albert Chan

In 2017, Amazon bought upscale grocery chain Whole Foods Market for $13.7 billion, in a deal that transformed the company from the pioneer of online shopping into a merchant with physical outposts in hundreds of locations across the country.

Since then, Amazon has been increasing its physical footprint in the grocery sector. As of October 2019, the company’s US physical stores include 500 Whole Foods Markets, 16 Amazon Go convenience stores, 18 Amazon Books stores and four 4-star outlets.

In 2018, Amazon’s sales from all its physical store formats totaled $17.2 billion. By comparison, Walmart’s US grocery sales amounted to $184 billion in the same year.

At Whole Foods, changes have been made to align it with Amazon: Prime members are now being offered increased benefits, such as discounts to members and cashback to those who purchase with an Amazon-branded Visa card.

This report details Amazon’s ongoing activities in the brick-and-mortar grocery sector.

Amazon Is Leveraging Whole Foods Market To Learn about the Physical Grocery Business

Amazon moved quickly to implement changes at Whole Foods. On August 28, 2017, the first day after its acquisition of Whole Foods, Amazon cut Whole Foods prices on a selection of best-selling grocery staples, including Whole Trade organic bananas, responsibly farmed salmon, organic large brown eggs and animal-welfare-rated 85% lean ground beef.

By November that year, over 100 Whole Foods locations also carried Amazon devices—such as Echo and Echo Dot devices, Fire TV, Fire tablets and Kindle e-readers. In addition, a number of Amazon pop-up stores were launched at select Whole Foods locations for the purpose of testing physical retail. (Amazon announced in March 2019 that it will close all 87 of its pop-up stores in the US, including those nestled inside Whole Foods.)

[caption id="attachment_98057" align="aligncenter" width="700"] Whole Foods started to sell Amazon products right after it was acquired by the e-commerce giant.

Whole Foods started to sell Amazon products right after it was acquired by the e-commerce giant.Source: Amazon[/caption]

Amazon Takes Actions To Further Expand Its Online Grocery Service

Amazon has used Whole Foods to connect physical and online grocery.

Selected Whole Foods stores now offer Prime members a curbside pickup service for online orders made through Prime Now, with collection available within as little as 30 minutes. Prime members in supported regions can add Whole Foods groceries to their Prime Now digital shopping cart with simple voice commands, such as “Alexa, add broccoli to my Whole Foods cart.” The Amazon Alexa device will pick the best available match for the customer’s request, taking into consideration their order history as well as the purchasing behavior of other customers.

Amazon bolsters its online order pickup program for general merchandise by providing lockers at Whole Foods stores. These self-service kiosks provide a place where customers can pick up packages and drop them off for return.

Amazon also enables online ordering at dozens of Whole Foods stores for home delivery in two hours via Prime Now. Customers in selected cities are able to see a Whole Foods storefront on Amazon’s website. The storefront offers visitors discounts to entice them to try fast delivery of perishables and shows them previous purchases they made in store.

[caption id="attachment_98058" align="aligncenter" width="700"] Amazon takes actions to further expand its online grocery offerings.

Amazon takes actions to further expand its online grocery offerings.Source: Company website[/caption]

Meanwhile, by offering benefits to Prime members who shop at Whole Foods, Amazon is encouraging brand loyalty. On Prime Day 2019 (July 15 & 16), Prime members received a $10 credit to use during online Prime Day sales after spending $10 at Whole Foods.

Amazon’s Two-Pronged Approach to Brick-and-Mortar Grocery Retailing

Amazon is taking a two-pronged approach to brick-and-mortar grocery retailing, with the rollout of Amazon Go stores complementing its acquisition of Whole Foods. We think these ventures represent an acknowledgment by Amazon that it cannot capture major share in grocery with a pure-play online model. While online grocery shopper numbers are increasing rapidly, Coresight Research estimates that 97.4% of US food and beverage retail sales will be offline this year, with e-commerce capturing just 2.6%. Amazon needs stores to win in grocery.

Since the Whole Foods acquisition, Amazon has brought its cashierless checkout technology to the public, opening its first Amazon Go store on January 22, 2018—although Amazon Go was in trial mode before the Whole Foods acquisition. The “just-walk-out” technology is intended to provide a streamlined shopping experience while providing data to Amazon regarding the consumer journey in physical retail—with insights into consideration sets, adjacencies and price triggers, to name a few. This data-rich environment can capture valuable consumer information that is not accessible to most grocery stores.

Amazon Go and Whole Foods complement AmazonFresh, Prime Now, Prime Pantry, Subscribe & Save and the regular Amazon.com website to form Amazon’s grocery ecosystem.

Amazon Reportedly Planning To Launch a New Retail Grocery Business

Amazon’s two brick-and-mortar prongs could soon become three: The company is planning to open a new grocery-store business, according to an unconfirmed March 2019 report by the Wall Street Journal. Amazon has reportedly already signed several leases in the Los Angeles area—starting with locations in Irvine, Studio City and Woodland Hills—which could open by the end of 2019. The company was in talks regarding locations in San Francisco, Seattle, Chicago, Philadelphia and Washington, DC, the Wall Street Journal reported.

Any such chain would be the first to be fully developed by Amazon after its purchase of Whole Foods. That acquisition, together with the data from Amazon Go stores, has enabled Amazon to gain a knowledge foundation about physical grocery retail. We expect those learnings to inform any future grocery-store formats.

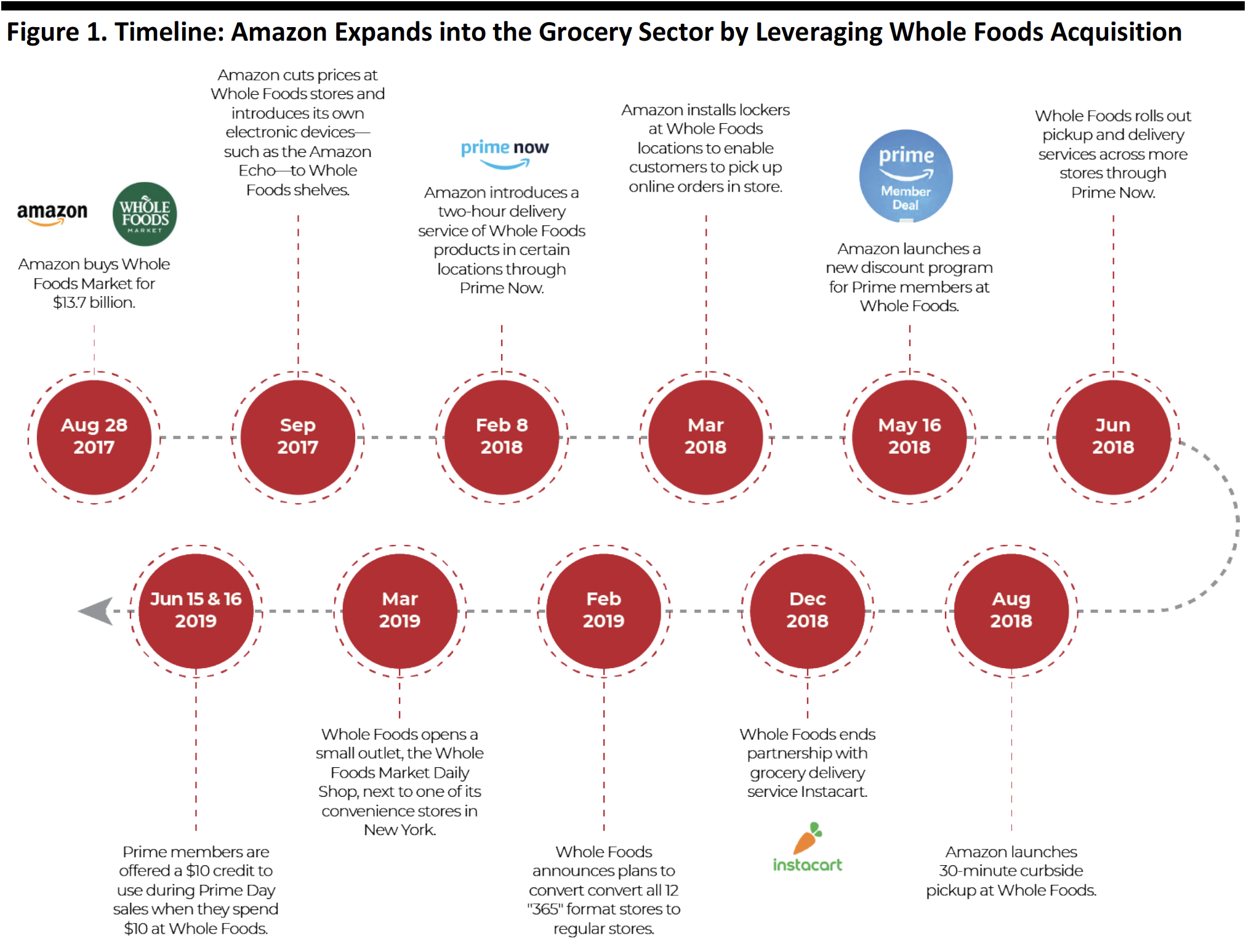

Amazon-Whole Foods Timeline

Below is a timeline of Amazon’s expansion into the grocery sector since it acquired Whole Foods Market.

[caption id="attachment_98064" align="aligncenter" width="700"] Source: Company Reports/Coresight Research[/caption]

Source: Company Reports/Coresight Research[/caption]