Hong Kong Grocery Market: An Overview

Hong Kong, with its 7.43-million-strongpopulation, has a very high daily demand for groceries and household necessities. The three major sources that fulfill this demand are:

- Traditional wet markets that supply mainly food items such as fresh produce, meat and live poultry. These markets serve residents in surrounding neighborhoods;

- Supermarket chains owned by large conglomerates, which offer a wide range of products such as staple food, snacks, beverages and household necessities; and,

- Independent grocery stores, which offer mostly basic items and not fresh produce. These are, typically, small in size and family-owned.

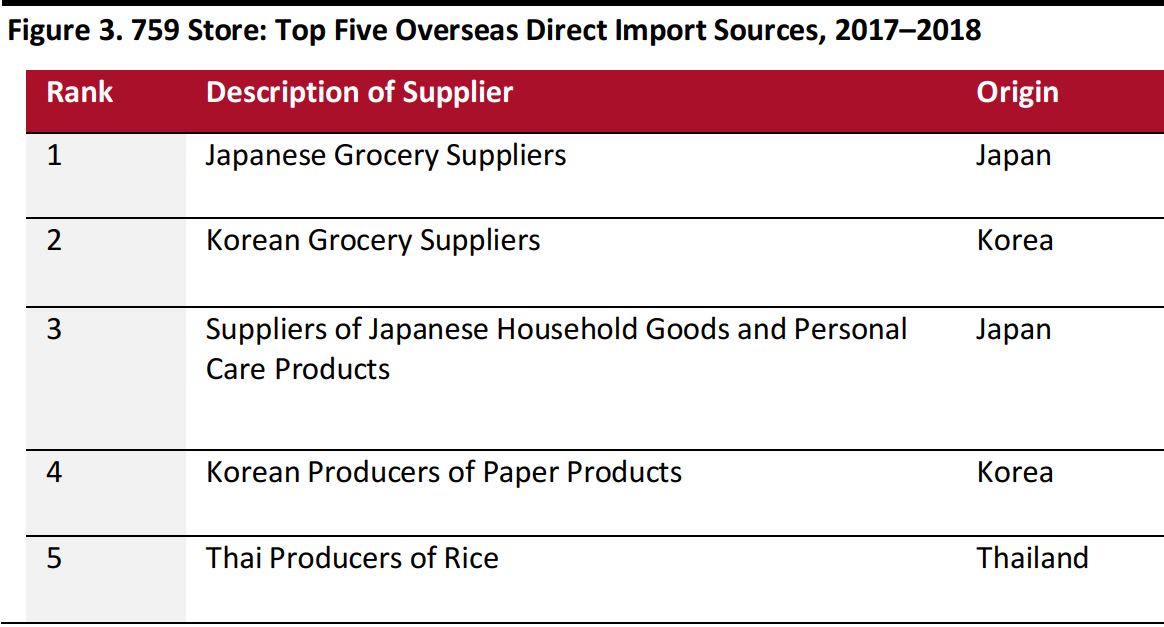

Supermarket chains, with their comprehensive range of offerings, area popular choice of Hong Kong’s citizens because they are one-stop shopping places where everything from food to household goods can be bought.Also, supermarket chains have a wide network of outlets and are therefore accessible for both spontaneous and planned shopping trips.

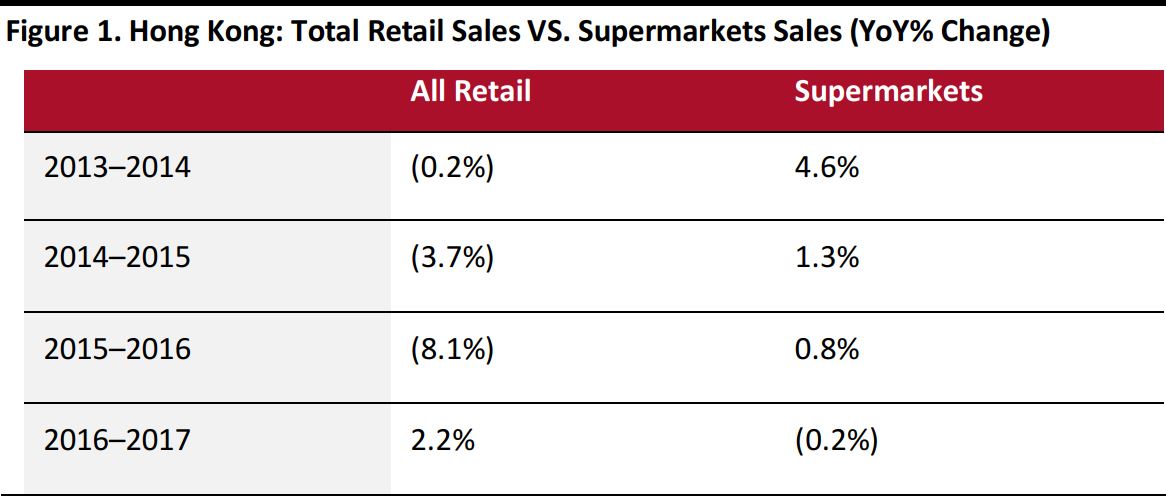

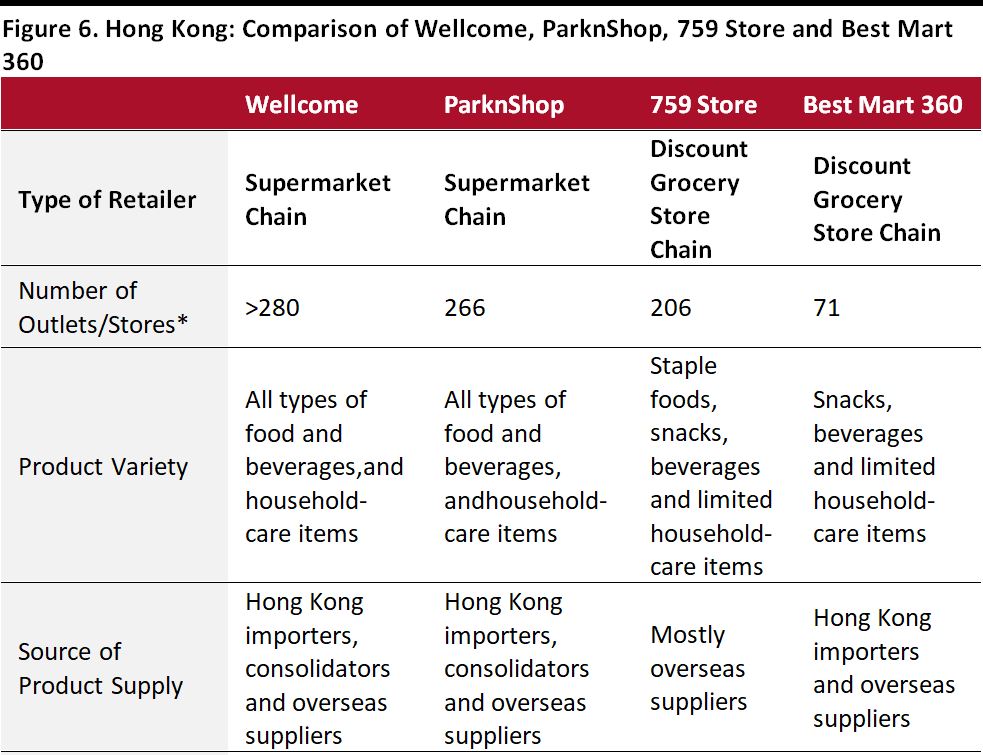

According to Hong Kong’s Census and Statistics Department, total retail sales in the city was HK$446 billion (US$57 billion) in 2017, of which supermarkets’ share was HK$52 billion (US$6.6 billion) or 11.7%. Supermarket sales grew at a rate of 6.5% in the five years from 2013 through 2017, much faster than the overall retail market which recorded a negative growth of 9.8% in the same period.

Source: Census and Statistics Department, Hong Kong/Coresight Research

Source: Census and Statistics Department, Hong Kong/Coresight Research

In terms of retails sales of food items, supermarkets have surpassed traditional wet markets. A 2016 USDA Foreign Agricultural Service report stated that food retail sales in supermarkets were exceeding sales in traditional wet markets since 1998.

In this report, we will take a look at:

- How Wellcome and ParknShop have been captured the lion’s share of Hong Kong’s grocery market.

- How two new players, 759 Store and Best Mart 360º, have emerged as challengers to the leading players.

The Two Giants and Their Duopoly

Dairy Farm International Holdings’ Wellcome and A.S. Watson Group’s ParknShop have long held the lion’s share of Hong Kong’s grocery market. The above mentioned 2016 USDA report revealed that these two chains accounted for approximately 75% of all grocery retail sales in Hong Kong in 2015. A 2013 report by the city’s Consumer Council stated that Wellcome and ParknShop accounted for 33.9% and 28.6%, respectively, of Hong Kong’s grocery market sales in that year.

A Wellcome outlet in Hong Kong

Source: Link Asset Management Limited

A Wellcome outlet in Hong Kong

Source: Link Asset Management Limited

A ParknShop outlet in Hong Kong

Source: Link Asset Management Limited

A ParknShop outlet in Hong Kong

Source: Link Asset Management Limited

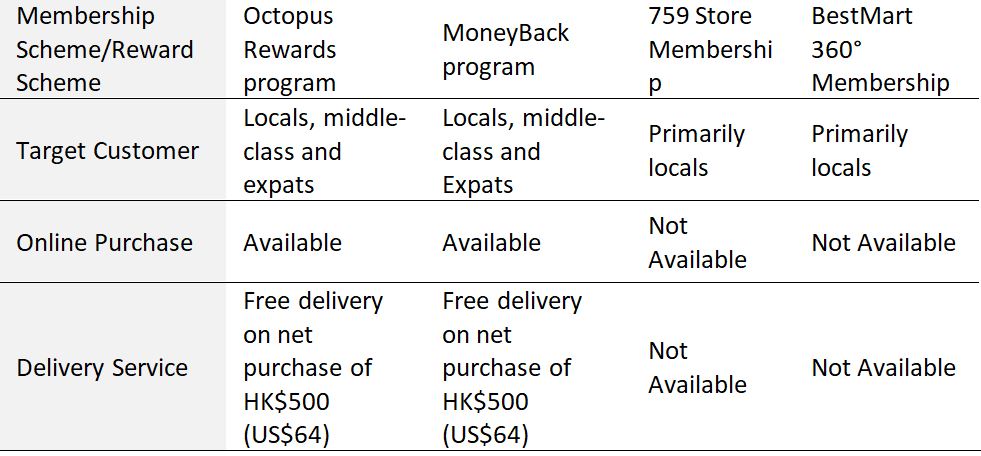

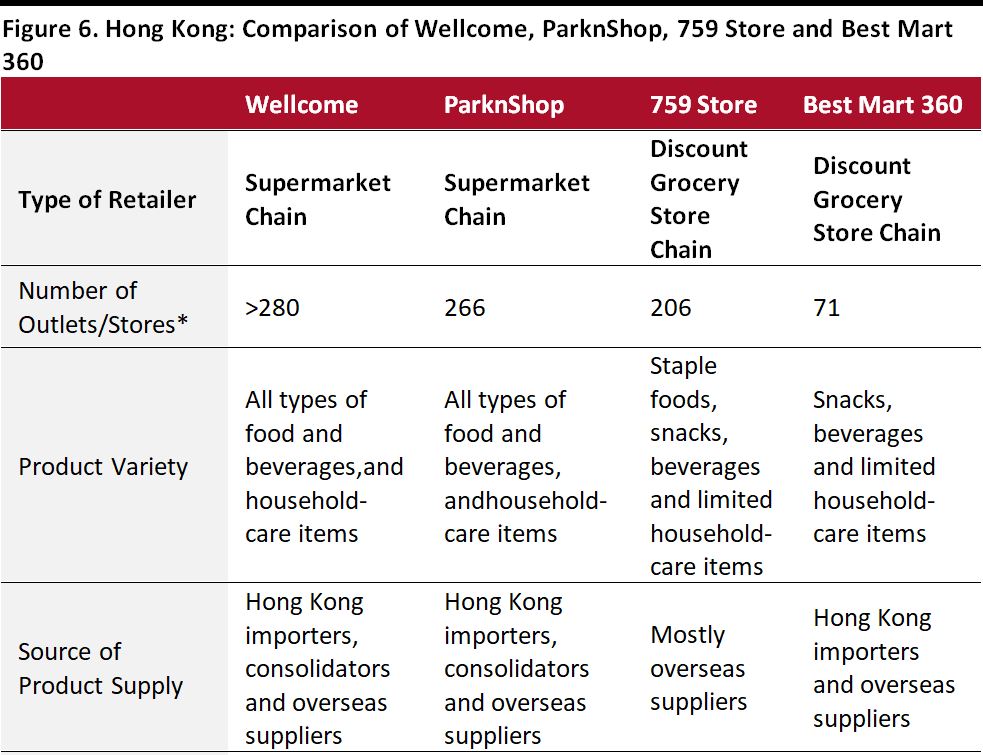

The substantial market share of the two big supermarket chains is reflected in the numbers of their outlets. Both have more than 200 outlets, far more than any other chains.

Source: Company websites/Coresight Research

Source: Company websites/Coresight Research

Wellcome and ParknShop enjoy economies of scale as their parent companies are both large conglomerates with multiple operations. Dairy Farm International Holdings owns the pharmacy chain Mannings, the catering group Maxim’s and operates 7-Elevenconvenience stores in the city. A.S. Watson, on the other hand, owns the pharmacy chain Watsons, the beverage brand Sunkist and the electronic-goods chain Fortress. Wellcome and ParknShop, therefore, enjoy economies of scale on account of their parent companies’ large-scale businesses.

Against this backdrop, the emergence of 759 Store and Best Mart 360º, and their success in gaining a foothold in Hong Kong’s grocery market is notable.

759 Store Emerges to Compete with the Supermarket Giants

Founded in 2010, 759 Store started competing with the supermarket duopoly by first:

- Offering low prices that results in quick turnover with lower profit margins; and,

- Selling unique Japanese and Korean snacks that Wellcome, ParknShop or other chains do not offer to the market.

And then, it:

- Expanded into the staple food category and developed private labels; and,

- Launched a membership scheme to enhance customer loyalty.

A 759 Store outlet in Hong Kong

Source: Company website

A 759 Store outlet in Hong Kong

Source: Company website

The strategies of the chain are detailed below.

Low Prices

759 Store’s achieves high turnover with lower margins. The Coresight Research team visited 759 Store, ParknShop and Wellcome outlets on September 27 and our spot-checks confirmed 759 Store’s highly attractive prices. For example, we found that the price of a 408-ml bottle of Tai Wo Soybean Milk was HK$6 (US$0.77) at 759 Store, HK$7.2 (US$0.92) at ParknShop and HK$8 (US$1.02) at Wellcome.

Tai Wo Soybean Milk

Source: Coresight Research

Tai Wo Soybean Milk

Source: Coresight Research

Selling Unique Japanese and Korean Snacks

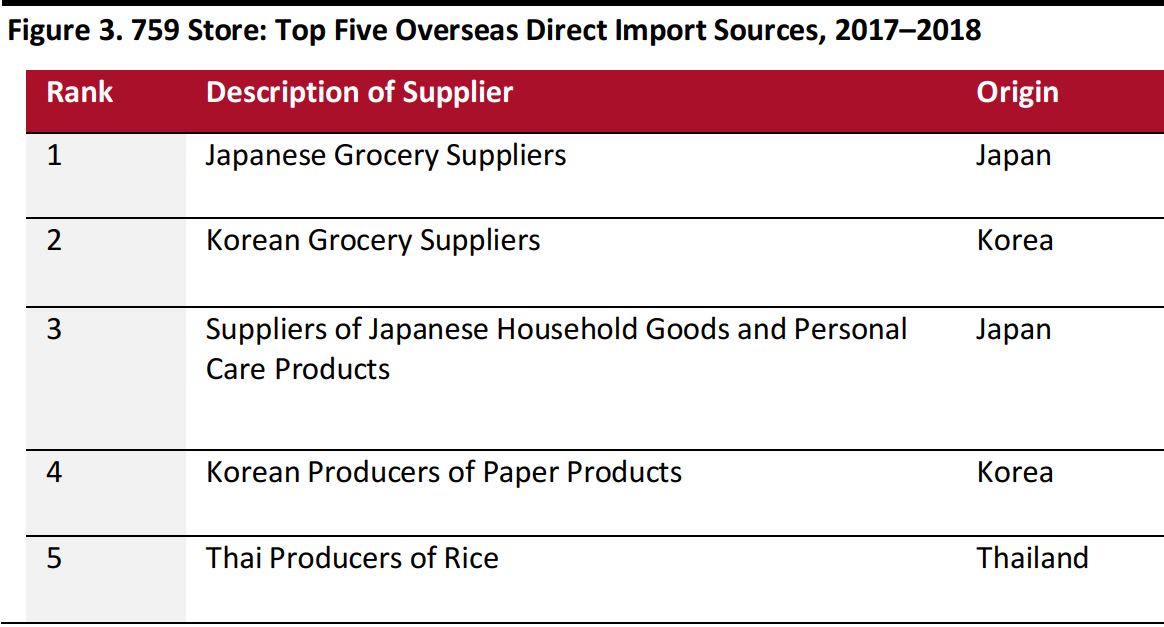

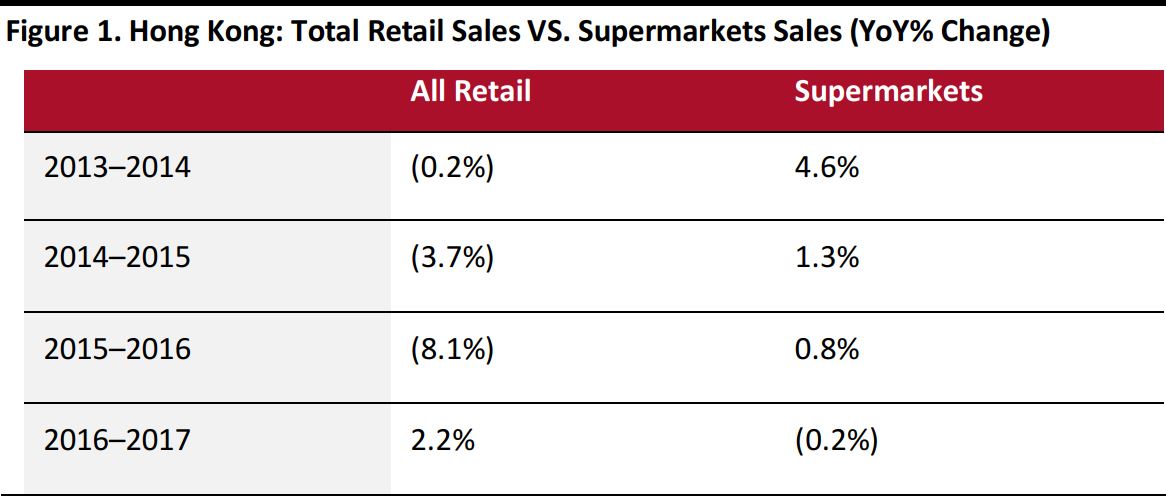

759Store started by selling snacks and beverages, especially those from Japan and South Korea. However, its low prices strained its relationship with local distributors and suppliers. In a bid to maintain its pricing autonomy, 759 Store adopted a self-import approach and started procuring products directly from overseas, and Japan was the first country from where it started importing unique snack products.

759 Store continued its merchandising activities in Japan even when many merchants had stopped sourcing from the country following the 2011 Tohoku earthquake and tsunami, and that resulted in the company’s close ties with Japanese suppliers and distributors. The chain then proceeded to establish partnerships with more suppliers in Japan, South Korea, Europe and Thailand, building an extensive overseas supplier network. Its reliance on local suppliers has reduced significantly over time and, currently,Japan and South Korea are the chain’s largest product supply sources.

According to the 2018 Annual Results Announcement of CEC International, more than 80% of 759 Store’s products were procured directly from overseas, of which Japan and South Korea accounted for nearly 50%. 759 Store had only three local supplier partners in the last fiscal year.

Source: Company reports

Source: Company reports

The strategy of self-importing ensures a steady supply of 759 Store’s products from overseas suppliers and has made it a renowned Japanese and Korean snacks retailer. Many of the Japanese and Korean snacks available at 759 Store outlets are not available anywhere else in Hong Kong and this product differentiation has been successful in attracting customers.

Hot-selling snacks from Japan that are sold at 759 Stores: White Peach Jelly, Grape Jelly, Corn Potage Snack

Source: 759store.com

Hot-selling snacks from Japan that are sold at 759 Stores: White Peach Jelly, Grape Jelly, Corn Potage Snack

Source: 759store.com

Expanded into Staple Food Category and Private Labels

759 Store has widened its offerings to include staple foods such as rice, noodles, cooking oil and seasonings. It also began developing private labels to boost revenues.

759 Store has been actively developing its staple food category in recent years with promising results. As stated in the 2017 annual report of CEC International, Thailand Jasmine Rice recorded the highest sales growth in fiscal 2017 and peripheral rice products such as rice noodles and rice bran oil were the chain’s bestsellers in the same year.

Private labels have contributed considerably to the chain’s revenues.The company sources merchandise from reputed manufacturers in China and South Korea to produce its branded products, which include frozen food, and household and personal-care items. CEC International’s annual report for 2018 states that revenue generated from sales of self-built or private-label products amounted to 31.5% of 759 Store’s total revenues in fiscal 2018.

Private label products of 759 Store: Fresh Udon, Bamboo Facial Tissues

Source: 759store.com

Private label products of 759 Store: Fresh Udon, Bamboo Facial Tissues

Source: 759store.com

Membership Scheme

759 Store has a membership scheme that offers discounts to customers.In our September 27 visits to 759 Store, Wellcome and ParknShop outlets, we saw that members of 759 Store could buy a pack of De-ma-e instant noodles (sesame oil) for an average price of HK$4.1 (US$0.52) while non-members had to pay HK$5.4 (US$0.69). The same product sold for HK$4.4 (US$0.56) per pack on average at Wellcome and ParknShop.

There are currently 1.2 million active 759 Store members, which means that one in every seven Hong Kong citizens is the chain’s regular customer.

A pack of De-ma-e instant noodles (sesame oil)

Source: Ztore.com

A pack of De-ma-e instant noodles (sesame oil)

Source: Ztore.com

Best Mart 360° Joins to Heat Up the Competition

Best Mart 360º, founded in 2013, is another successful grocery store chain in Hong Kong. The chain, which sells a mix of snack, beverage and house hold-care items, has applied for an IPO at The Hong Kong Stock Exchange. According to its prospectus filed in June 2018, Best Mart 360º revenues were HK$1.08 billion (US$138 million) for the year ended March 31, 2018. Currently, the chain operates 71 stores.

A Best Mart 360° outlet in Hong Kong

Source: Hong Kong Tourism Board

A Best Mart 360° outlet in Hong Kong

Source: Hong Kong Tourism Board

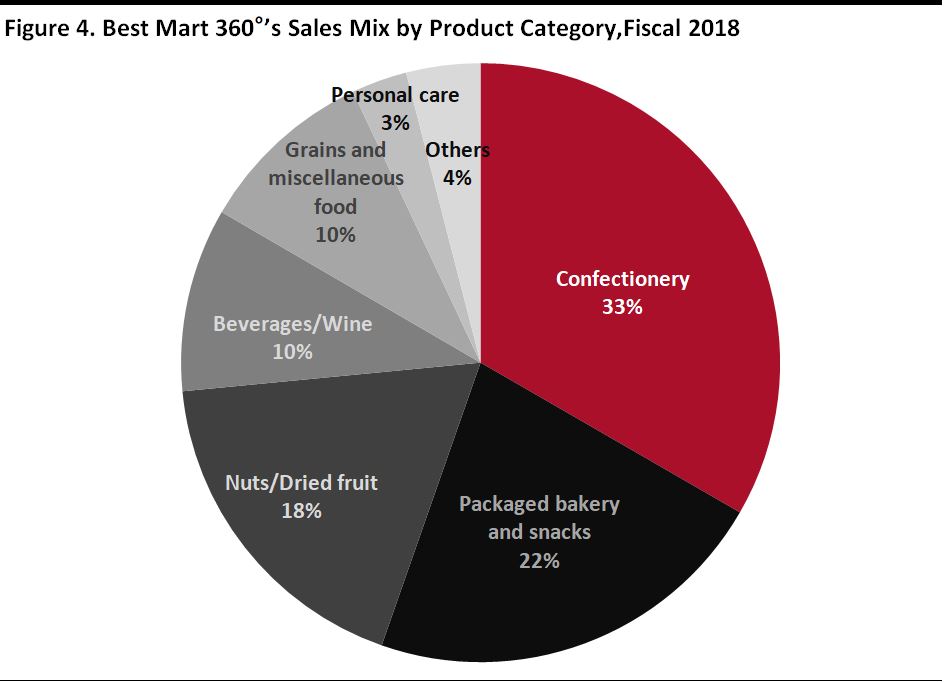

Focus on Confectionery and Packaged Snacks as Key Products

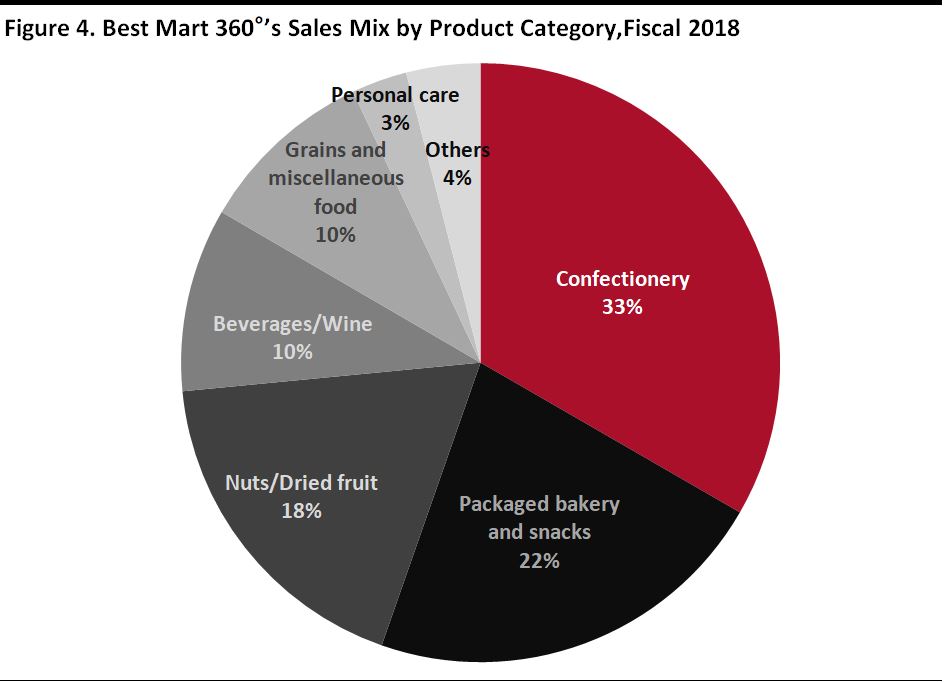

Best Mart 360° mainly sells confectionery and snacks items along with a few household care items.

According to the company’s prospectus filed at The Hong Kong Stock Exchange, confectionery sales accounted for HK$358 million (US$45.7 million) in the year ended March 31, 2018, which is 33% of Best Mart 360°’s total revenues in the same fiscal.

Source: Application Proof of Best Mart 360 Holdings Limited

Source: Application Proof of Best Mart 360 Holdings Limited

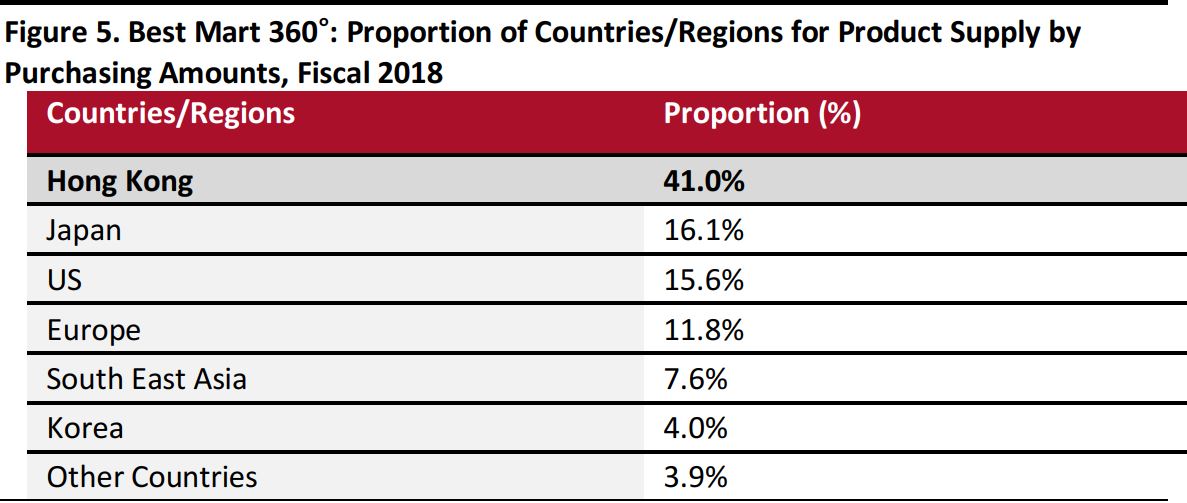

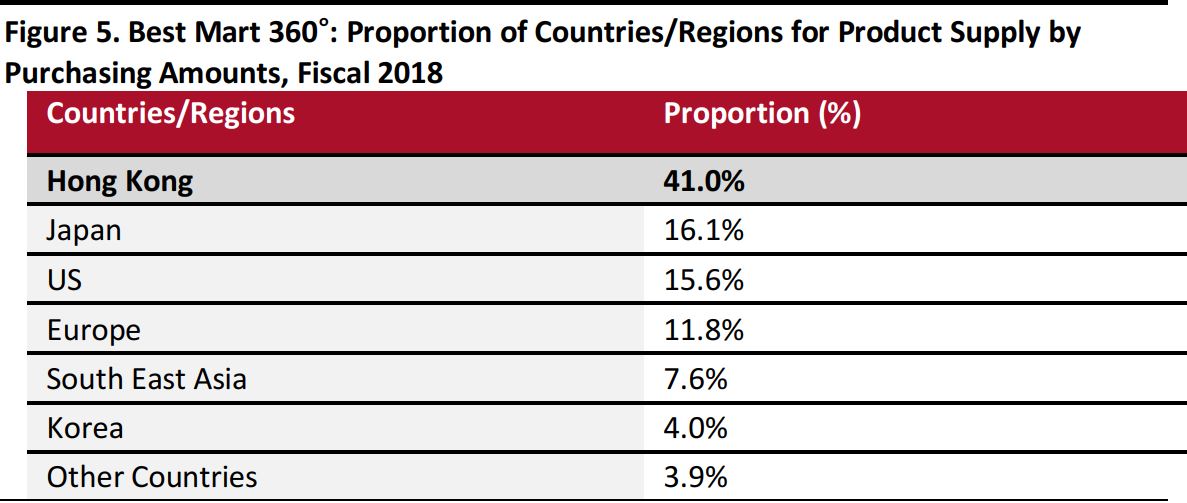

Sourcing Merchandise from Both Local and Overseas Suppliers

Best Mart 360° maintains a balanced profile of local and overseas suppliers and the chain relies mainly on parallel imports for its products procured from overseas. In the year ended March 31, 2018, Best Mart 360° purchased 41% of its products from importers in Hong Kong, and Japan (at 16.1%) and the US (at 15.6%) were its largest overseas supply sources.

Source: Application Proof of Best Mart 360 Holdings Limited

Source: Application Proof of Best Mart 360 Holdings Limited

Membership Scheme

In 2015, Best Mart 360° launched its membership scheme. The scheme offers many incentives and promotional offers (such as reward points and special prices for members) and the chain currently has approximately 880,000 members. Revenues from Best Mart 360° members as a proportion of the chain’s total revenue has grown significantly over the past three years, and were 17.3%, 25.8% and 40.3% for the years ending March 31, 2016, 2017 and 2018, respectively, according to its IPO prospectus.

Best Mart 360°’s September issue of discount items for members

Source: Bestmart360.com

Best Mart 360°’s September issue of discount items for members

Source: Bestmart360.com

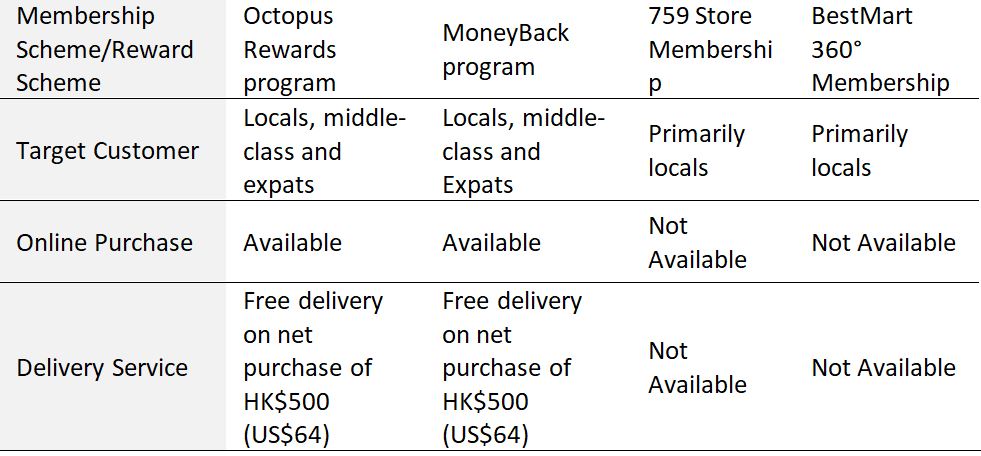

Source: Company websites/Coresight Research

*Number of outlets/stores was based on the latest available figures from the respective retailers as of the date of this report.

Source: Company websites/Coresight Research

*Number of outlets/stores was based on the latest available figures from the respective retailers as of the date of this report.

Key Takeaways

Supermarket chains are an integral part of the daily lives of Hong Kong citizens as they offer a convenient and comfortable shopping environment. Wellcome and ParknShop currently hold major shares of Hong Kong’s grocery market, making it difficult for new entrants to compete.

759 Store and Best Mart 360° are two new entrants in Hong Kong’s grocery market that are emerging as alternatives to the two giants but their product ranges are much limited cannot be compared with either Wellcome’s or ParknShop’s. Even though the new entrants have been carefully strategizing their expansions, the notoriously high real-estate rents and prices in Hong Kong might prove to be a hindrance to their expansion.

Source: Census and Statistics Department, Hong Kong/Coresight Research

Source: Census and Statistics Department, Hong Kong/Coresight Research A Wellcome outlet in Hong Kong

Source: Link Asset Management Limited

A Wellcome outlet in Hong Kong

Source: Link Asset Management Limited A ParknShop outlet in Hong Kong

Source: Link Asset Management Limited

A ParknShop outlet in Hong Kong

Source: Link Asset Management Limited Source: Company websites/Coresight Research

Source: Company websites/Coresight Research A 759 Store outlet in Hong Kong

Source: Company website

A 759 Store outlet in Hong Kong

Source: Company website Tai Wo Soybean Milk

Source: Coresight Research

Tai Wo Soybean Milk

Source: Coresight Research Source: Company reports

Source: Company reports Hot-selling snacks from Japan that are sold at 759 Stores: White Peach Jelly, Grape Jelly, Corn Potage Snack

Source: 759store.com

Hot-selling snacks from Japan that are sold at 759 Stores: White Peach Jelly, Grape Jelly, Corn Potage Snack

Source: 759store.com Private label products of 759 Store: Fresh Udon, Bamboo Facial Tissues

Source: 759store.com

Private label products of 759 Store: Fresh Udon, Bamboo Facial Tissues

Source: 759store.com A pack of De-ma-e instant noodles (sesame oil)

Source: Ztore.com

A pack of De-ma-e instant noodles (sesame oil)

Source: Ztore.com A Best Mart 360° outlet in Hong Kong

Source: Hong Kong Tourism Board

A Best Mart 360° outlet in Hong Kong

Source: Hong Kong Tourism Board Source: Application Proof of Best Mart 360 Holdings Limited

Source: Application Proof of Best Mart 360 Holdings Limited  Source: Application Proof of Best Mart 360 Holdings Limited

Source: Application Proof of Best Mart 360 Holdings Limited Best Mart 360°’s September issue of discount items for members

Source: Bestmart360.com

Best Mart 360°’s September issue of discount items for members

Source: Bestmart360.com

Source: Company websites/Coresight Research

*Number of outlets/stores was based on the latest available figures from the respective retailers as of the date of this report.

Source: Company websites/Coresight Research

*Number of outlets/stores was based on the latest available figures from the respective retailers as of the date of this report.