DIpil Das

[caption id="attachment_95032" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

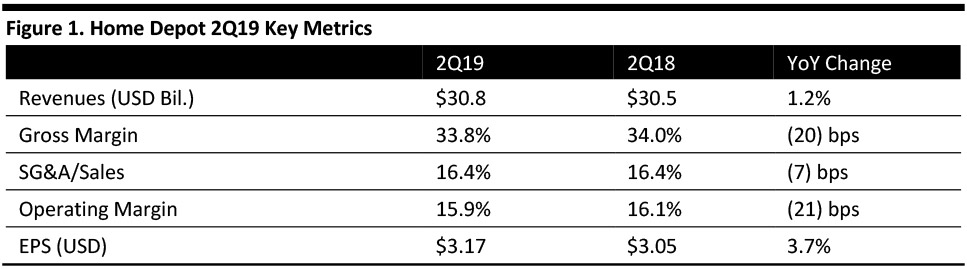

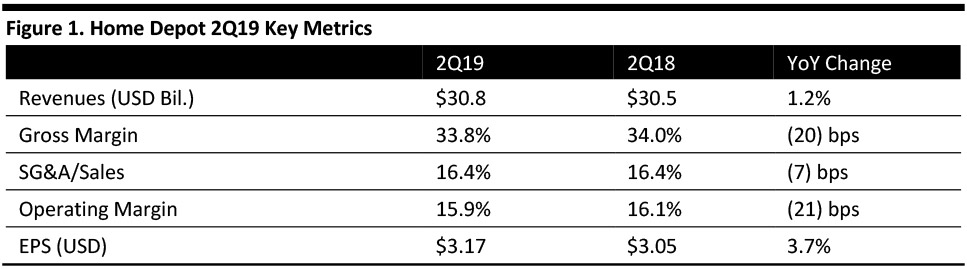

Home Depot reported 2Q19 revenues of $30.8 billion, up 1.2% year over year and marginally below the $31.0 billion consensus estimate.

Gross margin came in at 33.8%, a decrease of 20 basis points. EPS was $3.17, a rise of 3.7% against the year-ago quarter and ahead of the consensus estimate of $3.09.

Total company comps were positive at 3.0% for the quarter, below the consensus of 3.3% while US comps rose 3.1%.

Details from the Quarter

Management stated the primary reason for the difference between sales growth and comparable sales performance was a shift in the fiscal calendar base, as a result of 53 weeks of sales in fiscal 2018 versus 52 in fiscal 2019.

Craig Menear, Chairman, CEO and President said: “We were pleased with our results as we delivered accelerating comp performance throughout the quarter.”

Other details:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Home Depot reported 2Q19 revenues of $30.8 billion, up 1.2% year over year and marginally below the $31.0 billion consensus estimate.

Gross margin came in at 33.8%, a decrease of 20 basis points. EPS was $3.17, a rise of 3.7% against the year-ago quarter and ahead of the consensus estimate of $3.09.

Total company comps were positive at 3.0% for the quarter, below the consensus of 3.3% while US comps rose 3.1%.

Details from the Quarter

Management stated the primary reason for the difference between sales growth and comparable sales performance was a shift in the fiscal calendar base, as a result of 53 weeks of sales in fiscal 2018 versus 52 in fiscal 2019.

Craig Menear, Chairman, CEO and President said: “We were pleased with our results as we delivered accelerating comp performance throughout the quarter.”

Other details:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Home Depot reported 2Q19 revenues of $30.8 billion, up 1.2% year over year and marginally below the $31.0 billion consensus estimate.

Gross margin came in at 33.8%, a decrease of 20 basis points. EPS was $3.17, a rise of 3.7% against the year-ago quarter and ahead of the consensus estimate of $3.09.

Total company comps were positive at 3.0% for the quarter, below the consensus of 3.3% while US comps rose 3.1%.

Details from the Quarter

Management stated the primary reason for the difference between sales growth and comparable sales performance was a shift in the fiscal calendar base, as a result of 53 weeks of sales in fiscal 2018 versus 52 in fiscal 2019.

Craig Menear, Chairman, CEO and President said: “We were pleased with our results as we delivered accelerating comp performance throughout the quarter.”

Other details:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Home Depot reported 2Q19 revenues of $30.8 billion, up 1.2% year over year and marginally below the $31.0 billion consensus estimate.

Gross margin came in at 33.8%, a decrease of 20 basis points. EPS was $3.17, a rise of 3.7% against the year-ago quarter and ahead of the consensus estimate of $3.09.

Total company comps were positive at 3.0% for the quarter, below the consensus of 3.3% while US comps rose 3.1%.

Details from the Quarter

Management stated the primary reason for the difference between sales growth and comparable sales performance was a shift in the fiscal calendar base, as a result of 53 weeks of sales in fiscal 2018 versus 52 in fiscal 2019.

Craig Menear, Chairman, CEO and President said: “We were pleased with our results as we delivered accelerating comp performance throughout the quarter.”

Other details:

- Comp growth included an average ticket 2.0% higher and a 1.0% increase in the number of comparable transactions.

- All US business divisions reported positive comps and by geography. 17 of 19 regions generated positive comps, the Gulf and Florida regions being the only exceptions (they both had tough comps to beat with higher than usual sales following tropical storms that hit the region in the year-ago period).

- Internationally, Home Depot saw high-single-digit positive comps in Mexico while in Canada comps were positive in low single digits.

- All merchandising departments reported positive comps except lumber, as price deflation during the quarter negatively affected average ticket growth by around 110 basis points (bps).

- Home Depot added one new store each in the US and Mexico, taking its overall store count at the end of the quarter to 2,291.

- Online sales grew 20% over the year-ago quarter, and around 50% of online orders were picked up in store.

- The company completed converting its Hagerstown, Maryland, facility into a partial direct fulfillment center during the quarter, increasing the reach of same-day delivery for stock parcel goods from 30% to around 50% of the US population.

- Home Depot stated that it registered robust performance in big-ticket segments such as appliances, vinyl plank flooring and patio.

- Sales growth of 2.3%, below the 2.6% consensus.

- Comps of 4.0%.

- EPS of $10.03, below the $10.12 consensus estimate.