Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

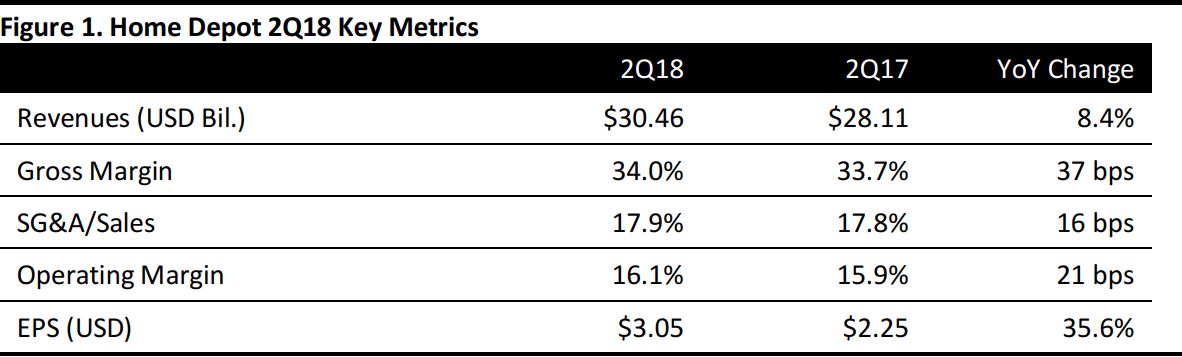

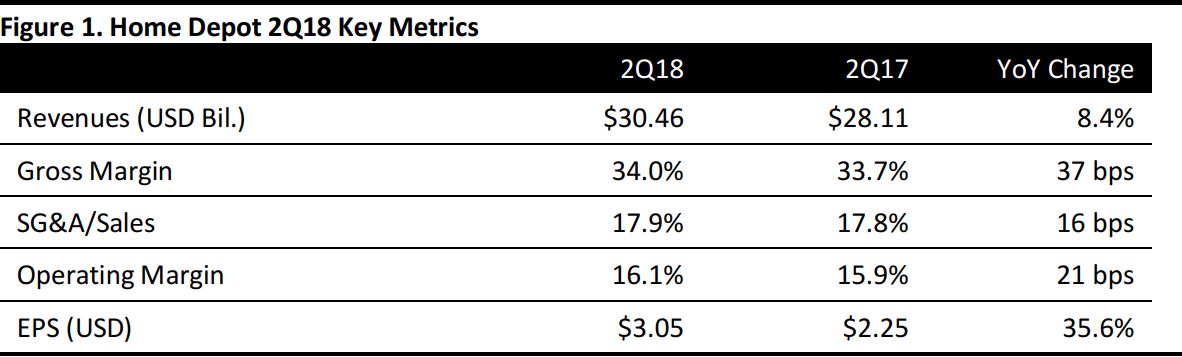

2Q18 Results

Home Depot reported 2Q18 EPS of $3.05, up from $2.25 in the year-ago quarter and ahead of the $2.84 consensus estimate. Total revenues were $30.46 billion, up 8.4% year over year and ahead of the $30.03 billion consensus estimate. Sales on a per-square foot basis increased 8.6% during the quarter.

Total comps rose by 8.0% during 2Q, beating the 6.6% consensus estimate and compared to a 3.9% increase in the prior quarter. Comps for US stores were up 8.1%. Comp growth was driven by a 4.9% increase in average ticket spend, to $66.20, and a 2.9% increase in customer transactions. Commodity price inflation in lumber, building materials and copper positively impacted average ticket growth by 119 basis points.

The company said that the seasonal sales missed in the first quarter due to inclement weather were recovered in the second quarter. Due to a colder-than-normal spring, many homeowners pushed back their gardening and remodeling projects into the summer.

Top-selling categories included lumber, indoor garden, outdoor garden and electrical. Sales for the Pro business continued to grow strongly in the quarter, once again outpacing DIY sales. Sales of Pro customers grew double digits. Pro-heavy categories like lumber, in-stock kitchens, power tools, windows and concrete all recorded double-digit comps. Categories such as lawnmowers, watering, patio, ceiling fans and interior and exterior paint all had strong comps.

Big-ticket sales—or transactions over $1,000, which represent about 20% of Home Depot’s US sales—were up 10.6%, driven by strength in flooring, appliances and strength with Pro customers. Online sales grew by approximately 27% from the year-ago quarter, driven by buy-online, pick-up-in-store and buy-online, ship-to-store services; 47% of the company’s online orders in the US are picked up in-store.

During the quarter, Home Depot adopted Accounting Standards Update (ASU) number 2014-09, which pertains to revenue recognition for certain items. Home Depot estimates that the adoption resulted in an increase of $33 million to revenues, a 46-basis-point gross margin expansion and an increase of $151 million to operating expenses for 2Q18.

Management noted several improvements to its interconnected shopping experience initiative, including better product content, a refreshed mobile experience, improved inventory visibility and faster checkout.

Outlook

The retailer is focused on growing its professional homebuilder business and believes that by bolstering its delivery platform it will be able to take a larger share of this market.

Home Depot raised its outlook for revenues and same-store sales for FY18, saying the number of customer transactions jumped during the quarter and shoppers were spending more at its stores.

Management provided the following guidance:

- The company expects revenues to increase 7.0%, compared with the prior forecast of 6.5%, reflecting comp growth of 5.3%, up from previous guidance for 5.0% growth.

- The consensus estimate calls for revenue growth of 6.8% and comp growth of 5.2%.

- Home Depot now guides for FY18 EPS of $9.42 up from previous guidance of $9.31, while the consensus estimate calls for EPS of $9.43.

- For the year, the company now expects its gross margin rate to expand by 41 basis points. This expansion is down slightly from previous guidance due to high-than-anticipated transportation costs in the supply chain.

- In December, Home Depot laid out a long-term goal of boosting its annual revenues from $100.9 billion in FY17 to as much as $120 billion by 2020. That would equate to revenue growth of 6% a year.

- The company plans to increase capital expenditures in order to bolster its supply chain, cut checkout times and train employees.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research