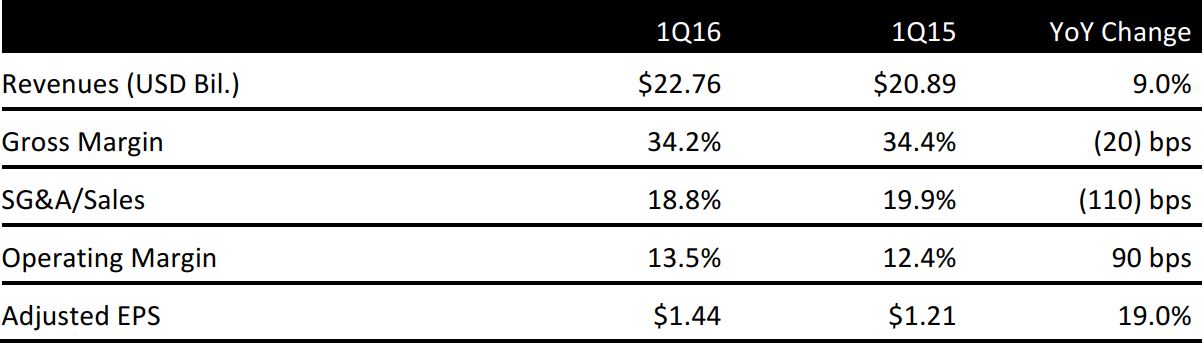

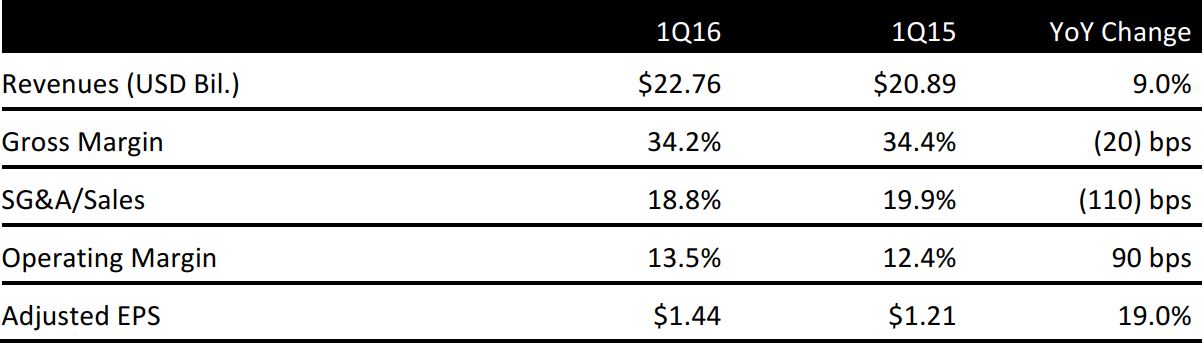

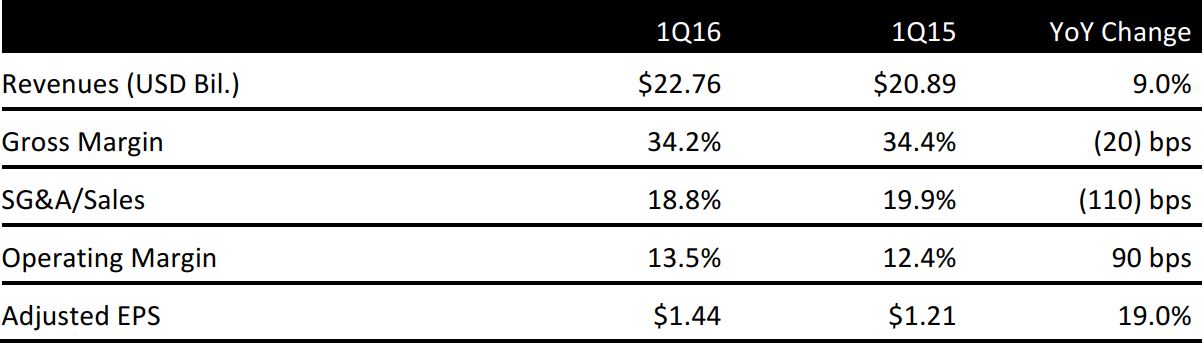

Source: Company reports

1Q16 RESULTS

Home Depot reported adjusted 1Q16 EPS of $1.44 versus the consensus estimate of $1.35.

Total revenue was $22.76 billion versus expectations of $22.38 billion. Comps were up 6.5% versus consensus of 5.2%. Comps for US stores were up 7.4%. By month, comps were strongest in February (up 10.2%), followed by March (up 6.7%) and then April (up 4.3%). Comps were driven by increases in both transactions and average ticket.

Management noted that demand spikes in week-to-week results were driven by variability in the weather. The company estimates that favorable weather added $250 million to sales in the US.

Inventory ended the period up 7.4% year over year versus a 9% increase in sales during the quarter.

2016 OUTLOOK

Management raised its full-year EPS guidance to $6.27 from $6.12–$6.18 previously; consensus is for EPS of $6.22. Total revenue is expected to increase by 6.3%, versus prior guidance of 5.1%–6%, and to total $94.1 billion, above consensus of $93.82 billion. Comps are projected to increase by 4.9% versus prior guidance of 3.7%–4.5% and compared to consensus of 4.7%.

Management expects gross margin to be roughly flat versus the prior year, and it now expects expenses to grow at 35% of the rate of sales growth, versus 40% previously.

The company continues to see strength in the housing market in terms of home price appreciation and increased housing turnover.