Source: Company reports

4Q15 RESULTS

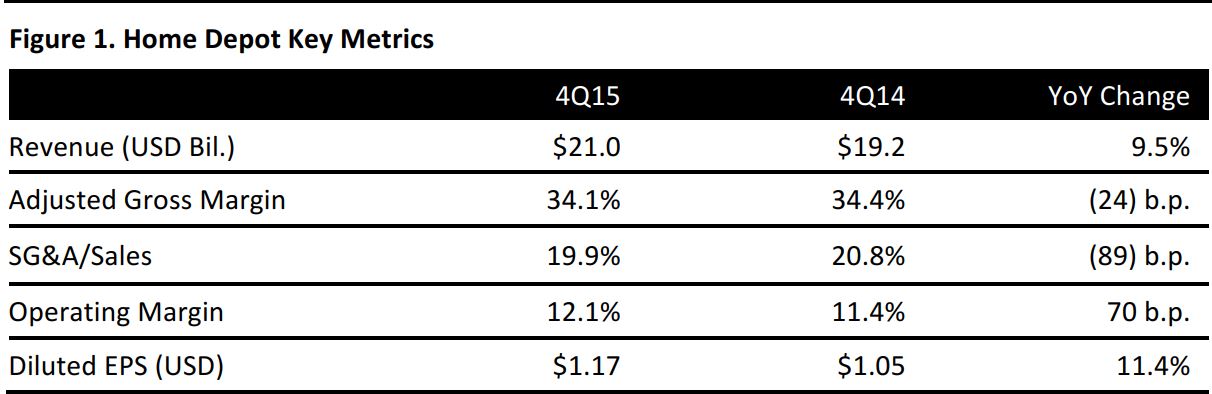

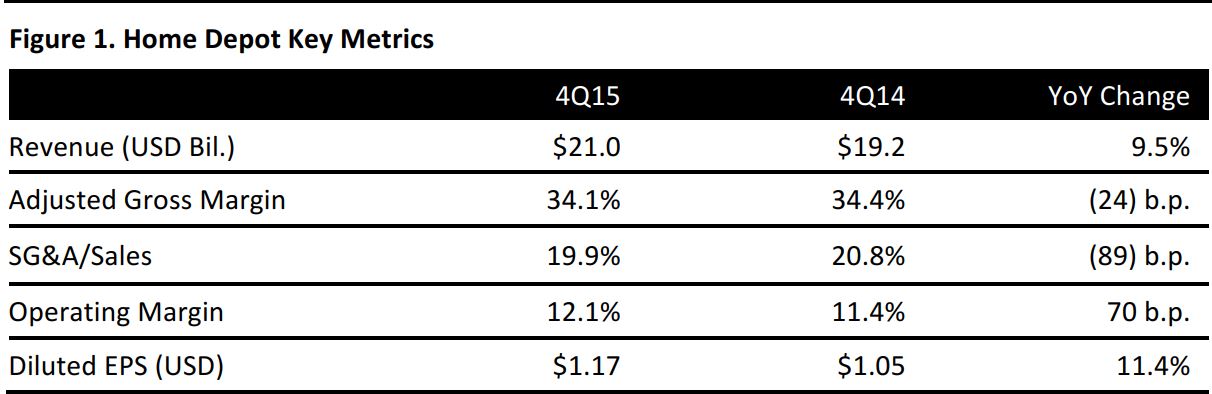

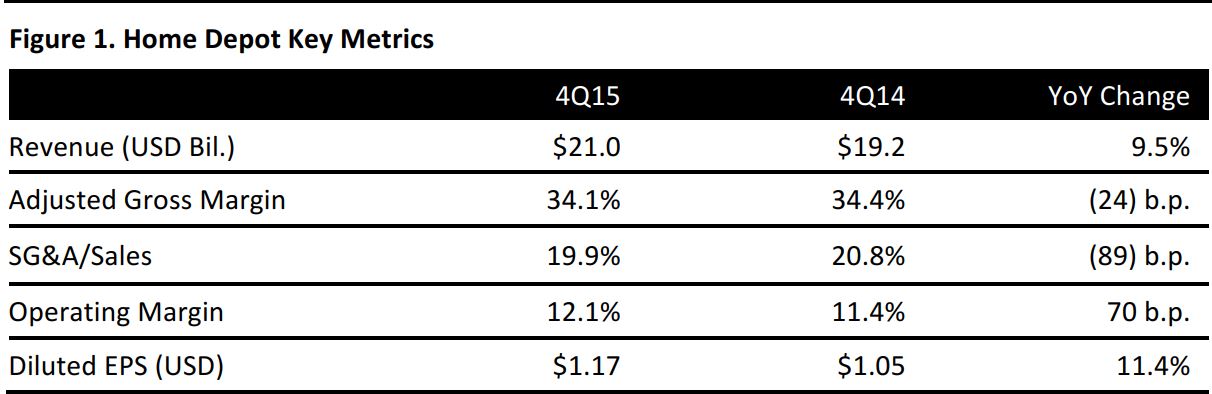

Home Depot, the world’s largest home improvement retailer, reported strong 4Q15 results: sales totaled $21.0 billion, up 9.5% from the same quarter last year. The company reported solid, 7.1% comp sales for the overall business and 8.9% comps for US stores.

For the quarter, the company delivered $1.5 billion in net earnings, or $1.17 per diluted share, versus net earnings of $1.4 billion, or $1.05 per diluted share, a year ago. EPS was roughly 6% higher than analysts’ estimate of $1.10.

In the US market, all 19 regions and top 40 markets saw comps in the mid-single to low double digits. On the international side, Home Depot’s Mexican business reported double-digit growth (in local currency), marking its 49th consecutive quarter of positive comps. The company’s Canadian business ended the year with single-digit comps and total sales of $7 billion (in local currency).

FY15 RESULTS

For FY15, Home Depot’s total sales were $88.5 billion, up 6.4% from the previous year, and comps were 5.6%. The revenues were the highest in the company’s history, and higher than it expected; it had guided for 5.7% sales growth and 4.9% comps for the year.

Diluted earnings per share were $5.46, compared to $4.71 in 2014. The figure was slightly higher than the guidance of $5.36.

The company saw healthy growth in its online business in 2015. For the year, Home Depot’s online business grew by $1 billion, or 25% over the prior year, and over 40% of its online orders were picked up from stores.

GUIDANCE

For FY16, Home Depot provided a range of guidance that assumes normalized currency exchange rates. The company expects total sales to increase by approximately 5.1%–6.0%, and comparable store sales to grow by 3.7%–4.5%. The company guided for an operating margin expansion of approximately 70 basis points. Gross margin is expected to be flat and diluted EPS growth is expected to be 12%–13%, for EPS of $6.12–$6.18.

The company’s guidance is based on the current US GDP estimate of 2.1% for 2016. The current low end of the guidance range reflects today’s exchange rates. However, if rates remain where they are today, the estimated currency effects would reduce total sales by $800 million and reduce EPS by $0.06.