Nitheesh NH

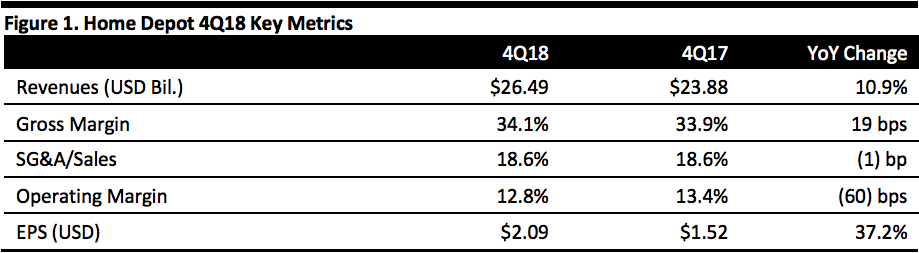

[caption id="attachment_78129" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

Home Depot reported 4Q18 revenues of $26.49 billion, slightly the $26.58 billion consensus estimate.

The quarter comprised 14 weeks, compared to 13 weeks in the year-ago quarter, which contributed an additional $1.7 billion to the quarter’s and year’s sales.

Online sales grew 22.7% in the quarter.

Comps were up 3.2%, missing the 4.5% consensus estimate, consisting of a 2.3% higher average ticket a 0.9% increase in the number of comp transactions. US comps were up 3.7%.

EPS was $2.09, up 37.2% and beating the $2.16 consensus estimate (when adding back a $0.16 charge for the impairment of certain trade names at Interline Brands.)

FY18 Results

Home Depot reported FY18 revenues of $108.2 billion, up 7.2%.

Comps increased 5.2% globally and 5.4% in the US.

Online sales grew 24.1% and accounted for 7.9% of sales for the year.

EPS was $9.73, up 33.5% (including the above $0.16 per share charge in 4Q18).

Management characterized progress in the year as very positive, based on the investments specified in December 2017. During the year, the company focused on enhancing its interconnected retail experience, providing localized and innovative products and delivering a high level of productivity.

Details from the Quarter and Year

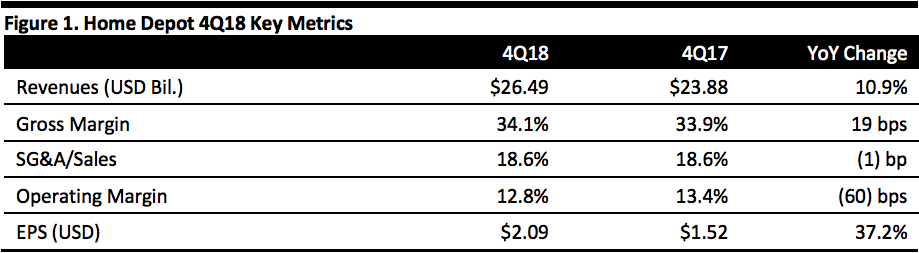

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Home Depot reported 4Q18 revenues of $26.49 billion, slightly the $26.58 billion consensus estimate.

The quarter comprised 14 weeks, compared to 13 weeks in the year-ago quarter, which contributed an additional $1.7 billion to the quarter’s and year’s sales.

Online sales grew 22.7% in the quarter.

Comps were up 3.2%, missing the 4.5% consensus estimate, consisting of a 2.3% higher average ticket a 0.9% increase in the number of comp transactions. US comps were up 3.7%.

EPS was $2.09, up 37.2% and beating the $2.16 consensus estimate (when adding back a $0.16 charge for the impairment of certain trade names at Interline Brands.)

FY18 Results

Home Depot reported FY18 revenues of $108.2 billion, up 7.2%.

Comps increased 5.2% globally and 5.4% in the US.

Online sales grew 24.1% and accounted for 7.9% of sales for the year.

EPS was $9.73, up 33.5% (including the above $0.16 per share charge in 4Q18).

Management characterized progress in the year as very positive, based on the investments specified in December 2017. During the year, the company focused on enhancing its interconnected retail experience, providing localized and innovative products and delivering a high level of productivity.

Details from the Quarter and Year

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Home Depot reported 4Q18 revenues of $26.49 billion, slightly the $26.58 billion consensus estimate.

The quarter comprised 14 weeks, compared to 13 weeks in the year-ago quarter, which contributed an additional $1.7 billion to the quarter’s and year’s sales.

Online sales grew 22.7% in the quarter.

Comps were up 3.2%, missing the 4.5% consensus estimate, consisting of a 2.3% higher average ticket a 0.9% increase in the number of comp transactions. US comps were up 3.7%.

EPS was $2.09, up 37.2% and beating the $2.16 consensus estimate (when adding back a $0.16 charge for the impairment of certain trade names at Interline Brands.)

FY18 Results

Home Depot reported FY18 revenues of $108.2 billion, up 7.2%.

Comps increased 5.2% globally and 5.4% in the US.

Online sales grew 24.1% and accounted for 7.9% of sales for the year.

EPS was $9.73, up 33.5% (including the above $0.16 per share charge in 4Q18).

Management characterized progress in the year as very positive, based on the investments specified in December 2017. During the year, the company focused on enhancing its interconnected retail experience, providing localized and innovative products and delivering a high level of productivity.

Details from the Quarter and Year

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Home Depot reported 4Q18 revenues of $26.49 billion, slightly the $26.58 billion consensus estimate.

The quarter comprised 14 weeks, compared to 13 weeks in the year-ago quarter, which contributed an additional $1.7 billion to the quarter’s and year’s sales.

Online sales grew 22.7% in the quarter.

Comps were up 3.2%, missing the 4.5% consensus estimate, consisting of a 2.3% higher average ticket a 0.9% increase in the number of comp transactions. US comps were up 3.7%.

EPS was $2.09, up 37.2% and beating the $2.16 consensus estimate (when adding back a $0.16 charge for the impairment of certain trade names at Interline Brands.)

FY18 Results

Home Depot reported FY18 revenues of $108.2 billion, up 7.2%.

Comps increased 5.2% globally and 5.4% in the US.

Online sales grew 24.1% and accounted for 7.9% of sales for the year.

EPS was $9.73, up 33.5% (including the above $0.16 per share charge in 4Q18).

Management characterized progress in the year as very positive, based on the investments specified in December 2017. During the year, the company focused on enhancing its interconnected retail experience, providing localized and innovative products and delivering a high level of productivity.

Details from the Quarter and Year

- 2018 set new records in terms of revenues and earnings for the company.

- Comps were slightly below the company’s expectations due to unfavorable weather (cold, snow and rain).

- On an international basis, Mexico recorded another quarter of positive comps, and Canada was flat.

- The quarter also faced a difficult comparison, since the year-ago quarter recorded $400 million in one-time hurricane-related sales.

- During the quarter, the company announced a consolidated platform for its professional customers called Home Depot Pro, and more than 100,000 customers have already been onboarded. The company expects to roll out the platform to more than one million professional customers in 2019.

- More than 50% of US orders are repicked up in stores, so the company is adding automated lockers in stores to make pickup simpler and easier. The company has 1,000 stores with lockers, with more to be added in 2019. Some 94% of customers rate the lockers five out of five stars.

- As part of its investment program, 40% of Home Depot stores feature a new look and feel.

- In Q4, comps for tools, appliances, decor, indoor garden, building materials, outdoor garden, hardware and paint were above the company average. Comps were also positive for electrical plumbing, flooring, millwork and kitchen and, but below the company average. Lighting and lumber reported low to mid-single-digit negative comps primarily due to price deflation.

- Lumber prices fell during the third and fourth quarter, hurting average ticket growth by 41 bps in Q4, and prices are now 25% below the price a year ago. However, this deflation was mostly offset by inflation in other core commodity categories, with the net effect of hurting average ticket by 8 bps in the quarter.

- Large-ticket transactions over $1,000, which represent 20% of sales, increased 4.8% in the quarter. Headwinds to big-ticket purchases include unexpected wet weather in the US and last year’s hurricane-related sales. Excluding the hurricane effect, big-ticket comps were up double digits. Big-ticket categories such as vinyl plant flooring, roofing and appliances all posted comps above the company average in fourth quarter.

- The company recorded growth among its Pro and do-it-yourself (DIY) customers in the quarters, and Pro comps were higher than the company average. Pro categories such as power tools, water heaters and commercial and industrial lighting were strong. DIY categories such as hard window coverings, safety and security and cleaning were strong in the quarter.

- Comps of 5.0%.

- Sales growth of 3.3% to $111.77 billion, in line with consensus.

- The addition of net five new stores.

- Gross margins of 34.0%.

- Operating margins of 14.4%.

- EPS of $10.03, below the $10.26 consensus estimate.

- Capital spending of $2.7 billion.

- Sales of $115-120 billion (up 2.9%-7.4%).

- Operating margins of 14.4-15.0%.

- Return on invested capital of at least 40%.