albert Chan

What’s the Story?

The pace of change in today’s retail environment, accelerated by the adverse effects of the Covid-19 pandemic, is making some roles redundant and some indispensable. The changing structure of global supply chains and the impact of the ongoing pandemic on fast-changing consumer habits are transforming category management. Many factors have led to a holistic change in how retailers can improve merchandising tactics within their category management process, including a surge in online orders, an evolving competitive landscape and a higher penetration of private-label goods.

Today’s category managers need access to advanced technologies such as artificial intelligence (AI) and machine learning (ML). Additionally, retailers must ensure that they fully understand the key category management challenges within their organization and work toward a solution.

In this report, we analyze the findings of a December 2020 Coresight Research survey of global grocery/drug retailers and consumer packaged goods (CPG) suppliers in France, Germany, the UK and the US—which we compare against select findings from a separate March 2020 survey of a similar respondent base. These surveys had 110 respondents and 104 respondents, respectively, and asked the same set of questions.

We explore the key benefits of effective category management, challenges in execution, the impacts of Covid-19 on collaboration—both internal and external—and retailers’ readiness to automate key category management processes.

This report is sponsored by Precima, a NielsenIQ company. Precima helps retailers improve their competitive position across all facets of planning and operations—from supplier collaboration to pricing optimization, promotional planning, assortment optimization and personalized marketing.

Why It Matters

Category decisions based on inaccurate information can negatively impact the expected outcome. Recent and rapid developments in the grocery sector—ranging from a surge in e-commerce to the widespread adoption of innovative fulfillment methods—have led to a fundamental change in the grocery sector.

Traditionally, in the US, shopping online has been much less common for groceries than for many nonfood categories, but the ongoing pandemic has led to a dramatic acceleration in online grocery growth. We expect the digital channel to see permanent gains as consumers retain their changed shopping behavior post pandemic. In fact, 36.4% of US online grocery shoppers expect to continue online grocery shopping once the crisis eases or ends, according to Coresight Research’s US Consumer Tracker.

Thriving in grocery e-commerce is relatively complicated versus other retail sectors. Many factors contribute to cut-throat price competition—such as limited product shelf life and delivery speed—and as a result, squeeze margins. Improving category management processes may seem one of the obvious solutions but is not necessarily straightforward.

In order to succeed in the role, retail category managers must anticipate future trends—some of which may have repercussions not just for the product category but for the store as a whole, causing ripple effects through the supply chain. In Figure 1, we present two key stages of an eight-step category management process: category strategy and category tactics. Analyzing our survey findings, we discuss some of the key facets of both category strategy and category tactics and underline the best path for achieving success in category management in the coming years.

Figure 1. Retail Category Management: Category Strategy and Category Tactics

[caption id="attachment_124445" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Retail Category Management: Key Insights and the Path Forward

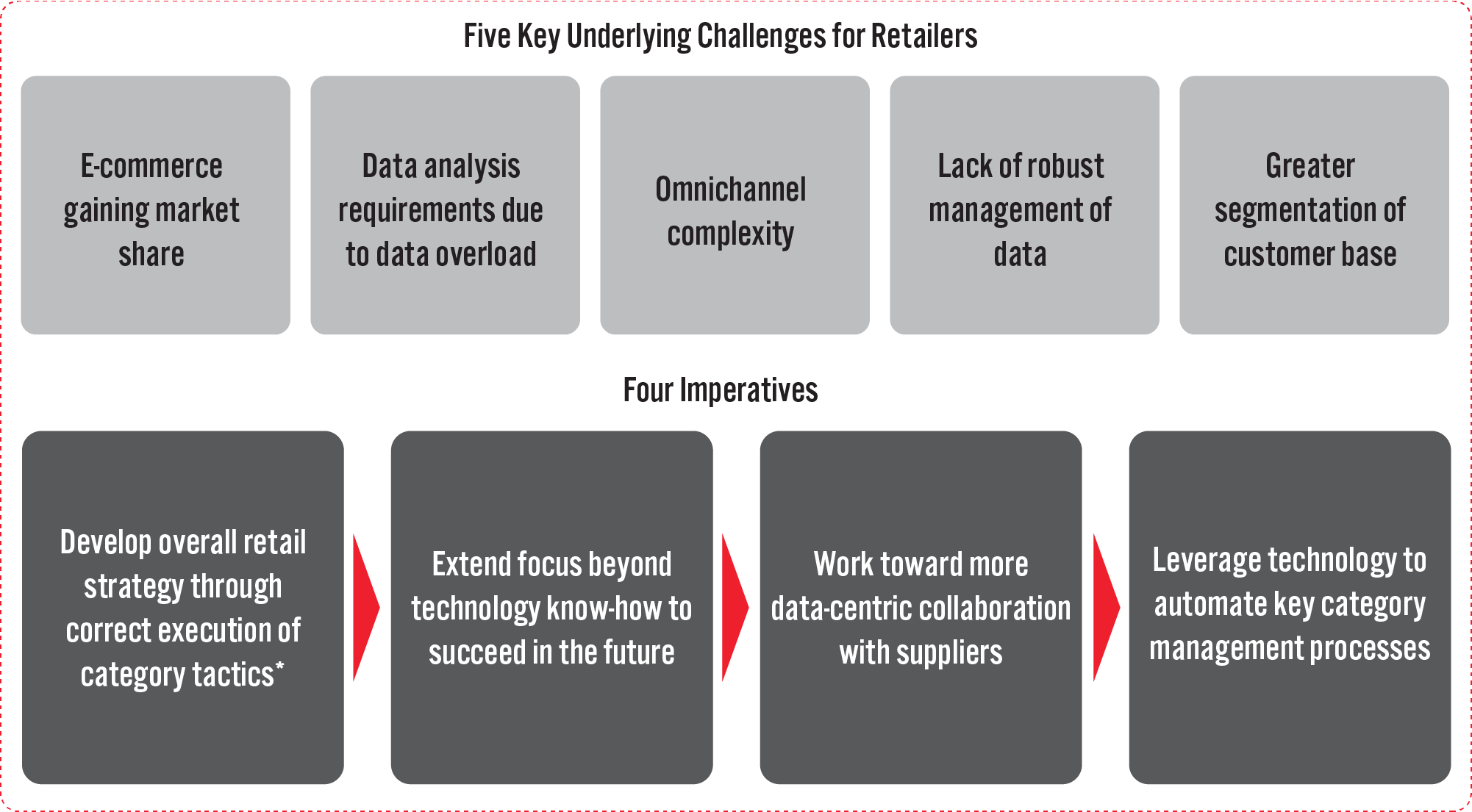

Our survey findings reveal existing challenges in category management that can be detrimental in preparing an overall retail strategy and achieving more data-centric collaboration with suppliers. However, our findings reveal a clear direction for retail category managers to overcome these challenges. We summarize these challenges and imperatives in Figure 2 and discuss each in detail in later sections of this report.

Figure 2. Retail Category Management: Key Challenges and Imperatives

[caption id="attachment_124446" align="aligncenter" width="700"] *Developing overall retail strategy encompasses retail category management responsibilities such as increasing footfall in physical stores, achieving a higher basket size and increasing sales and profitability.

*Developing overall retail strategy encompasses retail category management responsibilities such as increasing footfall in physical stores, achieving a higher basket size and increasing sales and profitability.Source: Coresight Research[/caption]

We believe there are several key opportunities for retailers to enhance category management effectiveness:

- Effectively leveraging advanced technologies can support data analysis. The top three challenges for retailers identified in our survey—e-commerce gaining market share, data analysis requirements due to data overload, and omnichannel complexity—are largely rooted in retailers’ inability to interpret and unify customer data across different channels. We believe that leveraging advanced technologies such as AI and ML can help retailers to better interpret data.

- Actionable insights are non-negotiable. Retailers can improve their execution efforts only if the insights obtained from analyzing large data sets are actionable. The unification of data supports both retailers and manufacturers in effectively carrying out their long-term plans by providing more accurate insights. Our survey findings support this, with almost six in 10 respondents citing a lack of robust data management as a category management challenge. We believe that access to actionable insights can help retail category managers offer a more personalized experience to shoppers (through targeted promotions), improve planning efficiency and recognize market shifts, among other benefits.

- Transparency in collaboration with suppliers can address concerns around data. There are many underlying factors that can make data interpretation and analysis highly cumbersome, including high volumes of data and real-time variations. By adopting a joint approach, both retailers and suppliers increase their likelihood of correctly interpreting consumer and market trends and achieving their goals. In the grocery sector, things can change quickly—products can go out of favor but still be produced based on previous trends. Such instances can lead to pressure on margins and sustainability. We believe that transparent collaboration eases the stress on supply chain operations.

Top Category Management Challenges: Rising Online Market Share and Data Analysis Requirements

One of the most widespread impacts of Covid-19 on the retail sector has been the acceleration of e-commerce growth. For 2020 overall, we estimate that US e-commerce sales reached $752 billion—having grown 35% from 2019—and accounted for 19% of total retail sales. In 2020, online grocery sales in the US reached $55 billion, according to research company Brick Meets Click (BMC). According to BMC, US online grocery sales reached $9.3 billion in January 2021, up 15% from November 2020—the previous research period.

The rising share of e-commerce has many implications for retailers, such as increasing omnichannel complexity and difficulties in managing product availability and fast-growing volumes of customer data. Access to real-time actionable data can help category managers make strategic decisions around which products to carry and offer a more personalized experience to their shoppers.

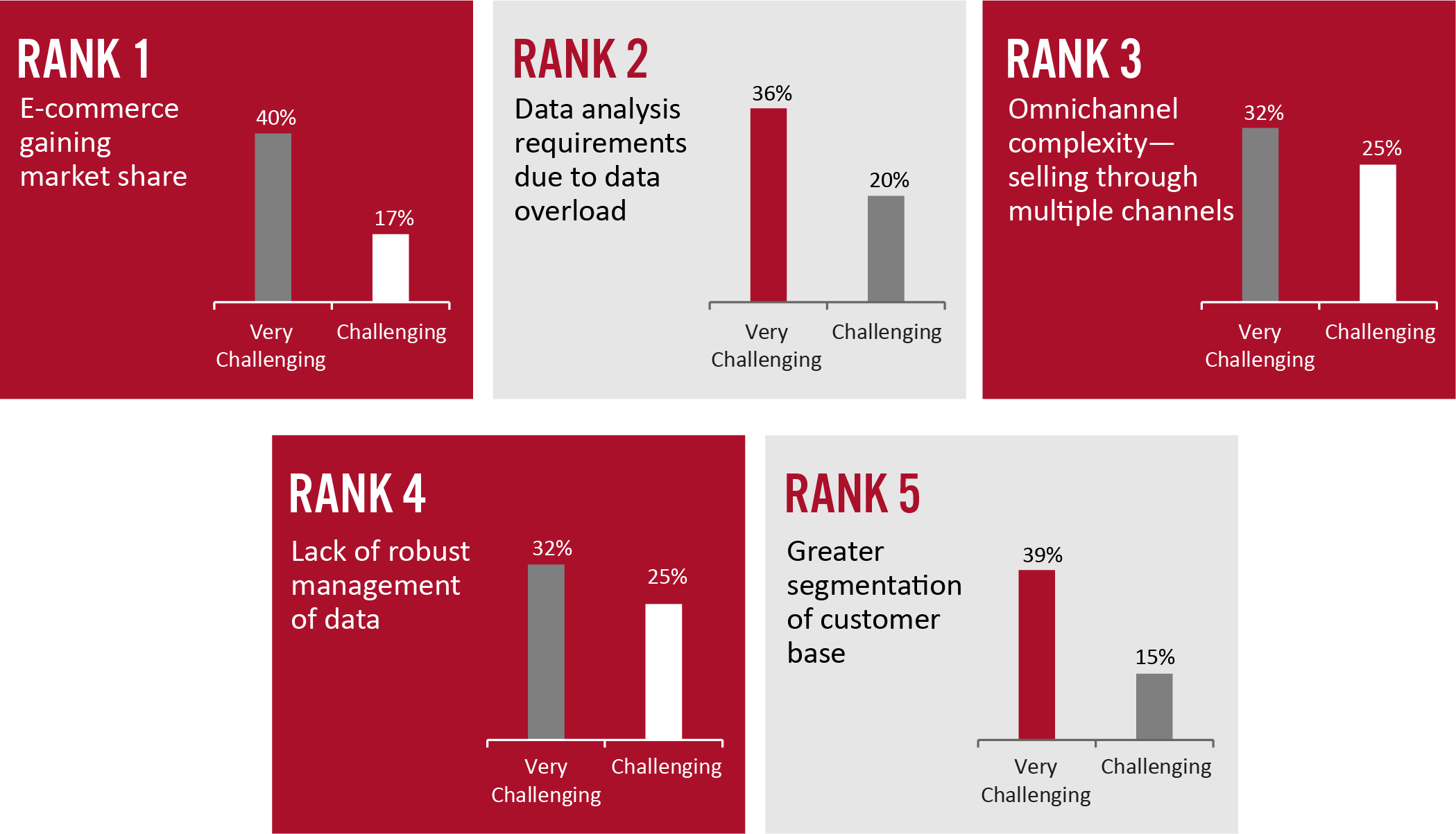

Based on our survey findings, the increasing penetration of e-commerce is the topmost challenge facing retail category managers, with 40% of respondents reporting it as “very challenging” and 17% reporting it as “challenging”. This is followed by data analysis requirements due to data overload. These two challenges are highly correlated: Due to a surge in online orders, most retailers are experiencing a large inflow of customer data through digital channels. The third most challenging factor influencing retail category management. We show the survey results highlighting the top five challenges in Figure 3.

Figure 3. Top Challenges Retail Category Managers Face (% of Respondents Who Cited Criteria as “Very Challenging” or “Challenging”)

[caption id="attachment_124447" align="aligncenter" width="700"] The ranking of responses is based on the weighted average of proportion of respondents who selected criteria as “Challenging” or “Very Challenging” where “Very Challenging” carries higher weight. To separate Rank 3 and 4, we based our decision on respondents who were “neutral” towards the challenge.

The ranking of responses is based on the weighted average of proportion of respondents who selected criteria as “Challenging” or “Very Challenging” where “Very Challenging” carries higher weight. To separate Rank 3 and 4, we based our decision on respondents who were “neutral” towards the challenge.Base: 110 grocery/drug retailers and CPG suppliers surveyed in December 2020

Source: Coresight Research[/caption]

Take More Charge: Setting Up for Success in Category Management

In order to thrive in the post-pandemic environment, customer-centricity must be at the core of retail category management. This is because shifts in consumer behavior present difficulties in aligning demand and supply; some pandemic-driven behaviors will likely revert as the environment changes, while some will stick in the long term. For example, the number of items sold at one food wholesaler decreased by 18.5% between March and December 2020. We believe this reduction serves as a proxy for narrowing customer preference—buying specific brands/products—when purchasing grocery, which makes carrying the right product mix even more difficult for retail category managers.

We asked respondents about the key skills for succeeding in the role of retail category management and found the following:

- Developing an overall retail strategy emerged as the topmost skill for succeeding in retail category management, with nine in 10 respondents citing it as “important” or “very important.” Category managers can build a robust retail strategy covering pricing, merchandising and promotional activities through end-to-end operational planning that leverages technology.

- Product availability management emerged as the second most important skill, with 88% of respondents citing this skill as at least “important.”

- Customer literacy, which also includes localization and personalization, is the third most important skill for retail category managers, who must understand shopper behavior. Monitoring and analyzing the wide array of shopper paths can help retailers better understand their shoppers and lay a strong customer-centric foundation. It is important to understand that not all stores can succeed at selling the same assortment. Localization can help retailers fulfill customer demand at the store level and improve overall efficiency in the movement of products across the supply chain.

Figure 4. Top Skills for Succeeding in Retail Category Management (% of Respondents)

[caption id="attachment_124448" align="aligncenter" width="550"] Base: 110 grocery/drug retailers and CPG suppliers surveyed in December 2020

Base: 110 grocery/drug retailers and CPG suppliers surveyed in December 2020Source: Coresight Research[/caption]

Skills for Succeeding in the Future

Covid-19 has impacted how retailers perceive the role of category management, not just today, but also in the future.

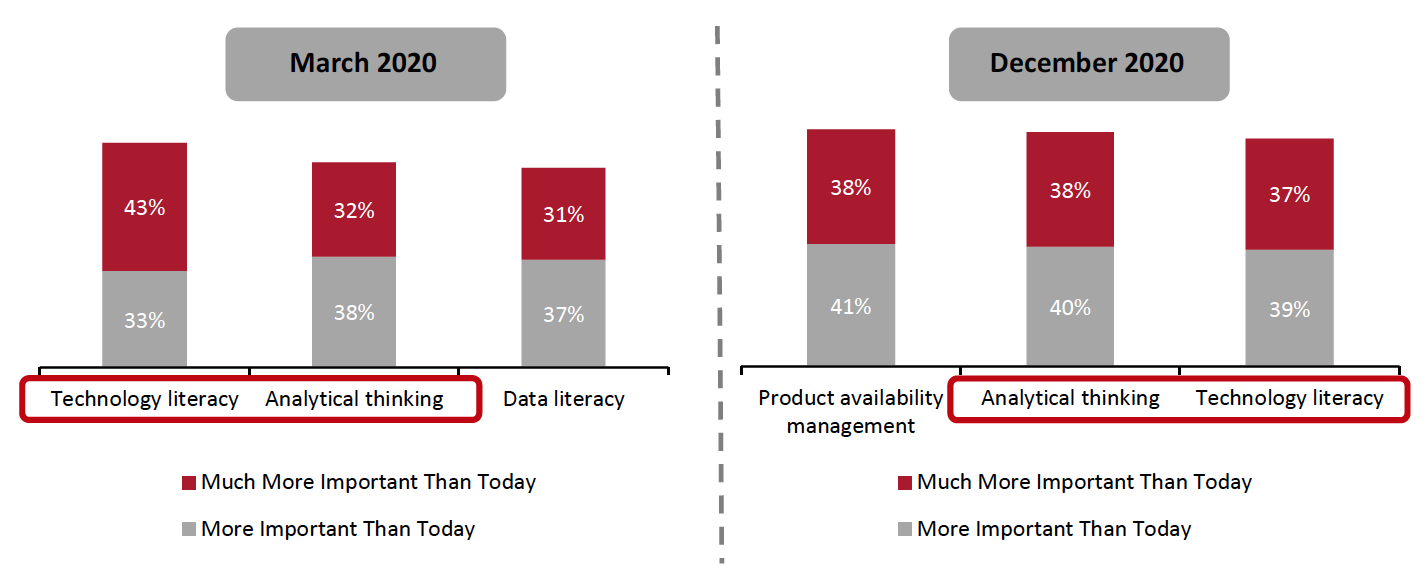

Our survey findings from March 2020 revealed that among the skills required for achieving success in category management, technology know-how was expected to increase the most in importance over the next five years versus today. However, when we asked respondents the same question in December 2020, product availability management topped the list: Almost eight in 10 respondents believe that it will be “more important than today” or “much more important than today.”

Even so, the key focus has not shifted from technology know-how, which consistently emerged as an important skill set for succeeding in category management over the next few years. Category managers must have the ability to leverage the increasing volume of data and information to derive implementable category tactics. One Precima customer said, “Particularly for traditional brick-and-mortar retailers, it is risky to continue to operate a traditional gut- and experience-based approach of category management. For our category manager teams, analytical skills are already crucial and will be even more so in the next two to three years.”

In our December 2020 survey, analytical thinking retained the second spot, with 78% of respondents citing it as more/much more important than today over the next five years—an increase of 8.0 percentage points from the March 2020 survey. In addition, technology literacy again featured in the top three skills that are expected to increase the most in importance over the next five years (see Figure 5).

Figure 5. Top Skills for Succeeding in Retail Category Management: Expected Change in Importance Over Next Five Years, March 2020 Findings Versus December 2020 Findings (% of Respondents)

[caption id="attachment_124449" align="aligncenter" width="700"] Base: 110 grocery/drug retailers and CPG suppliers surveyed in December 2020 and 104 grocery/drug retailers and CPG suppliers surveyed in March 2020

Base: 110 grocery/drug retailers and CPG suppliers surveyed in December 2020 and 104 grocery/drug retailers and CPG suppliers surveyed in March 2020Source: Coresight Research[/caption]

Best Practices in Category Management: Moving to a More Data-Centric Approach

Collaboration between retailers and suppliers provides increased access to data and helps both parties paint a forward-looking picture of customer demand—thus improving decision-making. Access to supplier data can help retailers to better understand consumer trends and verify their own findings. However, one of the many challenges is drawing actionable insights from large amounts of external data and incorporating these with analysis of already available data.

Leveraging an AI-enabled analytical platform can help retailers deploy data in the most effective manner and improve their understanding of the customer base.

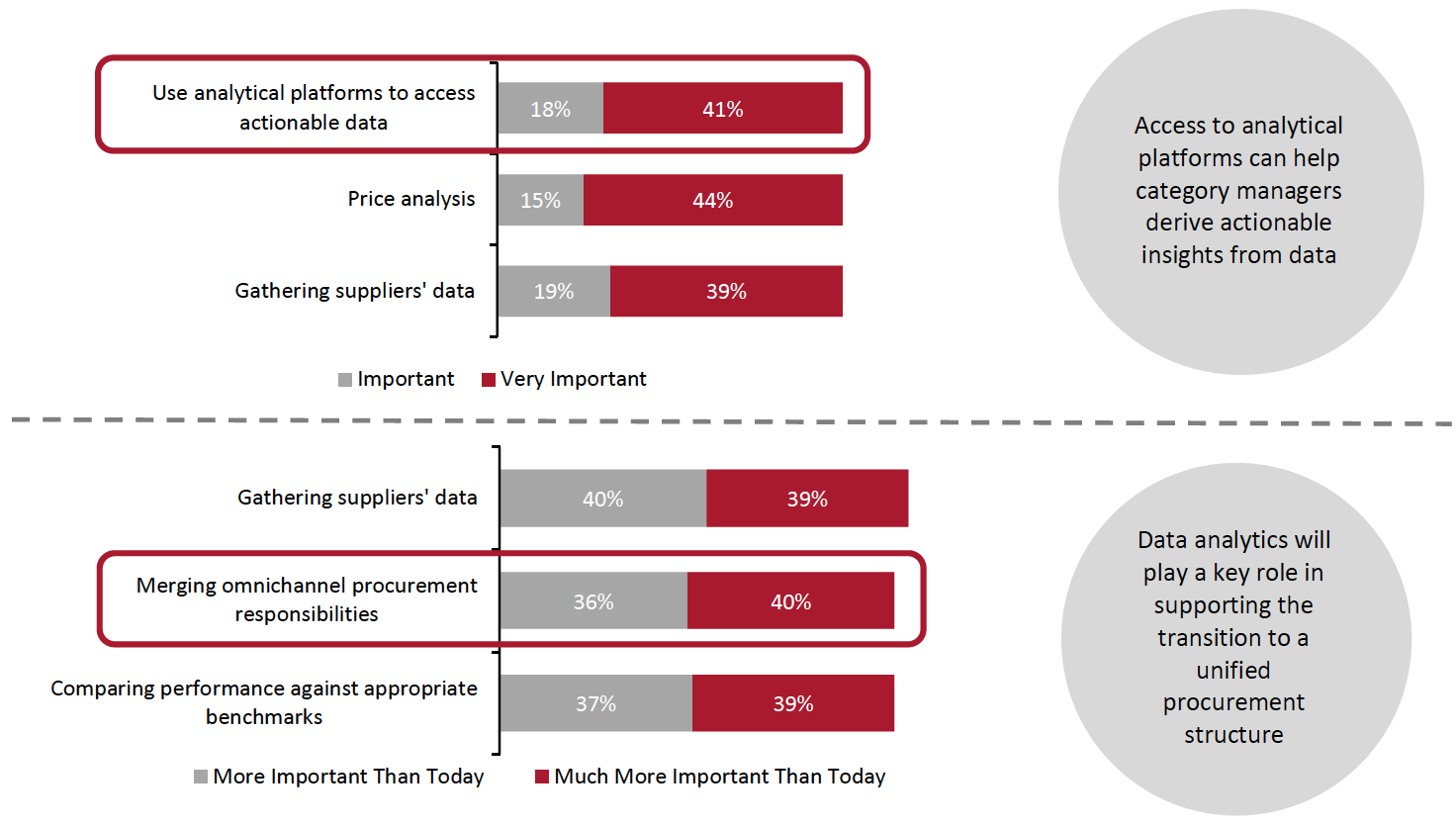

Below, we present key best practices in retail category management, based on our survey findings:

- Using an analytical platform to access actionable data was cited as the topmost best practice today, with 59% of respondents citing it as “important or “very important.” As discussed earlier in this report, data analysis requirements pose a great challenge to retail category managers, and using an analytical platform can help retailers process large amounts of data.

- Almost six in 10 respondents cited gathering suppliers’ data as an “important” or “very important” best practice. We believe that providing a common platform for retailers’ data can support integrated business planning and can help both retailers and suppliers work toward the mutual goal of customer-centricity.

- The majority of the respondents (79%) expect gathering suppliers’ data to become more important as a category management best practice over the next five years than it is today.

In a separate question, we asked retail respondents about their existing purchasing structure under category management and found that a majority (63%) have separate procurement teams for e-commerce and brick-and-mortar retail. In addition, most respondents (76%) believe that migrating to a unified procurement structure will increase in importance over the next five years. In this context, we expect data analytics to play an important role in supporting the transition from a separate procurement structure to a unified one.

Figure 6. Best Practices in Retail Category Management: Level of Importance Today (Top) and Expected Change in Importance over the Next Five Years (Bottom) (% of Respondents)

[caption id="attachment_124450" align="aligncenter" width="700"] Base: 110 grocery/drug retailers and CPG suppliers surveyed in December 2020

Base: 110 grocery/drug retailers and CPG suppliers surveyed in December 2020Source: Coresight Research[/caption]

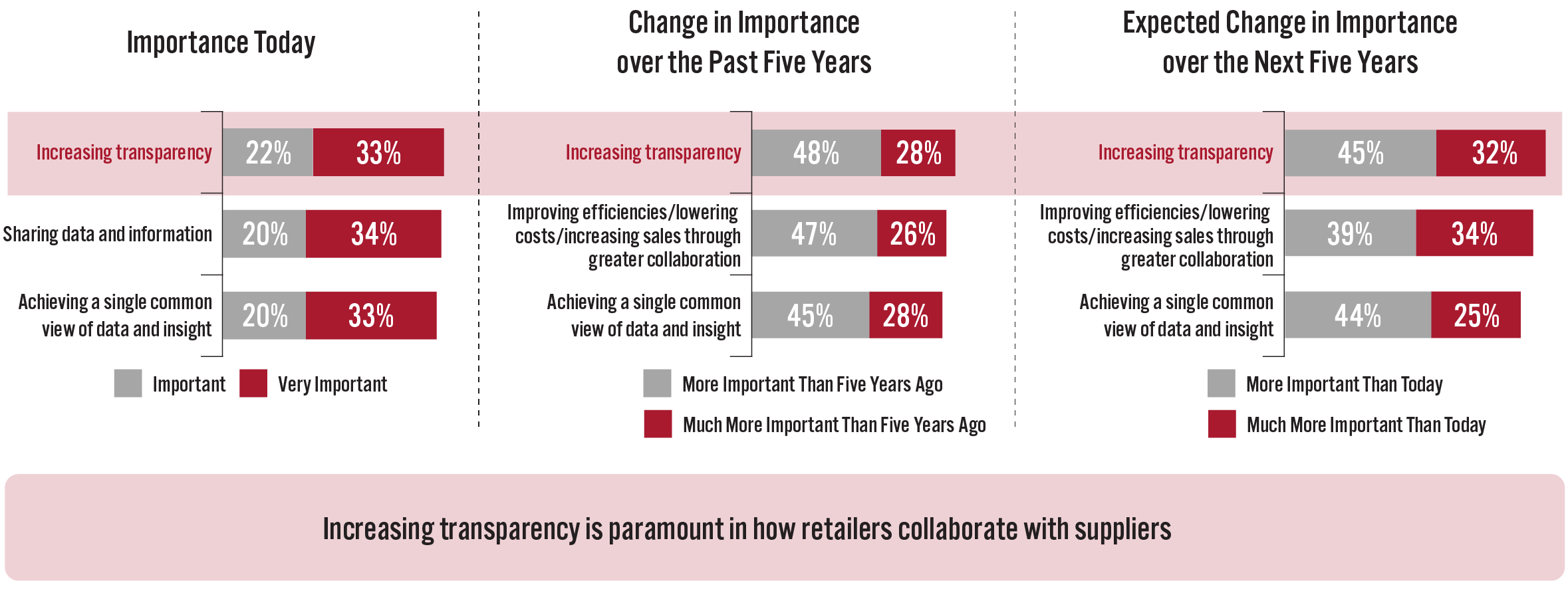

Transparency Is Paramount in Retailer-Supplier Collaboration

High omnichannel demand across grocery retail has put added pressure on the supply chain, which has exposed inefficiencies in manufacturing for suppliers and carrying the right products for retailers.

The pathway to succeeding as category managers begins with increasing the level of transparency and trust between retailers and suppliers.

- We found increased transparency to be essential for successful collaboration, with over five in 10 respondents citing it as “important” or “very important.”

- Some 76% of respondents cited transparency as “more important/much more important today than five years ago.”

- Interestingly, 77% of the respondents believe that transparency will be a more important collaboration criteria over the next five years versus today.

For example, one Precima customer said, “For the first time, we and a trusted supplier used the same data to review performance and formulate future joint plans; the data from our loyalty cards through Precima ensured our customers were at the heart of our decision-making process.”

Our survey findings reveal that improving overall operations through better collaboration has gained prominence over the past five years—47% of respondents believe it is “more important today than five years ago,” while 26% of respondents believe it is “much more important today than five years ago.” We believe that Covid-19 has exposed the fault lines through the grocery supply chain and shown that even fully automated models such as Ocado’s are not necessarily crisis-proof. We expect collaboration between retailers and suppliers to deepen alongside greater penetration of technology and collaboration platforms in the near term.

Figure 7. Engagement Criteria for Better Collaboration Between Retailers and Suppliers: Importance Today, Change in Importance over the Past Five Years and Expected Change in Importance over the Next Five Years (% of Respondents)

[caption id="attachment_124452" align="aligncenter" width="700"] Base: 110 grocery/drug retailers and CPG suppliers surveyed in December 2020

Base: 110 grocery/drug retailers and CPG suppliers surveyed in December 2020 Source: Coresight Research[/caption]

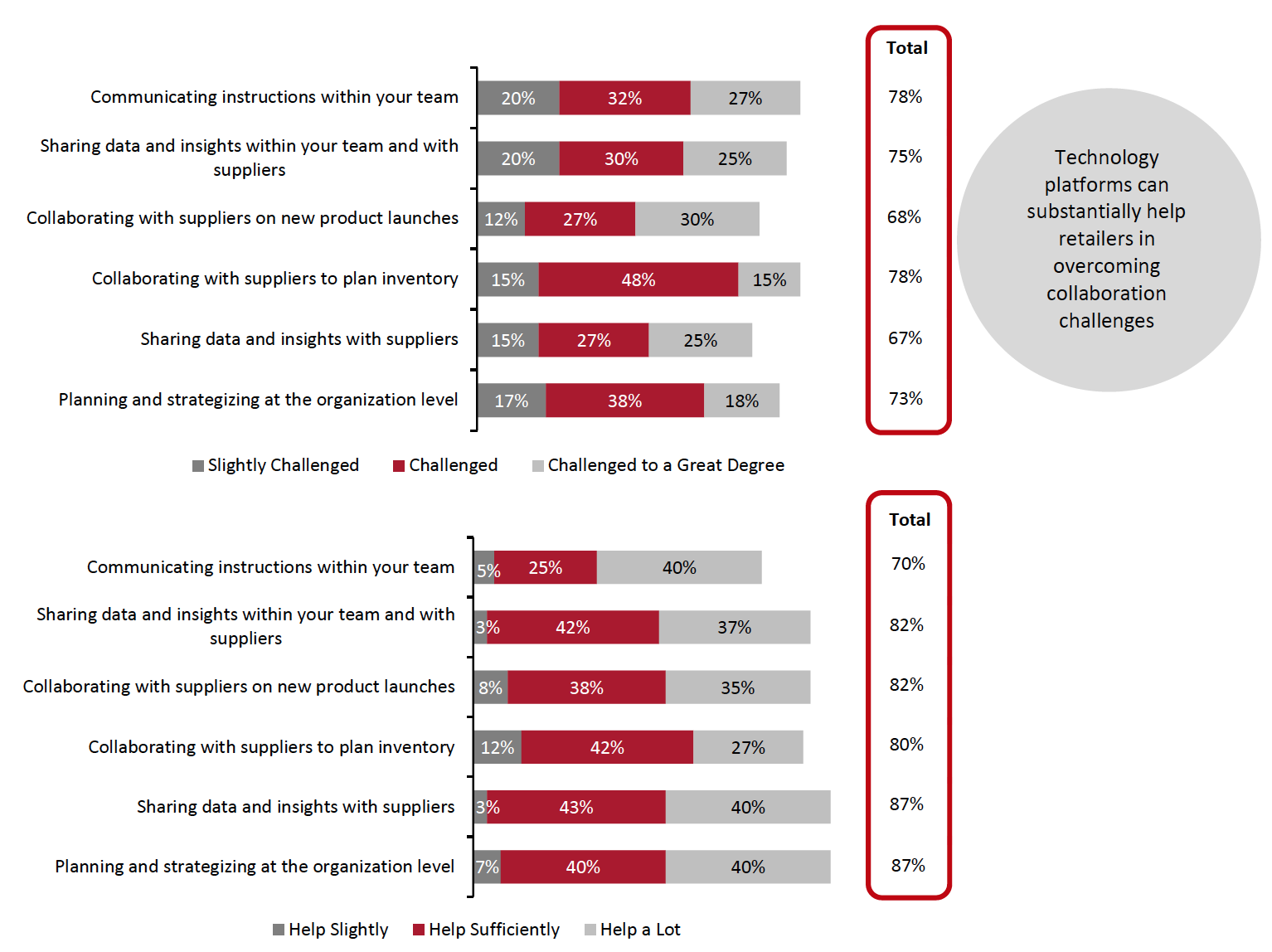

Covid-19 Greatly Challenged Collaboration but Technology Fuels Optimism

During the initial months of the Covid-19 pandemic, the grocery sector was among the most challenged sectors as consumers stockpiled essential commodities. We asked the retailers in our survey about the impact of the outbreak on collaboration and found that an overwhelming majority of retailers were challenged to some extent in collaborating within their organization as well as with their external suppliers:

- Almost eight in 10 retailers cited that they were challenged to some extent in communicating instructions within their team. Seven in 10 retailers suggested that a collaboration platform can be helpful in overcoming such challenges.

- Some 30% of retailers were “challenged to a great degree” in collaborating with suppliers on new product launches, and a further 39% of retailers reported being either “challenged” or “slightly challenged.” Eight in 10 retailers cited that collaboration platforms can help in overcoming this type of challenge.

We observe the same trend—a large majority citing challenges in collaboration and a large majority being hopeful of overcoming these challenges using collaboration platforms—across all criteria. We believe that collaboration platforms can substantially help retailers in sharing data and insights, communicating instructions and collaborating on new product launches and promotions.

Figure 8. Retailers: Impact of Covid-19 on Collaboration (Top) and the Role of Technology/Collaboration Platforms in Overcoming Collaboration Challenges (Bottom) (% of Respondents)

[caption id="attachment_124451" align="aligncenter" width="700"] The ordering of responses in the top chart is based on the weighted average of all responses, where “Challenged to a Great Degree” carries the highest weight. The responses in the bottom chart are ordered to correspond with the top chart.

The ordering of responses in the top chart is based on the weighted average of all responses, where “Challenged to a Great Degree” carries the highest weight. The responses in the bottom chart are ordered to correspond with the top chart.The sum of percentages may not equal the total in some cases due to rounding.

Base: 60 grocery/drug retailers surveyed in December 2020

Source: Coresight Research[/caption]

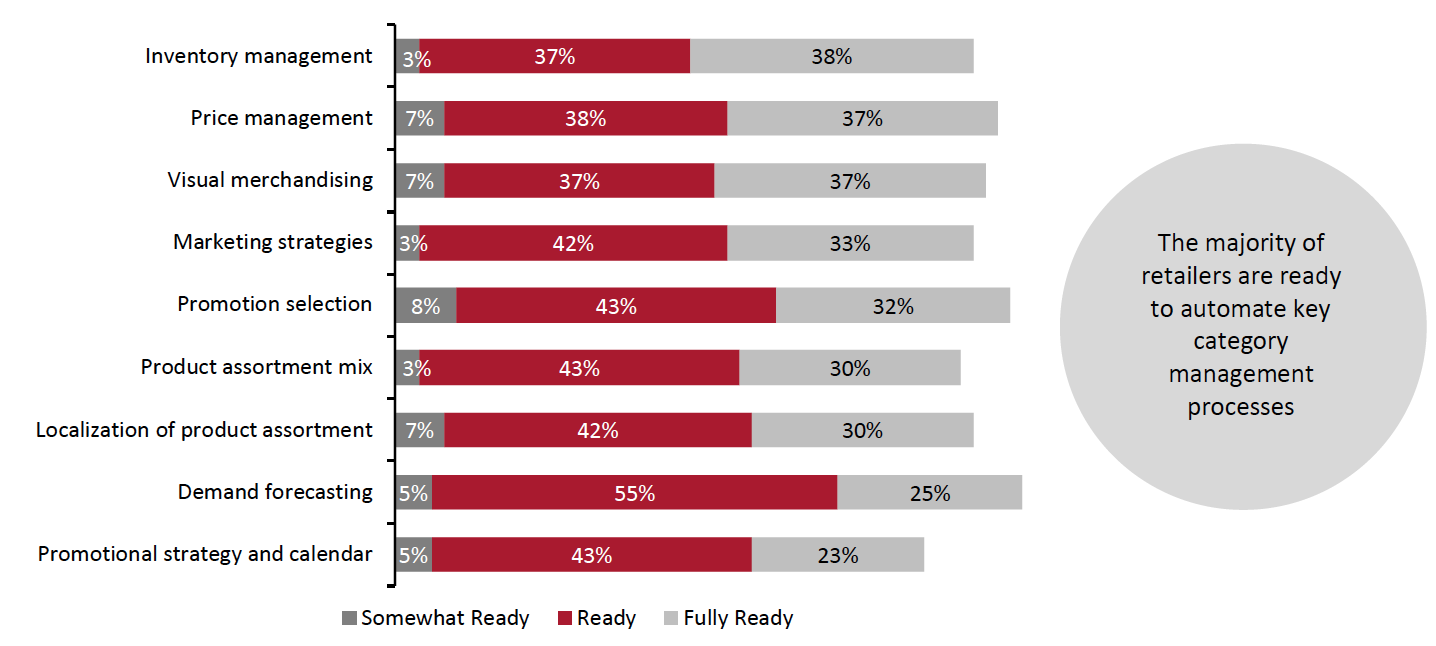

Retailers Are Bullish on Automating Category Management Processes

In the coming months and thereafter, data analysis and effective use of technology will be imperative for succeeding in the role of category management. The next obvious extension is automating key category management operations for mass localization and demand planning. Retailers understand the importance of speed in decision-making, and automation can help them make timely decisions about customer demand, promotion selection, price management and localization of product assortment. For example, a large supermarket retail client of Precima said, “For the big merchandising use cases like price and assortment optimization, we have started to successfully leverage prescriptive analytics and are seeing promising commercial results.”

Reflecting this, our survey findings reveal that retailers’ readiness to automate key category management processes is very high across all criteria.

- Some 38% of retailers are “fully ready” to automate inventory management—the highest proportion among all criteria. Four in 10 retailers are either “somewhat ready” or “ready” to automate inventory management.

- Price management and visual merchandising ranked second and third, respectively, with 37% of retailers citing that they are “fully ready” to automate these processes.

Although most retailers believe in their capabilities to automate key category management processes, retailers must solve the challenges discussed earlier in the report around effective use of data to achieve automation.

Figure 9. Retailers: Level of Readiness for Automating Key Category Management Processes (% of Respondents)

[caption id="attachment_124453" align="aligncenter" width="700"] The ordering of responses in the chart above is based on the weighted average of all responses, where “Fully Ready” carries the highest weight. The remaining proportion of respondents selected “Not Ready” or ‘Neutral” and are not included in the chart above.

The ordering of responses in the chart above is based on the weighted average of all responses, where “Fully Ready” carries the highest weight. The remaining proportion of respondents selected “Not Ready” or ‘Neutral” and are not included in the chart above.Base: 60 grocery/drug retailers surveyed in December 2020

Source: Coresight Research[/caption]

Solving Key Challenges in Retail Category Management

Precima, a NielsenIQ company, is a global retail strategy and analytics firm that provides tailored, cloud-based, data-driven solutions to drive sales, boost profitability and build customer loyalty. Leveraging AI/ML and deep analytics expertise, Precima helps organizations improve their competitive position across all facets of planning and operations—including pricing optimization, promotional planning, assortment optimization, targeted marketing and supplier collaboration.

Below, we list the key attributes of Precima’s solution suite that can benefit retailers in support of their category management teams:

- Assortment Optimization—Precima can help retailers understand the right product mix for each of their locations. Product availability management is vital for succeeding in the role of category management, and Precima’s solution can help retailers meet shopper demand, both online and in-store.

- Price Optimization—Precima's Total Store Price Optimization solution helps retailers simultaneously understand trade-offs across all categories and items—across the entire store/website—for smart, balanced pricing decisions that help achieve financial targets and meet customer expectations.

- Promotion Optimization—Precima leverages advanced analytics to review all promotions concurrently and help retailers understand the returns on promotions in real time, while slanting promotions toward more loyal customers.

- Category and Shopper Insights—Precima can help its clients solve the problems that arise out of omnichannel complexity by achieving a better understanding of shoppers and segmenting customers according to their preferences and lifetime value. Precima’s dashboard portal can help retail category managers make informed and shopper-centric decisions.

- Supplier Collaboration—Precima’s centralized data platform allows retailers and suppliers to share a common view of data. Furthermore, the platform enables retailers to improve communication with their suppliers, which increases transparency and the likelihood of a long-term strategic partnership.

For more information, visit precima.com

Methodology

This study is based on the analysis of data from an online survey of 110 grocery/FMCG/CPG manufacturers/suppliers and retailers conducted in December 2020 and 104 respondents surveyed in March 2020. We selected respondents based on the following criteria:

- Based in France, Germany, the UK and the US, with around 26 respondents per country.

- Positions focus on brick-and-mortar, e-commerce and business-to-business retail.

- Holding senior positions (owners, C-suite, VP/EVP, directors, senior managers).

- Responsible for operations management, merchandising, customer insights and analytics, logistics and supply chain, product sourcing, sales and marketing.

- Holding roles with significant strategic decision-making responsibilities.