CHIEF EXECUTIVE THE LATEST IN A RUN OF MANAGEMENT DEPARTURES

House of Fraser’s Chief Executive Officer, Nigel Oddy, has resigned, and will leave the company in the new year. Oddy had been CEO since early 2015, and his departure is the latest in a series of senior management changes. Chief Customer Officer, Andy Harding, left the business in May, and Supply Chain Director, Ray Kavanagh, is set to be the next to depart, according to

The Sunday Times.

The newspaper reported that House of Fraser’s management team had become frustrated at a reluctance by controlling firm Sanpower to inject cash into the business, and the owner’s lack of understanding of the retail market. China-based Sanpower acquired 89% of House of Fraser in 2014, when its Chairman, Yuan Yafei, reportedly pledged to invest £75 million in the department-store chain.

A House of Fraser spokesperson told

Retail Week, “Since the acquisition, Sanpower has committed to support House of Fraser in the event that the business development plans required them and the board had requested them. … Since the beginning of 2015, there has been no request from the board of House of Fraser as the business is self-funding through the bond issue last year and its own cash.”

Oddy’s departure comes after a weakening of performance at House of Fraser, following a period of robust top-line growth. In 1H17, the company reported comps of 0.9% (excluding Virgin Travel), a significant slowing from comps of 4.2% in the year ended January 30, 2016. In 1H17, EBITDA was down 88% year over year to £1.1 million; EBITDA was impacted by a £3.9 million decline in financial services income, due to the expiry of a financial services contract, in June 2015.

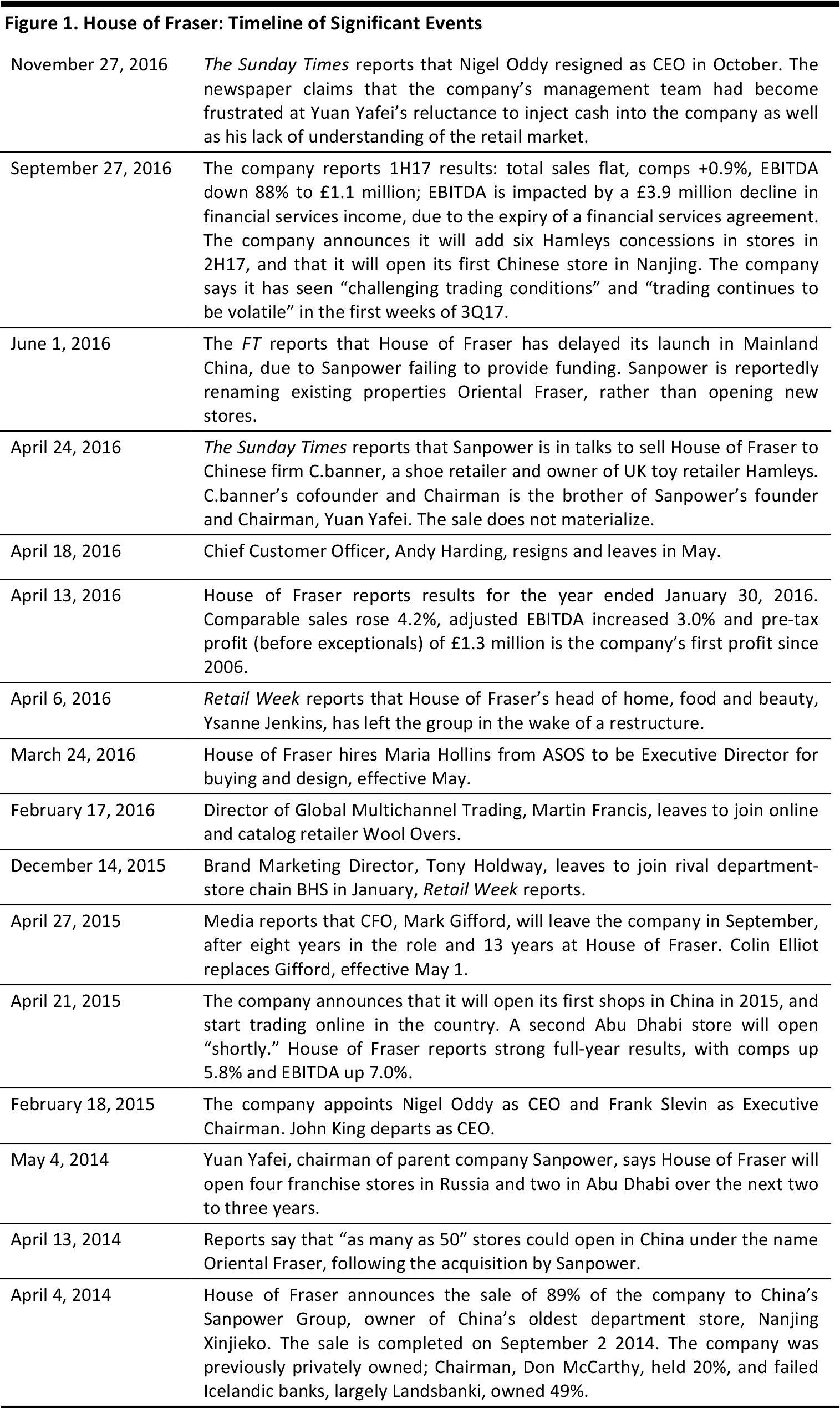

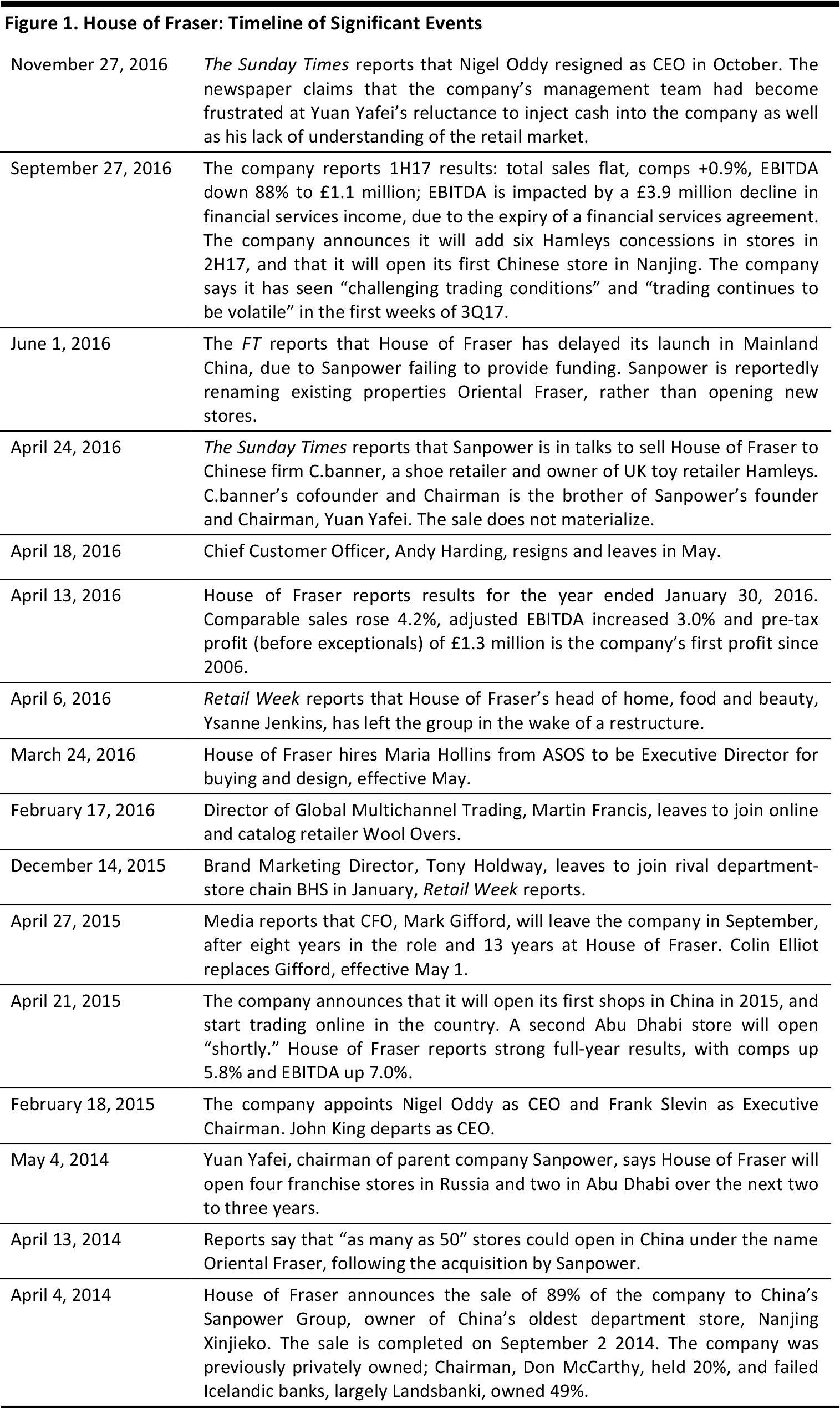

We provide a timeline of developments since the Sanpower acquisition below.

Source: Company reports

CHALLENGES FACING HOUSE OF FRASER

Among the challenges we perceive for the company are:

- A tough UK apparel market: In 2016, consumer spending on clothing and footwear has been the weakest in several years, as we have discussed in reports such as UK Apparel Malaise Signals A Shift In Consumer Spending Priorities.

- A reliance on promotions: Rivals Debenhams and Marks & Spencer are pulling back on price promotions, but House of Fraser has pushed discounts very heavily. As we noted in our recent report, Black Friday UK 2016: A Refocusing On Electronics, such is the scale of discounting at House of Fraser that this year’s Black Friday deals merged into other promotions, and it is possible that some promotions lacked credibility among shoppers.

- Pushing private labels at the expense of brands: House of Fraser has for several years been growing its private labels in terms of number of brands and the floor-space given to them. The push on private label has come at the expense of the branded offering, and we think this may have diminished House of Fraser’s appeal for some customers. In 1H17, private-label sales fell 3.7%, and Oddy told Retail Week that House of Fraser would trim the number of womenswear own-brand labels it offers and “reassert their value credentials.”

�