Nitheesh NH

[caption id="attachment_89109" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

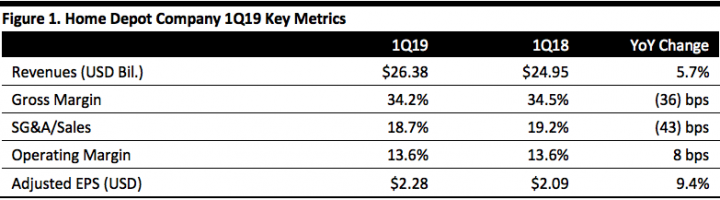

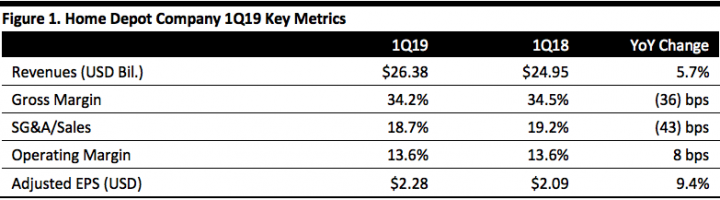

Home Depot reported 1Q19 revenues of $26.38 billion, up 5.7% year over year and slightly above the $26.38 billion consensus estimate.

Net income was $2.5 billion, an increase of 4.5% compared to the year-ago quarter.

Gross margin came in at 34.2%, a decrease of 36 basis points. Adjusted EPS was $2.28, a rise of 9.4% in the year-ago quarter and marginally ahead of the consensus estimate of $2.20.

Total company comps were positive at 2.5% for the quarter, with negative comps of 2% in February, positive comps of 5.6% in March and positive comps of 3.2% in April.

Adjusted EBITDA was $4.14 billion, compared to $3.91 billion in the year-ago quarter.

Details from the Quarter

Management confirmed sales and earnings guidance for fiscal 2019 and was positive about the core business performance.

Craig Menear, Chairman, CEO and President said:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Home Depot reported 1Q19 revenues of $26.38 billion, up 5.7% year over year and slightly above the $26.38 billion consensus estimate.

Net income was $2.5 billion, an increase of 4.5% compared to the year-ago quarter.

Gross margin came in at 34.2%, a decrease of 36 basis points. Adjusted EPS was $2.28, a rise of 9.4% in the year-ago quarter and marginally ahead of the consensus estimate of $2.20.

Total company comps were positive at 2.5% for the quarter, with negative comps of 2% in February, positive comps of 5.6% in March and positive comps of 3.2% in April.

Adjusted EBITDA was $4.14 billion, compared to $3.91 billion in the year-ago quarter.

Details from the Quarter

Management confirmed sales and earnings guidance for fiscal 2019 and was positive about the core business performance.

Craig Menear, Chairman, CEO and President said:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Home Depot reported 1Q19 revenues of $26.38 billion, up 5.7% year over year and slightly above the $26.38 billion consensus estimate.

Net income was $2.5 billion, an increase of 4.5% compared to the year-ago quarter.

Gross margin came in at 34.2%, a decrease of 36 basis points. Adjusted EPS was $2.28, a rise of 9.4% in the year-ago quarter and marginally ahead of the consensus estimate of $2.20.

Total company comps were positive at 2.5% for the quarter, with negative comps of 2% in February, positive comps of 5.6% in March and positive comps of 3.2% in April.

Adjusted EBITDA was $4.14 billion, compared to $3.91 billion in the year-ago quarter.

Details from the Quarter

Management confirmed sales and earnings guidance for fiscal 2019 and was positive about the core business performance.

Craig Menear, Chairman, CEO and President said:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Home Depot reported 1Q19 revenues of $26.38 billion, up 5.7% year over year and slightly above the $26.38 billion consensus estimate.

Net income was $2.5 billion, an increase of 4.5% compared to the year-ago quarter.

Gross margin came in at 34.2%, a decrease of 36 basis points. Adjusted EPS was $2.28, a rise of 9.4% in the year-ago quarter and marginally ahead of the consensus estimate of $2.20.

Total company comps were positive at 2.5% for the quarter, with negative comps of 2% in February, positive comps of 5.6% in March and positive comps of 3.2% in April.

Adjusted EBITDA was $4.14 billion, compared to $3.91 billion in the year-ago quarter.

Details from the Quarter

Management confirmed sales and earnings guidance for fiscal 2019 and was positive about the core business performance.

Craig Menear, Chairman, CEO and President said:

We were pleased with the underlying performance of the core business despite unfavorable weather in February and significant deflation in lumber prices compared to a year ago.

Other details:- Total customer transactions reached 390.0 million, up 3.8% year over year.

- In the first quarter, comps in the US were 3%, with comps of (1.9)% in February, up 6.1% in March and 4% in April.

- Home Depot added two new stores in the quarter and reached sales per square foot of $435.18, compared to $412.03 in the year-ago quarter, a rise of 5.6%.

- The company says its total addressable market is $600 billion, and is implementing the following strategic initiatives to better reach it:

- Investments in physical stores and online capabilities.

- Focus on interconnected strategy between stores and online orders: Approximately 54% of online orders were picked up in stores.

- Improve front-end processes by investing in front-end checkouts, increasing automated lockers and streamlining customer service desks.

- Internationally, Home Depot saw positive comps in Mexico while in Canada market comps were slightly negative.

- During the quarter, the company added 35,000 new customers and reached a total of 135,000 customers in its B2B website. The company hopes to hit one million by year end.

- The company faced unfavorable weather in February and lumber prices continued to fall in the quarter, negatively impacting sales growth by approximately $200 million.

- Home Depot faces two major challenge: The recent announcement that certain tariffs on goods imported from China will increase to 25% and significant deflation in lumber prices. The company projected an impact of $800 million on sales if lumber prices remain at today’s level.

- Carol Tomé retired as Chief Financial Officer and EVP of Corporate Services effective August 31, after serving Home Depot for 24 years. He will be replaced by Richard McPhail in September.

- At the end of the first quarter, Home Depot operated a total of 2,289 retail stores in all 50 states, the District of Columbia, Puerto Rico, the US Virgin Islands, Guam, 10 Canadian provinces and Mexico. The company employs more than 400,000 associates.

- Comps of 5.0%.

- Sales growth of 3.3% to $111.77 billion.

- The addition of net five new stores.

- Gross margin of 34.0%.

- Operating margin of 14.4%.

- EPS of $10.03, below the $10.26 consensus estimate.

- Capital spending of $2.7 billion.