Catherine Rolfe

Introduction

Retailers face a complex business environment in which strong in-store execution is key to delivering a consistent, high-quality shopping experience and avoiding sales loss, all of which require exceptional store operations management. “Store operations” include stock and inventory management and visual merchandising. Seeking to optimize store management and enhance the in-store experience, many retailers are exploring advanced technology solutions such as computer vision, which, applied to inventory optimization, uses complex image processing algorithms that turn digital images of the shelf—taken via a smartphone or auto-captured by fixed cameras or robots—into meaningful information and analytics around factors including out of stocks and planogram compliance. This report—sponsored by computer vision and retail-technology company Trax—dives into the findings of an October 2019 Coresight Research survey of 200 global grocery retail decision-makers in the US, UK, Germany and Australia, who were asked about their companies’ in-store operations strategies, challenges and future plans. Among the points of discussion, the study shows the impact of poor in-store execution on retailers’ profitability, the challenges retailers face with store operations and how adopting advanced in-store execution tracking technology is helping retailers deliver a higher quality, more consistent customer experience.Poor In-Store Execution Costs Sales

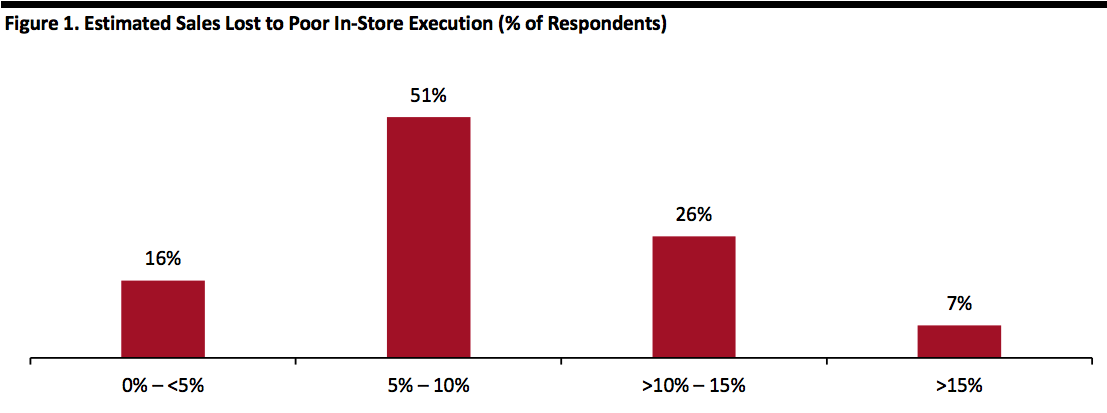

In today’s complex retail environment, poor in-store execution can easily lead to issues such as infrequent stock replenishment; misplaced stock-keeping units (SKUs); and, non-compliance with planograms, prices and promotions, all of which cost sales. We asked retail executives what proportion of their sales are lost to poor in-store execution, and found that:- More than half (51%) of grocery retailers asked said they lose 5–10% of sales to store operations issues.

- More than a quarter (26%) lose 10–15% of sales to poor in-store execution.

Survey question summary: What percentage of your company’s sales are lost every year due to in-store execution issues?

Survey question summary: What percentage of your company’s sales are lost every year due to in-store execution issues?Source: Coresight Research[/caption]

Ensuring Consistency in Store Execution is a Key Challenge for Retailers

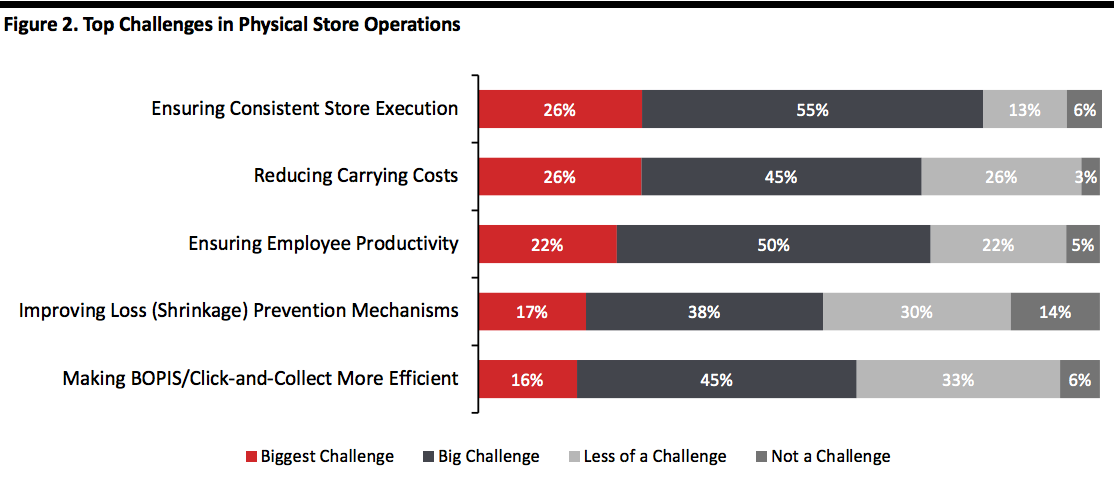

More efficient store operations can help retailers deliver a better shopping experience and better control cost. However, retailers face a number of challenges in optimizing operations. In fact, 81% of respondents cited delivering consistent in-store execution as a key challenge. Another top concern was cost pressure, cited by over 70% of respondents. [caption id="attachment_101359" align="aligncenter" width="700"] Survey question summary: What are the main challenges relating to physical store operations you are facing today?

Survey question summary: What are the main challenges relating to physical store operations you are facing today?Source: Coresight Research[/caption] Today’s retailers need to maximize efficiency in operations to stay competitive as margins continue to be squeezed, competition increases from numerous channels and operations become more complex with the introduction of omnichannel shopping. When asked about the top challenges their businesses face today, some 58% of respondents said consumer price sensitivity was a top concern, while 57% cited both competition from online channels and pressure to reduce operational costs.

Store Operations Are a Strategic Tool to Deliver a Better Shopping Experience

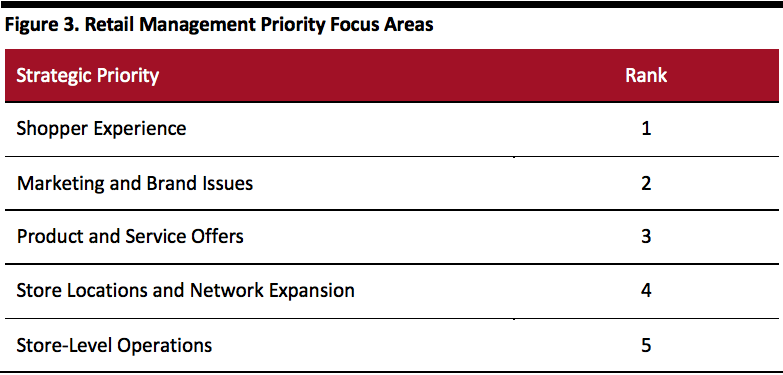

Retailers need to pay greater attention to store operational efficiency to deliver a better shopper experience and greater consistency in product and service offerings. Indeed, when asked to rank the areas getting the most attention from senior management, the in-store experience was ranked number one. However, our survey also uncovered a disconnect between what senior management sees as being most important and where they focus their strategic effort: Most retailers do not consider store operations a strategic priority. Our survey found management teams tend to look at factors such as shopper experience (28% of respondents) and service quality (21%) as key strategic priorities, but overlook store-level operation efficiency: Just 13% of respondents named store-level operational efficiency as a priority. [caption id="attachment_101360" align="aligncenter" width="550"] Survey question summary: Respondents were asked to rank in order of importance retailing areas according to the attention received from their management team, with rank 1 as the most important area. Source: Coresight Research[/caption]

Even though store-level operations may not get the attention they deserve, management does recognize their importance: Some 57% of respondents said in-store execution and the quality of the customer experience are the factors senior managers focus on to understand store performance.

[caption id="attachment_101361" align="aligncenter" width="550"]

Survey question summary: Respondents were asked to rank in order of importance retailing areas according to the attention received from their management team, with rank 1 as the most important area. Source: Coresight Research[/caption]

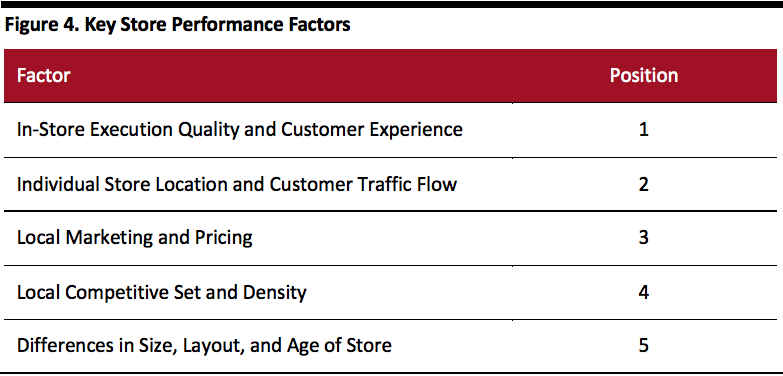

Even though store-level operations may not get the attention they deserve, management does recognize their importance: Some 57% of respondents said in-store execution and the quality of the customer experience are the factors senior managers focus on to understand store performance.

[caption id="attachment_101361" align="aligncenter" width="550"] Survey question summary: Which of these factors do senior managers in your company focus on to understand performance differences across stores? Position rates the number of times the option was selected by respondents, with position 1 being the factor selected most often.

Survey question summary: Which of these factors do senior managers in your company focus on to understand performance differences across stores? Position rates the number of times the option was selected by respondents, with position 1 being the factor selected most often.Source: Coresight Research[/caption] In-store execution issues, such as infrequent stock replenishment; misplaced SKUs; and, non-compliance with planograms and prices and promotions could affect retail performance.

Advanced Store Monitoring Tools Give Access to Better Insight

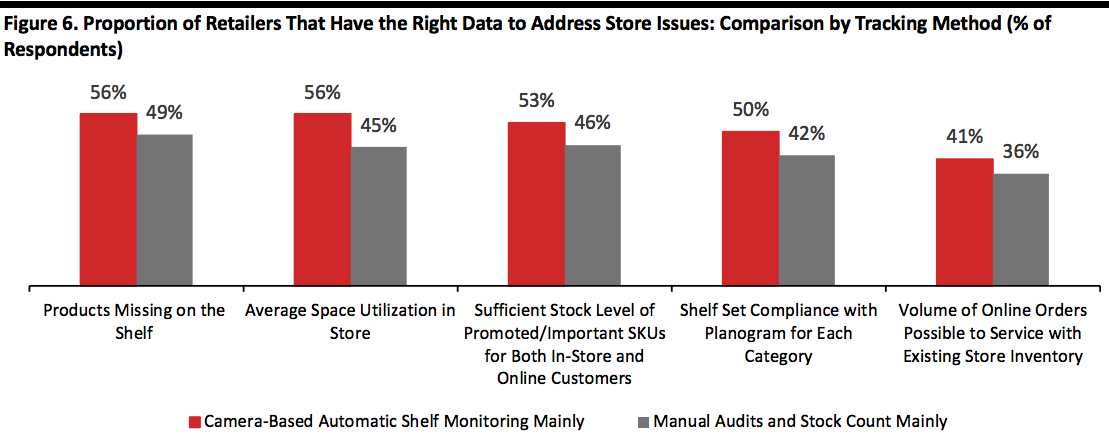

Given the importance of in-store execution in delivering a consistent, high-quality shopping experience, retailers need the right tools to monitor store operations. However, our survey found that some 75% of respondents still rely on manual audits and stock count as their primary store execution tracking method—tools woefully insufficient to meet the needs of today’s complex retail operations. And, only 17% of respondents use advanced tools—such as artificial intelligence (AI) and computer vision—as a primary method to monitor shelves. Encouragingly, some 52% of respondents said advanced tools were their secondary method for store execution tracking, in conjunction with more traditional methods such as a manual audit. These retailers are open to adopting AI, computer vision and image recognition and are exploring applications to track store operations. [caption id="attachment_101362" align="aligncenter" width="700"]Source: Coresight Research[/caption] Our survey shows that, when asked about the availability of the right data to address specific store operations issues, retailers that use camera-based automatic shelf monitoring tracking methods have greater availability of key data to address operational issues than those who rely on manual tools. [caption id="attachment_101363" align="aligncenter" width="700"]

Survey question summary: At any given time, do you have the right data to answer the following questions? Please rate the availability of data for each option from “1. Always” to “4. Never.” The chart breaks down the percentage of respondents who selected “always” by store execution tracking method, as defined by the survey question, what methods does your organization employ to keep track of store execution issues, such as low stock, items missing on shelf, misplaced items, non-compliance of planograms, prices and promotion? described in Figure 5.

Survey question summary: At any given time, do you have the right data to answer the following questions? Please rate the availability of data for each option from “1. Always” to “4. Never.” The chart breaks down the percentage of respondents who selected “always” by store execution tracking method, as defined by the survey question, what methods does your organization employ to keep track of store execution issues, such as low stock, items missing on shelf, misplaced items, non-compliance of planograms, prices and promotion? described in Figure 5.Source: Coresight Research[/caption] Retailers understand the importance of having effective tools to manage key aspects of in-store operations. Most respondents (95% and 87% respectively) said in-store fulfillment solutions and real-time monitoring of store conditions are very important or important to manage in-store operational issues.

Gradual Adoption Could Be the Most Effective Approach

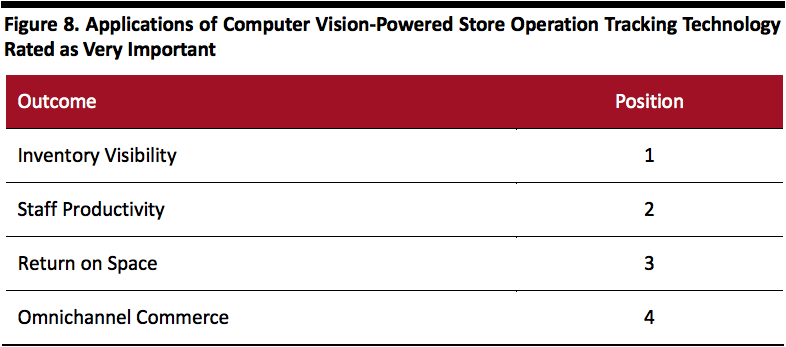

Considering the better access to key store operations insight computer vision tracking tools offer, most retailers surveyed plan to adopt the technology to improve in-store operation management capabilities. Some 52% of respondents said they plan to adopt image-recognition tracking technology in the next two years, while 13% said they already use image recognition technology. [caption id="attachment_101364" align="aligncenter" width="700"]Source: Coresight Research[/caption] Our survey found retailers plan to use advanced store tracking technology to improve visibility of store operations. Some 58% of respondents said improving inventory visibility, including preventing stockouts and reducing sales loss due to misplaced items, would be a key application of AI-powered in-store tracking technology. [caption id="attachment_101365" align="aligncenter" width="550"]

Survey question summary: With access to store monitoring solutions (AI technology that automates store data collection and provides better intelligence on store conditions), which one of the following outcomes would you prioritize? Respondents could rate each option in order of importance. Position represents the number of times the option was rated as very important by respondents, with position 1 being the factor rated very important most often.

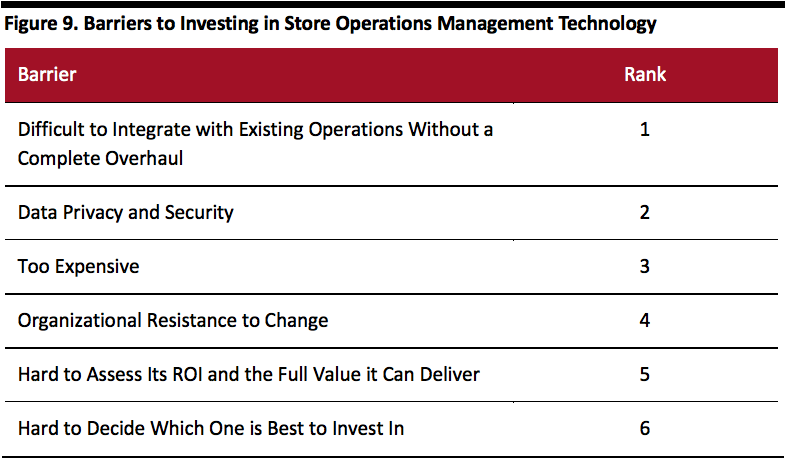

Survey question summary: With access to store monitoring solutions (AI technology that automates store data collection and provides better intelligence on store conditions), which one of the following outcomes would you prioritize? Respondents could rate each option in order of importance. Position represents the number of times the option was rated as very important by respondents, with position 1 being the factor rated very important most often.Source: Coresight Research[/caption] While retailers recognize the importance of in-store execution technology, they face challenges with adoption. In particular, our survey identified difficulty integrating new technology with existing operations, data privacy and security concerns and the cost of investing in more advanced tools as key challenges. [caption id="attachment_101366" align="aligncenter" width="550"]

Survey question summary: Typically, what are the main barriers for investing in technology for improving retail operations at your organization? Respondents could rank each option by order of importance, with 1 being the biggest barrier.

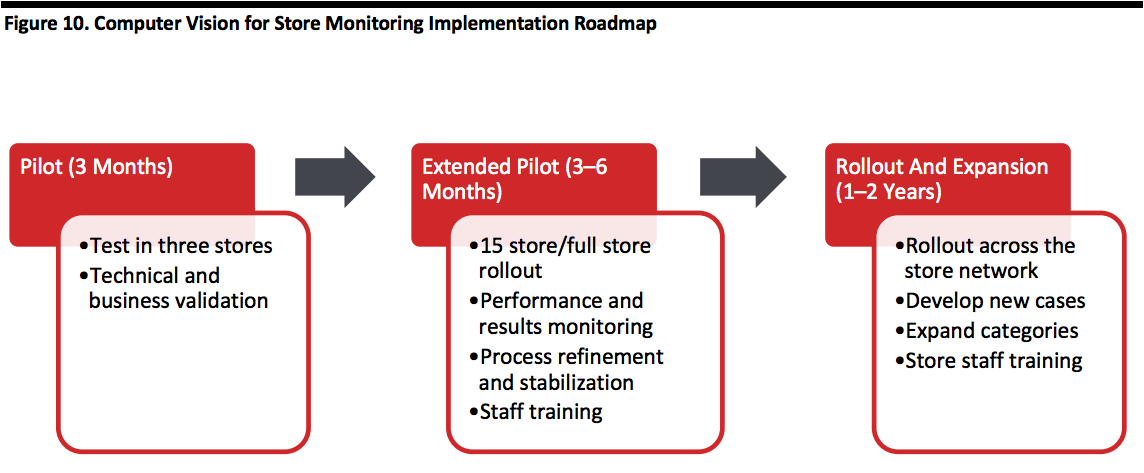

Survey question summary: Typically, what are the main barriers for investing in technology for improving retail operations at your organization? Respondents could rank each option by order of importance, with 1 being the biggest barrier.Source: Coresight Research[/caption] To overcome barriers, embrace advanced store monitoring systems and improve in-store execution, retailers could implement a gradual approach, planning for stages during which new tools will work in tandem with current systems before full implementation. Indeed, figure 5 above shows 52% of respondents are taking this gradual approach to implementation with the adoption of advanced tools as a secondary tracking method. A gradual approach makes it easier to integrate new systems into existing operations; reduces the cost of implementation; allows time to set up systems to handle data privacy and security; and, minimizes the impact of the change on the organization, which in turn can ease internal resistance.

Five-Step Guide to Store Digitization Through Computer Vision

We asked retail-technology company Trax to outline a five-step guide for retailers to integrate computer vision into store operations tracking:- Identify key problems to solve and decide target KPIs: Identify which teams to involve and what are the problems the technology will solve for each team. Pick meaningful KPIs, such as product availability, price accuracy, promotion identification and location mapping.

- Understand how to evaluate computer vision solutions and providers: Evaluate platforms based on factors such as ease of integration into existing operations, cost and the experience of the technology provider in working with retailers to successfully implement the solution.

- Select the best automation method to collect data: Evaluate the best way to track dynamic store conditions from options such as mounting shelf-edge cameras, dome cameras or autonomous robots to browse the aisles.

- Establish clear data adoption and management guidelines: Establish a data management plan to maximize the use of the SKU-level datapoints the technology collects.

- Pilot, deploy and prove the return on investment: Start gradually by piloting in selected stores, then scale up to full implementation. We outline an example of this approach in figure 10 below.

Source: Trax[/caption]

When evaluating the impact of technology implementation, retailers should compare adoption cost with the cost of failing to address in-store execution issues.

Harnessing continual SKU-level data at shelf over time will reveal hidden insights which can improve operations management—and profitability.

One large supermarket operator Trax worked with found that out-of-stock issues persisted for 31 hours before corrective action was taken. When the company implemented an advanced tracking platform to continually monitor shelves using computer vision, it reduced the out-of-stock duration to under nine hours and increased on-shelf availability nearly 14%, according to Trax.

Source: Trax[/caption]

When evaluating the impact of technology implementation, retailers should compare adoption cost with the cost of failing to address in-store execution issues.

Harnessing continual SKU-level data at shelf over time will reveal hidden insights which can improve operations management—and profitability.

One large supermarket operator Trax worked with found that out-of-stock issues persisted for 31 hours before corrective action was taken. When the company implemented an advanced tracking platform to continually monitor shelves using computer vision, it reduced the out-of-stock duration to under nine hours and increased on-shelf availability nearly 14%, according to Trax.

Key Insights

Solid in-store execution is key to delivering a consistent, high-quality shopping experience. However, our survey found there is a mismatch between what retailers judge important to drive sales and what their strategies focus on, which shows most retailers do not consider store operations a strategic priority to achieve better customer engagement. Retailers that have adopted advanced in-store execution tracking systems—such as camera-based automatic shelf monitoring technology—are better positioned to effectively monitor in-store conditions and to provide a more seamless and engaging shopping experience. Retailers recognize its importance: Some 52% said they plan to adopt such a system in the next two years, but around a quarter said they are waiting to see how the technology develops. As more retailers adopt the technology, we believe retailers will gain greater insight into the value computer vision-based store tracking technology brings to store operations.Methodology

- This study is based on the analysis of data from an online survey of 200 decision-makers in retail. The survey selected respondents selected based on the following criteria:

- Employed in grocery retail (B2C), with offline sales representing more than 50% of total sales.

- Based in the US, UK, Germany and Australia, with 50 respondents per country.

- Employed in companies with an annual turnover equal to or exceeding $10 million in the most recent fiscal year.

- Holding senior positions (owners, C-suite, VP-EVP, directors, senior managers).

- Responsible for in-store operations, category management, customer experience, IT and innovation, strategy, sales, marketing, insight and analysis, logistics and supply chain.

- Holding roles with significant strategic decision-making responsibilities.