albert Chan

Introduction

The boundary between online commerce and offline commerce is blurring in China. “New Retail,” meaning an integration of online retail, offline retail and logistics across a single value chain powered by data and technology, has been taking shape over the past few years. New Retail helps enhance the consumer experience, increases merchant efficiency and enables better product offerings leveraging data and technology. In this report, we review recent developments in New Retail in eight retail and consumer sectors: e-commerce; consumer electronics; fashion; fast-moving consumer goods and supermarkets; cosmetics and beauty; furniture and home improvement; department stores; and, local services.New Retail Propels Online-Offline Integration, Improving Experience and Efficiency

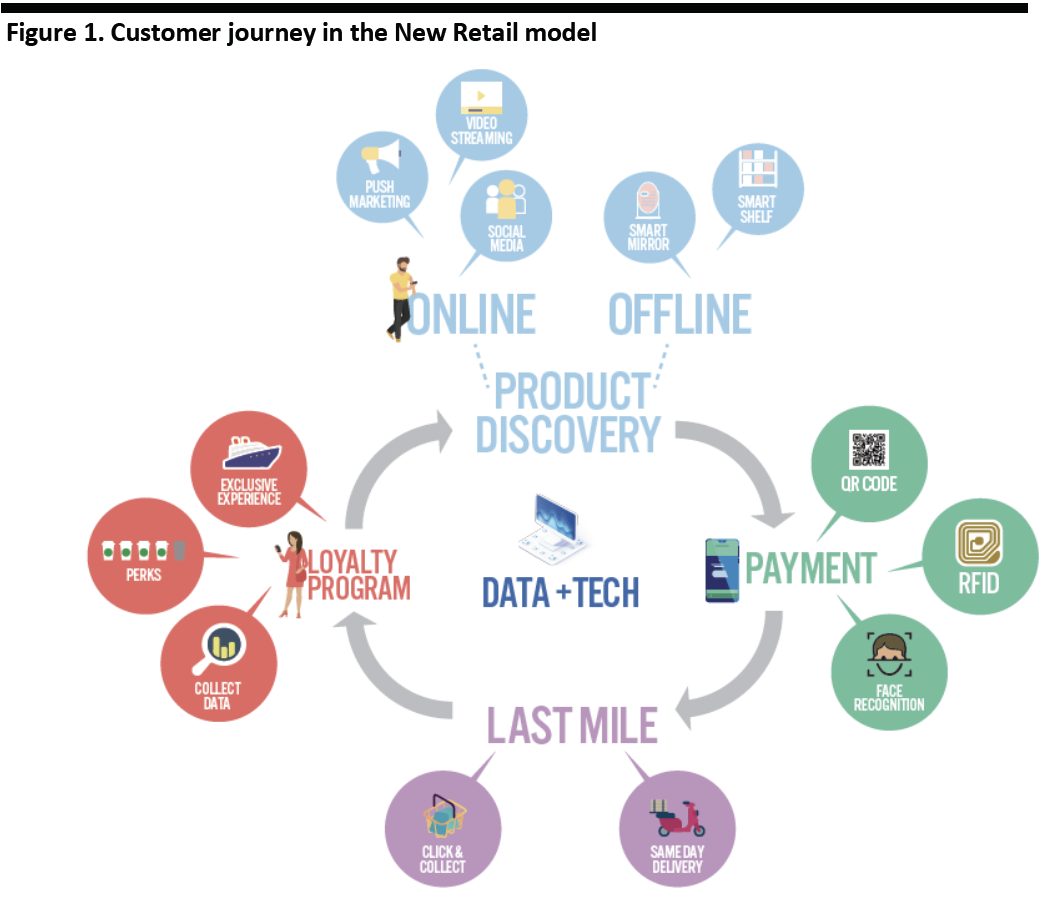

Data and technology are at the core of the New Retail model, connecting online and offline commerce. Along the customer journey, data is collected in both online and offline settings to glean insights into consumer behavior. The insights are then used to inform production decisions and storefront operations. In addition, the offline space has been increasingly digitalized and equipped with new technologies to enhance the in-store shopping experience.- Product discovery: A set of online and offline tools help customers learn more about products before making a purchase in physical stores, customers can use apps to learn more about products by scanning QR codes, and customers can use smart mirrors and other in-store technology to explore products.

- Payment: Mobile payments make it easier to pay online at home or in store. More advanced payment options such as facial recognition technology are being used selectively.

- Last-mile: Customers can choose to pay online and collect at a local store, or request home delivery as fast as the same day.

- Loyalty programs: Integration of digital membership programs with online and offline shopping channels is another New Retail enhancement. Merchants can better personalize offerings and offer perks for specific customers. Loyalty programs are integrated with mobile payment to enable a seamless experience for shoppers.

Source: Coresight Research[/caption]

In the following sections, we review recent developments in New Retail in China by different retail verticals.

Source: Coresight Research[/caption]

In the following sections, we review recent developments in New Retail in China by different retail verticals.

E-Commerce Companies

E-commerce companies, predominantly Alibaba and JD.com, are the pioneers of New Retail. To encourage retailers to embrace New Retail, both platforms have launched their own initiatives to work with brands and physical retailers in various categories and bolstered after sales service. Help Businesses Embrace New Retail From Alibaba’s “Business as a Service” initiative to JD.com’s “Retail as a Service,” the Chinese e-commerce players have worked to promote New Retail. In January, Alibaba announced the A100 Strategic Partnership program to accelerate partner companies’ digital transformation. For example, Alibaba has helped home appliance brand Haier digitalize its physical stores: Customers can now read product reviews by scanning QR codes attached to products in Haier’s physical stores, giving them benefits of the online community experience while also being able to see and touch the products. Step Up After-Sales Services for Consumers Alibaba and JD.com have devoted more attention to after-sales service. In 2018, JD.com launched the JD Service Plus program to strengthen its repair, maintenance, cleaning and warranty services for broader categories such as electronics and electrical appliances, household equipment, pet services and musical instruments. JD.com will send staff to collect items for repair from customers’ homes and return them after they are fixed. The components used for replacement and reinstallation all come from approved manufacturers to ensure authenticity. Offering this service to online customers creates another tool for ongoing customer engagement – and a new revenue stream. [caption id="attachment_93039" align="aligncenter" width="700"] Brands that authorize JD.com to undertake repair services

Brands that authorize JD.com to undertake repair servicesSource: Sale.jd.com[/caption] JD Service Plus plans to roll out another service that lets customers make appointments online in advance and bring items for repair to JD’s offline stores or the brands’ authorized service stations. This will help drive consumers to online platforms to as they book and track the progress of the repair. Alibaba’s online B2C marketplace Tmall opened the Tmall Wuyougo (Tmall carefree shopping) Service Center in Hangzhou in 2018. The service center was opened jointly by Tmall and Alibaba-owned mall operator Intime. It also represented another offline venture for the e-commerce platform. The service center offers complementary services for physical goods, including mobile phone and watch repairs, cleaning for luxury goods, alterations for clothing, footwear and jewelry. Customers can book service appointment on their Taobao mobile apps and check the status of the order before picking it up at the store. The price of each service item is clearly listed on the Taobao mobile app as Alibaba aims to make the pricing transparent. [caption id="attachment_93040" align="aligncenter" width="700"]

Tmall Wuyougo Service Center

Tmall Wuyougo Service CenterSource: Alizila.com[/caption] These after-sales services will strengthen the appeal of third-party e-commerce platforms and allow them to work with more physical retailers in driving online-offline integration. Heading into Healthcare JD.com and Alibaba have both expanded to the healthcare sector and begun digitalizing healthcare services. JD.com set up a healthcare services department in 2014 and later launched a series of healthcare platforms including B2C platform Pharmacy.jd.com, B2B platform Yao.jd.com and doctor consultation services platform JD Online Healthcare. The latest development was in May when JD.com announced it will consolidate all healthcare businesses into a new business group called JD Health, making it the third major subsidiary along with JD Logistics and JD Digits. [caption id="attachment_93041" align="aligncenter" width="700"]

JD Online Healthcare homepage

JD Online Healthcare homepageSource: Care.jd.com[/caption] Alibaba entered the healthcare sector with online healthcare services platform AliHealth in 2014. In August 2018, Alibaba launched a new medical initiative on its Taobao marketplace: 24-hour medicine delivery and online medical consultation for Taobao users in Hangzhou. After the pilot, the service extended to tier-one cities Beijing, Guangzhou and Shenzhen with 30-minute delivery day and night, enabled by Alibaba’s on-demand delivery platform Ele.me. Providing Dedicated Delivery Service for Luxury JD.com offers a dedicated delivery service called JD Luxury Express to replicate the premium service experience customers would experience shopping at a luxury brands’ physical store to encourage luxury brands to sell online. With JD Luxury Express service, a white-glove wearing gentleman in a suit will deliver your goods in an electric car. When luxury brands move to e-commerce platforms, they will be able to build more accurate customer profiles by tapping into JD.com data.

Consumer Electronics

Physical stores are important because consumers still want to touch and feel products and in some cases try them out before making a purchase. They are a crucial part of the New Retail transformation. Physical stores have become more experience-oriented, with data and technology used to provide a better experience to consumers. In the consumer electronics vertical, JD.com has expanded offline and set up two kinds of offline stores—JD Specialty Store and JD Home. Both stores have made use of online sales data from JD.com to plan product assortments. JD Specialty shops feature trendy consumer electronics products and are equipped with advanced technologies such as smart surveillance cameras which can track shoppers’ movement, how long they stay in different sections in the stores and other metrics to analyze differences in product preferences. [caption id="attachment_93042" align="aligncenter" width="700"] JD Specialty store

JD Specialty storeSource: Sale.jd.com[/caption] JD Home stores offer a space for pure-online brands such as OnePlus and Smartisan to showcase their electronic products. The stores are often in a business district (as opposed to a shopping district) in tier 1 and tier 2 cities with a focus on the in-store experience, offering designated areas for relaxation such as a leisure zone, a children’s zone and a reading zone. [caption id="attachment_93043" align="aligncenter" width="700"]

JD Home store

JD Home storeSource: Sale.jd.com[/caption] Chinese smartphone manufacturer Xiaomi’s Xiaomi Home is another brick-and-mortar consumer electronics store that emphasizes the in-store experience. Its first domestic flagship store in Shenzhen features an interactive shopping guide wall which can respond to shoppers’ gestures. Shoppers can view products on the screen and purchase immediately with e-wallets Alipay or WeChat Pay.

Fashion

Online Brands Go Offline to Interact with Customers Going offline is important for pure-online fashion brands as apparel is a category that consumers are eager to see, touch and try on before buying. To bridge this gap, digital native apparel brands are adopting a New Retail concept in their physical store to provide enhanced experience with data and technology, and Alibaba’s Taobao is one of key drivers. Taobao recently opened a showroom-style multi-label store called Taostyle store for online apparel brands, in Hangzhou. The store helps smaller online brands showcase their products to customers in real life so that they do not need to invest in building a physical presence on their own. The store will rotate inventory and refresh the brands selling there at least twice a month to allow more brands to join. [caption id="attachment_93044" align="aligncenter" width="700"] Taostyle store

Taostyle storeSource: Alizila.com[/caption] There is no lack of technology in the store. Shoppers can scan a QR code on the clothing tag to get detailed product information and read customer reviews. A booth offers livestreaming functionality so anyone can get online and promote products in real time. In-Store Retail Technology Improving Shopping Experience Apparel stores have employed in-store retail technology to enhance the shopping experience. Smart mirrors or magic mirrors are a common feature. They make trying out clothes easier and capture customer behavior by linking with their apps and online accounts. Jack & Jones features this technology in its stores in Guangdong province. The smart mirrors are powered by facial recognition technology and activated only when shoppers access the brands’ WeChat mini program (a mini application that runs inside the WeChat app). Shoppers can see themselves in the clothes they pick on the smart mirror. And as the WeChat mini program connects with users’ WeChat account, the smart mirror can recommend items based on the customer’s age, gender and other factors. Alibaba’s FashionAI pop-up stores also featured smart mirrors. By learning from the images of outfits put up by stylists on Taobao and the purchase history on shoppers’ Taobao accounts, the smart mirrors can provide mix and match suggestions and personalized recommendations. [caption id="attachment_93045" align="aligncenter" width="700"]

A shopper uses a smart mirror in the FashionAI pop-up store

A shopper uses a smart mirror in the FashionAI pop-up storeSource: Alizila.com[/caption] Swiss sportswear retailer Intersport partnered with Tmall to open a co-branded megastore in Beijing. The store features a wide range of in-store technology that improves the shopping experience. These include a smart shelf and smart shoe mirror that gives customers information about the shoes. If customers cannot find what they want in the store, they can also turn to a touchscreen powered by cloud technology to view more products on the e-commerce platform Tmall, and then place orders in store for home delivery. [caption id="attachment_93046" align="aligncenter" width="700"]

A customer checks shoe information on a screen connected with smart shelves in the Tmall x Intersport store

A customer checks shoe information on a screen connected with smart shelves in the Tmall x Intersport storeSource: Alizila.com[/caption]

Grocery Retailing

Digitalize Supermarket Operations Supermarkets are adopting digitalization to improve store operations. Product QR codes, smart shelves, autonomous robots, facial recognition payment and self-checkouts are some of the features of the digitalized formats of supermarkets. Alibaba has invested in hypermarket group Sun Art and digitalized around 470 Sun Art stores as of March 2019, according to Alibaba. The stores are integrated with online, digitalized in operations, and equipped with in-store technologies to enhance the shopping experience. The partnership also lets users of the Taobao app to shop Sun Art products on the Taobao app and request home delivery. Transaction data helps Sun Art more accurately profile its customers for more relevant offerings. [caption id="attachment_93047" align="aligncenter" width="700"] Auchan hypermarket, part of the Sun Art Group, in Shanghai

Auchan hypermarket, part of the Sun Art Group, in ShanghaiSource: Auchan.com.cn[/caption] O2O Fresh Food Supermarkets Online-to-offline (O2O) fresh food supermarkets are the signature of New Retail. Major Internet companies in China have established their own fresh food supermarkets: Freshippo (formerly Hema) by Alibaba, 7Fresh by JD.com and Ella by Meituan. The pace of offline expansion varies: Freshippo leads with the highest number of physical stores at nearly 140 to date. A Freshippo supermarket serves as an experiential retail outlet where shoppers can shop and dine in store, and also as a fulfillment center for online orders to delivery within 30 minutes within three kilometers (about 1.8 miles). [caption id="attachment_93048" align="aligncenter" width="700"]

Freshippo store

Freshippo storeSource: Alizila.com[/caption] Building an O2O fresh food supermarket is costly, as outlined in our previous report Understanding Fresh Food E-Commerce in China. O2O fresh food supermarket store expansion has slowed, with some stores even closing. Businesses have been more careful with resource planning in operating these O2O grocery stores. Utilize Data-Driven Insights to Expedite Product Launch With New Retail, retailers can collect more insightful data from daily operations which can be used to optimize production. This has led to an insights-driven or customer-to-business production process, which has helped speed product launch. For example, P&G worked with the Tmall Innovation Center (TMIC), the retail innovation arm of Tmall that helps brands improve their offerings through market analysis and product concept testing, to develop a new fragrance shampoo series specifically for Chinese consumers in just nine months. Tapping into real-time consumer insights from Tmall delivered faster understanding of consumer trends and more agile modifications to create the final product. [caption id="attachment_93049" align="aligncenter" width="700"]

An Ele.me courier picks up a parcel from a drugstore

An Ele.me courier picks up a parcel from a drugstoreSource: Alizila.com[/caption] Cosmetics/Beauty Cosmetics and beauty brands have embraced in-store technologies to boost the customer experience. Korean beauty brand Innisfree partnered with Tmall to open a co-branded New Retail format store in Hangzhou in 2018 which features intensive use of technology. Some of the high-tech features in the store include:

- Augmented-reality (AR)-powered mirrors which let shoppers “try on” make up virtually.

- The Smart Skin Analyzer can capture shopper’s skin conditions using a high-precision camera placed over the skin. The device generates a detailed report and recommends Innisfree products based on their specific skin. Shoppers can also scan a QR code to save the report to their Taobao accounts.

- Smart shelves that enable shoppers to read product details on a touchscreen when they pick up an item from the sensor-equipped shelves.

- An AR interactive photo booth allows Innisfree members to take photos with the brand’s celebrity ambassadors.

A shopper reads product details on a touchscreen at the Innisfree x Tmall New Retail Store

A shopper reads product details on a touchscreen at the Innisfree x Tmall New Retail StoreSource: Alizila.com[/caption]

Furniture and Home Improvement

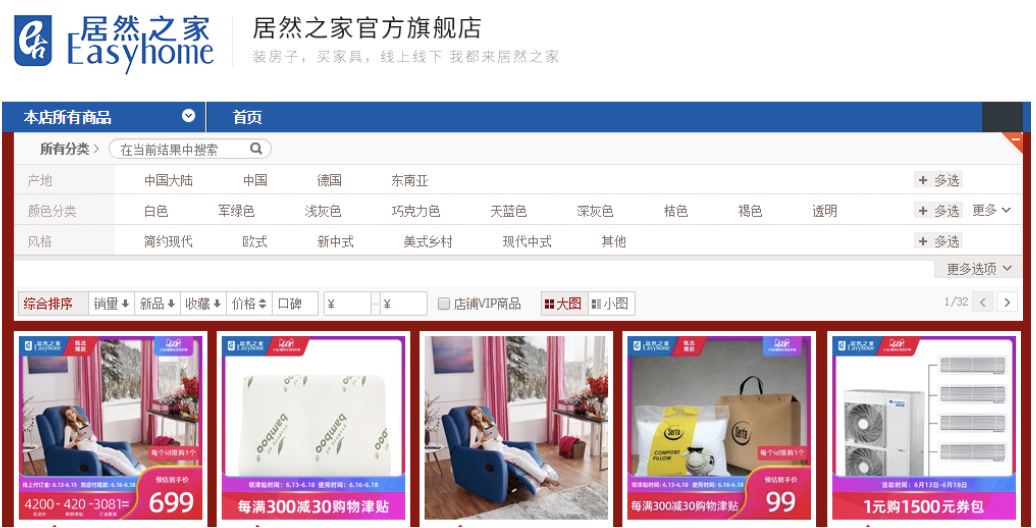

Furniture and home improvement stores are often low-tech formats but are now catching up and increasingly digitalizing to adopt New Retail technology. Alibaba’s New Retail solutions helped Chinese furniture retailer Easyhome digitalize its first store in October 2018, digitalizing operations from customer targeting and profiling, to manufacturing, delivery and installation. All Easyhome stores in China will accept digital payment in 1-2 years. In addition, Easyhome has begun selling online by setting up a flagship store on Tmall. [caption id="attachment_93051" align="aligncenter" width="700"] Easyhome’s Tmall flagship store

Easyhome’s Tmall flagship storeSource: Tmall.com[/caption] The Qumei-JD co-branded store, a partnership between furniture retailer Qumei and JD.com, opened in Beijing in September 2018. The store uses technology such as smart screens and features interactive games to enhance the customer experience. JD.com undertakes the logistics services for the store. Customers can also shop online on their JD mobile app for items that do not appear in the store. [caption id="attachment_93052" align="aligncenter" width="700"]

Qumei-JD co-brand store

Qumei-JD co-brand storeSource: Qumei.com[/caption]

Department Stores

Large-scale department stores are undergoing a digital transformation, too. Alibaba-owned department store Intime has completely digitalized its operations from membership to payments to logistics. It has launched the Intime mobile app that allows customers to get product information by scanning items at the department store, and keeps them engaged after they leave the store. Intime malls are also tapping into booming online commerce by serving as fulfillment centers and pick-up stations for online orders. The department store chain was the first of its kind in China to offer “same city, two hours” delivery service, leveraging its store footprint quickly fill orders. [caption id="attachment_93053" align="aligncenter" width="700"] An Intime mall in Hangzhou

An Intime mall in HangzhouSource: China-yintai.com[/caption] E-commerce platform Suning.com entered the department store business when it acquired all 37 Wanda Group department stores in early 2019. Wanda Group is a major property developer in China. Suning.com plans to convert the acquired department stores to smart retail formats that feature digitalized operations in payments, customer service and inventory management.

Local Services

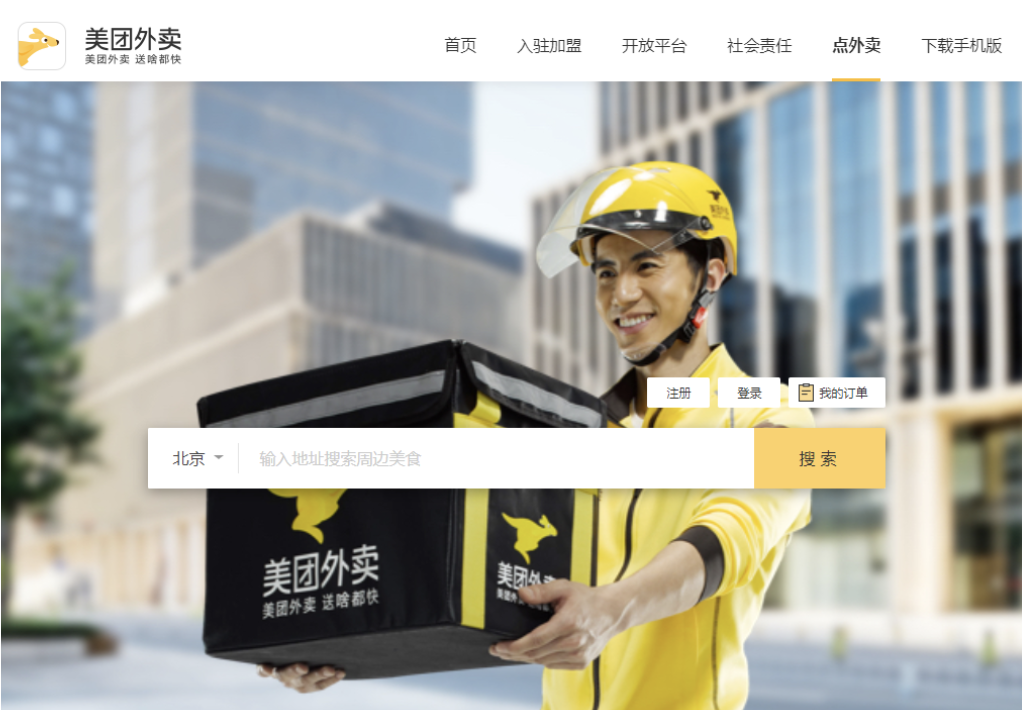

Local service is an emerging area that links consumers with offline consumer services and on-demand delivery through online platforms. Through online platforms and apps, consumers can book offline facilities and services such as transportation tickets, movie tickets and hotel accommodation – and read user reviews. The major local service platforms in China are Alibaba-owned Ele.me and Meituan Dianping, which both offer a comprehensive list of local services. Ele.me was originally an on-demand food delivery services platform. Alibaba merged the company with its lifestyle unit Koubei in October 2018 to boost its local services capabilities. Since then, Ele.me has become a dedicated local services platform that is able to offer quick delivery. For example, Ele.me partnered with Starbucks to deliver coffee to 30 cities in China and with drugstore chain Watsons to offer on-demand delivery service for personal care and beauty products. Meituan Dianpian operates an online-to-offline platform that covers a wide range of consumer services with its four business units: Meituan (marketplace for services), Dianping (lifestyle services and restaurants review), Meituan Waimai (on-demand delivery) and mobike (bike-sharing). [caption id="attachment_93054" align="aligncenter" width="700"] Meituan Waimai’s homepage

Meituan Waimai’s homepageSource: Waimai.meituan.com[/caption] Alibaba and Meituan also compete in online movie ticketing. Alibaba’s Tao Piao Piao and Meituan’s Maoyan are the major online movie ticketing platforms. According to the Chinese government unit that monitors movie production and listing, online movie ticketing platforms now account for over 85% of total movie ticket sales, up from 18% in 2012. Maoyan is filing for IPO in Hong Kong in 2018. With local services emerging as a new vertical, Chinese consumers are increasingly turning to local services platforms to research products and order offline facilities and services, brining online traffic to offline stores and spurring the development of on-demand delivery platforms.