Nitheesh NH

Introduction

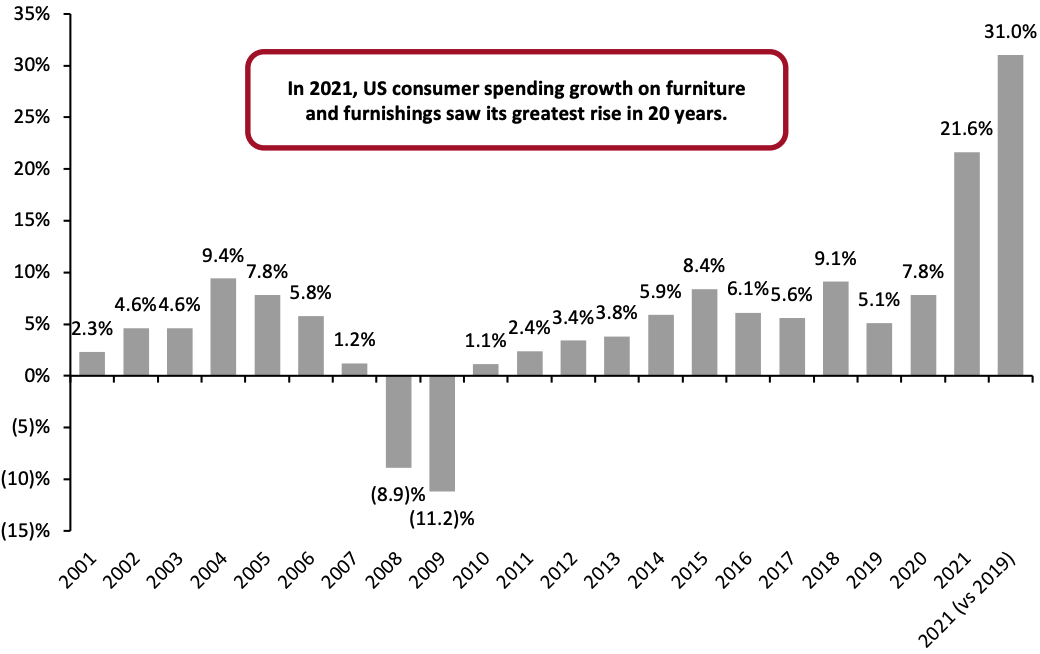

What’s the Story? Recent disruptions to the furniture supply chain have resulted in extremely long wait times for furniture delivery, as has been well-documented by the media. While supply chain strategies vary among US furniture and home-furnishing retailers, all are preparing for future disruptions. We discuss how US retailers have fared sourcing furniture and furnishings (lighting, decorative household items, carpets and other floor coverings) and present five strategies for overcoming the sector’s continuing sourcing challenges. Coresight Research has identified responsive logistics and sourcing as key trends to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the appendix of this report for more details). Why It Matters Since the start of the Covid-19 pandemic, spending on furniture and furnishings has grown at record levels. During lockdowns, people naturally spent time making their homes more pleasant and livable by outfitting their living rooms, home offices, balconies and patios. In 2021, US consumer spending on furniture and furnishings grew 21.6% year over year and 31.0% on a two-year basis—the greatest rise in 20 years. This moved furniture and furnishings’ share of total personal consumer spending from 1.6% in 2019 to 1.9% in 2020 and 2021.Figure 1. US Consumer Spending Growth on Furniture and Furnishings (YoY % Change) [caption id="attachment_145906" align="aligncenter" width="700"]

Source: BEA[/caption]

Consumers have invested significant time and money into making their homes more appealing and will want to continue enjoying and showing off their homes to a greater degree than prior to the pandemic, resulting in sustained demand for this sector in the near term. However, ongoing sourcing challenges could stand in the way of meeting this demand.

Sourcing furniture and furnishings differs from sourcing apparel or food. It is less trend-driven than apparel and, therefore, not as dependent on quick deliveries to meet current demand. Similarly, the goods are not perishable like food products, so they do not require short transport times, proximity sources or temperature-controlled storage.

However, sourcing in this sector presents its unique challenges, including:

Source: BEA[/caption]

Consumers have invested significant time and money into making their homes more appealing and will want to continue enjoying and showing off their homes to a greater degree than prior to the pandemic, resulting in sustained demand for this sector in the near term. However, ongoing sourcing challenges could stand in the way of meeting this demand.

Sourcing furniture and furnishings differs from sourcing apparel or food. It is less trend-driven than apparel and, therefore, not as dependent on quick deliveries to meet current demand. Similarly, the goods are not perishable like food products, so they do not require short transport times, proximity sources or temperature-controlled storage.

However, sourcing in this sector presents its unique challenges, including:

- Many pieces—such as sofas, chairs, beds and tables—tend to be large and bulky, and need storage spaces and modes of transport that can accommodate them. With high freight rates, smaller businesses shipping large items may be disproportionately disadvantaged compared to larger businesses.

- They may require assembly closer to market, as larger items tend to be shipped in unassembled parts.

- In the case of flat-pack furniture, such as items sold by IKEA, the brand or retailer needs the capacity to hold inventory of such items.

- Brands and retailers that offer made-to-order pieces need supply partners and capacity for orders.

- Retailers that rely on drop-shipping, such as Wayfair, need to ensure their supply partners have sufficient inventory and can deliver quality goods. One disadvantage such retailers might encounter is long lead times for delivery, especially if the suppliers are in distant, overseas locations.

How Can Furniture and Home-Furnishing Retailers Overcome Supply Chain Challenges?: Coresight Research Analysis

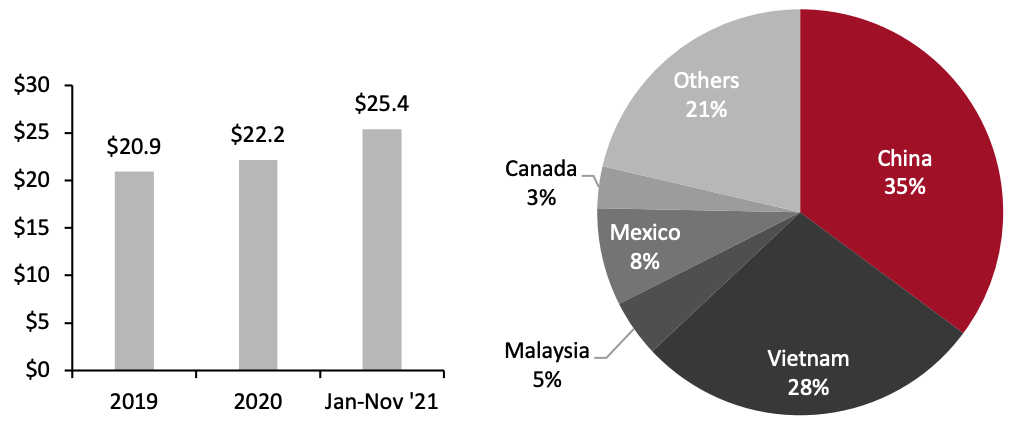

We discuss five strategies for brands and retailers to address supply chain challenges in furniture and home-furnishings sourcing. 1. Diversification of Production and Distribution Sources Single-country sourcing and multiple-sourcing both have their economic benefits. However, concentrating on a handful of markets for sourcing exposes buying companies to several risks. Prolonged shutdowns in China and Vietnam significantly impacted timely inventory receipts for several US retailers and sectors, including the US furniture industry. US imports of household furniture amounted to $22.2 billion in 2020, up 6% from 2019. Meanwhile, imports increased 15% over 2020 from January to November 2021 (data for 2021 only available through November), reflecting robust demand for furniture. The top five countries the US imports furniture from account for 79% of total household furniture and furnishings imports—down from 83% in 2019—making the US vulnerable to large-scale shutdowns in these nations.Figure 2. US Furniture and Furnishings Imports (Left; USD Bil.) and Top Five Countries the US Imports From (Right; Jan–Nov ’21 Household Furniture Import %) [caption id="attachment_145907" align="aligncenter" width="700"]

Source: Census Bureau[/caption]

To that point, Williams-Sonoma stated on its November 2021 earnings call that it had received only 85% of its holiday inventory, as Vietnam—a country it sources significantly from—had shut down for several weeks. It also remarked that it does not expect its inventory levels to recover until mid-2022. As a result, the company stated it would inventory plan further in advance in 2022 and possibly source from countries it had not considered previously, such as Brazil and Mexico, seeing upsides to diversifying.

Meanwhile, Restoration Hardware’s CEO Gary Friedman believes the company is already well-diversified, with only “20-something percent” of its production in Vietnam, according to the company’s December 2021 earnings call. Friedman also believes that temporary setbacks in Vietnam are not reason enough to move production out of the country, as the company has developed strong relationships with its Vietnamese vendors. As the situation is temporary, the company needs “to ride it out,” he said.

Acquisitions are one way to build capacity and diversify quickly. For example, US furniture maker and retailer La-Z-Boy acquired Furnico, an upholstery manufacturer in the UK, in October 2021, in addition to investing in expanding its manufacturing plants in the US and Mexico. La-Z-Boy remarked on its February 2022 earnings call that the ongoing supply challenges “while significant, are temporary in nature, and each day we get better at managing through them.”

Companies should also look beyond production for other areas ripe for diversification. During its November 2021 earnings call, Williams-Sonoma stated it had already diversified its US distribution points, allowing it to bring in goods from multiple ports.

Similarly, American furniture retailer LoveSac experienced serious headwinds during the lockdowns in Vietnam, as it sources significantly from the country. It handled this by redirecting some of its sourcing to China and diversifying inbound freight to multiple US ports. It then used various transport means to move the products along the supply chain, reserving air freight for its top-selling products only.

2. Using Returns as a Source of Materials and Finished Products

Returns continue to be a pressing issue for retailers as the costs associated with returns tend to be high.

According to a report from the National Retail Federation and Appriss Retail, US retail returns amounted to 16.6% of total US retail sales in 2021—$761 billion in total—up from 10.6% in 2020. Specifically, returns are higher during seasonal peaks in retail sales and the end-of-year holiday season. According to a Coresight Research survey of US consumers from January 24, 2022, one-third of respondents had returned or planned to return holiday gifts.

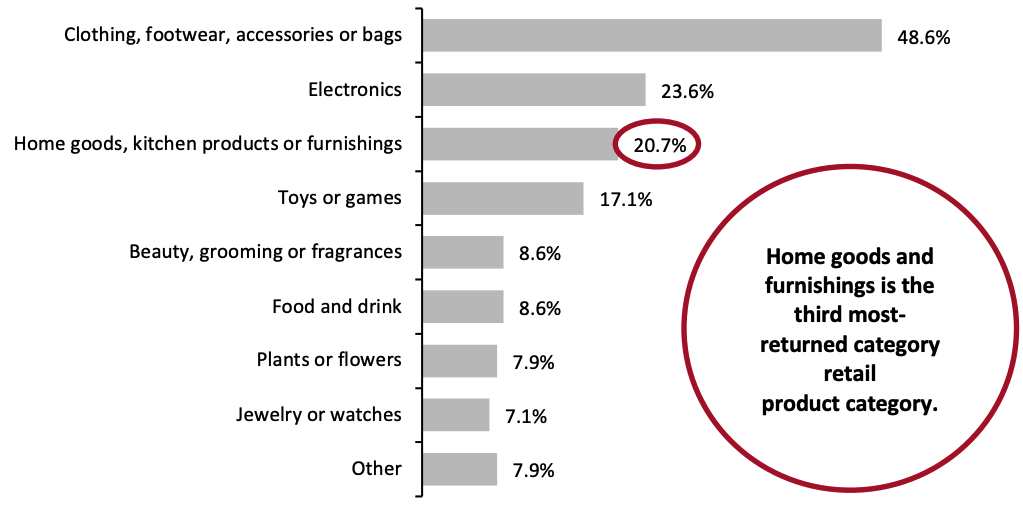

Returns rates vary widely by product category. While clothing was the most-returned category, our survey found that 20.7% of all consumers planned on returning gifts in the home goods category.

Source: Census Bureau[/caption]

To that point, Williams-Sonoma stated on its November 2021 earnings call that it had received only 85% of its holiday inventory, as Vietnam—a country it sources significantly from—had shut down for several weeks. It also remarked that it does not expect its inventory levels to recover until mid-2022. As a result, the company stated it would inventory plan further in advance in 2022 and possibly source from countries it had not considered previously, such as Brazil and Mexico, seeing upsides to diversifying.

Meanwhile, Restoration Hardware’s CEO Gary Friedman believes the company is already well-diversified, with only “20-something percent” of its production in Vietnam, according to the company’s December 2021 earnings call. Friedman also believes that temporary setbacks in Vietnam are not reason enough to move production out of the country, as the company has developed strong relationships with its Vietnamese vendors. As the situation is temporary, the company needs “to ride it out,” he said.

Acquisitions are one way to build capacity and diversify quickly. For example, US furniture maker and retailer La-Z-Boy acquired Furnico, an upholstery manufacturer in the UK, in October 2021, in addition to investing in expanding its manufacturing plants in the US and Mexico. La-Z-Boy remarked on its February 2022 earnings call that the ongoing supply challenges “while significant, are temporary in nature, and each day we get better at managing through them.”

Companies should also look beyond production for other areas ripe for diversification. During its November 2021 earnings call, Williams-Sonoma stated it had already diversified its US distribution points, allowing it to bring in goods from multiple ports.

Similarly, American furniture retailer LoveSac experienced serious headwinds during the lockdowns in Vietnam, as it sources significantly from the country. It handled this by redirecting some of its sourcing to China and diversifying inbound freight to multiple US ports. It then used various transport means to move the products along the supply chain, reserving air freight for its top-selling products only.

2. Using Returns as a Source of Materials and Finished Products

Returns continue to be a pressing issue for retailers as the costs associated with returns tend to be high.

According to a report from the National Retail Federation and Appriss Retail, US retail returns amounted to 16.6% of total US retail sales in 2021—$761 billion in total—up from 10.6% in 2020. Specifically, returns are higher during seasonal peaks in retail sales and the end-of-year holiday season. According to a Coresight Research survey of US consumers from January 24, 2022, one-third of respondents had returned or planned to return holiday gifts.

Returns rates vary widely by product category. While clothing was the most-returned category, our survey found that 20.7% of all consumers planned on returning gifts in the home goods category.

Figure 3. Holiday Gift Returns, by Product Category (% of Respondents) [caption id="attachment_145908" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 140 US consumers aged 18+ who returned, or planned to return, holiday gifts, surveyed January 24, 2022

Source: Coresight Research[/caption] Furniture retailers can look to returned furniture to address supply constraints and ease costs: they could repurpose returned materials or put the products up for resale, placing the items back in the supply chain. There are even returns management companies dedicated to the furniture sector, such as FloorFound. FloorFound is a reseller built to pick up, move and process bulky items that has partnered with furniture brands Burrow, Castlery, and Feather and Floyd, among others. Most recently, FloorFound partnered with Joybird, a La-Z-Boy subsidiary and website that sells customizable home furnishings. The partnership allows Joybird to list returned items for resale on the FloorFound site automatically. As a result, Joybird began realizing revenues from products that may have instead gone to landfills. FloorFound also has a nationwide network of 30 warehouse locations that can store returned furniture, keeping them out of retailers’ warehouses. 3. Expanding RTA Assortments Expanding assembly lines and hiring and training assembly workers takes time. Growing a company’s RTA assortment, on the other hand, may be a faster method of alleviating supply problems. RTA furniture has several benefits from a sourcing perspective, whether importing it from overseas or developing it domestically. The parts can be mass-produced, separated and packed without assembly, and the “flat” packages are easier to transport than bulky furniture. Moreover, the packages can be shipped directly to consumers rather than to retailers’ warehouses, distribution centers or stores, cutting down delivery time. While IKEA may be the industry totem for RTA furniture, other furniture brands offer RTA products, such as Homestyles and Ashley Furniture, which expanded its RTA line in 2019. However, competition within the RTA segment has grown over the past two years, according to Furniture In addition to Ashley Furniture, Dorel Home, Prepac Manufacturing and Walker Edison all expanded their RTA capacity to better serve customers. Meanwhile, Canada-based home and office furniture company Bestar acquired New York-based furniture maker Bush Industries, one of the largest RTA manufacturers in the US, in January 2020. 4. Developing Assembly and Transport Capacity Given the nature of the furniture sector and its dependence on labor for assembly and transport, companies in the segment need to mitigate not only the challenges of sourcing from overseas, but also domestic hurdles. At a March 2021 conference hosted by investment firm Raymond James, La-Z-Boy Senior VP and CFO Robert Lucian stated that the biggest bottleneck for the company was increasing capacity as it is a labor-intensive, rather than capital-intensive, business. So, the company grew capacity in various ways: it actively hired and trained more furniture assembly workers, increased the number of shifts at its existing plants, ran more overtime, worked weekends and reactivated a portion of a plant in Mississippi that closed during the pandemic. However, developing transport capacity and partners may be less time-consuming than developing assembly capacity. Home Depot managed to expand its overseas freight capacity by chartering a vessel to move shipments from China to the US, according to a CNBC report from June 2021. Home Depot’s move came amid soaring ocean shipping rates, and its volume of shipments justifies chartering a vessel—a luxury that smaller retailers cannot afford. Online-only or primarily online retailers need to adopt a different strategy when looking to diversify transport capacity, such as Wayfair’s drop-ship model. Wayfair’s drop-ship model allows it greater flexibility to expand its vendor base than retailers that are more vertically integrated in terms of manufacturing and holding inventory. Meanwhile, vetting and onboarding vendors with ready-to-sell stock is quicker than establishing relationships with manufacturers before producing products. Still, drop-shipping comes with its downsides, such as not having design control of products and how that might reflect the retailer’s brand image. Wayfair also developed transport capacity by scaling CastleGate, its network of fulfillment centers and logistics facilities, in May 2021. Once orders are placed on the company’s site, Wayfair’s suppliers can use CastleGate to book containers and shipping slots, which the company says provides competitive pricing. This is especially advantageous to smaller suppliers who can leverage Wayfair’s scale to receive lower prices than if they had booked the shipping slots through an outside agent or platform. If not drop-shipping, retailers can partner with or acquire local logistics providers to develop transport capacity further once the products or materials arrive onshore. For example, Ashley Furniture acquired Wilson Logistics, which owns 1,000 trucks and five truck terminals that serve the Western US, in November 2021. According to Sourcing Journal, while the company already had one of the most efficient logistics operations among furniture companies and the largest private fleet in the US, the acquisition will expand its capacity by 50%. 5. Ensuring Consumer Transparency In crisis times, keeping customers informed of inventory disruptions helps manage expectations, alleviating the number of disgruntled customers. Transparency can also mitigate unreasonably high demand—if customers know a product is affected by supply chain delays, they could order earlier or look at alternative, available items. During its November 2021 earnings call, Wayfair briefly described how the pandemic led to changes in its customer communication strategy. It listed items not present in its own or supplier warehouses as “out of stock,” only selling goods either in stock or in transit to onshore warehouses. The company also stated longer lead and delivery times to its customers, setting more accurate expectations. Likewise, custom furniture manufacturer The BOLD Companies stated that it has been upfront with its customers about materials price increases and formulated a strategy to ensure that customers do not have to contend with frequent price fluctuations. The company has shortened its quote window, providing customers with both materials pricing details and price increase forecasts in its quote documents. The company can also offer higher pricing upfront for a project, allowing costs to remain stable for two to three months.

What We Think

The supply chain challenges that furniture and home-furnishings makers, brands and retailers face set the sector apart in many ways. Furniture sourcing is less trend-driven and more complex than apparel or grocery due to its bulky nature, need for assembly and lack of flexibility in deploying a production line. However, in the medium-term, furniture demand is likely to ease as people have already decorated, or redecorated, their homes. And, as demand eases, supply pressures in the sector are likely to subside as well. Implications for Brands/Retailers- Diversifying sources of supply when a company’s supplier base is already diversified may be uneconomical in the long run, especially for larger companies. For smaller furniture retailers, nearshoring some of their manufacturing can help cut shipping costs.

- Apart from supply sources, brands and retailers should look to diversify sources of transport and distribution, especially in areas where there is dependence on a few providers.

- Brands and retailers should look to include resale within their distribution channel and make it an opportunity for revenues.

- RTA is becoming a lucrative segment with lower costs than assembled furniture; brands and retailers should at least explore including a line of basic RTA furniture if they are unwilling to go further into the segment.

- Assembly and transport capacity remains crucial, especially as demand for labor continues to surge. As such, brands and retailers must look at ways to develop assembly and transport capacity, such as acquiring plants to onboard large groups of workers quickly.

- Materials costs and shipping times remain higher than what they were pre-pandemic; retailers and brands need to be transparent about these issues and communicate to customers strategically.

- As companies look to diversify vendor sources, providers of distribution space should help diversify brands’ and retailers’ distribution space so that they can receive goods from multiple ports and connect their distribution networks better.

Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes. RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework. The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments. Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.Appendix Figure 1. RESET Framework [caption id="attachment_145909" align="aligncenter" width="600"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]