What’s the Story?

In this report, we discuss four key strategies that Amazon is using to fulfill its grocery ambitions in the US market.

Why It Matters

Amazon has been making significant investments in the grocery channel to carve a meaningful share in the US grocery market. While the company’s current market share of US grocery is relatively modest, the following data insights provide compelling reasons to expect significant US grocery channel growth from the e-commerce giant:

- Coresight Research estimates that US total grocery market sales reached $1.2 trillion in 2020, which equates to 12% year-over-year growth—vastly greater than any recent year. Amazon (including Whole Foods) accounted for 1.3% of the offline grocery market share in 2020. Increasing share in this market presents a significant revenue opportunity for Amazon.

- Coresight Research’s US online grocery survey conducted in April 2021 found that Amazon is the most shopped online retailer. Despite the surge in grocery e-commerce seen in the US in 2020 and into 2021, grocery remains a predominantly offline sector and consumers that use e-commerce tend to be cross-channel shoppers. Amazon has recognized that it cannot win a significant share in grocery with a pure-play online model—as such, its move into opening strategically designed and located brick-and-mortar stores will have a significant role to play in the years ahead, even as e-commerce continues to grow.

- Although grocery is a low-margin retail category, grocery shopping is ubiquitous. Investing in the grocery category will offer Amazon the chance to attract more customers, leading to additional sales of higher margin products and services.

How Amazon Is Doubling Down on the US Grocery Market Opportunity: Coresight Research Analysis

We identify four key ways that Amazon is developing its grocery ecosystem in the US market.

Figure 1. Amazon’s Four Strategies To Grow Its Share of the US Grocery Market

[caption id="attachment_135356" align="aligncenter" width="725"]

Source: Coresight Research

Source: Coresight Research[/caption]

1. Brick-and-Mortar Footprint Expansion

Whole Foods

In 2017, Amazon bought upscale grocery chain Whole Foods Market for $13.7 billion, which catapulted Amazon into the grocery space and provided the company with a footprint of 472 stores, located in some of the most affluent urban areas in the US. Moreover, Whole Foods had a strong private-label business with 365 products, as well as a well-oiled supply chain.

The store portfolio enabled Amazon to improve its distribution network, reach more consumers and increase its overall market share. The company’s online grocery initiatives, including Amazon Fresh, Amazon Pantry and Amazon Prime, also benefited from Whole Foods’ store network as well as its loyal, affluent customer base.

The Whole Foods store count has risen by about 30 units since the closing of the acquisition by Amazon. In May 2021, Whole Foods announced plans to expand across the country with 41 stores across 13 states and Washington D.C.

Amazon has leveraged Whole Foods stores in the following ways:

Amazon has bolstered its online order pickup program for general merchandise by providing lockers at Whole Foods stores. Amazon Lockers are self-service kiosk that allows shoppers to pick up packages at a time convenient for them.

Amazon offers a return option for Amazon.com orders at almost all of its Whole Foods stores across the country. A box-free, label-free return option is available using a QR code that is generated after a return is created.

- “Just Walk Out” Technology

Amazon is paving the way for tech-driven Whole Foods stores that will complement its Amazon Fresh chain. In September 2021, Amazon announced that it will launch its cashierless “Just Walk Out” technology at two Whole Foods stores that are scheduled to open in 2022 in Washington D.C. (21,500 square feet) and Sherman Oaks, California (9,100 square feet). Both new locations will be smaller than the traditional Whole Foods format, which could help the chain to reach new markets and consumers.

Whole Foods stores have provided Amazon with new distribution hubs for grocery delivery. Amazon offers free two-hour delivery and pickup of Whole Foods items at all locations as part of its Prime membership.

- Tapping Existing Prime Members

Amazon made efforts to reshape the grocer’s pricey image by making several rounds of price cuts at Whole Foods, reducing hundreds of items by up to 20%. Prime members who shop at Whole Foods have access to several benefits including weekly exclusive discounts on selected products and an additional 10% off in-store sale items.

Amazon Fresh

Amazon opened its first

Amazon Fresh store in California in September 2020 and has quickly ramped up to 18 stores, as of September 2021. Amazon can use the valuable data that it has on its Prime members to best determine where to locate stores and what inventory to stock. We discuss three key elements of the company’s expansion of its Amazon Fresh store network.

- Mid-Market Price Positioning

Prior to launching the Fresh chain, Amazon did not have a physical format to capture the same consumer base it attracts online. Amazon Go is primarily positioned to cater to young shoppers’ demand for greater convenience. The stores are small (less than 1,800 square feet), checkout-free convenience stores that primarily offer on-the-go food options in urban locations. On the other hand, Whole Foods caters to a niche segment, offering natural and organic products at typically higher price points.

Amazon Go and Whole Foods formats, therefore, hold limited relevance for mid-market, big-basket grocery shoppers as neither are positioned on value—even if Amazon expands the two chains, they will likely capture relatively few core big-shop customers from the company’s rival grocery retailers.

However, the introduction of Amazon Fresh poses a more serious threat to traditional retailers. Amazon Fresh claims to offer “lower prices consistently” and stocks a wide assortment of mainstream brands. It is targeted at low and middle-income shoppers who don’t frequent Whole Foods, as well as high-income customers looking for a bargain.

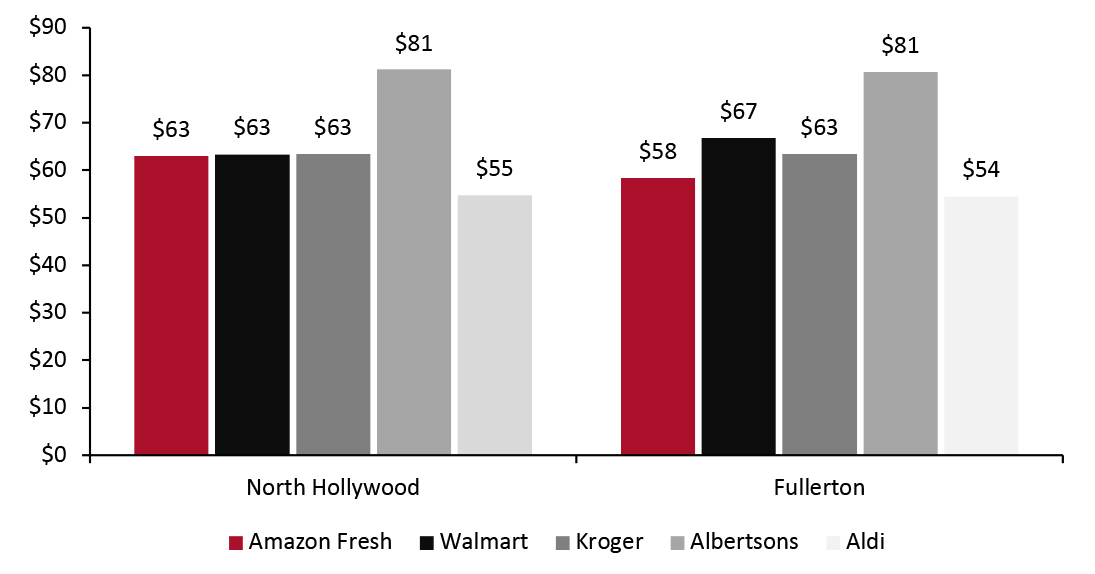

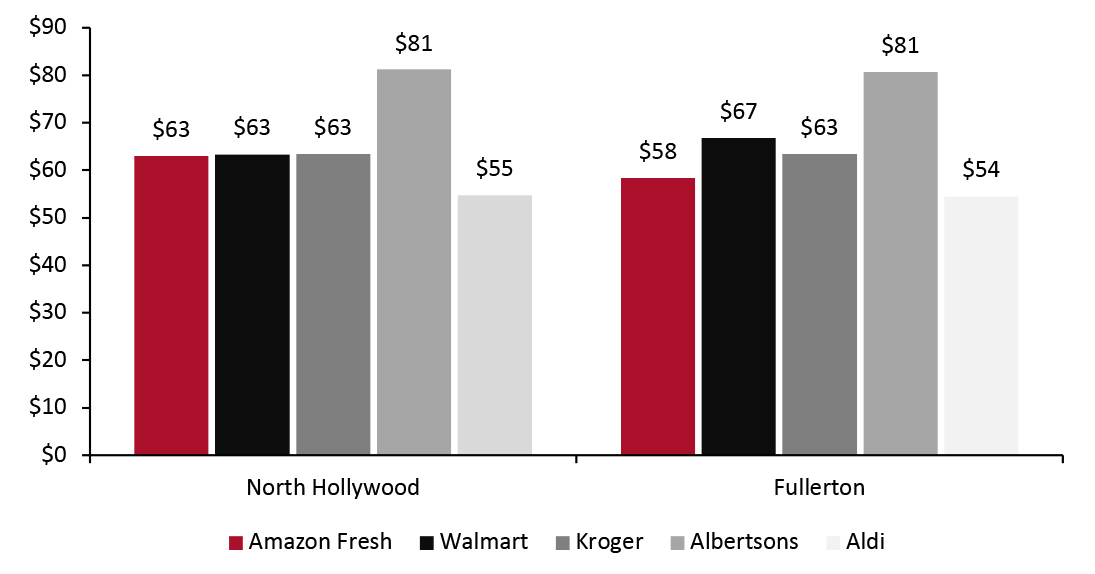

In May 2021, Coresight Research conducted online price checks for a basket of 10 comparative items at nearby Amazon Fresh competitors (in the same zip code region) at two locations—one in North Hollywood and one in Fullerton, California. The results indicate that Amazon Fresh is priced competitively with nearby Kroger and Walmart stores in the North Hollywood area but is priced lower than both in Fullerton. At both locations, Amazon Fresh is priced higher than Aldi, while undercutting Albertsons by over 30%.

Figure 2. Absolute Price Comparisons: Amazon Fresh Basket Versus Competitors (May 2021)

[caption id="attachment_135357" align="aligncenter" width="725"]

Source: Coresight Research

Source: Coresight Research[/caption]

Amazon Fresh’s focus on affordability will allow it to go head-to-head with traditional grocers, intensifying price competition in the near future. Given Amazon’s historical willingness to accept low profit margins for long-term gains, we believe that the company could gain significant grocery industry market share by undercutting established players on price.

By choosing sites close to Prime members (who tend to shop more on Amazon), the company has boosted its last-mile advantage, making both pickup and delivery easier by generating a higher order volume from the immediate trade area—which can translate to lower delivery costs. Amazon Fresh stores also serve as pickup and return sites for Amazon.com orders, improving convenience for Amazon online shoppers.

Additionally, Fresh stores will enable Amazon to extend its free two-hour grocery delivery service to more Prime members at more locations. Currently, free grocery delivery services are only available in selected US cities.

Many customers prefer delivery over other options, so long as it does not involve an added cost. By offering free grocery delivery services at more locations, Amazon will potentially attract more online pickup business from other neighborhood grocery stores.

Amazon differentiates its offerings through the technology solutions built into its stores. Amazon Fresh has a particular focus on check-out free shopping—offering smart shopping carts, referred to as Dash Carts, that scan and weigh items while keeping a running total of purchases. In addition, the Dash Carts feature integrated voice recognition technology, enabling customers to navigate Fresh stores based on the location of items on their Alexa shopping lists. The stores also use electronic shelf labels that can easily be updated to reflect price changes, and larger graphic displays offer product promotions, product reviews and shopper advice.

In June 2021, Amazon opened an Amazon Fresh in Bellevue, Washington, spanning 25,000 square foot and equipped with “Just Walk Out” technology. The new store is significantly larger than the 10,400-square-foot Amazon Go stores. Amazon introducing this technology in a full-sized grocery store gives it an upper hand on startups that offers similar systems but have struggled to roll them out to bigger stores due to technical challenges

2. Private-Label Product Launches

Amazon has ramped up its food offerings with the launch of private-label brand Aplenty in April 2021, which is available online and at Amazon Fresh grocery stores. Amazon is set to roll out hundreds of Aplenty-branded products including cookies, pantry staples, savory snacks and sweets by April 2022. Aplenty products will not contain artificial flavors, high fructose corn syrup or synthetic colors.

The addition of Aplenty builds on a private-label grocery assortment that Amazon has expanded rapidly since 2017 amid its increased focus on omnichannel retailing. The retailer sells frozen vegetables, milk and spices under its Happy Belly brand, baked goods under the name Amazon Fresh, as well as “heat-and-eat” meals and meal accompaniments under its Amazon Kitchen brand. Amazon continues to expand its lineup of private-label brands, with the promise of larger profit margins than name brands.

Private-label products have emerged as significant sales drivers for retailers in recent years. US

grocery private-label sales growth outpaced name brands for the fourth consecutive year, increasing by 13.7% year over year in 2020 versus a 12.9% increase in name brand sales growth. Sales of grocery private-label products accounted for 16.7% of the overall US grocery market in 2020 and the penetration is on an upward trend.

In a reflection of that trend, Kroger announced on its

Investor Day in March 2021 that it plans to launch 660 new private-label items in fiscal year 2021, the majority of which will be under its Simple Truth and Private Selection lines. Albertsons also announced plans in March 2021 to increase its private-label penetration to 30% in next few years from the current 25% rate.

We believe that Amazon’s private-label expansion could present increased competition for traditional retailers down the road, particularly if it ramps up its physical footprint and creates aggressive marketing around the brands in Amazon Fresh and Amazon Go stores. This subsequent brand awareness would buoy online sales of its private labels, driven by added exposure and the ability to physically merchandise higher-end private labels.

3. Streamlining Online Grocery Offerings

In November 2019, Amazon integrated its rapid online delivery service Amazon Fresh into Amazon Prime, axing the separate $14.99 monthly fee and offering Amazon Fresh as a free Amazon Prime benefit. This means Prime members—who pay $119 per year—are eligible to receive free grocery shipments within two-hour delivery window at no additional cost.

By bundling Amazon Fresh’s fees within Prime, Amazon has shown a willingness to incur losses on its online retail business to foster a broad, loyal customer base. Prime members show greater propensity than those without Prime membership to buy groceries on Amazon—at 58% versus 42% from our online grocery survey data—with Amazon Fresh marking another potential vehicle to drive this strategy. Additionally, with Amazon Fresh’s links to Amazon Prime and the shared variable costs with higher margin nongrocery items, Amazon can leverage Amazon Fresh to absorb warehousing and transportation costs.

Amazon has recently taken further steps to consolidate and simplify its sprawling array of delivery services. In January 2021, Amazon discontinued its Prime Pantry service and announced in May 2021 that it will shut down its Prime Now offering by the end of the year. The company said that it will move groceries, shelf-stable items and household goods from these standalone apps into the primary Amazon website. This will simplify the shopping experience, enabling consumers to buy groceries, track their orders and contact customer service from a single site.

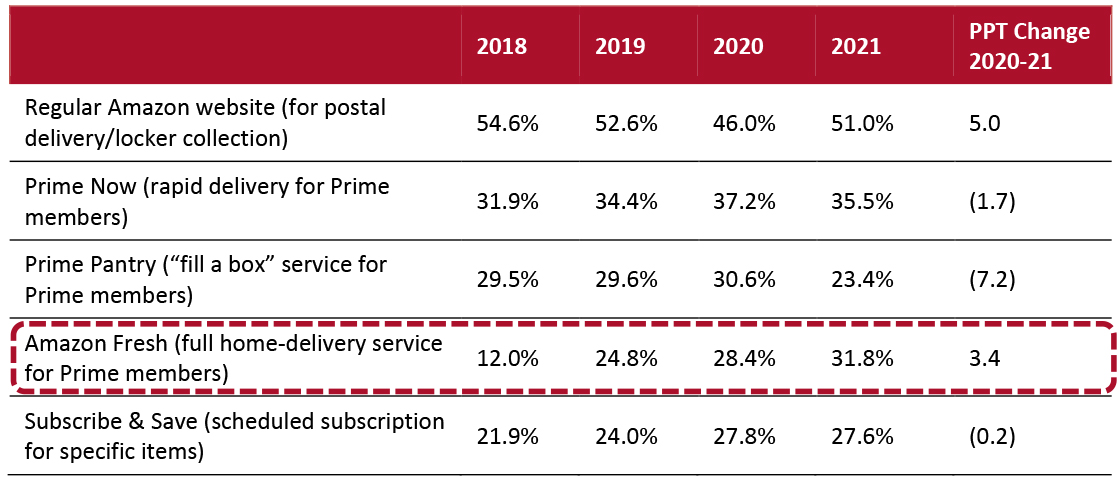

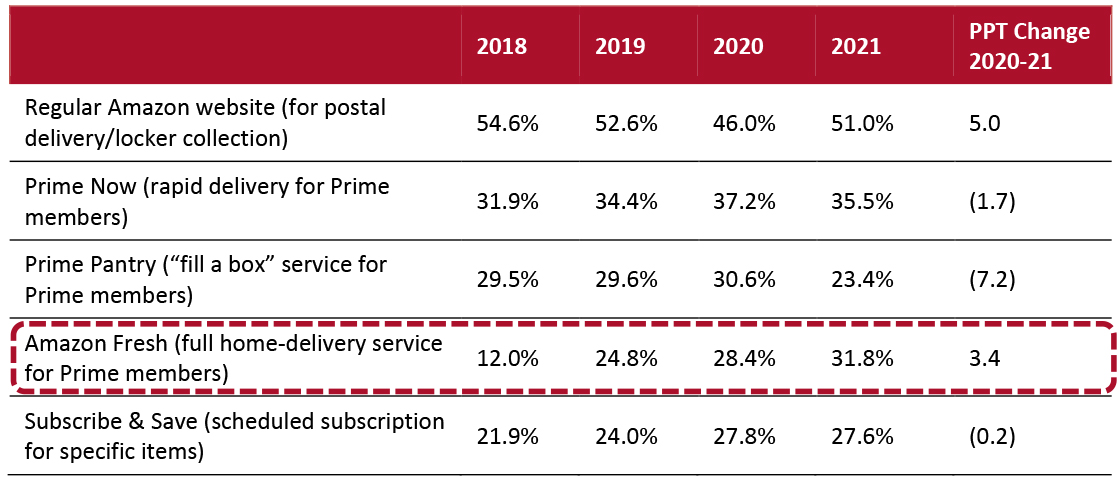

Trend data from our annual US online grocery survey conducted in April this year suggests that Amazon Fresh services has steadily gained popularity among Amazon shoppers, with growth of 3.4 percentage points in the proportion of respondents using the service in 2021. This indicates that the retailer is seeing increasing success in attracting full-basket grocery shoppers.

Figure 3. Amazon Grocery Shoppers: Which Amazon Services They Had Used to Purchase Groceries in the Past 12 Months (% of Respondents)

[caption id="attachment_135358" align="aligncenter" width="700"]

Base: US respondents aged 18+ who had purchased groceries on Amazon.com in the past 12 months

Base: US respondents aged 18+ who had purchased groceries on Amazon.com in the past 12 months

Source: Coresight Research [/caption]

4. Delivery Infrastructure Development

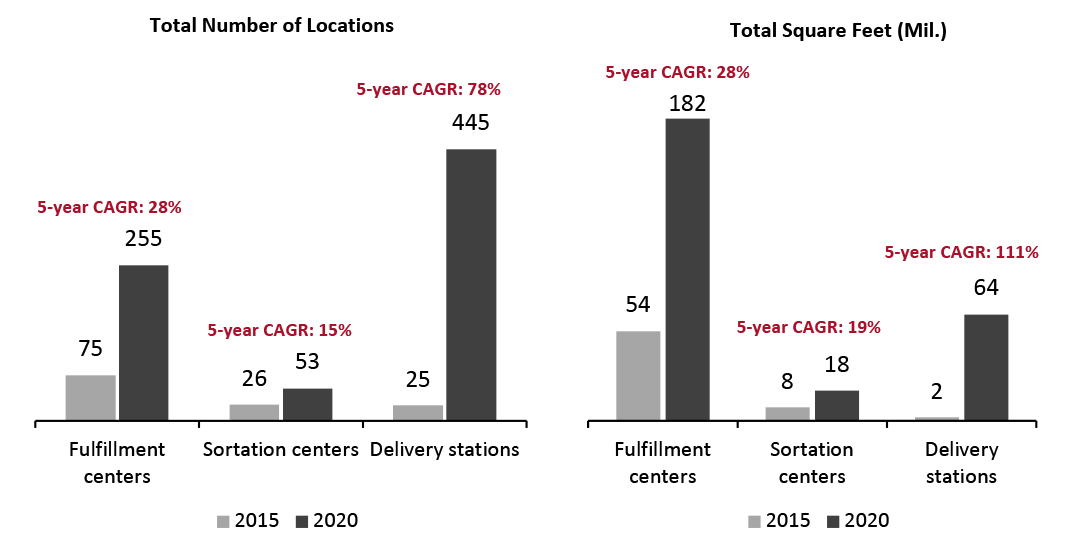

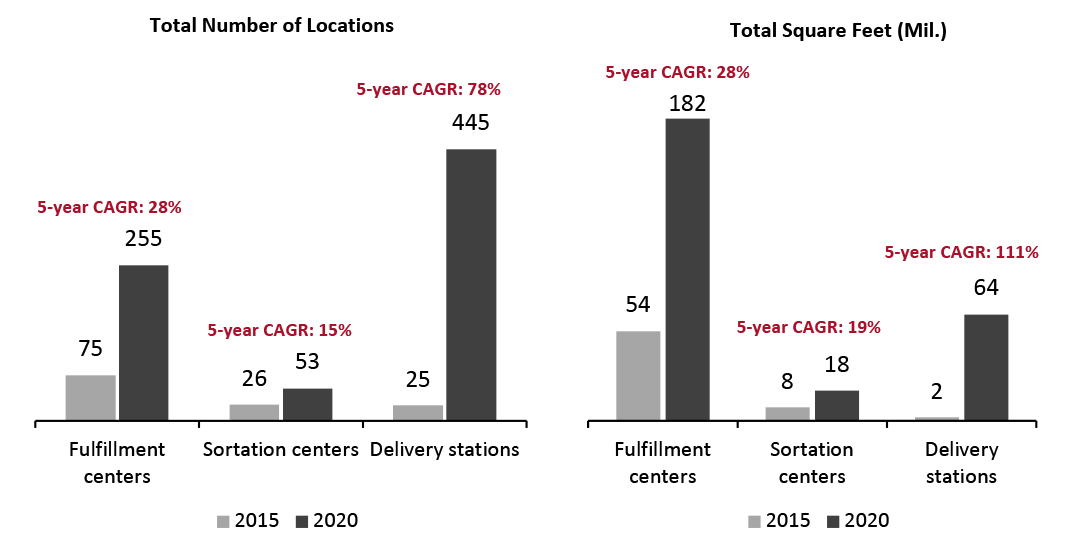

Amazon currently operates a network of ambient and cold storage grocery distribution centers across the US. The company has made significant progress in logistics expansion amid the pandemic, focused on last-mile

fulfillment. In its February 2021 earnings call, Amazon said that it boosted its fulfillment capacity—the network of warehouses, delivery stations and drivers it uses to get packages to customers—by 50% in fiscal 2020, which is more than Amazon’s distribution network has grown over the prior three years combined.

According to the supply chain consultancy MWPVL, Amazon’s delivery stations, the facilities that are closest to consumers, are seeing the most growth as the company builds out its logistics footprint. The emphasis on delivery stations suggests that Amazon is moving its inventory dramatically closer to the consumer to enhance its last-mile delivery speed and efficiency.

Figure 4. Amazon Logistics Infrastructure Growth

[caption id="attachment_135359" align="aligncenter" width="726"]

Source: MWPVL

Source: MWPVL[/caption]

Developing

last-mile infrastructure aligns with Amazon’s ambition to establish rapid grocery home-delivery services in major metropolitan markets. Amazon Fresh’s online service is already established in Los Angeles, San Francisco and Seattle. The company has been ramping up Amazon Fresh to cover several other large metropolitan cities to enable customers to order fresh food and dry grocery merchandise with two-hour or same-day delivery.

What We Think

More than a decade after it started selling groceries, Amazon has just a sliver of the US grocery market as grocery retailers finally start figuring out how to sell food online. Increasing investments in grocery is a way for the company to keep up the competition with traditional retailers, become even stickier with loyal Prime members, as well as appeal to a broader cross-section of US consumers.

Implications for Retailers

- Amazon is drastically raising consumer expectations from brick-and-mortar retailers. The company aims to provide consumers with affordable, convenient and personalized shopping experiences both online and offline, through grocery delivery programs, technological innovations and Prime discounts. By creating an incentivized ecosystem, it has the potential to lock out its competition.

- We believe that the combination of Fresh store additions, growing comfort with online grocery usage and increased interest in healthy eating (Whole Foods’ core offering) will enhance Amazon’s market share penetration in the total US grocery market in the coming years.

Source: Coresight Research[/caption]

1. Brick-and-Mortar Footprint Expansion

Whole Foods

In 2017, Amazon bought upscale grocery chain Whole Foods Market for $13.7 billion, which catapulted Amazon into the grocery space and provided the company with a footprint of 472 stores, located in some of the most affluent urban areas in the US. Moreover, Whole Foods had a strong private-label business with 365 products, as well as a well-oiled supply chain.

The store portfolio enabled Amazon to improve its distribution network, reach more consumers and increase its overall market share. The company’s online grocery initiatives, including Amazon Fresh, Amazon Pantry and Amazon Prime, also benefited from Whole Foods’ store network as well as its loyal, affluent customer base.

The Whole Foods store count has risen by about 30 units since the closing of the acquisition by Amazon. In May 2021, Whole Foods announced plans to expand across the country with 41 stores across 13 states and Washington D.C.

Amazon has leveraged Whole Foods stores in the following ways:

Source: Coresight Research[/caption]

1. Brick-and-Mortar Footprint Expansion

Whole Foods

In 2017, Amazon bought upscale grocery chain Whole Foods Market for $13.7 billion, which catapulted Amazon into the grocery space and provided the company with a footprint of 472 stores, located in some of the most affluent urban areas in the US. Moreover, Whole Foods had a strong private-label business with 365 products, as well as a well-oiled supply chain.

The store portfolio enabled Amazon to improve its distribution network, reach more consumers and increase its overall market share. The company’s online grocery initiatives, including Amazon Fresh, Amazon Pantry and Amazon Prime, also benefited from Whole Foods’ store network as well as its loyal, affluent customer base.

The Whole Foods store count has risen by about 30 units since the closing of the acquisition by Amazon. In May 2021, Whole Foods announced plans to expand across the country with 41 stores across 13 states and Washington D.C.

Amazon has leveraged Whole Foods stores in the following ways:

Source: Coresight Research[/caption]

Amazon Fresh’s focus on affordability will allow it to go head-to-head with traditional grocers, intensifying price competition in the near future. Given Amazon’s historical willingness to accept low profit margins for long-term gains, we believe that the company could gain significant grocery industry market share by undercutting established players on price.

Source: Coresight Research[/caption]

Amazon Fresh’s focus on affordability will allow it to go head-to-head with traditional grocers, intensifying price competition in the near future. Given Amazon’s historical willingness to accept low profit margins for long-term gains, we believe that the company could gain significant grocery industry market share by undercutting established players on price.

Base: US respondents aged 18+ who had purchased groceries on Amazon.com in the past 12 months

Base: US respondents aged 18+ who had purchased groceries on Amazon.com in the past 12 months  Source: MWPVL[/caption]

Developing last-mile infrastructure aligns with Amazon’s ambition to establish rapid grocery home-delivery services in major metropolitan markets. Amazon Fresh’s online service is already established in Los Angeles, San Francisco and Seattle. The company has been ramping up Amazon Fresh to cover several other large metropolitan cities to enable customers to order fresh food and dry grocery merchandise with two-hour or same-day delivery.

Source: MWPVL[/caption]

Developing last-mile infrastructure aligns with Amazon’s ambition to establish rapid grocery home-delivery services in major metropolitan markets. Amazon Fresh’s online service is already established in Los Angeles, San Francisco and Seattle. The company has been ramping up Amazon Fresh to cover several other large metropolitan cities to enable customers to order fresh food and dry grocery merchandise with two-hour or same-day delivery.