Source: Company reports/FGRT

3Q17 Results

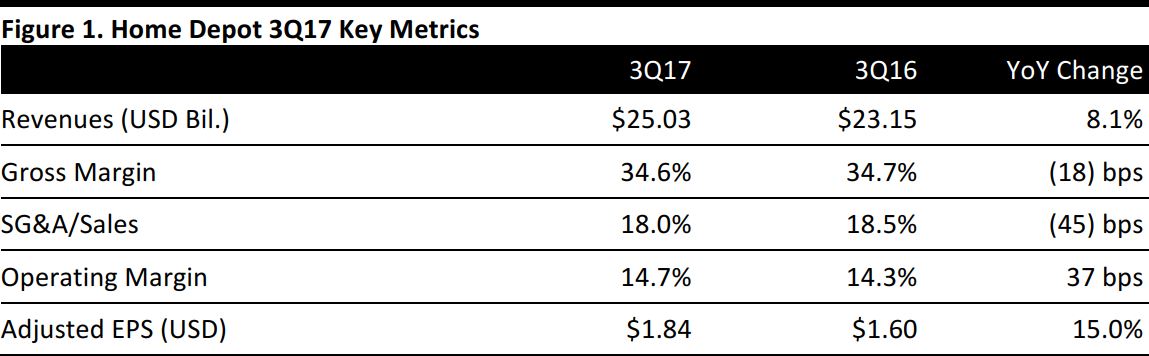

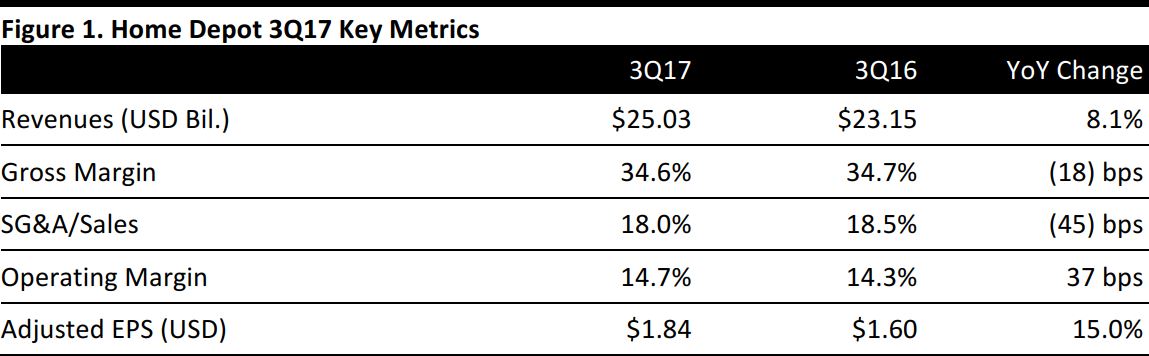

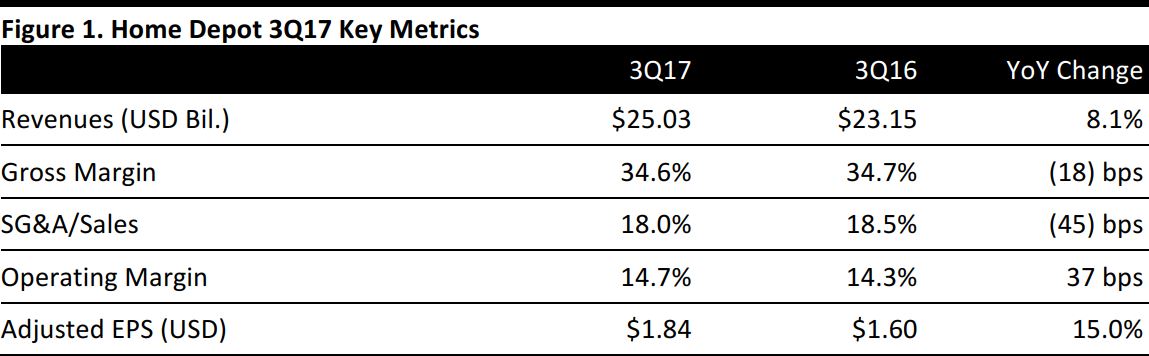

Home Depot reported 3Q17 adjusted EPS of $1.84, up 15% from the year-ago quarter and beating the $1.82 consensus estimate. Total revenues were $25.03 billion, up 8.1% from the year-ago quarter. Big-ticket sales—or transactions over $900, which represent 22% of Home Depot’s US sales—were up 12.1%, driven by strength in appliances, flooring and several Pro-heavy categories. The online business reported sales growth of 19% for the quarter and online sales accounted for 6.2% of total sales.

Comps rose by 7.9% during the quarter, beating the 5.7% consensus estimate. Comps for US stores were up 7.7%. Internationally, Mexico and Canada posted positive comps in local currency. Comp growth was driven by a 5.1% increase in average ticket spend and a 2.7% increase in customer transactions. Home Depot’s average shopper spent $62.84 in the quarter, up from $59.79 in the year-ago period.

Core merchandising departments that posted double-digit comp growth in the quarter include lumber, appliances, electrical, indoor garden and tools. Building materials and flooring comps were also above the company’s average comp. Décor, hardware, paint, plumbing, kitchen, bath, and outdoor garden posted comps that were positive but below the company average. Commodity price inflation in lumber, building materials, and copper positively impacted average ticket growth by approximately 105 basis points.

The Pro and DIY categories grew at healthy rates in the quarter, with Pro sales up by double digits in the quarter. Pro-heavy categories such as lumber, wire, insulation, gypsum and hand tools saw double-digit growth. Storm-related categories saw significant growth, with generators, wet/dry bags, tarps, and ladders all posting double-digit comps.

The company estimates that hurricane-related sales positively impacted comparable store sales growth by approximately $282 million. Gross margin on hurricane-related sales was considerably lower than the company average due to the majority of these sales being in lower-margin categories as well as the impact of additional supply chain costs. Home Depot noted roughly $104 million in hurricane-related expenses. The hurricanes hurt operating profit by $51 million.

Sales per square foot rose by 7.9% compared with the year-ago quarter, reaching $412.

FY17 Outlook

Home Depot raised its FY17 guidance, based on its year-to-date performance, the underlying strength in its core business, positive signs in the housing data and projected hurricane recovery sales.

The company now expects revenues to increase by 6.3%, versus 5.3% previously, implying revenues of $100.55 billion compared with the $99.94 billion consensus estimate. Management now expects full-year comp growth of 6.5%, up from 5.5% previously and above the 5.8% consensus estimate. Home Depot raised its FY17 EPS guidance from $7.29 to $7.36; consensus calls for full-year EPS of $7.33.