Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

1Q17 Results

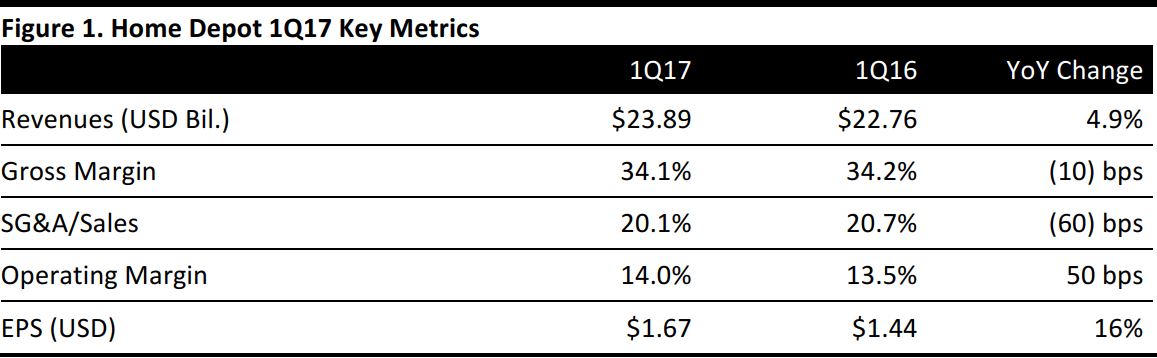

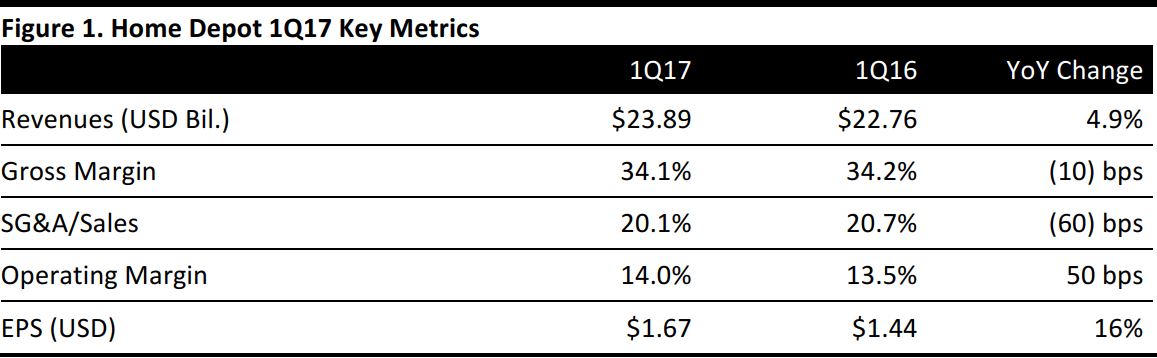

Home Depot reported 1Q17 EPS of $1.67, which was ahead of the $1.61 consensus estimate and up 16% from the year-ago quarter. Total revenues were $23.89 billion for 1Q17, up 4.9% from the year-ago quarter and ahead of the consensus estimate. Big-ticket sales—or transactions over $900, which represent 20% of Home Depot’s US sales—were up 15.8%. The increase in big-ticket purchases was driven by flooring, appliances and roofing materials. The online business reported sales growth of 23% for the quarter.

Sales per square foot rose by 4.6% compared with the year-ago quarter, reaching $394. Foreign currency effects, primarily in the form of a weaker Mexican peso, negatively impacted total sales by about $71 million.

Comps rose by 5.5% versus the 4.4% consensus estimate. Comps for US stores were up 6%, ahead of the 4.3% consensus estimate. Internationally, Mexico and Canada posted positive comps in local currency. Comp growth was driven by a 1.5% increase in customer transactions and a 3.9% increase in average ticket spend, to about $62.39. Commodity price inflation in lumber, building materials and copper positively impacted average ticket by approximately 75 basis points.

All merchandising departments posted positive comps, led by appliances, lumber and flooring, all of which posted double-digit comps in the quarter. Comps for the tools, electrical, plumbing, and core kitchen and bath categories were above the company average. Comps for the building materials, hardware, lighting, paint and outdoor garden categories were positive, but below the company average. Pro-heavy categories such as commercial and industrial lighting, several lumber categories and electrical wiring also saw strong comps.

FY17 Outlook

Home Depot reiterated its FY17 guidance for net revenues to increase by 4.6%, to about $96.16 billion, and for comps to increase by 4.6%. The consensus estimate calls for sales growth of 4.8% and same-store sales growth of 4.8%.

The company raised its full-year EPS guidance from $7.13 to $7.15, which represents an 11% year-over-year increase. The consensus calls for full-year EPS of $7.20.

Management noted that while US GDP forecasts are mixed, the positive housing backdrop continues to be a tailwind for Home Depot, encouraging shoppers to invest more in their homes as values rise.

With regard to 2Q17, management noted that May has been very good so far, but that the company does anticipate some foreign exchange pressure.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology