Hong Kong Retail Sales Gain Momentum

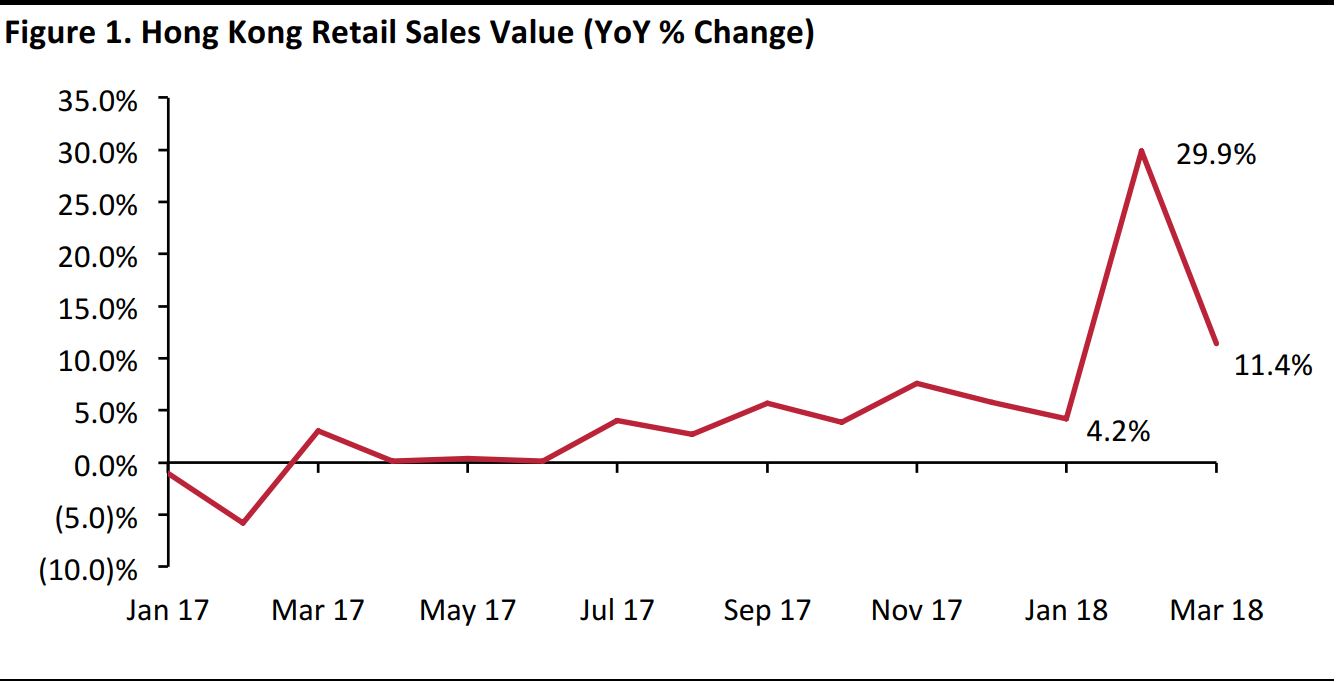

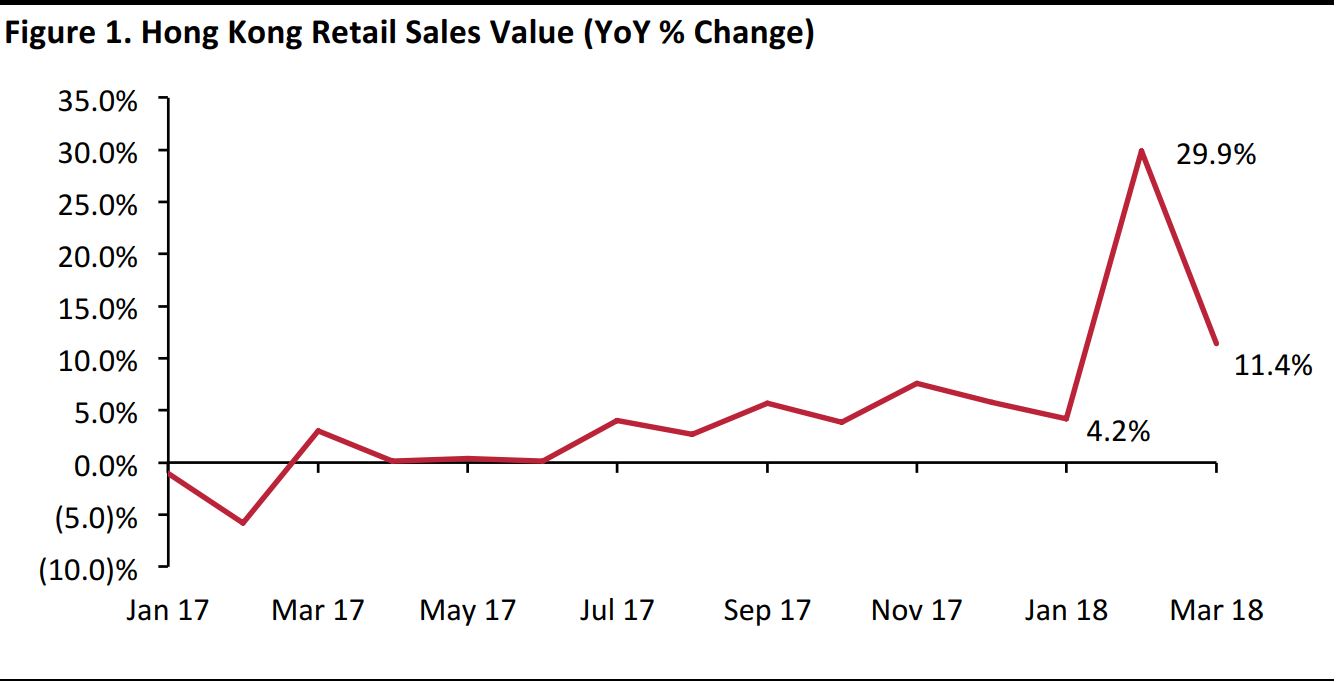

The Hong Kong Census and Statistics Department provisionally estimates the value of total retail sales in March 2018 at HK$39.8 billion, an increase of 11.4% year over year. In the first quarter, retail sales reached HK$129.9 billion, up by 14.3% over the same period in 2017. Retail sales peaked at HK$494 billion in 2013, followed by a period of contraction. The decline began to taper off beginning in 2017, and we are now seeing signs of momentum picking up.

Source: HK Census and Statistics Department

Source: HK Census and Statistics Department

Source: Hong Kong Census and Statistics Department

Source: Hong Kong Census and Statistics Department

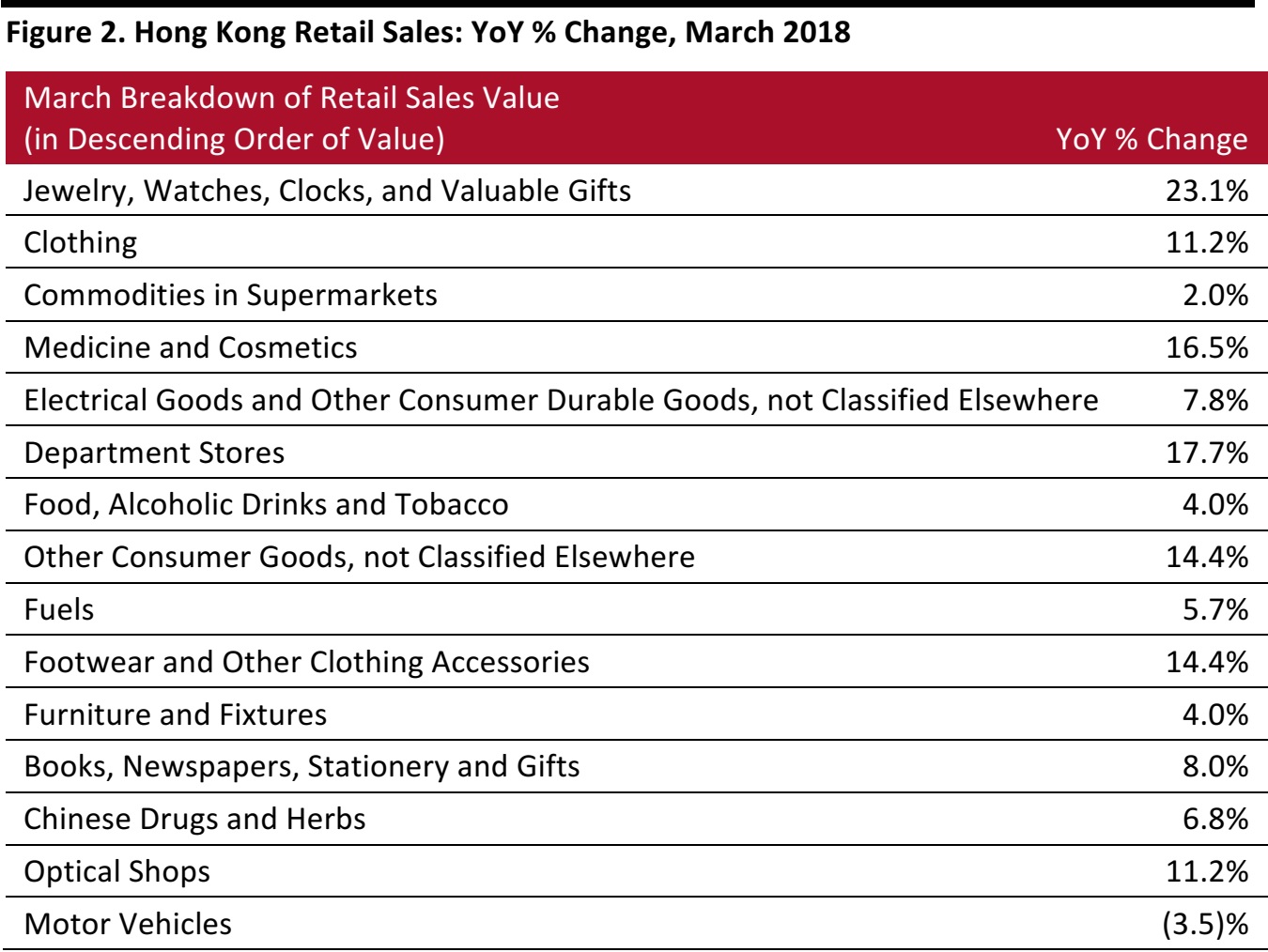

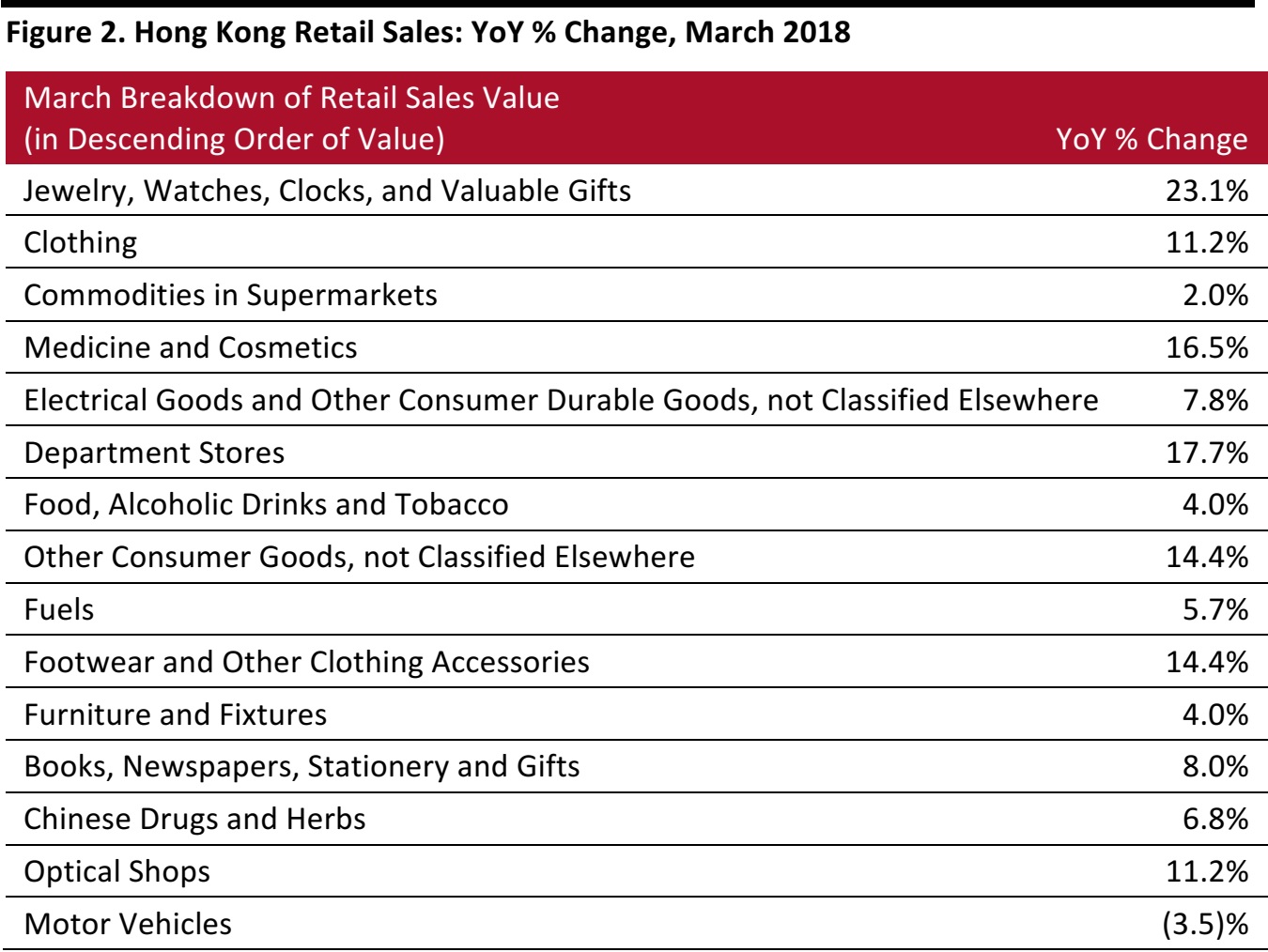

A breakdown of retail sales by category, shows that those categories heavily influenced by tourism saw a significant rise: sales of jewelry, watches, clocks and valuable gifts increased by 23.1% year over year, medicine and cosmetics rose by 16.5% year over year and department stores climbed by 17.7% year over year.

The strength of leading retailers in specific categories also supports the current trend. In the first quarter, retail sales for Chow Tai Fook Jewellery Group rose by 11.0% year over year in Hong Kong and Macau, due to a recovery in tourist arrivals. Cosmetics chain Sa Sa International also reported a 17.8% increase in turnover in Hong Kong and Macau in the first quarter, and the company was optimistic about the outlook for the retail market. International brands, including L’Oréal and Hugo Boss, saw strong momentum in the Hong Kong and China market, attributing the strong quarter to the popularity of iconic brands among Chinese consumers.

Increase in Visitor Arrivals

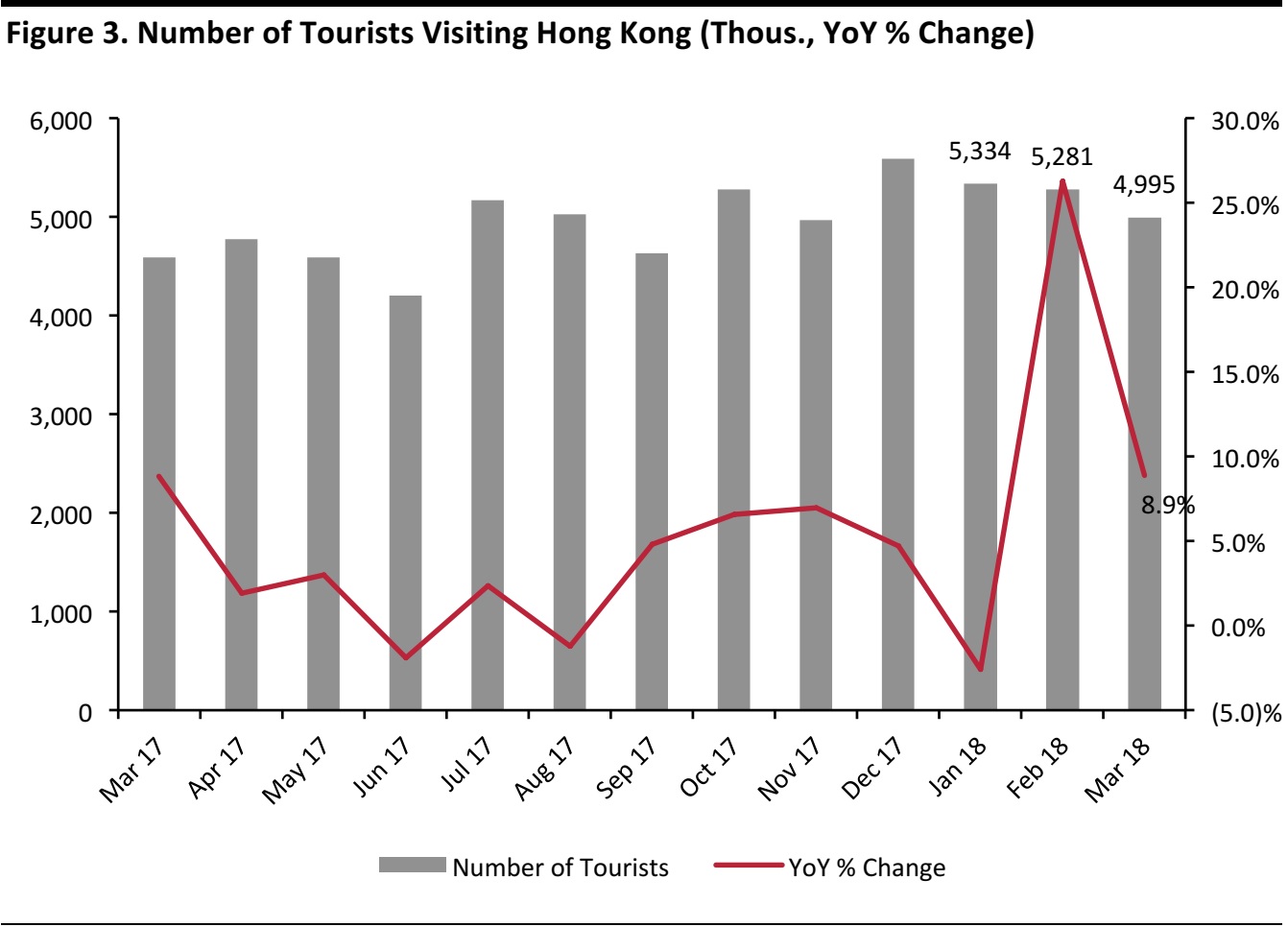

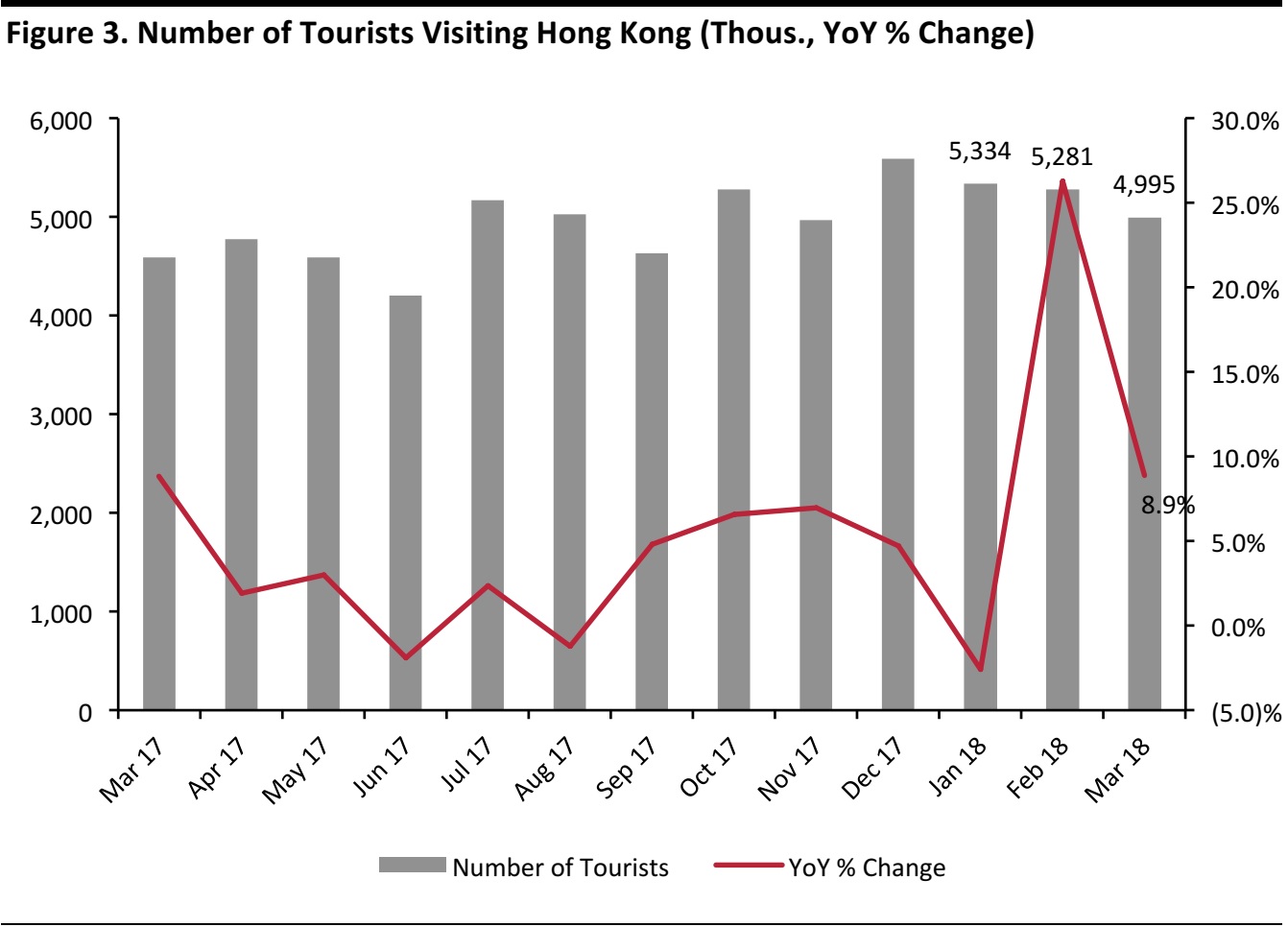

The strong performance in retail sales was buttressed by the continued increase in visitor arrivals in the first quarter of 2018, with a significant pickup in corresponding retail categories. According to the Hong Kong Tourism Board and data from the Hong Kong Census and Statistics Department, more than 15 million tourists visited the city in the first quarter, up by 9.6% year over year. Tourists from Mainland China, which account for over 70% of all tourists, rose by 12.6% year over year. This increase in visitor arrivals resonates with the strong performance in jewelry, cosmetics and department stores, which are popular among tourists.

Source: Hong Kong Census and Statistics Department

Source: Hong Kong Census and Statistics Department

Anti-Corruption Campaign Has Led to More Sustained Retail Growth in Hong Kong

The strong pickup in tourists’ spending in Hong Kong follows the sweeping anti-corruption campaign in China over the past few years, led by President Xi Jinping. “In the past, it was not uncommon to see Mainland Chinese shoppers snap up watches worth a couple of hundred thousand dollars as gifts,” according to Thomson Cheng, Chairman of the Hong Kong Retail Management Association. However, the anti-corruption campaign has decreased this type of purchase and Cheng expects that the pickup in retail sales will likely evolve into more sustained retail growth, as sales are now less dependent on luxury transactions and more dependent on value-for-money items. Purchases by tourists are now mainly for personal use compared to before the campaign when luxury products were popular gift items.

Outlook

The government expects the retail sales outlook to remain sanguine in the near term, given the positive employment and earnings prospects, and buoyant inbound tourism. Retail sales, which declined sharply back in 2014, because of the economic downturn and the anti-corruption campaign in China, have since rebounded, albeit slowly. We expect this upward trend to continue and, if the favorable conditions persist, we believe sales could break the HK$494 billion annual record set in 2013 in three years’ time.

Source: HK Census and Statistics Department

Source: HK Census and Statistics Department Source: Hong Kong Census and Statistics Department

Source: Hong Kong Census and Statistics Department Source: Hong Kong Census and Statistics Department

Source: Hong Kong Census and Statistics Department