Nitheesh NH

Introduction

Dollar stores have remained resilient amid a tough climate for brick-and-mortar retail. While many retailers are closing stores, the major dollar stores are defying the trend by continuing to expand. Dollar stores’ focus on lower-income consumers and significantly lower prices have shielded them from e-commerce disruption—until recently. Faced with growing digital pressure, dollar stores are upping their digital game. Dollar stores are also betting on grocery and private-label brands to drive sales and improve profitability. In this report, we examine how dollar stores are gearing up to sustain their meteoric growth. We focus on the two largest dollar store chains: Dollar General and Dollar Tree (which includes Family Dollar).Why Do Dollar Stores Continue to Flourish Amid a Challenging Retail Climate?

Dollar stores became increasingly popular during the Global Financial Crisis in 2008–09 as US consumers were forced to cut spending. But the penchant for thrifting stuck even after the economy recovered, and dollar stores have continued to perform well. Dollar stores have also developed expertise in identifying areas underserved by retail, especially rural areas with low population densities and lower-income urban and suburban areas. The relative absence of competition has boosted dollar stores in those areas. Dollar stores say people earning around $40,000 a year or below are their primary target market, but they also attract a significant number of more affluent customers. According to a 2018 NPD report, 32% of dollar store customers earn more than $100,000 a year. Dollar stores have moved from being a bargain destination to a positioning that is more about value and variety, and are finding increasing resonance among consumers across all income brackets. These factors are further supported by relatively simple store layouts that make it easier to find products, smaller formats that make visiting one faster and their sheer numbers which give them exceptional reach. While the factors above have helped dollar stores thrive, they continue to evolve and modify their strategies to secure continued growth. We discuss these new strategies below.Dollar Stores Are Betting on Grocery for Growth

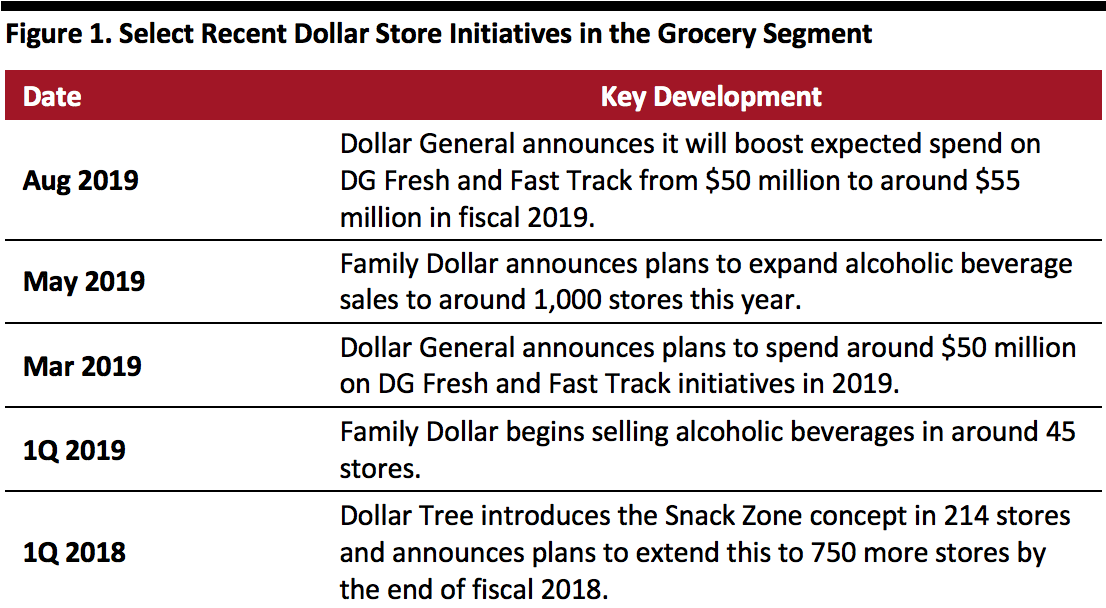

The three major dollar store banners are all exploring ways to expand their grocery portfolios. Although average grocery margins are slimmer than general merchandise, the dollar stores are betting on moving large volumes in this category from higher traffic and greater sales densities, driven by expanded grocery selections. According to our estimates, grocery (including food and consumables) accounted for 77% of Dollar General’s and 48.7% of Dollar Tree’s total net sales in the latest fiscal year, ended February 2019. In 2018, Dollar General installed more than 20,000 additional coolers in its US store network to offer more frozen and refrigerated food. In 2018, Dollar General also launched its “Better for You” initiative, focused on promoting and raising awareness on the availability of healthy food products, seeking to position itself as a one-stop grocery destination. The company launched the initiative in more than 2,500 stores in 2018 and announced plans to extend it to around 6,000 by the end of 2019. By the end of 2019, Dollar General expects to install 40,000 additional coolers across its store portfolio, while also increasing the number of outlets offering fresh produce from around 450 to approximately 650. Dollar General followed the “Better for You” initiative with “DG Fresh” in 2019, through which the company independently distributes a wide range of frozen and refrigerated products such as dairy, deli and frozen goods, which as a product group accounts for around 8% of total sales. The company also launched “Fast Track,” an initiative to improve productivity and customer convenience and said it would spend around $50 million in fiscal 2019 to roll it out—and then only a few months later raised that figure to $55 million. The DG Fresh initiative had been launched in around 4,900 stores as of the end of October 2019, and the company expects to expand it to 5,500 locations by year end. Dollar Tree has also launched its own initiatives to expand its grocery portfolio. In 2018 the company introduced the “Snack Zone” concept to drive incremental sales through immediate-consumption snack foods. The company launched it in 260 Dollar Tree stores in its first quarter of fiscal year 2018, ended May 5, 2018, extended it to around 930 stores by the end of fiscal 2018 and installed freezers or coolers in more than 5,600 stores. Dollar Tree continued the roll out into 2019, and as of the end of third quarter of fiscal 2019, ended November 2, 2019, it had reached around 2,087 stores and the number of stores with freezers or coolers crossed 6,000. Family Dollar also started selling alcoholic beverages in around 45 stores in its first quarter, ended May 4, 2019, and announced plans to expand to around 1,000 stores this year. The company also announced plans to expand freezer and cooler space in 400 outlets. [caption id="attachment_100926" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Dollar Stores Continue to Expand and Optimize Store Footprints

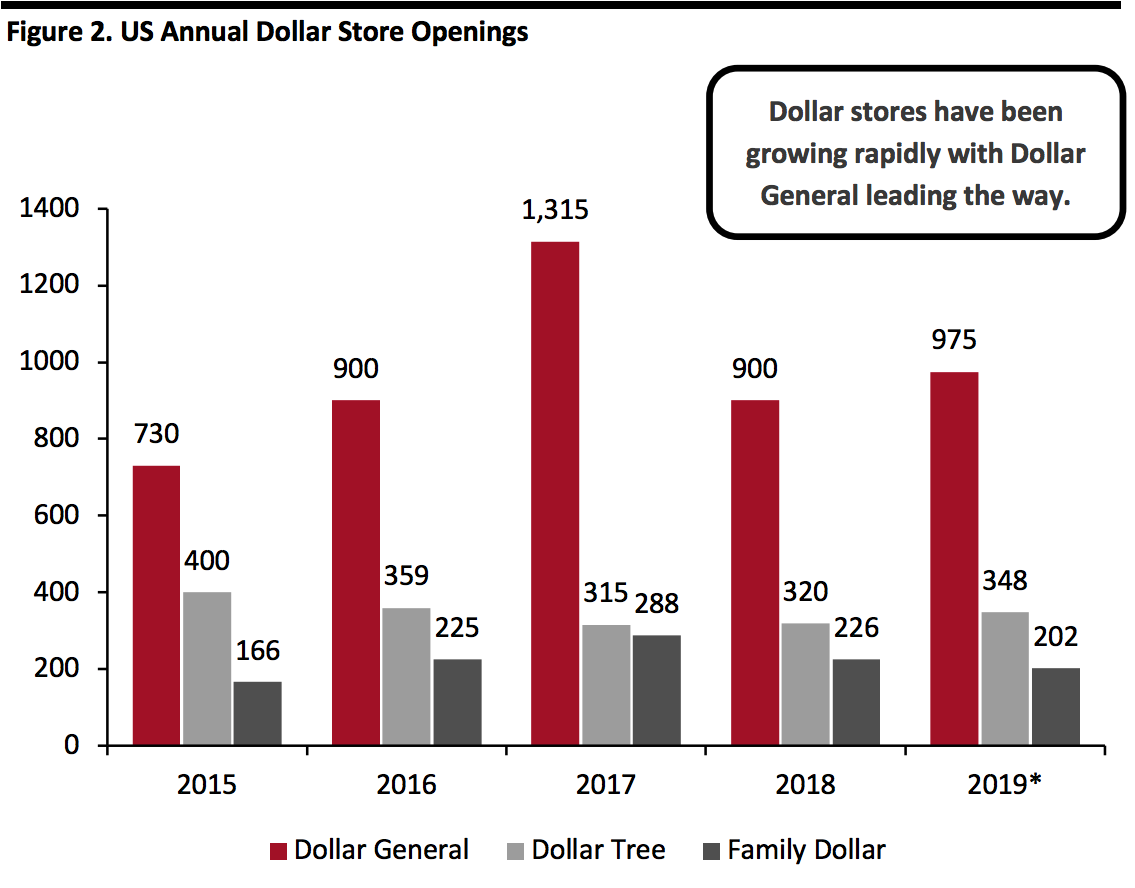

Expanding store networks continues to be a key growth strategy for the dollar store giants. Dollar General announced plans to open around 975 stores this year, while Dollar Tree and Family Dollar expect to open around 348 and 202 stores respectively. Dollar General also announced plans to remodel 1,000 mature stores and relocate 100. While Dollar General continues to focus primarily on rural areas, Dollar Tree and Family Dollar focus on urban and suburban areas. Dollar General’s store expansion plans include launching new smaller-format DGX stores. DGX stores are about half the size of the average 7,300 square foot Dollar General store and primarily target urban millennial shoppers. Dollar General opened its first DGX store in Nashville in January 2017, plans to open a total of 10 DGX locations in fiscal 2019 and around 20 more in 2020. The company opened its fourth DGX location in downtown Cleveland in June 2019. [caption id="attachment_100927" align="aligncenter" width="700"] *Number of store openings represented for 2019 are the announced numbers for the year

*Number of store openings represented for 2019 are the announced numbers for the yearSource: Company reports[/caption] The outlier in this equation is Family Dollar: Dollar Tree acquired Family Dollar in 2015, but the acquired company has been struggling and proven a drag on its parent company, prompting Dollar Tree to rationalize the Family Dollar footprint and announce plans to close around 359 this year, significantly more than the number of new stores it plans to open. The company has also launched a renovation initiative for the struggling Family Dollar banner to convert many of them to a new model internally called “H2.” In its third quarter earnings call, Dollar Tree confirmed that around 1,150 Family Dollar H2 renovations have already been completed this year and that these new formats are driving top-line sales and transaction count. Dollar Tree is also re-bannering many Family Dollar stores into Dollar Tree stores: 190 stores as of November 2, 2019, with plans to complete 10 more by year end.

Private Labels Remain a Key Strategic Focus

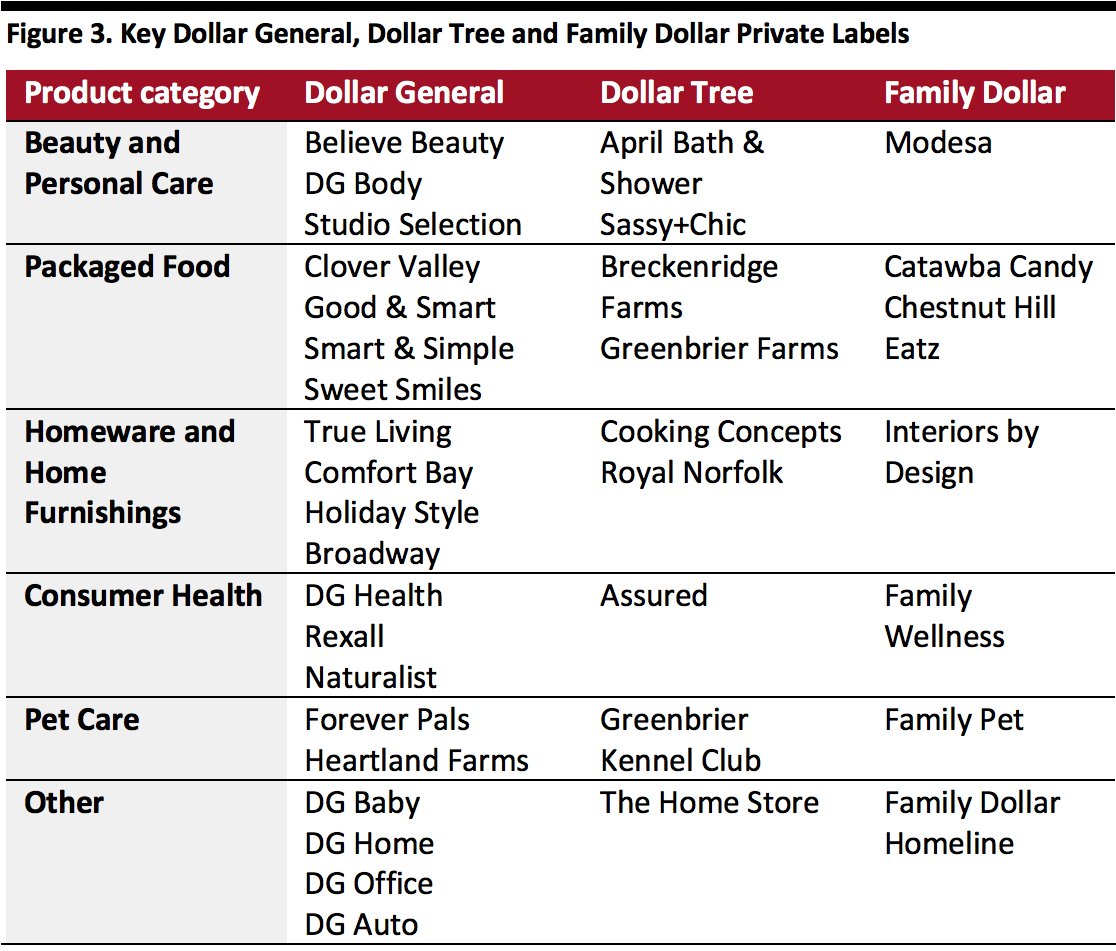

All three leading dollar stores offer a range of private labels across various product categories, and these private labels now account for 20-30% of total sales, according to Euromonitor International. And, the dollar stores continue to expand their private-label portfolios. Dollar General now offers over 40 unique private-label product lines and has announced plans to continue introducing new ones as it expands to new locations. In March 2019 it introduced a new private-label beauty brand called Believe Beauty. The brand offers an exclusive makeup collection, with each product priced at $5 or less. The company is actively promoting the new brand and has enlisted popular beauty vloggers to promote the brand. Dollar Tree offers a wide range of home essentials at the $1 price point, with a focus on private-label products. [caption id="attachment_100928" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Dollar Stores Are Enhancing Digital Capabilities

Dollar stores have been investing in e-commerce capabilities. According to Dollar General, around 45% of its customers use digital retail tools, and said its digitally engaged shoppers spend twice the average in-store checkout receipt of around $12. Dollar General launched its e-commerce operations relatively late, in 2011, and has invested primarily in its mobile app, and recently added digital push notifications. Dollar General fulfills online orders in three separate price brackets: standard shipping (3–8 days), 2–3-day shipping and 1–2-day shipping. The company also announced plans to introduce a buy online pick up in store (BOPIS) service called DG Pickup in the second half of 2019, which could attract more millennials and younger customers. In the company’s recent third-quarter earnings call, the company confirmed it is on track to launch the service during its fourth quarter, ending January 31, 2020. The company will test the new service through the mobile app, but has not said how many stores will participate. The company did clarify it will roll out the service slowly to ensure it resonates with customers. Our view is that while this may not be a game changer for the company given the smaller average basket sizes involved, it would enhance the convenience factor and would help it keep up with similar services offered by competitors such as Walmart. Last year, Dollar General introduced a separate mobile app called DG GO!, which lets customers use their phones to scan while shopping and check out directly via the app, skipping the checkout lines by paying at DG GO! in-store kiosks instead. The app also helps customers track final cost as they add items to the basket through its “cart calculator” feature. In its third quarter earnings call in December 2019, the company said DG GO! checkout is now available in more than 700 stores, and the company plans to make it available in around 750 stores by the end of its fiscal year on January 31, 2020. After gaining the insight that customers use the cart calculator frequently as a budgeting tool even when not using DG GO! to check out, the company announced in its third quarter earnings call on December 5 that the feature has now been made available in around 15,000 stores. [caption id="attachment_100929" align="aligncenter" width="700"] Source: Dollar General[/caption]

Dollar Tree beat Dollar General with an online offering in 2009, and now offers BOPIS. The company also offers delivery for online orders, usually within 4–5 business days, but can deliver in 2–3 business days for a higher shipping charge.

Family Dollar, however, lags when it comes to e-commerce: The company operates a website, but it does not support online orders, delivery or pick-up, nor does the company offer a mobile app.

Source: Dollar General[/caption]

Dollar Tree beat Dollar General with an online offering in 2009, and now offers BOPIS. The company also offers delivery for online orders, usually within 4–5 business days, but can deliver in 2–3 business days for a higher shipping charge.

Family Dollar, however, lags when it comes to e-commerce: The company operates a website, but it does not support online orders, delivery or pick-up, nor does the company offer a mobile app.