albert Chan

What’s the Story?

In this report, we discuss digital sales performance in the US on Black Friday and during Cyber Week (the period from Thanksgiving to Cyber Monday, November 25–29, 2021, as defined by Adobe Analytics; November 23–29, 2021, according to Salesforce).

Why It Matters

The confluence of a new Covid variant, Omicron, along with enduring supply chain constraints makes this holiday shopping season tenuous despite the solid consumer macro backdrop of strong employment and growing discretionary income. Our holiday coverage aims to offer directional guidance.

US Store Traffic Jumps, Digital Sales Underwhelm During Cyber Week: Coresight Research Analysis

A Consumer Return to Physical Stores Impacts Digital Sales Growth

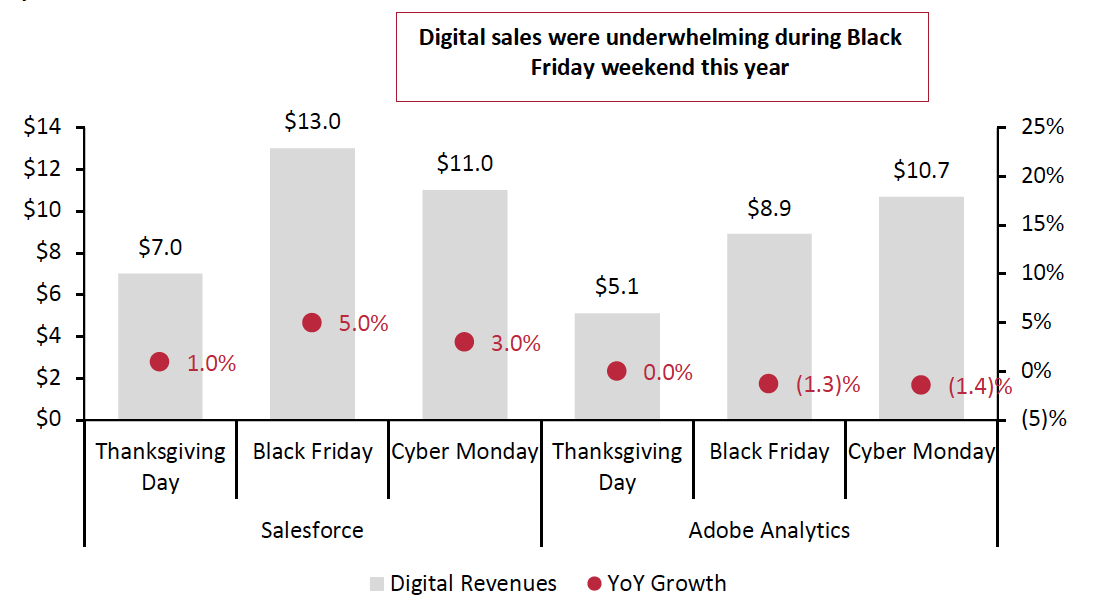

On Black Friday, consumers migrated back to in-store shopping: Retail technology company Sensormatic reported a 47.5% increase in Black Friday store traffic versus 2020, although traffic was 28.3% below pre-pandemic 2019 levels. The return to the brick-and-mortar channel impacted digital sales, which declined by 1.3% year over year on Black Friday, to $8.9 billion, according to Adobe Analytics.

Fewer doorbusters, higher prices and some out of stocks characterized the Cyber Week shopping holiday this year. The Coresight Research team visited many mall-based and off-mall retailers, and while the pace was not frenzied, store traffic was significantly more robust than we saw a year ago.

- Salesforce data indicated that Black Friday digital sales rose 5% to $13 billion, outpacing the online growth of both Thanksgiving and Cyber Monday (see Figure 1). This reflects a significant slowing from the 10% growth in US digital sales in the first three weeks of November, as recorded by Salesforce, confirming an early start to the holiday shopping season ahead of the Black Friday weekend this year.

- However, Adobe Analytics recorded declines in digital retail revenue during the Black Friday weekend—it is worth noting that Salesforce data cover “commerce, marketing and service,” while Adobe Analytics data cover retail only. Adobe Analytics recorded the steepest year-over-year decline in online sales, of 1.4%, on Cyber Monday.

- Overall, digital retail sales during Cyber Week 2021 were down 1.4% compared to 2020, totaling $33.9 billion, according to Adobe Analytics. Salesforce reported a total of $62 billion in digital sales for Cyber Week, up 4.0% year over year (Cyber Week as defined by Salesforce is two days longer than Adobe’s coverage).

The high online growth of 15%–20% (according to Adobe Analytics) across Thanksgiving, Black Friday and Cyber Monday during pandemic-impacted 2020 provided demanding comparatives, and the return to physical stores this year will have been a major factor in the digital decline.

Moreover, Adobe Analytics reported that online retail sales across the longer period of November 1–29 were up by a much more substantial 11.9% year over year—which we expect to be a closer reflection of total digital holiday demand than the shorter Cyber Week(end) period.

Figure 1. US Retailers’ Digital Revenues (Left Axis; USD Bil.) and Digital Revenue Growth (Right Axis; YoY %)

[caption id="attachment_137199" align="aligncenter" width="550"] Salesforce data cover “commerce, marketing and service,” while Adobe Analytics data cover retail only

Salesforce data cover “commerce, marketing and service,” while Adobe Analytics data cover retail onlySource: Salesforce/Adobe Analytics[/caption]

Retailers Offering Pickup Services Record Greater Growth in Digital Sales

Indicating the omnichannel shopping preferences of US consumers, US stores offering curbside or in-store pickup services grew their revenue by 50% more, year over year, on Black Friday than retailers that did not offer these options, according to Salesforce.

Adobe Analytics reported that curbside pickup was used for 18% of all online orders on Cyber Monday (for retailers that offer the service), versus 20% last year, again highlighting the value of physical stores in the online shopping journey.

Retailers Temper Discounts as Inventories Drop

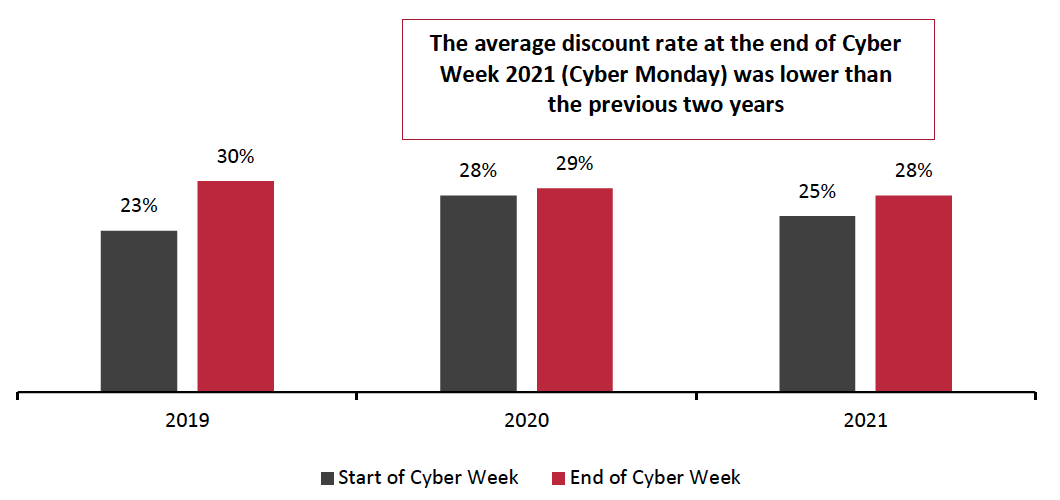

US retailers’ average discount rate was 25% on November 23, 2021 (the start of Cyber Week) and reached 28% on Cyber Monday (the last day of Cyber Week), according to Salesforce. These averages are lower than in 2020, and the average discount on Cyber Monday was higher still in pre-pandemic 2019 (see Figure 2).

Inventory challenges may have played a key role in the lower average discounts this year: The number of out-of-stock notifications during the week ended November 29, 2021, rose 8% compared to the previous week, according to Adobe Analytics; and during November 2021 (through November 29), the number of out-of-stock messages was 169% higher than in pre-pandemic January 2020 and 258% higher than in November 2019.

Retailers began holiday promotional activity early this year to spread out the shopping season and so reduce inventory risk while encouraging consumers to return to stores. We expect to see muted promotional activity through the remainder of the shopping season.

Figure 2. US Retailers’ Average Discount Rates Through Cyber Week

[caption id="attachment_137200" align="aligncenter" width="550"] Source: Salesforce[/caption]

Source: Salesforce[/caption]

Games and Technology Are Among the Most Sought-After Categories

Adobe Analytics listed toys, gift cards, books, video games and baby/toddler products as the drivers of Cyber Monday online spending. In the appliance category, microwave ovens and small kitchen appliances were bestsellers.

We list the bestselling products on Cyber Monday in the toys and electronics categories in Figure 3, as reported by Adobe Analytics.

Figure 3. Top Products Consumers Bought on Cyber Monday

[caption id="attachment_137201" align="aligncenter" width="550"] Source: Adobe Analytics[/caption]

Source: Adobe Analytics[/caption]

What We Think

Cyber Week saw increased store traffic compared to a year ago, impacting digital sales. Online revenue growth rates across Thanksgiving, Black Friday and Cyber Monday were also negative on a year-over-year basis, against the tough comparatives of pandemic-impacted 2020 Black Friday weekend. Covid-19 has disrupted the traditional start to the holiday shopping season, with retailers pulling forward promotions—and consumers beginning to shop—earlier than Black Friday weekend, although this is a trend that has been building momentum for more than a decade.

The recent spike in Covid-19 cases along with the first case of Omicron in the US (announced on December 1, 2021) could impact store visits and drive consumers back online. We expect BOPIS (buy online, pick up in store) to grow in popularity through the remainder of the holiday shopping season and beyond, as consumers value convenience in an omnichannel shopping journey.

Coresight Research believes that the 2021 holiday quarter (October–December) remains on track for a solid 9%–10% total holiday sales gain (online and in-store) barring a media barrage of Covid-19 related bad news that could stymie consumer interest in the holidays.