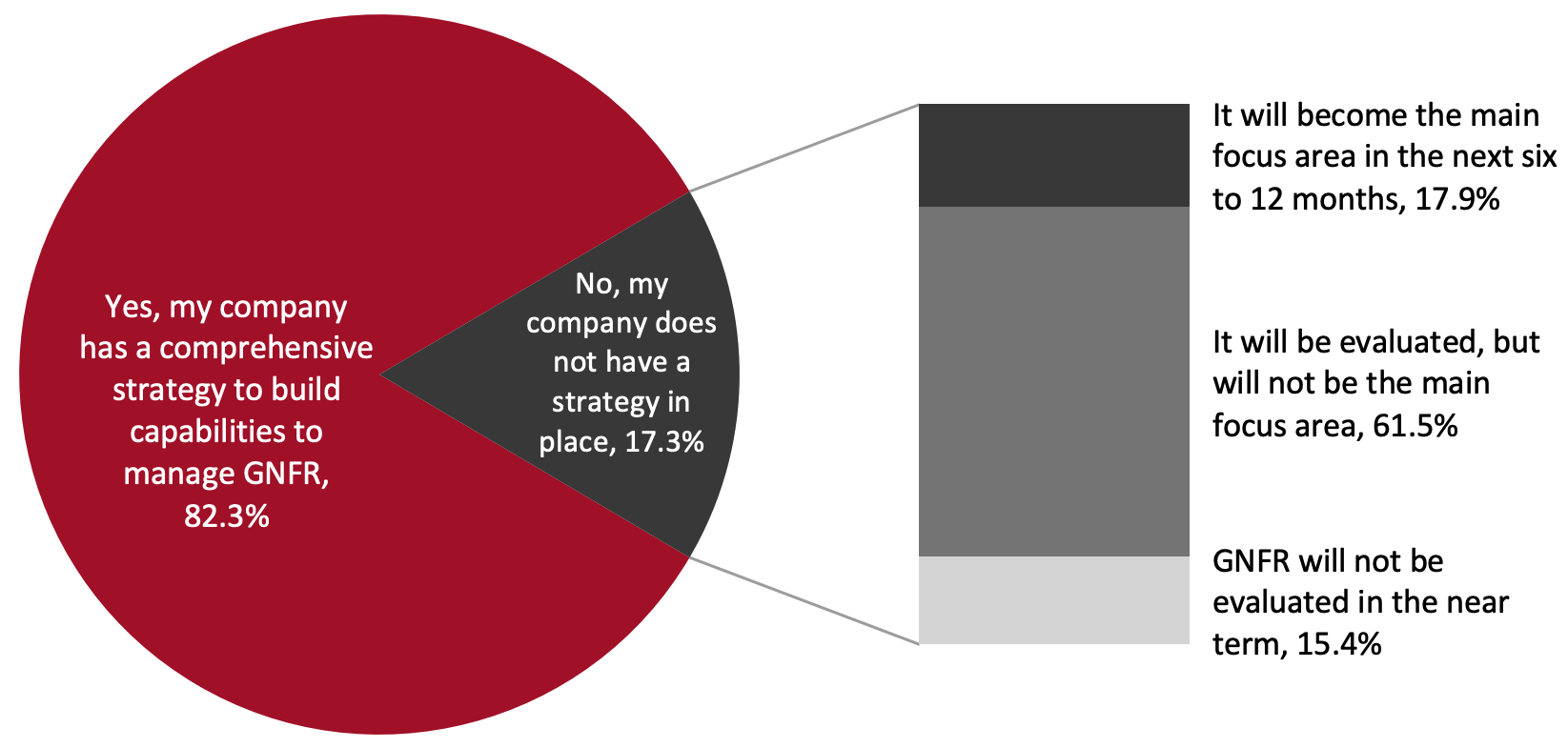

Base: 156 respondents whose organization had taken steps to manage GNFR costsSource: Coresight Research[/caption] Retailers and CPG companies are developing strategies to manage GNFR in order to address issues related to declining profit margins amid unpredictable demand and rising costs. The majority of our survey respondents (82.3%) stated that their businesses have strategies in place to build GNFR-management capabilities, including investing in an in-house procurement team or outsourcing GNFR procurement functions to control GNFR costs. Not only does GNFR management support profit improvement, it also helps retailers and CPG companies streamline their operations and frees up funds for investment in future growth opportunities. Of the respondents who do not have a GNFR expense management strategy in place, 17.9% said that it will be the main focus area over the next six to 12 months, while a further 61.5% said that they will be evaluating a GNFR cost management strategy in the future. Figure 5. Whether Organizations Have a Comprehensive Strategy To Manage GNFR Expenses (% of Respondents) [caption id="attachment_127729" align="aligncenter" width="700"]

Numbers may not sum to 100 as some respondents selected “I don’t know” as an option

Numbers may not sum to 100 as some respondents selected “I don’t know” as an optionBase: 220 retail and CPG executives

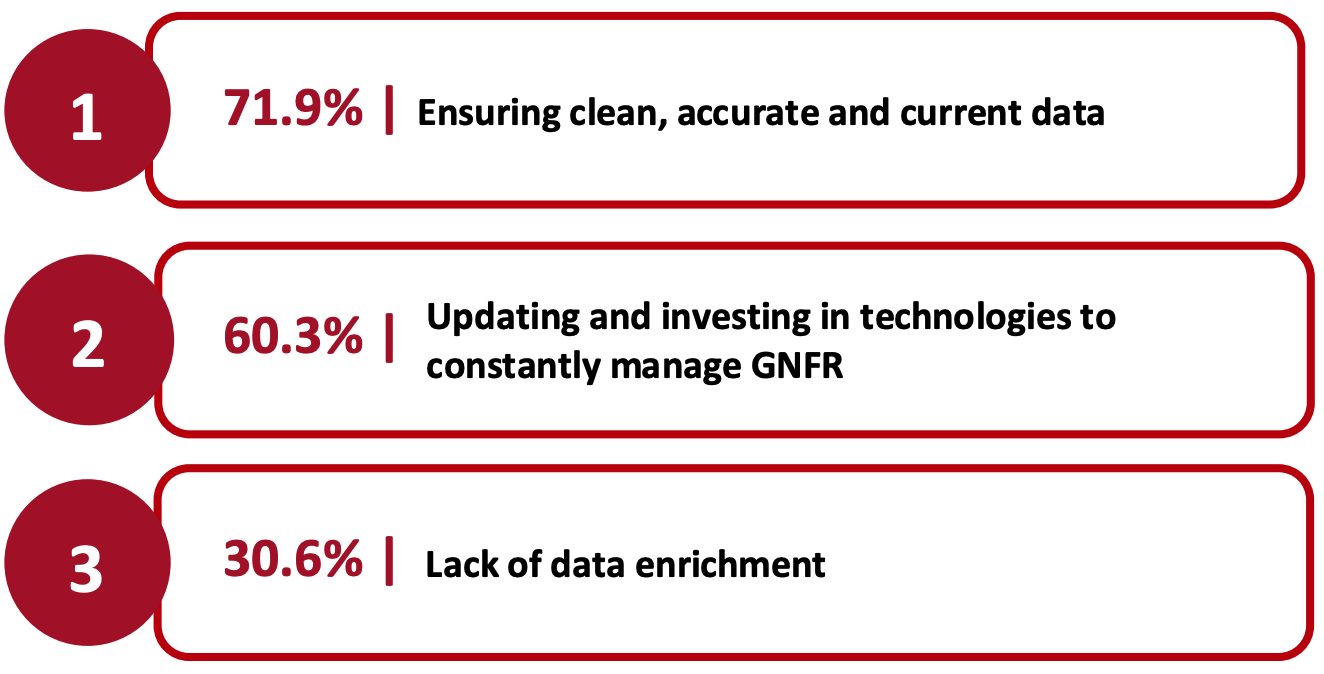

Source: Coresight Research[/caption] Organizations Face Data Headwinds in Managing GNFR Spending Managing indirect expenses is more challenging than managing direct spending as it involves tracking and controlling a significant number of transactions in terms of volume, a higher number of buyers and suppliers, and multiple varieties of transactions across the supply chain in categories where a company typically does not have domain expertise. These costs are often fragmented across the organization, making visibility of expenditures difficult to achieve and therefore challenging to consolidate and manage. Some of the critical challenges as mentioned by respondents are highlighted in the figure below. Figure 6. Top Three Challenges Faced by Retailers and CPG Players in Managing GNFR Spending (% of Respondents) [caption id="attachment_127730" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 220 retail and CPG executives

Source: Coresight Research[/caption]

Retailers and CPG Firms Should Leverage Data Analytics To Realize Cost Savings

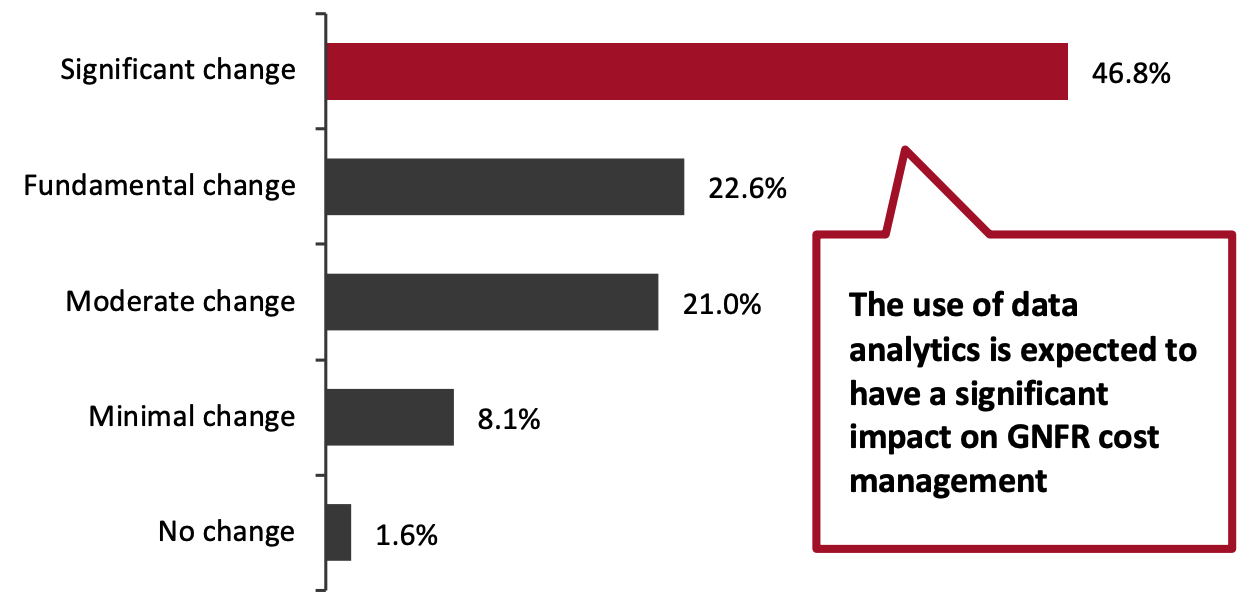

Currently, the use of data analytics to manage GNFR is not widely adopted in the retail and CPG industry, but the few organizations that have implemented such practices recognize the effectiveness of using data analytics to realize cost savings:- Only 29.5% of our survey respondents indicated that they had a clear understanding of how data can be used to manage GNFR costs, nearly all of whom reported that their organizations are using or plan to use data analytics to manage GNFR costs. Of this subset, 90.4% believe that leveraging data analytics will have at least a moderate impact on GNFR cost savings (see Figure 7).

Base: 62 respondents who have a clear understanding of how data can be used to manage GNFR costs and whose organizations are presently using, or plan to use, data analytics to manage GNFR costs

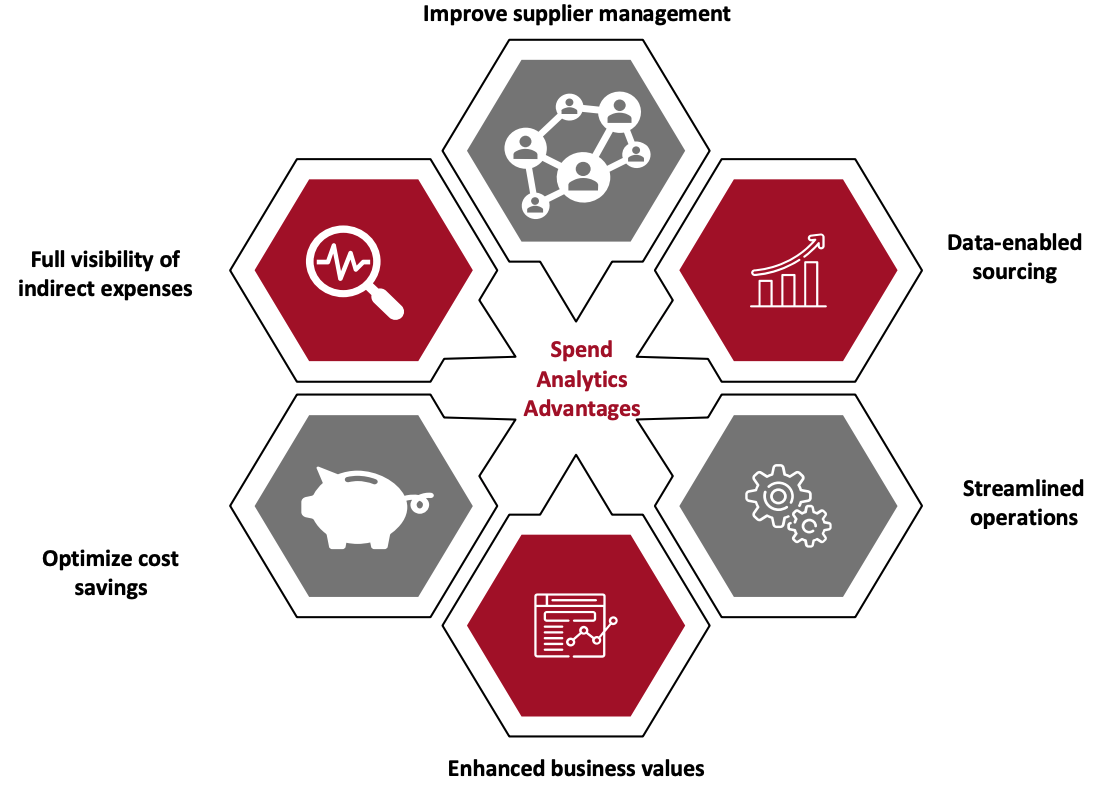

Base: 62 respondents who have a clear understanding of how data can be used to manage GNFR costs and whose organizations are presently using, or plan to use, data analytics to manage GNFR costsSource: Coresight Research[/caption] Leveraging data analytics platforms enables retail and CPG companies to keep track of their indirect expenditures, generate insights on their overall GNFR spending and make more profitable decisions. By providing complete visibility of GNFR spending—with data collated, stored, managed and categorized into relevant operational functions/business units—data analytics is arming companies with the tools to reduce inefficiency and improve profitability.

Realizing Benefits Using Data Analytics

Retail and CPG companies increasingly use advanced analytics to describe, predict and improve business performance. Although under-utilized today (only 29.5% of our survey respondents reported using data analytics to support GNFR initiatives), utilizing data analytics to support profit improvement initiatives for GNFR expenses is extremely effective (Figure 7 above). When utilized effectively, procurement analytics enables data-driven decision-making, where purchasing decisions and supplier relationships are managed more effectively and costs are reduced. Intelligent spend analytics platforms enable organizations to achieve greater cost savings and spending efficiencies by analyzing the company’s purchases and invoices. These tools use machine-learning technologies and automated engines to classify and categorize spending. They also integrate data pools and analytic functions to create cross-category synergies. It is imperative for retail and CPG companies to modify their procurement strategies and include intelligent spend analysis tools to find opportunities to reduce unmanaged indirect expenses. Figure 8. Benefits of Spend Analytics Platforms—An Overview [caption id="attachment_127732" align="aligncenter" width="700"] Source: Coresight Research[/caption]

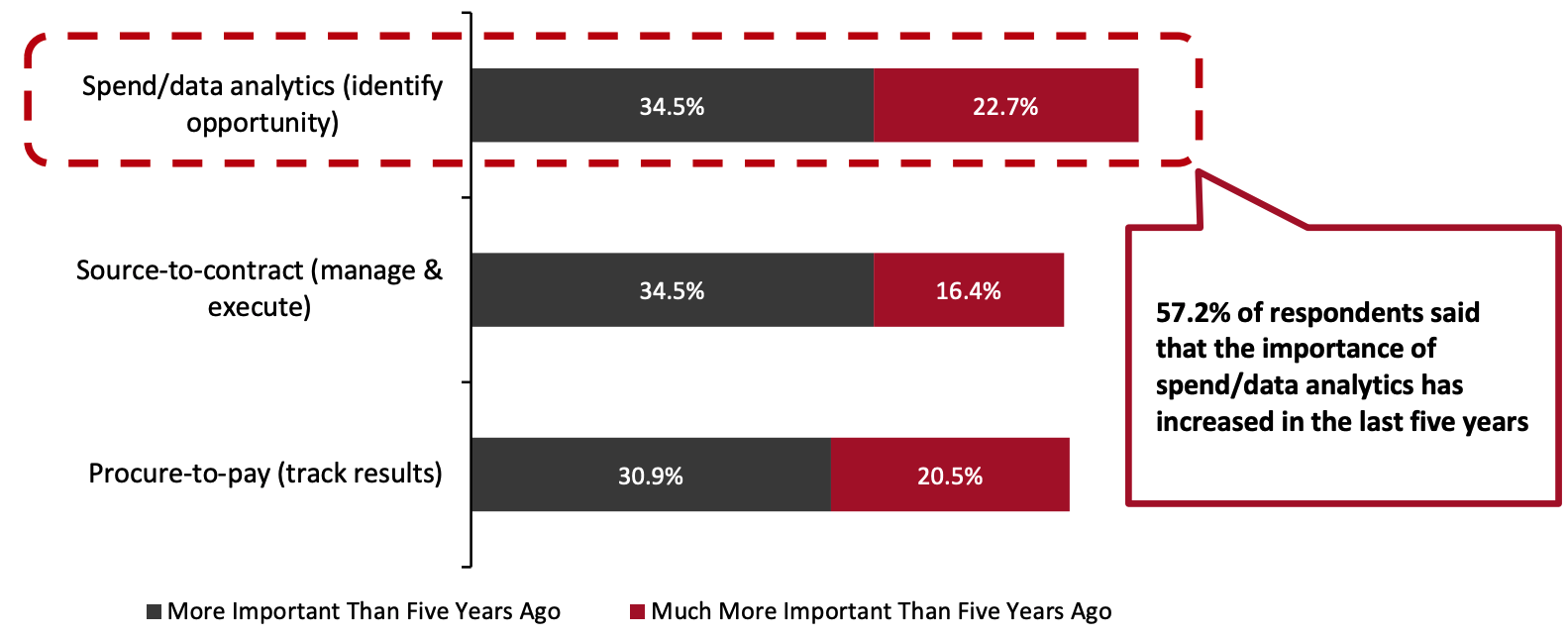

In our survey, the majority of respondents (57.2%) said that the importance of spend/data analytics has increased in the last five years (see figure below).

Figure 9. Changes in Procurement and Sourcing Strategies: Level of Importance Today Compared to Five Years Ago (% of Respondents)

[caption id="attachment_127733" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

In our survey, the majority of respondents (57.2%) said that the importance of spend/data analytics has increased in the last five years (see figure below).

Figure 9. Changes in Procurement and Sourcing Strategies: Level of Importance Today Compared to Five Years Ago (% of Respondents)

[caption id="attachment_127733" align="aligncenter" width="700"] Base: 220 retail and CPG executives

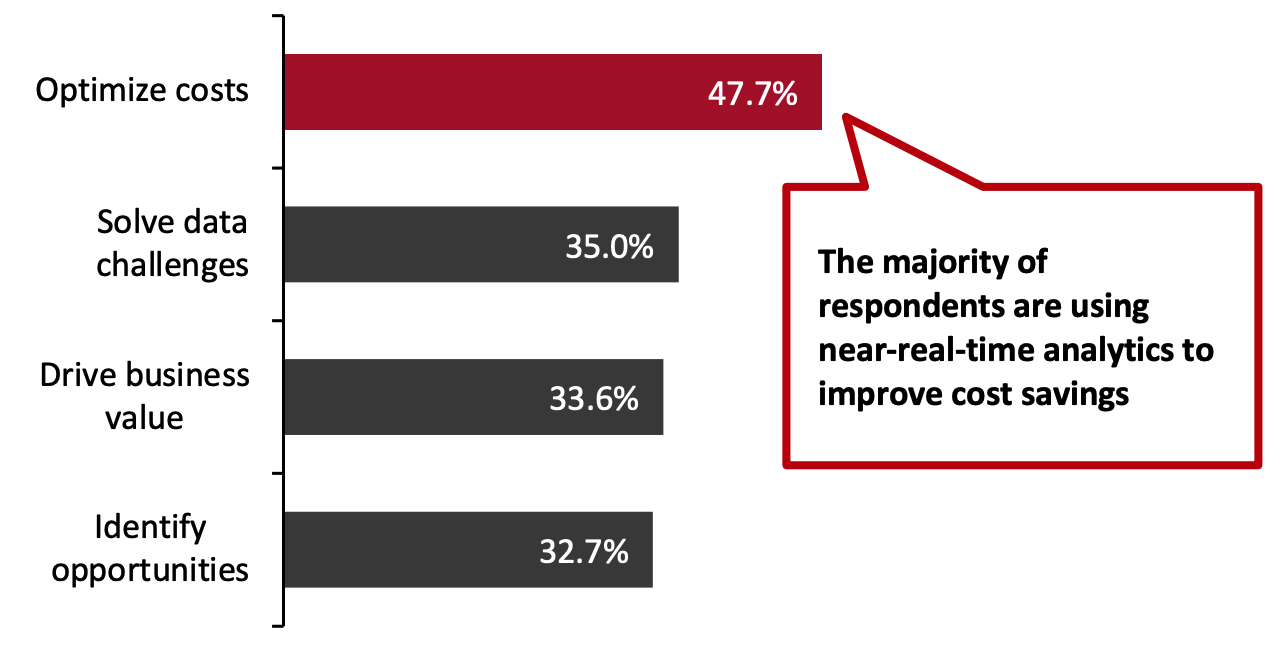

Base: 220 retail and CPG executivesSource: Coresight Research[/caption] Retail and CPG companies are leveraging near-real-time procurement analytics to generate meaningful insights by continuously collecting and analyzing procurement data. Our survey respondents believe that these insights can drive significant bottom-line savings and generate greater business value as well as identify opportunities such as new suppliers or service partners. Figure 10. Key Areas Where Organizations Are Using Near-Real-Time Procurement Analytics (% of Respondents) [caption id="attachment_127734" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 220 retail and CPG executives; Respondents could select multiple options

Source: Coresight Research[/caption]

Outsourcing GNFR Management Services to the Experts

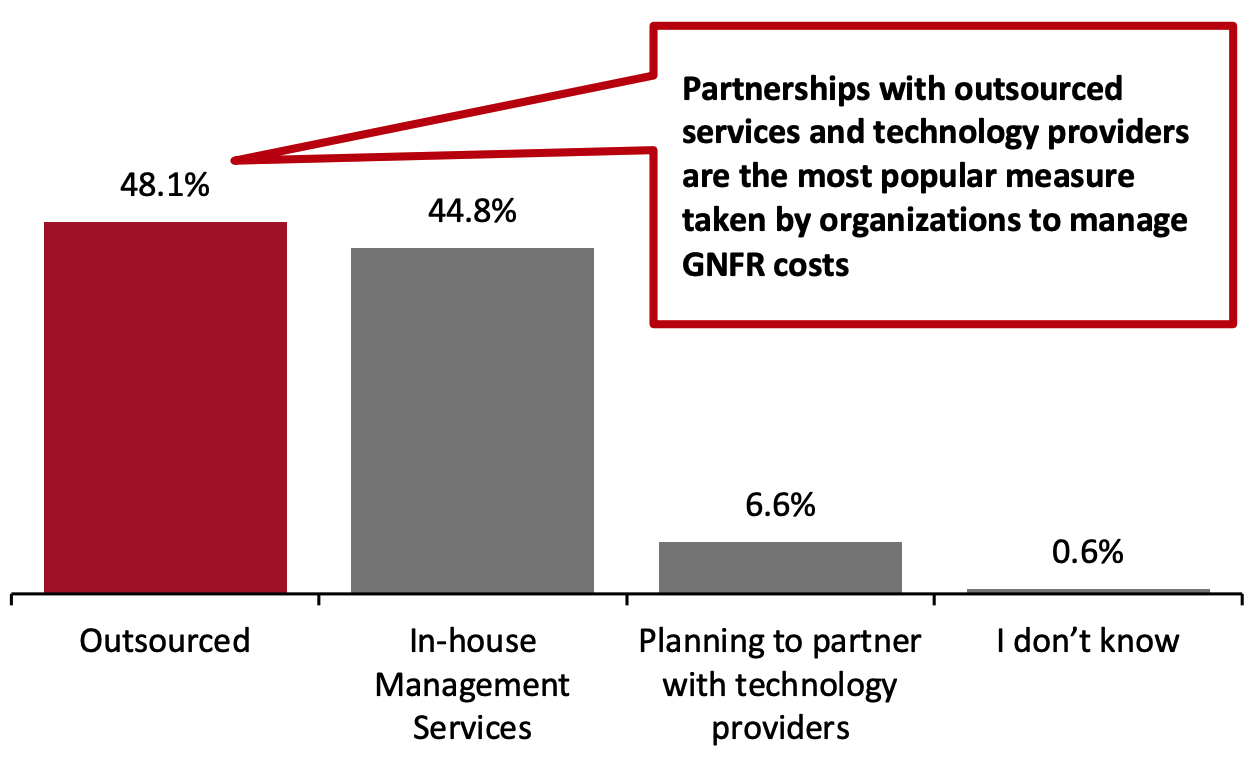

Organizations Outsource GNFR Management Functions To Solve Profitability Challenges Outsourcing procurement capabilities to specialized solution providers allows retail and CPG companies to accelerate the realization of GNFR profit-improvement initiatives. These solution providers are experts in procurement services and GNFR management and can provide data analytics and other procurement-focused technology, know-how and domain expertise that retail and CPG companies need to rapidly drive profit improvement. Moreover, the sheer volume of data a specialized solution provider deals with daily provides up-to-the-moment insight into current costs and best-in-market pricing that affords optimal savings. They are continuously in the market, working with thousands of sourcing events and delivering savings, process improvements and best practices to their clients, allowing their retail and CPG clients to focus on their core competencies and enhance their go-to-market value proposition. Outsourcing GNFR management services enables retailers and CPG companies to receive analysis of their supply chain, providing clear insights into GNFR spending. LogicSource is one such firm that can help retail and CPG companies realize cost savings on GNFR expenses and deliver programs for enhanced profitability. Around half of respondents whose organizations had built capabilities to manage GNFR costs reported that GNFR cost and procurement management capabilities had been outsourced—and 94.3% of these are satisfied by the services provided by the technology companies specializing in managing GNFR costs. Figure 11. Measures Taken by Companies To Manage GNFR Expenses (% of Respondents) [caption id="attachment_127735" align="aligncenter" width="700"] Base: 181 respondents who said that their organization had built capabilities to manage GNFR costs

Base: 181 respondents who said that their organization had built capabilities to manage GNFR costsSource: Coresight Research[/caption] Case Studies Multibillion-Dollar US Apparel Retailer A multibillion-dollar apparel retailer in the US was looking to drive GNFR-related profit improvement that its internal procurement function had not historically been able to achieve. Limited access to accurate spend baseline information, a lack of finance integration and tactically-driven business unit relationships limited the internal team’s effectiveness. Procurement was outsourced to LogicSource. As part of a broad technology, process and organizational change program, LogicSource implemented its OneMarket Insights Data Analytics Technology, which offered fast, accurate spend information to the apparel retailer. With accurate information as the foundation, the new Procurement organization delivered a 100% increase in realized profit improvement as well as a material uplift in broader GNFR-related value for its finance and business unit stakeholders. Big Lots! Big Lots!, a US-based discount retailer, has engaged LogicSource for its GNFR expense management since November 2011. Starting in Marketing, then expanding to Store Operations (including a multi-year store remodel program), and ultimately to all GNFR categories, LogicSource has consistently delivered GNFR-related profit improvements year-on-year for Big Lots! for over a decade. Today, the program covers all GNFR-related expenses, and through a combination of LogicSource’s OneMarket Insights (data analytics) and Portfolio (sourcing performance management) technology, dedicated onsite resources and shared-services support, continues to drive significant profit improvement and GNFR-related value for the company.