DIpil Das

Introduction

Today’s abundance of choice is great for shoppers, but makes it harder than ever for retailers to retain customers. According to management consulting firm A.T. Kearney, it costs five to 25 times more to acquire a new customer than to retain an existing one. Furthermore, the value of loyal customers is that they typically spend more and are more likely to promote the brand to others. One way in which retailers can gain a larger share of wallet and increase customer retention is through a well-designed loyalty program. Data analytics company LoyaltyOne has estimated that by the end of 2019, the global annual spend on loyalty management by companies will total $75 billion, and this number will continue to grow by low double digits year over year. For retailers, the rewards of a loyalty program extend beyond retaining shoppers through incentives: The data harvested through such programs provides greater customer insight and can power personalization in marketing and promotions. In this report, we examine best practices for loyalty programs and how retailers can leverage data to drive growth, as well as several emerging trends in the implementation of such programs.Types of Loyalty Programs: Proprietary vs. Coalition

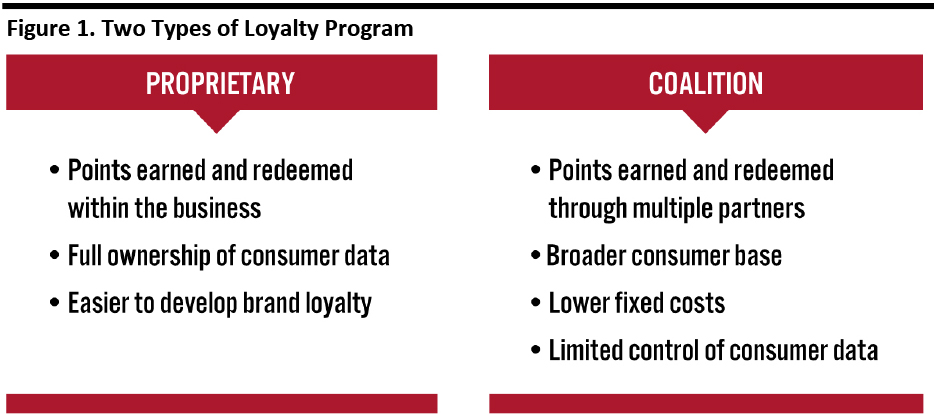

Currently, there are two types of loyalty programs in the retail sector: proprietary and coalition. Companies should take their strategic goals and consumer preferences into consideration when determining which type to adopt. [caption id="attachment_98078" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Proprietary Programs aim to focus on the company’s core business and build a personal connection with customers. Retailers have full control of the program’s operation and marketing, as well as full ownership of customer data, allowing them to create a more consistent experience across channels and offer more customized solutions for consumers. This is intended to build emotional connections with shoppers, who are then more likely to promote the business to others. Examples of loyalty programs of this type include Starbucks Rewards, Sephora Beauty Insiders, Family Mart’s membership and Ikea Family.

Coalition Programs are consolidated single platforms that serve the needs of several companies. This type of program is most commonly adopted by airlines (frequent flyers programs) and cobranded credit cards. It is easier and faster for consumers to earn points, and they are able to receive a variety of reward options. From a retailer perspective, these programs do not require heavy investment in their development and management, as they are not bespoke. However, companies have limited access to consumer data and are hard to differentiate from competitors, so it is difficult to grow customer loyalty. Examples include Matas, Star Alliance and Upromise.

Source: Coresight Research[/caption]

Proprietary Programs aim to focus on the company’s core business and build a personal connection with customers. Retailers have full control of the program’s operation and marketing, as well as full ownership of customer data, allowing them to create a more consistent experience across channels and offer more customized solutions for consumers. This is intended to build emotional connections with shoppers, who are then more likely to promote the business to others. Examples of loyalty programs of this type include Starbucks Rewards, Sephora Beauty Insiders, Family Mart’s membership and Ikea Family.

Coalition Programs are consolidated single platforms that serve the needs of several companies. This type of program is most commonly adopted by airlines (frequent flyers programs) and cobranded credit cards. It is easier and faster for consumers to earn points, and they are able to receive a variety of reward options. From a retailer perspective, these programs do not require heavy investment in their development and management, as they are not bespoke. However, companies have limited access to consumer data and are hard to differentiate from competitors, so it is difficult to grow customer loyalty. Examples include Matas, Star Alliance and Upromise.

Leveraging Consumer Data

One of the biggest benefits of loyalty programs is the amount of consumer data that they can provide to retailers, such shopping behavior, average spending, purchasing frequency and other information that can generate valuable insights for companies. However, consumers may now care more about privacy issues than rewards, particularly as several data breach scandals have come to light over the past few years. According to a Harris Poll survey, 71% of US consumers would be less likely to join a rewards program if it collects personal information including home address, bank account information and other sensitive data. Retailers must keep that in mind when requesting such details, and ensure that private data will not be given to third parties without customer consent. Personalized Promotion and Rewards According to a study from digital marketing company Avionos, 78% of US consumers are more likely to shop with brands that provide personalized experiences. Offering perks and rewards is a way for retailers to show appreciation for consumers’ actions. By analyzing consumers’ shopping behaviors using technologies such as AI, companies can create specific promotions and rewards that resonate with their customers and therefore drive promotional return on investment. For example, based on historical purchasing behavior, the Starbucks Rewards program offers discounts for customers on the beverage that he/she often orders. The program also offers birthday rewards. [caption id="attachment_98079" align="aligncenter" width="686"] Personalized emails with discounts from Starbucks

Personalized emails with discounts from Starbucks Source: Starbucks [/caption]

Loyalty Program Best Practices To Improve Customer Experience

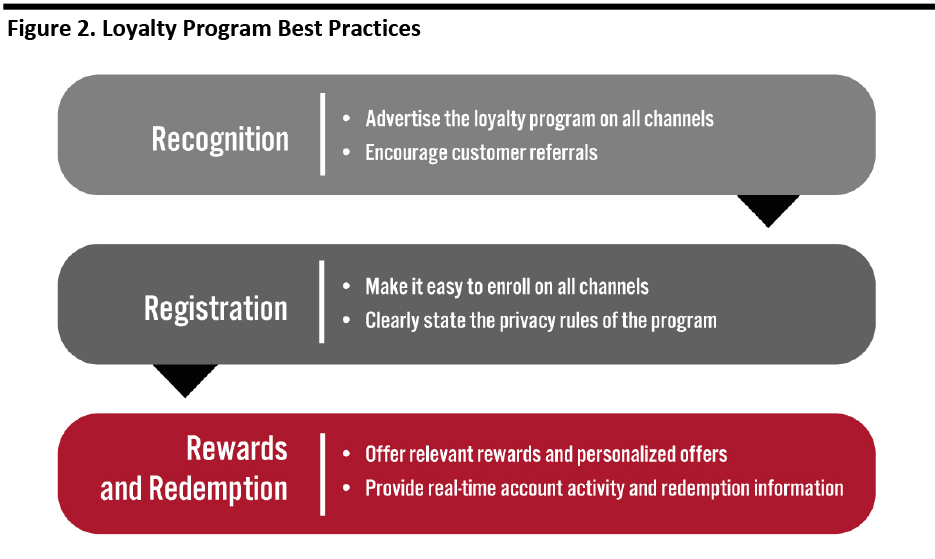

Loyalty programs help retailers to elevate customer experience if implemented effectively. Brands must therefore identify consumer pain points in the process of joining and using the program in order to mitigate the risk of deterring sign-ups. We examine some of the best practices for retailers in offering loyalty programs. [caption id="attachment_98080" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Best Practices – Recognition

Retailers should promote their loyalty program on both offline and online channels. Loyalty program banners and signages should be highly visible in store, and employees should be trained to pitch the program to every customer. Offering a signup bonus or instant reward is the quickest way to attract customers to join the program. Another effective way is to incentivize existing members by offering rewards for referrals. Companies should also announce the launch of their program over email to existing subscribers, as well as on social media and through their official website.

Best Practices – Registration

Program enrollment should be quick and easy for consumers, whether it is done online or offline. With many consumers expressing concern over data privacy, it is important that retailers request only necessary information and inform consumers how they will use that information.

Best Practices – Rewards and Redemption

All retailers that have a loyalty program offer rewards, so it is key for each company to differentiate itself from competitors. Rewards should be relevant and resonate with the brand’s targeted consumers. Having tiers in the program and providing personalized offers also make loyal customers feel more appreciated. Keeping the rewards reasonably attainable is important; according to a report from marketing company HelloWorld, top complaints for loyalty programs are the long time it takes to earn a reward and rewards or points expiring too soon. Consumers expect a seamless reward accrual and redemption process. As part of this, retailers should provide loyalty program members with real-time account information such as a record of purchase history and rewards earned, and keep rewards reasonably attainable.

Source: Coresight Research[/caption]

Best Practices – Recognition

Retailers should promote their loyalty program on both offline and online channels. Loyalty program banners and signages should be highly visible in store, and employees should be trained to pitch the program to every customer. Offering a signup bonus or instant reward is the quickest way to attract customers to join the program. Another effective way is to incentivize existing members by offering rewards for referrals. Companies should also announce the launch of their program over email to existing subscribers, as well as on social media and through their official website.

Best Practices – Registration

Program enrollment should be quick and easy for consumers, whether it is done online or offline. With many consumers expressing concern over data privacy, it is important that retailers request only necessary information and inform consumers how they will use that information.

Best Practices – Rewards and Redemption

All retailers that have a loyalty program offer rewards, so it is key for each company to differentiate itself from competitors. Rewards should be relevant and resonate with the brand’s targeted consumers. Having tiers in the program and providing personalized offers also make loyal customers feel more appreciated. Keeping the rewards reasonably attainable is important; according to a report from marketing company HelloWorld, top complaints for loyalty programs are the long time it takes to earn a reward and rewards or points expiring too soon. Consumers expect a seamless reward accrual and redemption process. As part of this, retailers should provide loyalty program members with real-time account information such as a record of purchase history and rewards earned, and keep rewards reasonably attainable.

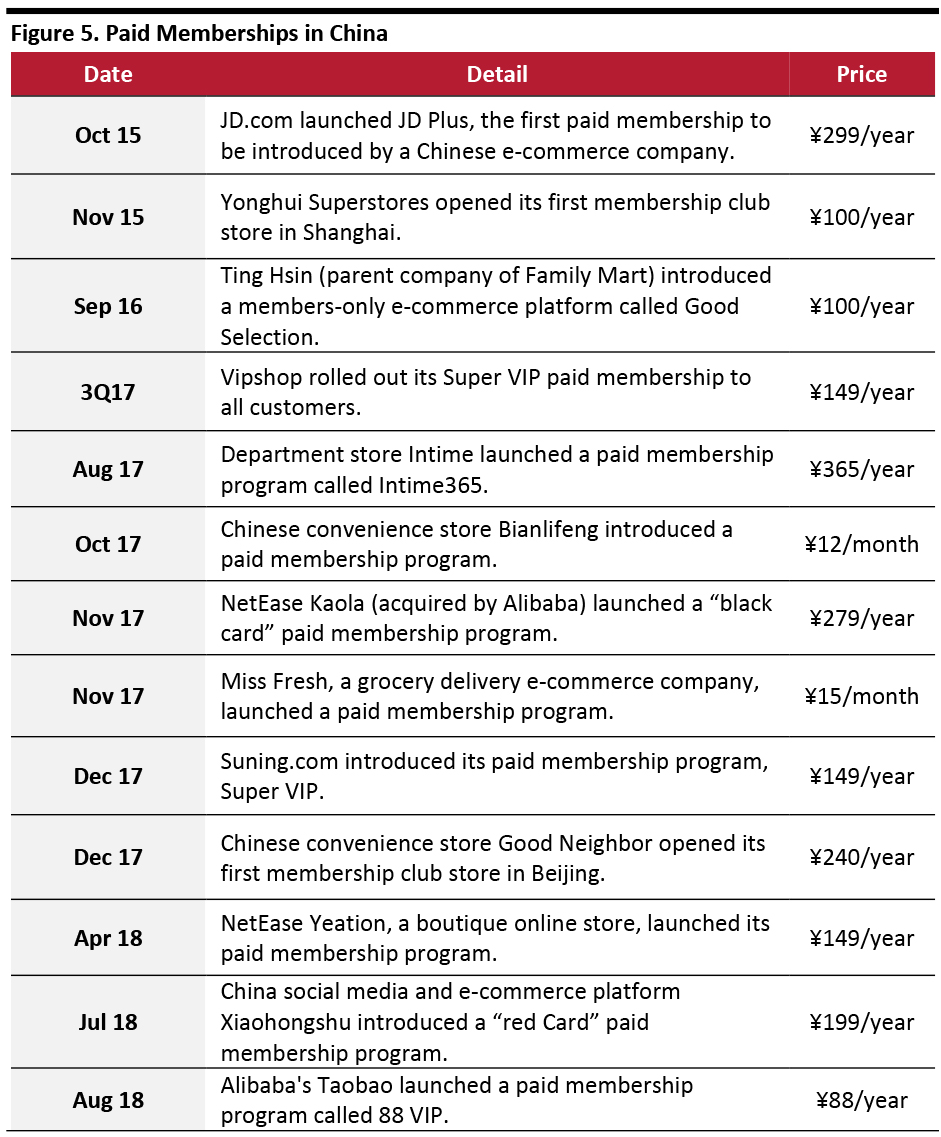

Loyalty Program Emerging Trends To Follow

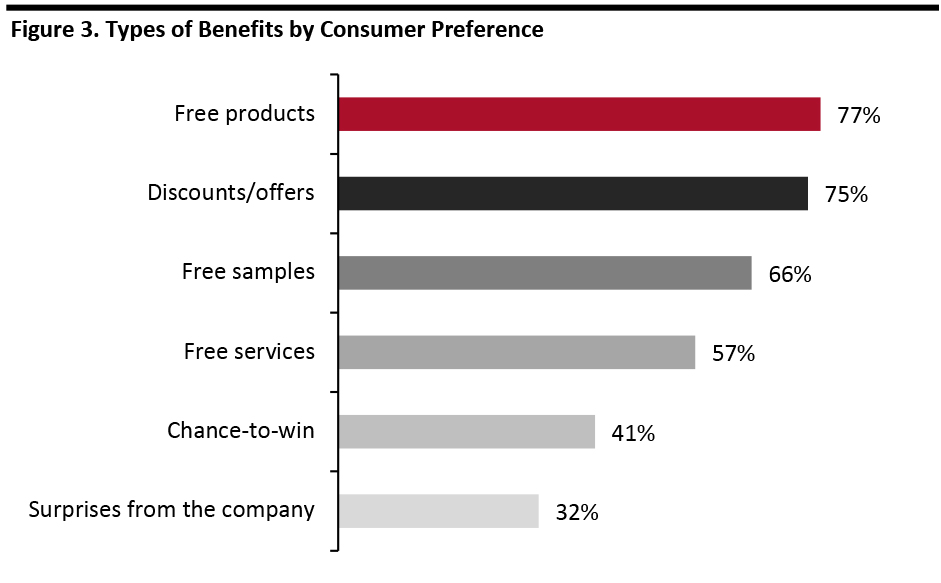

Retailers are evolving their loyalty programs to better meet consumers’ expectations, with upgrades such as providing experiential rewards, integrating with mobile and offering premium membership. Consumers Are Looking for Experiential Rewards Most of the traditional retailers offer similar benefits, such as free shipping and product discounts. According to a survey from marketing company HelloWorld, monetary benefits are still the most wanted rewards. However, customers are also looking for experiential benefits from retailers. Nowadays, consumers are more tech savvy, and it is easier for them to search for discounts. If they are not satisfied with a brand’s monetary benefits, they can easily switch to other brands that offer similar rewards. On the other hand, experiential benefits could translate to emotional connections with consumers, which helps drive engagement and satisfaction.- Sephora’s Beauty Insider is a tiered loyalty program that offers a variety of benefits. The highest-tiered insiders, VIB Rouge members, receive early access to new products, access to exclusive events, free custom beauty services and more.

- NikePlus is a free-to-join loyalty program. Besides free shipping, members enjoy access to new and member-only products, special store hours and expert advice. Moreover, Nike offers three complementary apps—SNKRS, Nike Run Club and Nike Train Club—providing health-conscious active consumers a comprehensive Nike mobile experience.

Base: Over 1,500 female and male US consumers aged 18-65.

Base: Over 1,500 female and male US consumers aged 18-65. Source: HelloWorld 2019 Loyalty Barometer Report [/caption] Integration of Loyalty Programs with Mobile Apps Boosts Consumer Engagement With the number of cell phone users surging and the growing adoption of mobile payment options by retailers, consumers are increasingly using their phones to shop. As of February 2019, 81% of Americans owned smartphones, according to Pew Research Center. China is also a huge mobile market—817 million users used cell phones to access the Internet in 2018, according to the China Internet Network Information Center. Loyalty program apps allow users to receive instant updates on purchases and rewards. More retailers are offering payment options in their app to provide a smoother checkout process. Apps are an effective way to engage with users, as retailers can send push notifications of promotions and personalized marketing to customers. Adding gamification features in apps can also increase customer engagement by offering interactive games or activities for customers to earn rewards. Moreover, retailers can utilize mobile location function to offer information and promotion of specific physical store when customers are nearby. There are a number of convenience stores that have implemented loyalty programs through an app, including:

- Alimentation Couche-Tard subsidiary Circle K, which launched a mobile app called OK Stamp It in 2016. The app can be linked with Hong Kong’s Octopus contactless payment card. The app offers exclusive product discounts to users and automatically loads loyalty stamps when purchases are made with the Octopus card.

- 7-Eleven, which launched its 7Rewards points program in 2015 and expanded it in 2017. The company ran a Million Points Sweepstakes Giveaway in the US in early 2018 to promote the program, giving customers the chance to win 1 million points that could be redeemed for food and drinks.

- Casey’s General Stores, which revamped its mobile app in July 2019 and plans to launch its loyalty program in late October to create a seamless experience for its customers.

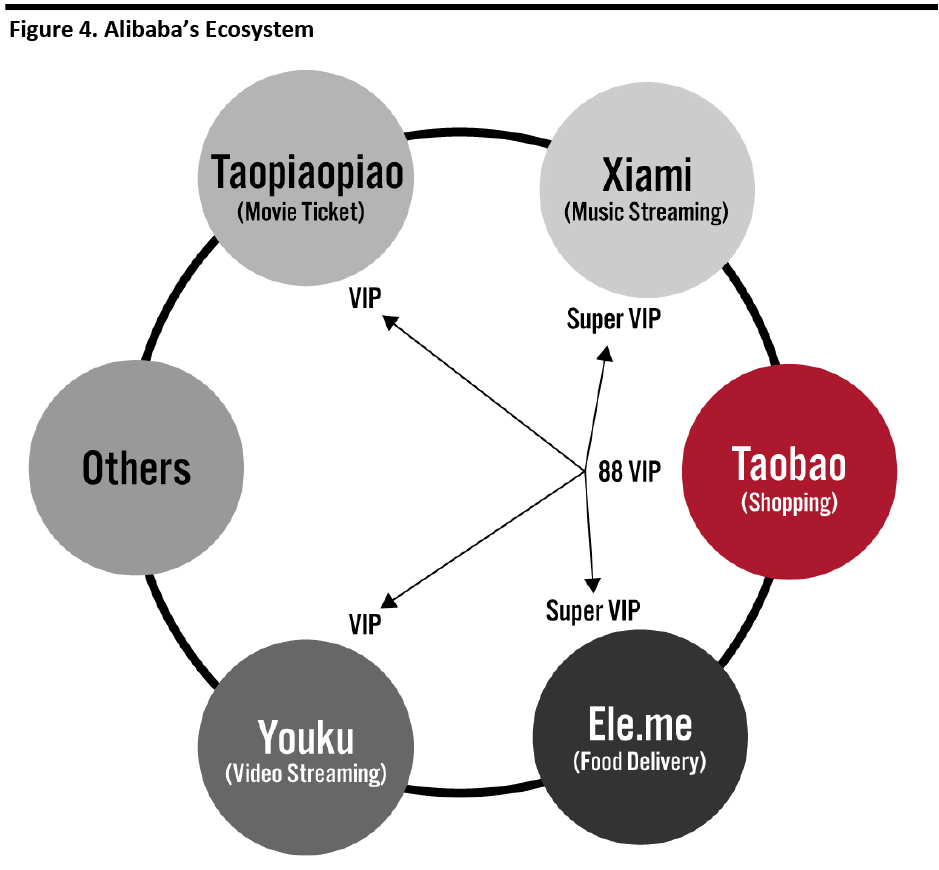

Source: Alibaba/Coresight Research[/caption]

Another type of membership is the subscription-only model, where customers must pay a recurring fee to access a company’s products. Examples include Blue Apron, a service that delivers meal kits to customers every week, and Birchbox, a curated monthly beauty subscription box. In China, MSParis and YCloset offer monthly clothing rental subscription services.

[caption id="attachment_98083" align="aligncenter" width="700"]

Source: Alibaba/Coresight Research[/caption]

Another type of membership is the subscription-only model, where customers must pay a recurring fee to access a company’s products. Examples include Blue Apron, a service that delivers meal kits to customers every week, and Birchbox, a curated monthly beauty subscription box. In China, MSParis and YCloset offer monthly clothing rental subscription services.

[caption id="attachment_98083" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Key Insights

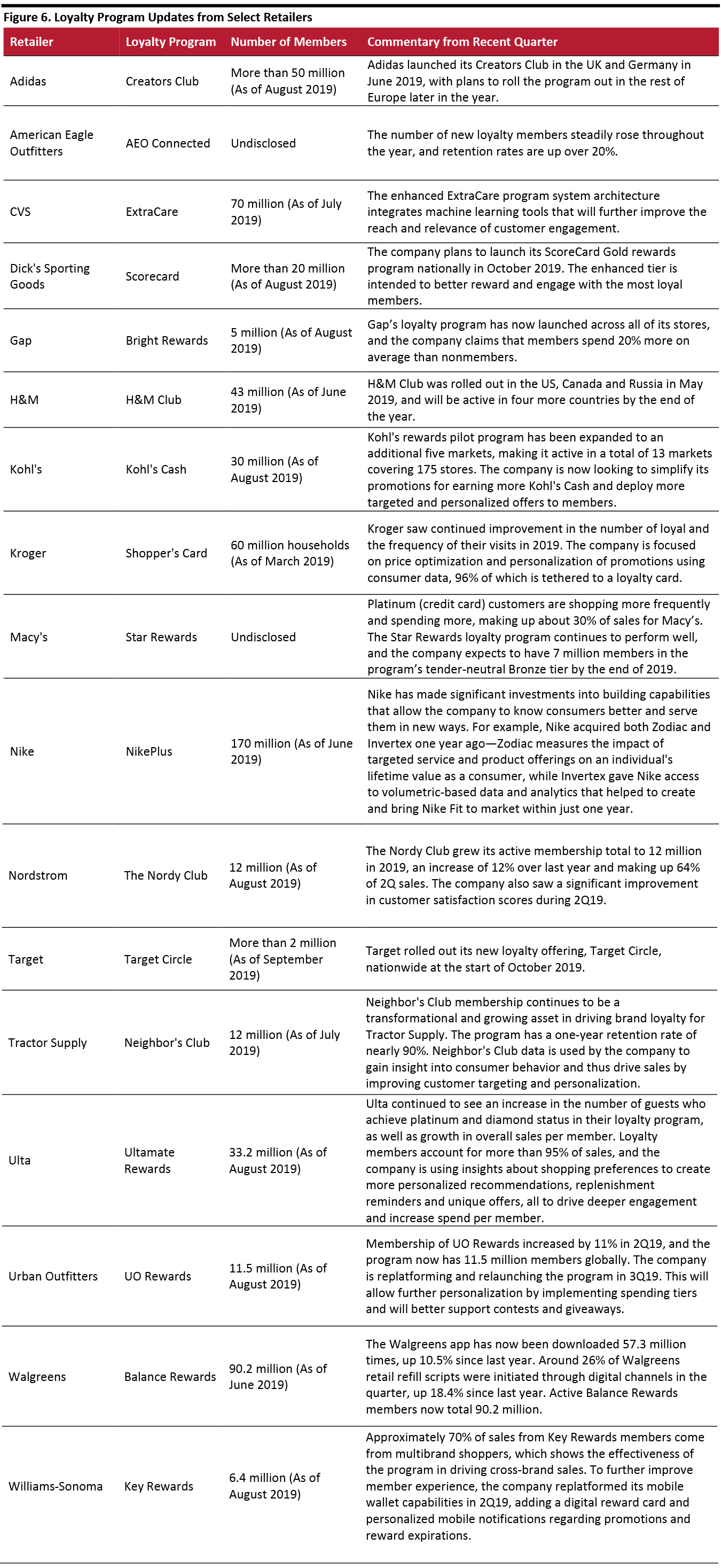

The retail industry has been changing in recent years as companies look to differentiate themselves from increasing competition and promote customer loyalty. Loyalty programs will continue to evolve to enable retailers to better serve their targeted customer base and deliver higher business value. A well-designed loyalty program provides value for retailers through access to consumer data, which helps companies to better engage, and create a deeper connection, with customers. Shoppers will therefore be more willing to make return visits and promote the brand to others, resulting in higher customer retention and growth for the retailer.Appendix

[caption id="attachment_98084" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]