What’s the Story?

Handling product returns is an ongoing challenge for retailers across sectors, including the home and home-improvement sector. With the acceleration in e-commerce sales amid the pandemic, the challenge has increased. Building on existing return policies, home and home-improvement retailers have implemented various measures to ensure that returns are handled efficiently, in order to ensure minimal adverse impacts on their bottom lines. We discuss existing returns policies and new measures implemented in relation to increased e-commerce demand.

Why It Matters

Home and home-improvement retailers should pay close attention to managing returns for the following reasons:

- Dealing predominantly in heavy goods, returns for home and home-improvement retailers can be a costly and cumbersome process with significant impacts on operational profit.

- Home and home-improvement continues to see predominantly store-based sales, despite the uptick in e-commerce sales. Efficacy of the returns process can have a significant impact on shoppers’ decisions to continue shopping online.

- As retailers scale their e-commerce businesses, optimizing the balance between sales enhancement and returns reduction is crucial to ensuring a successful digital pivot.

- Retailers’ returns policies influence also where consumers shop and can have a significant bearing on top-line growth.

Growing E-Commerce Sales Accentuate Returns Challenges

Product returns is an ongoing challenge for home and home-improvement retailers, with significant costs for US retailers each year—especially as e-commerce sales continue to accelerate. We estimate that

e-commerce sales for US furniture, home furnishings and housewares accounted for 20.5% of total sales in 2020 and expect this penetration to grow to almost one-quarter of total sales by 2025.

Amid the coronavirus pandemic, online orders for appliances, furniture, home-improvement goods and other heavy goods have increased significantly. In anticipation of a busier-than-usual holiday season in the US for online shopping in 2020, that was expected to involve much higher returns, many retailers set up dedicated handling sites for returns and struck deals with reverse logistics specialists.

According to Erik Caldwell, President of XPO Logistics, the rate of returns for furniture and other heavy goods retailers in the US has “increased since the pandemic, from about 10% [of total orders] to around 11% on much higher volumes.”

In our weekly

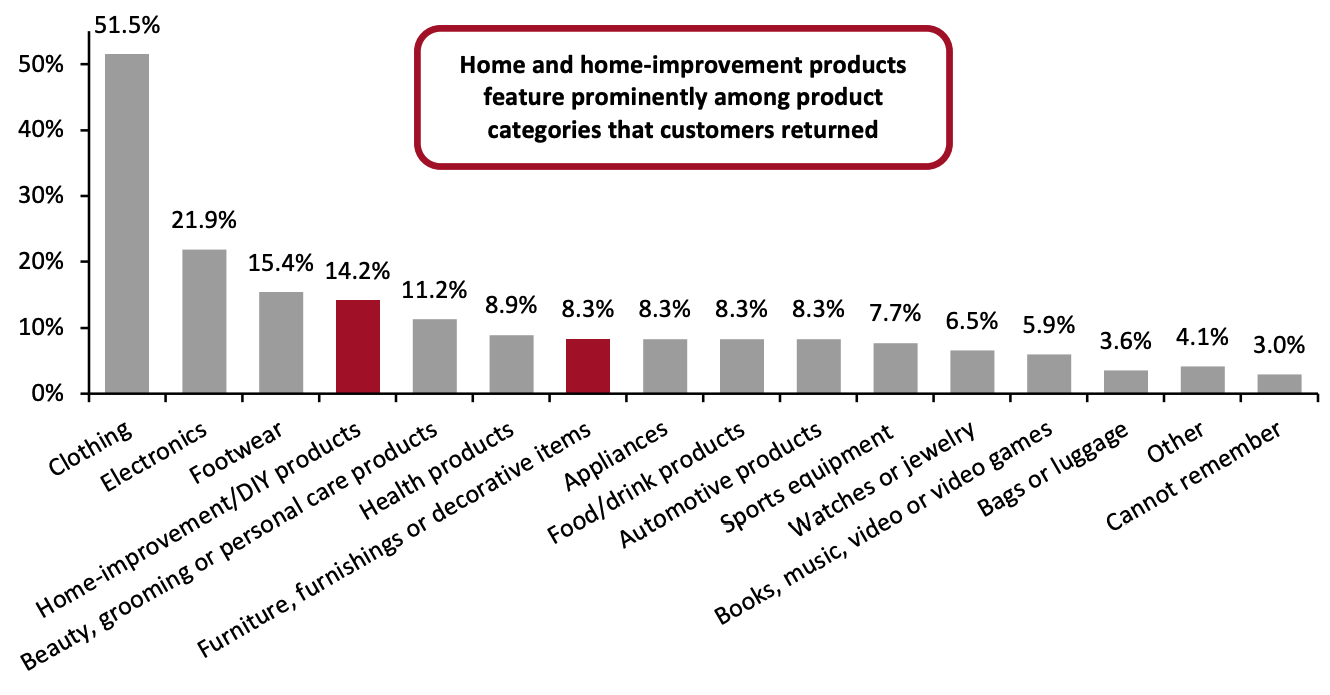

US consumer survey from November 17, 2020, around 14% of respondents said that they had returned home-improvement products that they purchased in the twelve months preceding the survey. Around 8% of respondents reported returning decorative items, furnishings or furniture in the same period. Although the rate of returns for home and home-improvement products is not as high as more portable items, such as clothing, footwear and some electronics, the category still experiences a notable share of returns relative to overall retail.

Figure 1. Respondents That Had Returned Any Unwanted Purchases in the Past 12 Months: Product Categories They Have Returned (% of Respondents)

[caption id="attachment_124280" align="aligncenter" width="720"]

Base: 169 US respondents aged 18+ who had returned any unwanted purchases in the 12 months preceding November 17, 2020

Base: 169 US respondents aged 18+ who had returned any unwanted purchases in the 12 months preceding November 17, 2020

Source: Coresight Research[/caption]

Our survey results also showed that among those that had returned unwanted purchases from any category in the defined period, a much higher proportion (42.6%) preferred to return online orders by mail, compared to the 25.4% that would rather return unwanted items to a store. This consumer preference for online returns implies higher logistics and labor costs for retailers.

The Returns Challenge: In Detail

1. Clearly Defined Return Policies

Both brick-and-mortar and online store retailers have well-defined existing return policies in place to manage returns. In response to the pandemic, retailers including Home Depot and Lowe’s made adjustments to their policies to maintain an optimum balance between enhancing sales and driving down returns. We discuss the return policies and updates made by US home and home-improvement retailers.

Physical Stores

Depending on the retailer, return policies at walk-in stores vary. On average, stores that offer full refunds expect items to be returned within 10 to 30 days. However, some stores have more stringent policies.

- Bob’s Discount Furniture only accepts refund requests for products that are returned within three days of delivery. The cost of return shipping by a store-specified delivery service is deduced from accepted refunds.

- Furniture Row, on the other hand, allows products to be exchanged, but not refunded, within 90 days of receipt of the product.

Among the more flexible retailers:

- Following the outbreak of the pandemic, Home Depot, extended its returns policy for most new and unopened merchandise to 180 days (previously 90 days) from purchase. There are a few exceptions, as listed on Home Depot’s website. The retailer has stated that it will revert to its 90-day return period from March 15, 2021.

- IKEA offers a full refund if customers return products within 365 days and provide proof of purchase. The company briefly suspended all returns in response to the pandemic in 2020.

- Lowe’s accepts most returns with a receipt within 90 days of purchase according to its website, with some product exceptions. The retailer extended this window to 180 days in response to the pandemic in early 2020 but reverted to its 90-day policy by August.

Some retailers accept returns outside their normal return window in return for store credit. For instance,

Badcock Home Furniture offers full refunds for products returned within 10 days of delivery and store credit for products returned between 11 to 30 days after purchase. All returns are subject to a 20% restocking fee. For other home and home-improvement retailers that issue a restocking fee, the amount typically ranges from 10 to 20% of the product’s original sale price.

Online Retailers

Many online retailers require customers to bear the cost of return shipping unless the retailer or delivery agent is responsible for a fault, such as a damaged product or incorrect order. In the latter instance, customers do not have to pay for return shipping, although some retailers expect them to repack the item and take it to a shipping facility.

Some online retailers expect customers to return items in their unused condition and original packaging or equivalent in order to be eligible for a refund or store credit. If a product has been assembled or modified, some retailers do not accept returns. This can be a challenge for customers if they’ve already assembled furniture or disposed of the packaging materials.

For instance,

Wayfair customers can return most items for a refund or credit within 30 days of delivery. The retailer requires the item to be in its original condition and packaging for the return to be accepted and applies return shipping costs.

Contrastingly, online mattress firm

Casper offers a risk-free returns process that allows consumers to test out its products. Customers have a 100-night trial period and if they are unsatisfied with the product during this period, they can return it for a full refund. The retailer often uses its generous return policy as part of its promotional efforts.

Williams-Sonoma customers can return most items within 30 days. Returns with a gift receipt will be refunded by way of a merchandise credit for the purchased amount, whereas returns with an original receipt will be refunded in the original form of payment. The retailer expects returned items to be in new condition.

2. Store Returns Services for Online Purchases

BORIS is becoming increasingly popular among US retailers as it facilitates faster returns and offers upselling opportunities. According to a 2018 Bell and Howell study, nearly 53% of shoppers make additional purchases when they return online ordered items to a store.

According to a 2017 study by UPS, unsurprisingly, most US consumers that opt for the BORIS model do so to avoid shipping fees and for faster return resolution.

- Home Depot first launched its BORIS offering in 2011 and currently offers the service at all of its 2,295 locations across the US. The majority of Home Depot items ordered online by customers are currently returned in-store, enabling the company to cut shipping and postage costs associated with online operations.

A notable innovator in the BORIS space is logistics and

asset-tracking company Position Imaging. The company’s iPickup platform solution provides a quick and easy way for shoppers to buy online and return items in stores without having to wait in line. It also allows shoppers to buy online, exchange in store (BOXIS), optimizing the exchange process so that the new item is ready within 15 seconds of a customer dropping off the original item at the store.

3. Partnerships with Specialists

Towards the end of last year, retailers partnered with reverse logistics specialists to deal with anticipated increases in holiday season returns.

- In early December 2020, Walmart announced a partnership with FedEx to pick-up return packages from consumers’ doorsteps for free, through a service called “Carrier Pickup by FedEx.” The mass merchandiser stated that the service will remain in place even after the holiday shopping season.

4. “Returnless” Refunds

E-commerce giant

Amazon and mass merchandisers

Target and

Walmart are trialing a new returns approach, as of January 2021, wherein consumers receive a refund and keep the purchased item, according to the Wall Street Journal. The companies are using AI-based analysis to identify the instances where it is more cost-effective to offer a “returnless” refund than manage the product return process.

Retailers may see sense in taking this approach in cases where the cost of returns outweighs any gains from reselling the item and where this option may ensure customer satisfaction. Walmart, for example, has stated that the option to keep the refunded item is usually given for items that the company doesn't plan to resell.

5. Refund Now, Return Later Services

Customers may be put off purchases by the prospect of a long wait to see refunds credited back to their bank accounts if they need to return a product. Smart returns platform

Returnly provides a solution to retailers to overcome this pain point, transferring refunds to shoppers in advance of the retailer receiving their returned item. On receipt of the original item, retailers refund the money directly to Returnly instead of to the shopper. The platform thus absorbs the friction from the refund delay on behalf of the shopper.

Returnly has also devised a similar solution for exchanging an item, which enables shoppers to get the correct item before returning the wrong one with no risk to the retailer

6. Investment in AI, AR and VR

AI can be used to automate returns management. Some retailers leverage AI technology through Software as a service (SaaS) inventory management software to ascertain the optimal channel for a product once it returns to the warehouse. Whether it’s for liquidation, refurbishment, re-shelving or scrapping an item, AI-based automated processes enable retailers to easily process, reroute and track merchandise—boosting efficiency significantly.

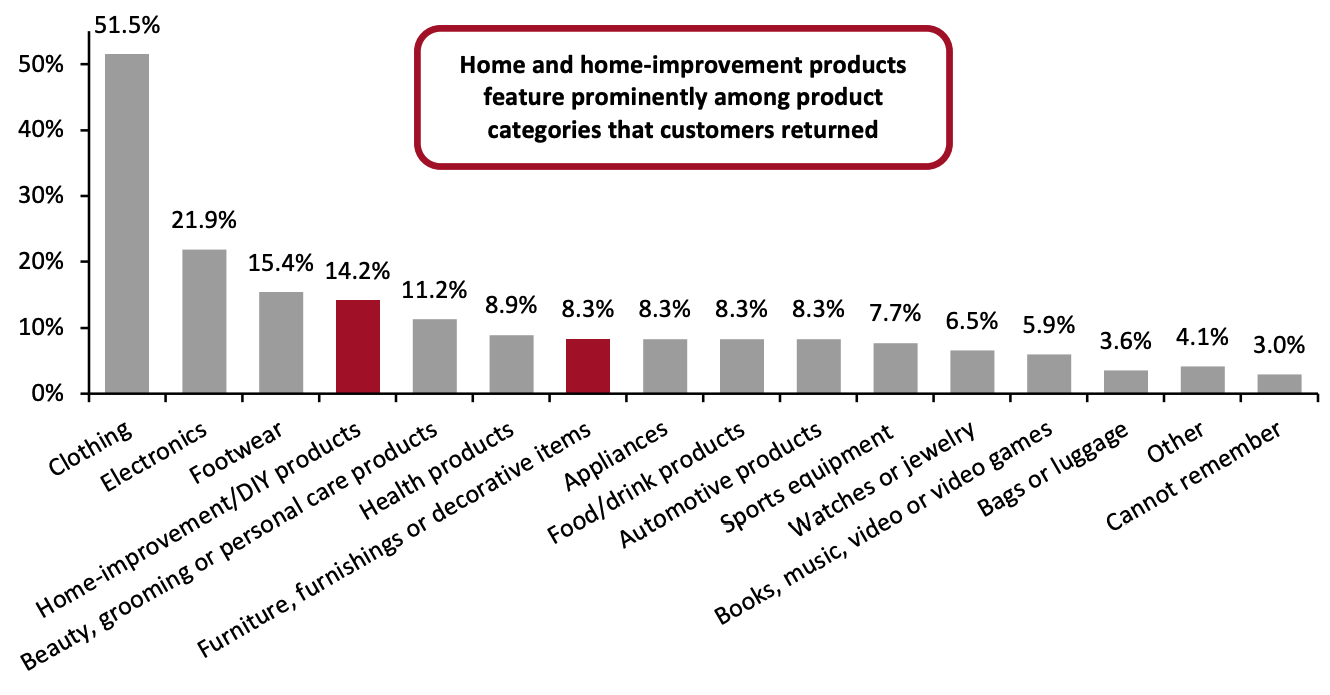

The AI-powered Chief Returns Officer platform developed by

retail-tech innovator Newmine offers analysis and prescriptive actions across the value chain, enabling retail organizations to actively reduce returns and work collaboratively. Unlike other solution providers that focus on reactive returns handling and processing, Newmine focuses on proactively reducing future returns. It provides a holistic view of returns data through powerful AI elements such as anomaly detection (AD) and natural language processing (NLP), to determine the root cause of return. The platform then identifies corrective actions that retailers can take to reduce future returns, thus improving their bottom line. Figure 2 outlines the functions of Newmine’s Chief Returns Officer platform for retailers.

Figure 2. Newmine’s AI-Powered Chief Returns Officer Platform

[caption id="attachment_124281" align="aligncenter" width="720"]

Source: Newmine

Source: Newmine[/caption]

Logistics software company

Optoro offers an AI-powered reverse logistics platform that helps retailers manage returns in a more efficient way. IKEA bought a minority stake in Optoro in December 2019 and has installed an AI platform developed by the latter in its operations to reduce waste related to returned products. The platform does this by predicting the best possible destination for returned merchandise, which could be back on the shop floor, listed on the retailer’s website, donated to charity or sold to a third-party wholesaler. The algorithm’s prediction is based on the best outcome for IKEA’s profitability.

Retailers such as IKEA and Macy’s have invested significantly in AR and VR, through which customers are able to gain a better sense of the items that they plan to purchase and how they would look and fit in their home environment. While AR-and VR-based apps are enhancing sales conversion rates, the adoption of these technologies also appears to be lowering the rate of returns for both physical stores and digital retailers.

- The IKEA Place app allows customers to assess how furniture would look in their homes by viewing it virtually using their smartphone cameras.

[caption id="attachment_124282" align="aligncenter" width="720"]

IKEA Place app

IKEA Place app

Source: Company website[/caption]

- Macy’s partnered with AR and VR specialist Marxent in October 2018 to introduce more than 70 VR installations across its US stores. Using VR headsets, consumers can visualize how furniture items will look in their homes before purchasing—facilitating better-informed decisions. As of February 2020, Macy’s had VR installations in around half of the 250 stores in which it offers furniture. The retailer’s VR galleries have helped it to increase furniture sales by 60% and drive down returns by 25% since implementing the technology, according to a statement given in February 2020, by Mohamed Rajani, who leads VR and AR initiatives at Macy’s.

7. Consolidating Return Shipments

In-person returns are typically a more cost-effective solution for retailers due to reduced shipping costs. However, online retailers that have no physical presence do not have the option to do this. Returns solution providers, such as Happy Returns, enable such retailers to outsource the management of their returns and decrease shipping costs by consolidating returns into one shipment.

Happy Returns partnered with FedEx in October 2020 (before the peak US holiday season) allowing shoppers to drop-off items at any of the latter’s brick-and-mortar locations. Happy Returns collects items from FedEx, and then returns them to individual brand fulfillment centers, through its reverse logistics system. Optoro also offers a reverse logistics service, as we discussed above.

What We Think

Implications for Brands/Retailers

- Home and home-improvement retailers should take a data-oriented approach to assess their product returns strategy and look to finetune their returns policy to maintain an optimal balance between enhancing sales and driving down returns.

- E-commerce-focused retailers should consider investing in AI, AR and VR technology to help drive down returns.

- Retailers should consider offering returnless refunds or refund now, return later options to customers taking cost implications and impact on customer satisfaction into consideration.

- E-commerce retailers can consider working with reverse logistics partners, such as Happy Returns, after assessing the merits of consolidating return shipments for their returns management strategy.

Implications for Technology Vendors

- Opportunities exist for AR and VR specialists, such as Marxent, to work with home and home-improvement retailers to leverage the use of technology to help them drive down returns.

- AI-powered technology firms Optoro and Returnly also have significant opportunities to work with retailers to devise custom solutions to manage returns efficiently.

Base: 169 US respondents aged 18+ who had returned any unwanted purchases in the 12 months preceding November 17, 2020

Base: 169 US respondents aged 18+ who had returned any unwanted purchases in the 12 months preceding November 17, 2020 Source: Newmine[/caption]

Logistics software company Optoro offers an AI-powered reverse logistics platform that helps retailers manage returns in a more efficient way. IKEA bought a minority stake in Optoro in December 2019 and has installed an AI platform developed by the latter in its operations to reduce waste related to returned products. The platform does this by predicting the best possible destination for returned merchandise, which could be back on the shop floor, listed on the retailer’s website, donated to charity or sold to a third-party wholesaler. The algorithm’s prediction is based on the best outcome for IKEA’s profitability.

Retailers such as IKEA and Macy’s have invested significantly in AR and VR, through which customers are able to gain a better sense of the items that they plan to purchase and how they would look and fit in their home environment. While AR-and VR-based apps are enhancing sales conversion rates, the adoption of these technologies also appears to be lowering the rate of returns for both physical stores and digital retailers.

Source: Newmine[/caption]

Logistics software company Optoro offers an AI-powered reverse logistics platform that helps retailers manage returns in a more efficient way. IKEA bought a minority stake in Optoro in December 2019 and has installed an AI platform developed by the latter in its operations to reduce waste related to returned products. The platform does this by predicting the best possible destination for returned merchandise, which could be back on the shop floor, listed on the retailer’s website, donated to charity or sold to a third-party wholesaler. The algorithm’s prediction is based on the best outcome for IKEA’s profitability.

Retailers such as IKEA and Macy’s have invested significantly in AR and VR, through which customers are able to gain a better sense of the items that they plan to purchase and how they would look and fit in their home environment. While AR-and VR-based apps are enhancing sales conversion rates, the adoption of these technologies also appears to be lowering the rate of returns for both physical stores and digital retailers.

IKEA Place app

IKEA Place app