ABOUT THE COMPANY

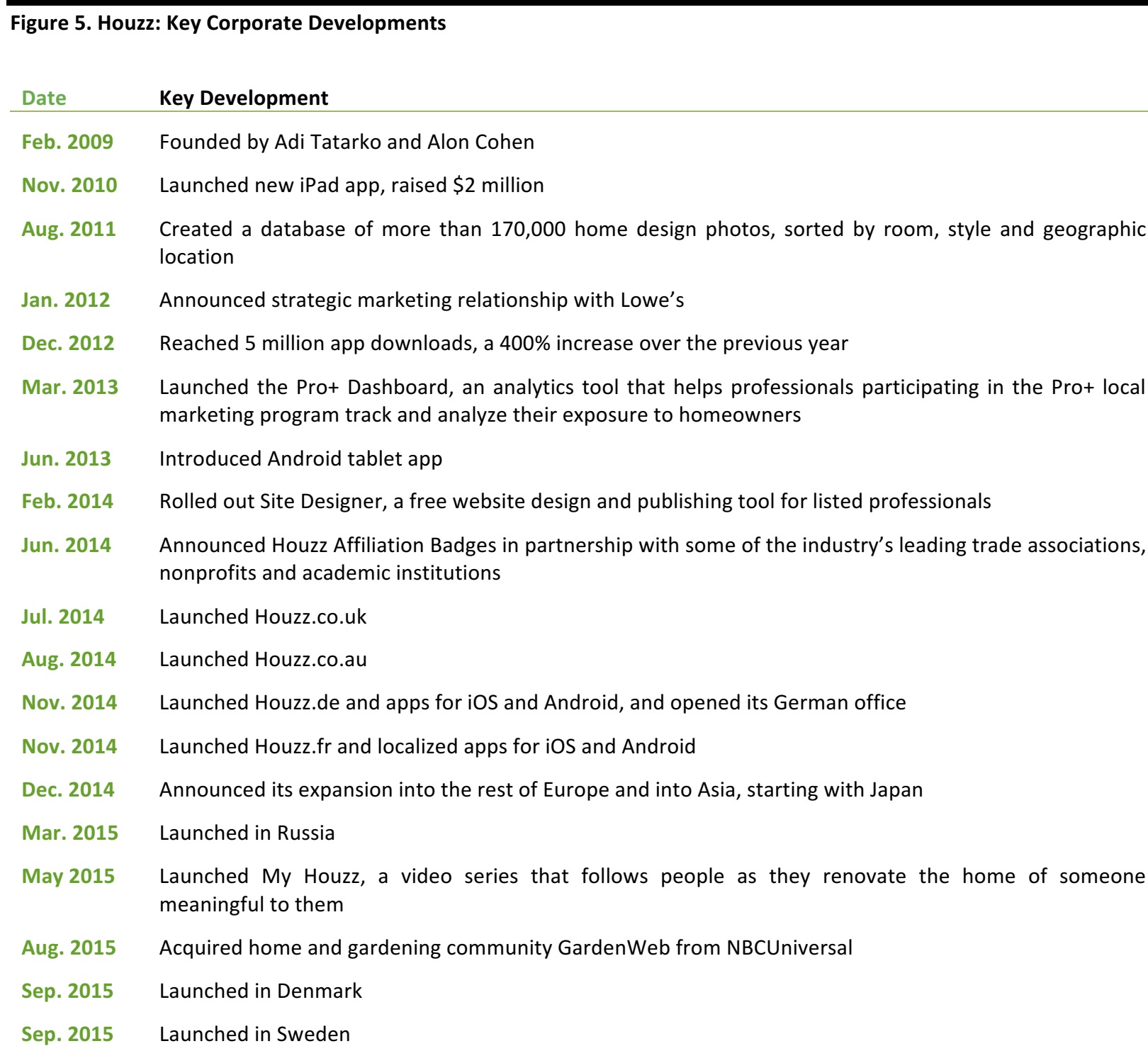

Houzz is an online home remodeling community that connects homeowners with design inspirations and home professionals. Started in 2009 by Adi Tatarko and Alon Cohen, a young couple frustrated by the traditional ways of remodeling homes, the online platform has grown into a community of 35 million unique monthly users, including 80,000 active architects, designers, contractors and other home improvement professionals.

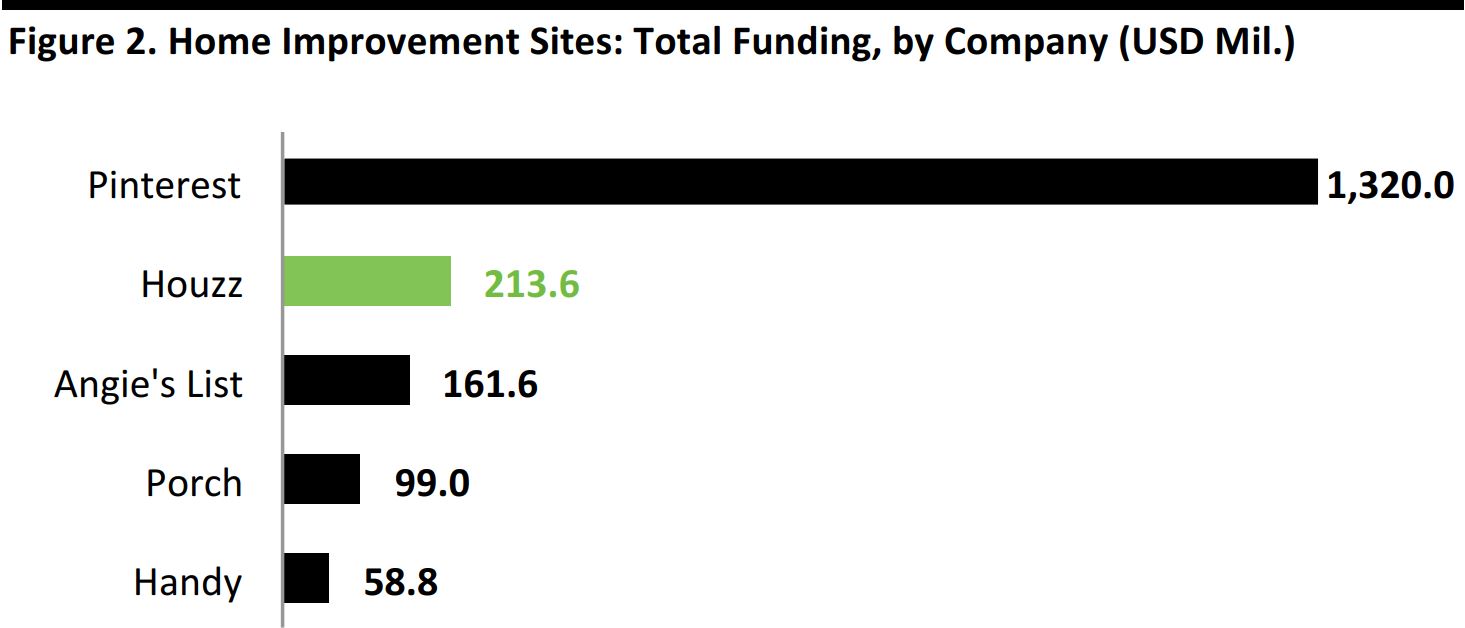

Source: CB Insights

Source: CB Insights

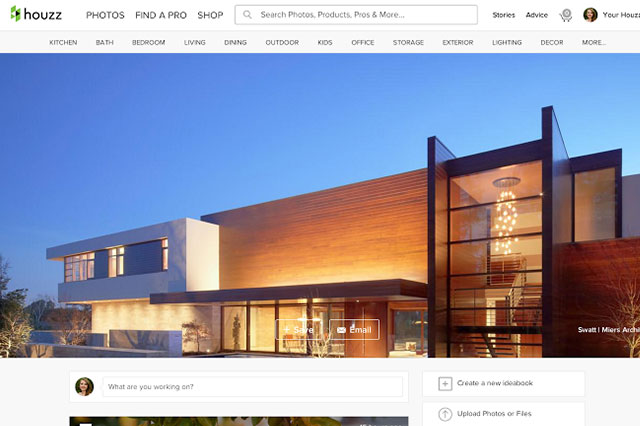

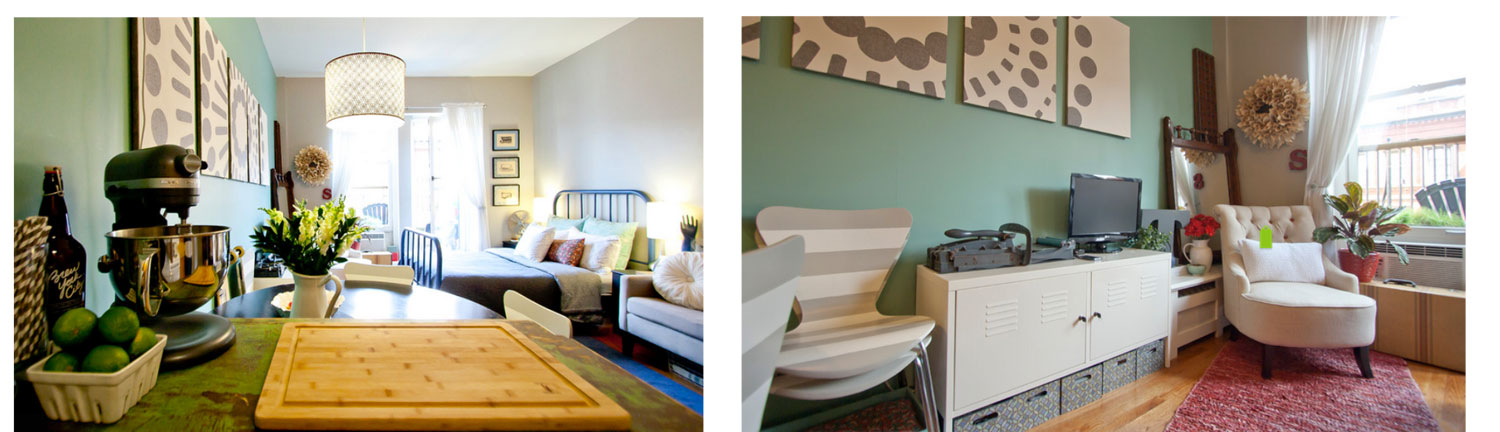

ONE-STOP SHOP FOR HOME PROJECTS: COMMUNITY, CONTENT AND COMMERCE

Houzz’s success is attributable to its focus on building a community of homeowners and professionals to exchange ideas and complete home projects in the most efficient manner. Homeowners can find inspiration from over 8 million home design images and pin useful pictures in their “ideabooks,” which are similar to Pinterest boards. In addition, homeowners can use Houzz to:

- Interact with a large online community of other homeowners and home improvement professionals

- Find designers, architects and contractors to complete their projects

- Read inspirational content and learn about the latest trends from home renovation professionals

- Explore and purchase new products, from materials to furniture to home decor

ACQUISITION OF GARDENWEB SOLIDIFIES HOUZZ’S STATUS AS THE LEADING COMMUNITY FOR HOME REMODELING

Houzz received $165 million in series D funding from investors in September 2014. In August 2015, the company announced its first acquisition, of GardenWeb, NBCUniversal’s online home and gardening community. The addition of the 20-year-old GardenWeb website gave Houzz access to millions of participants in 2.8 million discussion threads and 14 million discussion posts covering nearly 400 discussion topics.

BUSINESS MODEL DRIVEN BY USER DEMAND

While Houzz does not disclose actual sales figures, industry analysts estimate that it could reach $1 billion in annual sales by 2020. The company generates revenues in three ways, all of which stem from organic demand from the established community:

1) Targeted brand advertising: Houzz works with almost all of the largest brands in home categories, and it charges manufacturers to advertise on its sites. Brand marketing on Houzz is particularly targeted, as it leverages 35 million monthly active users (90% of which are homeowners) who are actively involved in home improvement projects. Sponsored ads are embedded in inspiration photos and categorized by style. Consumers are likely to click on the sponsored pages because they are already interested in a similar home style on the page they are browsing.

2) Sales commission fees: Houzz added a commerce element to its site in 2014, and now carries over 1 million products from 1,000 vendors. Demand for products grew in tandem with the number of inquiries from community members about products featured in Houzz’s design photos. Houzz charges listing merchants a 15% commission fee. The online marketplace allows customers buy furniture and home accessories from manufacturers such as Hamilton Beach, Black & Decker and Viking Cookware without leaving the Houzz website.

3) Premium listing for home professionals: Since 2012, Houzz has offered listings services for home professionals such as architects, designers and contractors. Professionals are given the option to highlight and customize their online images in order to better engage with community members.

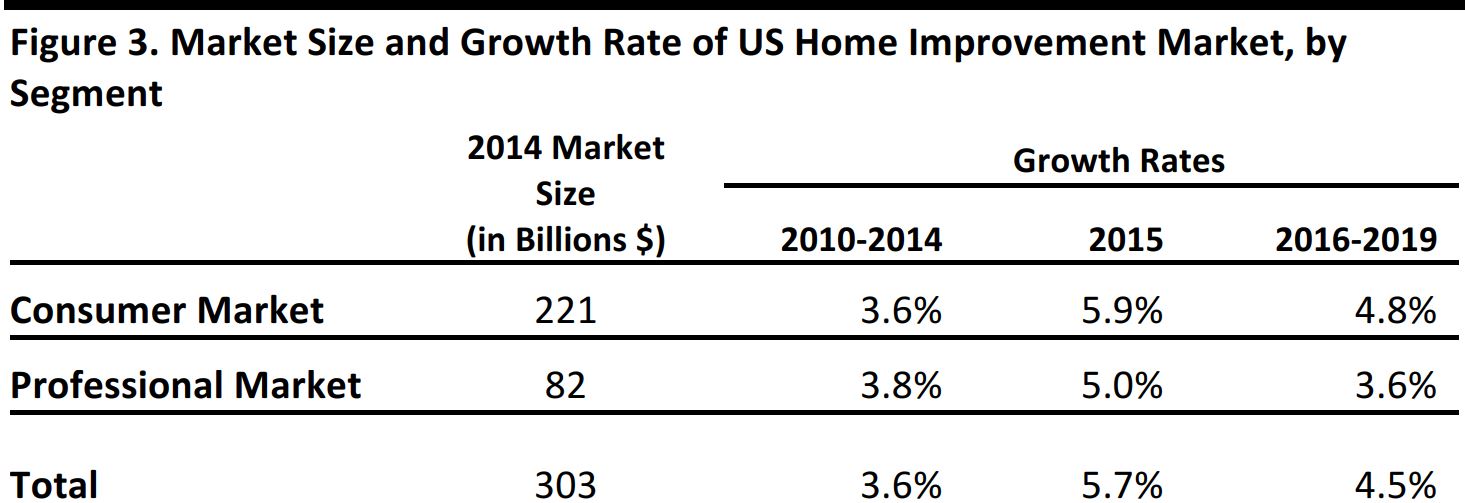

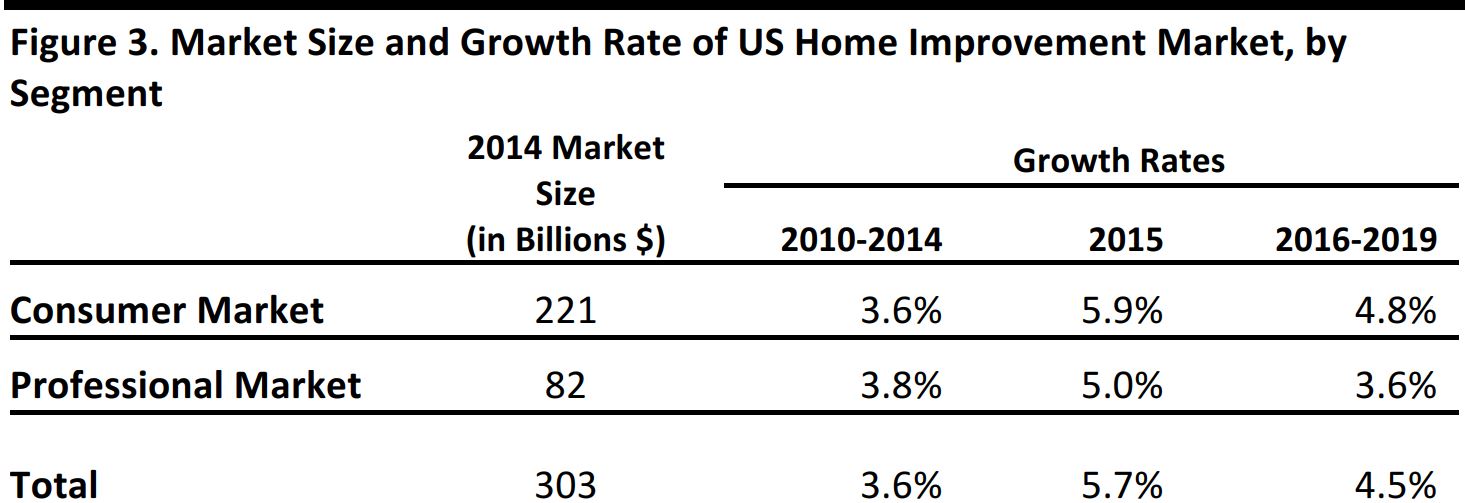

HOUZZ IS POISED TO DISRUPT THE BILLION-DOLLAR HOME IMPROVEMENT MARKET

The company is revolutionizing the way people complete home improvement projects. The total home improvement market in the US alone amounted to $303 billion in 2014. And, according to IHS Global Insight and the Home Improvement Research Institute, the US market will grow at a rate of about 5% over the next five years, thanks in part to an improving job market and falling gas prices.

Source: IHS Global Insight/Home Improvement Research Institute

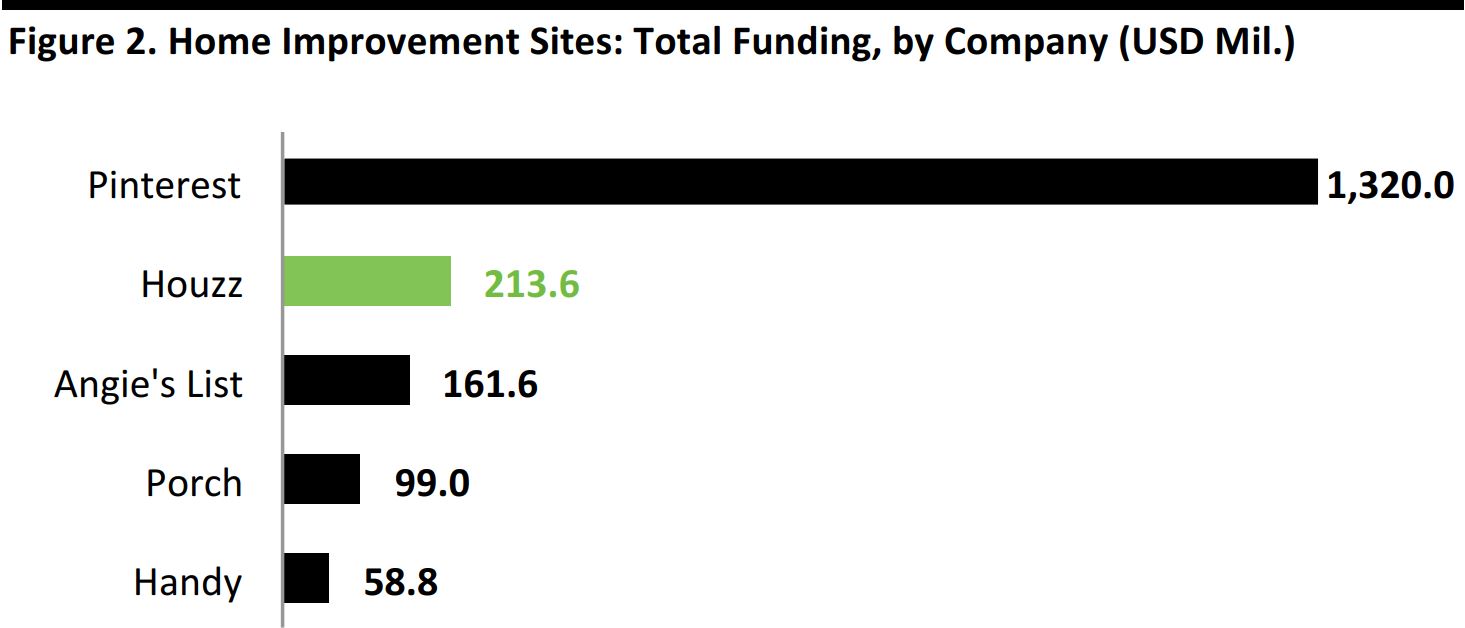

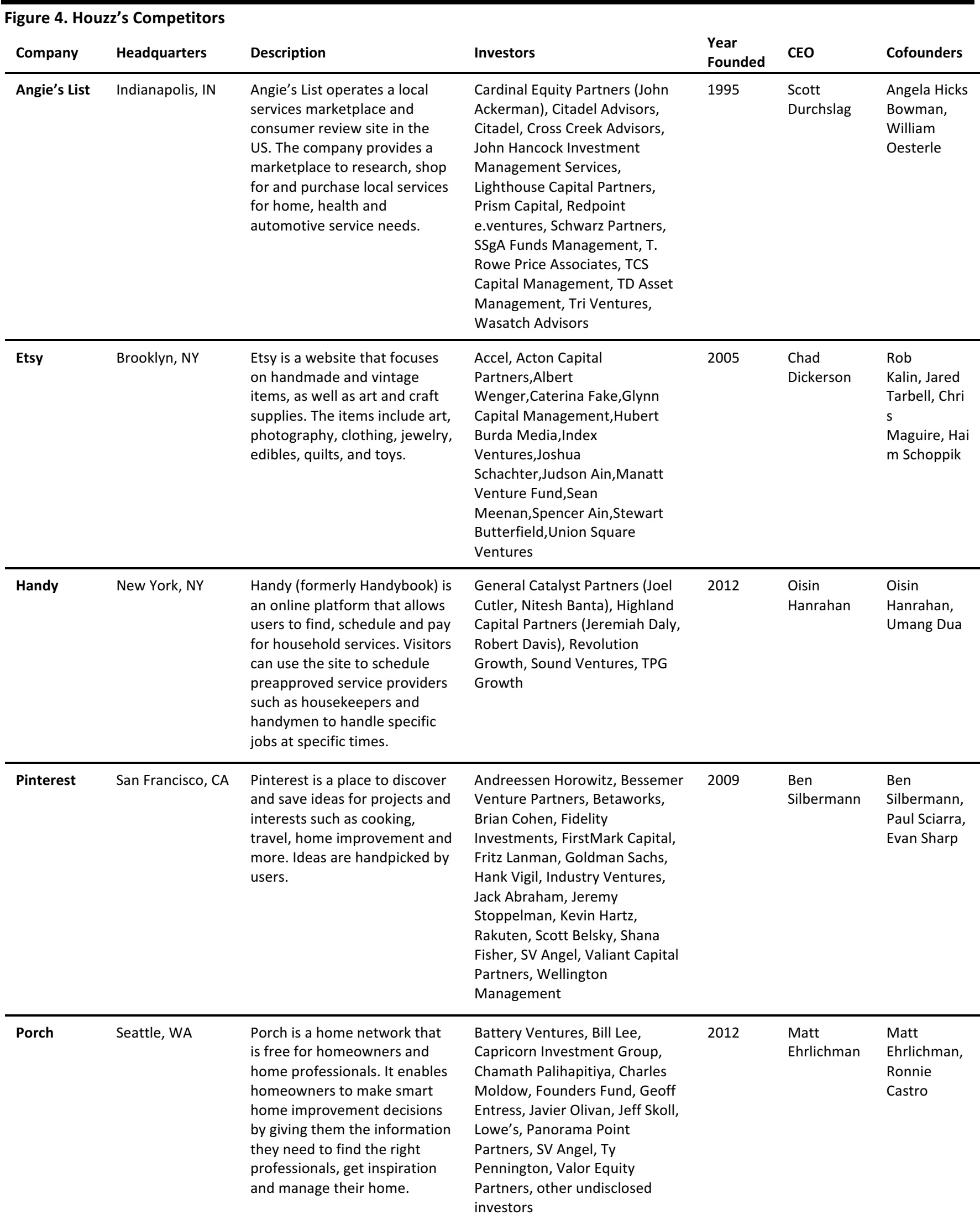

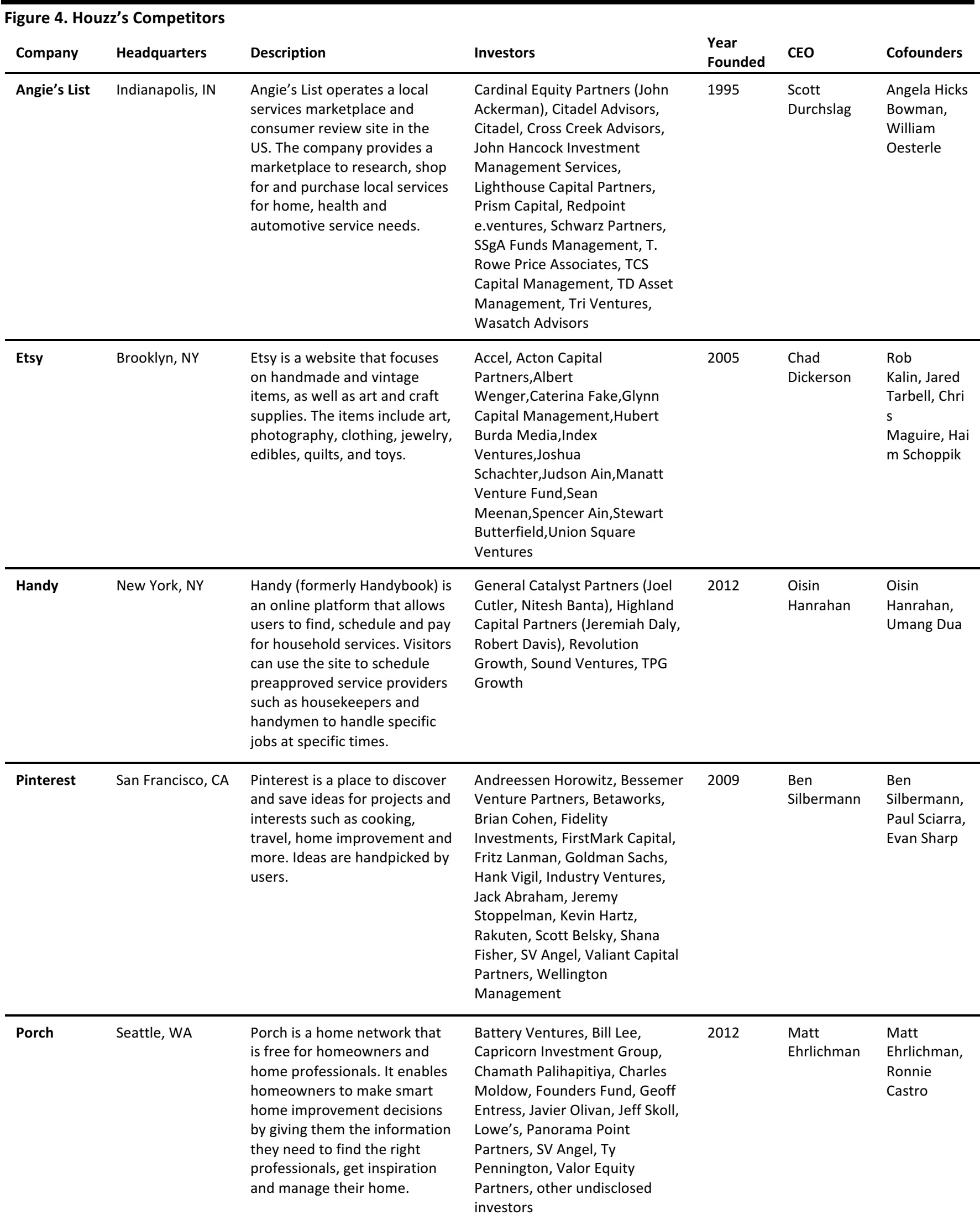

Due to its unique one-stop-shop business model, Houzz does not have a close competitor in its overall business, although it does compete in terms of separate service and product offerings:

- Design images: Houzz has the potential to disrupt the home improvement magazine business, which includes titles such as Handyman, Home and Home Improvement. Its ideabooks put it in direct competition with Pinterest.

- Products: Houzz is well positioned to take market share from traditional home improvement retailers such as Lowe’s, Home Depot and Ace Hardware. On the e-commerce side, furniture e-tailer Wayfair.com and handcraft marketplace Etsy offer similar product categories.

- Services: Online review website Angie’s List provides ratings of home improvement services providers, among many other categories. Handy is a site that allows users to schedule household services, such as cleaning or repairs. Home improvement network Porch gives homeowners direct access to a personal Porch Concierge who can help find the best professionals for a particular home project

Source: Crunchbase

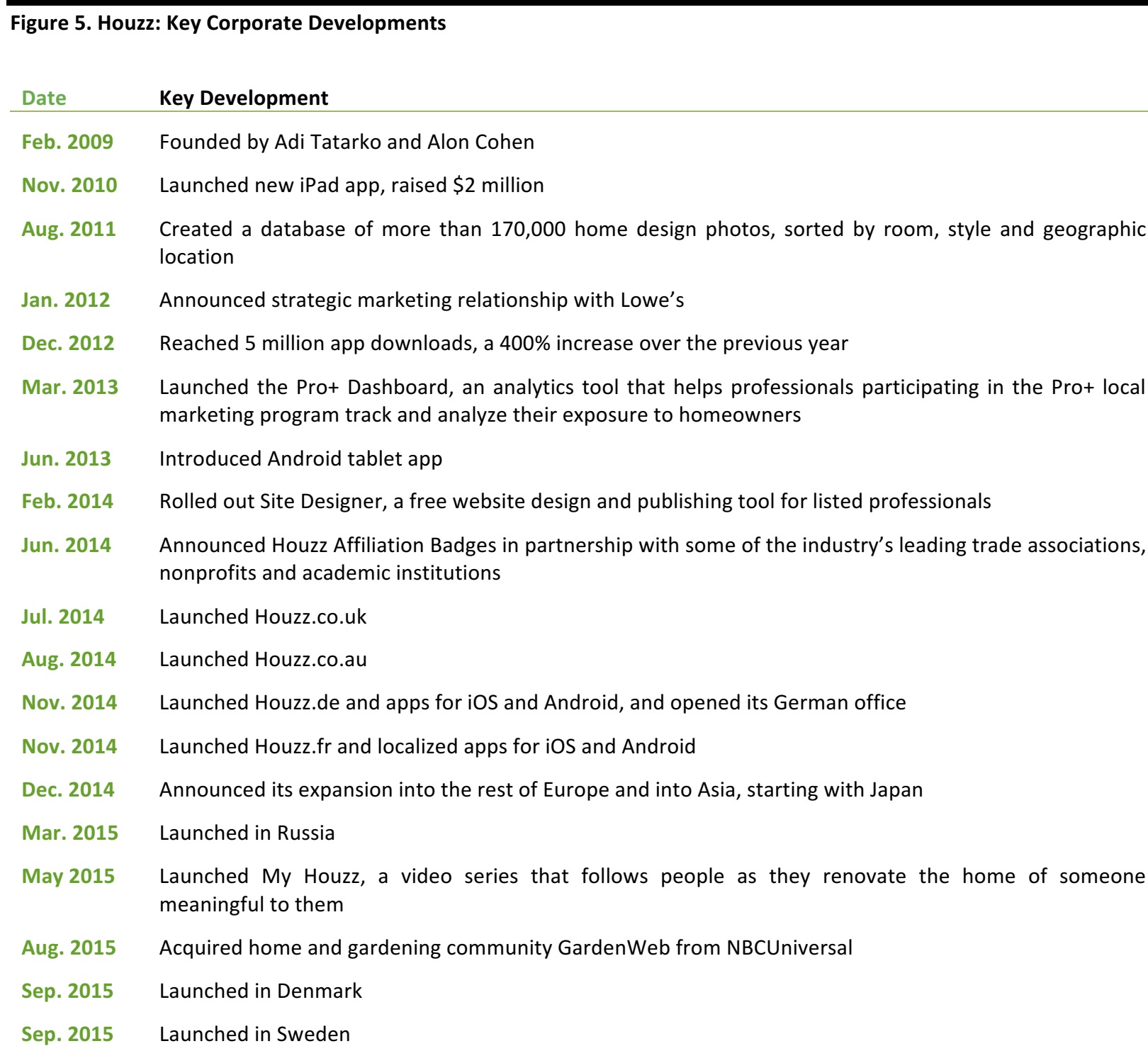

HOUZZ IS BECOMING A GLOBAL COMMUNITY FOR HOME RENOVATION

Five years after its launch, Houzz decided to expand internationally in 2014. Unlike other companies, Houzz expands to areas that already have a vocal Houzz community. During a keynote speech at the Israel Collaboration Network (ICON) 2nd annual meeting in October 2015, Adi Tatarko shared her ambition for international expansion. Houzz aspires to create a global community with localized services. So far, Houzz sites have attracted users from 200 countries. Its international offices account for about 35% of its revenues. The company has created localized websites and mobile apps, and it has physical offices in 15 international locations in Europe, Asia and the Pacific region outside of the US as of 1Q 2015. The sense of community is also reflected in Houzz’s corporate culture. The founders still interview every candidate before they are hired and share thank you letters from clients in company meetings.

Source: Company website and FBIC Research

Houzz is an online home remodeling community that connects homeowners with design inspirations and home professionals. Started in 2009 by Adi Tatarko and Alon Cohen, a young couple frustrated by the traditional ways of remodeling homes, the online platform has grown into a community of 35 million unique monthly users, including 80,000 active architects, designers, contractors and other home improvement professionals.

Houzz is an online home remodeling community that connects homeowners with design inspirations and home professionals. Started in 2009 by Adi Tatarko and Alon Cohen, a young couple frustrated by the traditional ways of remodeling homes, the online platform has grown into a community of 35 million unique monthly users, including 80,000 active architects, designers, contractors and other home improvement professionals.

Five years after its launch, Houzz decided to expand internationally in 2014. Unlike other companies, Houzz expands to areas that already have a vocal Houzz community. During a keynote speech at the Israel Collaboration Network (ICON) 2nd annual meeting in October 2015, Adi Tatarko shared her ambition for international expansion. Houzz aspires to create a global community with localized services. So far, Houzz sites have attracted users from 200 countries. Its international offices account for about 35% of its revenues. The company has created localized websites and mobile apps, and it has physical offices in 15 international locations in Europe, Asia and the Pacific region outside of the US as of 1Q 2015. The sense of community is also reflected in Houzz’s corporate culture. The founders still interview every candidate before they are hired and share thank you letters from clients in company meetings.

Five years after its launch, Houzz decided to expand internationally in 2014. Unlike other companies, Houzz expands to areas that already have a vocal Houzz community. During a keynote speech at the Israel Collaboration Network (ICON) 2nd annual meeting in October 2015, Adi Tatarko shared her ambition for international expansion. Houzz aspires to create a global community with localized services. So far, Houzz sites have attracted users from 200 countries. Its international offices account for about 35% of its revenues. The company has created localized websites and mobile apps, and it has physical offices in 15 international locations in Europe, Asia and the Pacific region outside of the US as of 1Q 2015. The sense of community is also reflected in Houzz’s corporate culture. The founders still interview every candidate before they are hired and share thank you letters from clients in company meetings.