DIpil Das

What’s the Story?

We offer our early thoughts on the trajectory and trends that we expect to see in US holiday retail this year. We will follow up with an update to our holiday outlook in early October as well as a full series of reports counting down to the season’s peak. Our definition of the holiday season is the October–December quarter and our core metric is the change in total retail sales excluding automobiles and gasoline (and retail inherently excludes restaurants/food service).Why It Matters

After a year of strong growth and, for some sectors, recovery, understanding the shape and scale of demand during the holiday season is critical for retailers. Our holiday coverage provides directional insights to help the sector, and those working with it, plan for the peak.US Retail Outlook: Coresight Research Analysis

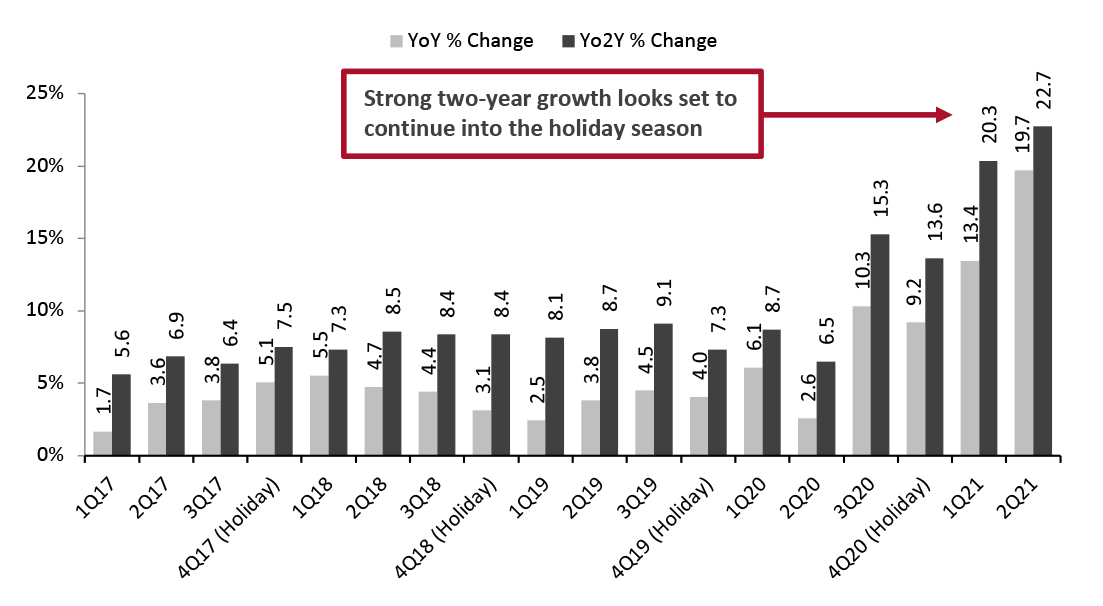

1. Coresight Research Expects Strong Total Holiday Retail Demand Coresight Research is penciling in a strong total expansion in retail sales for the holiday quarter. We expect a 9–10% year-over-year increase in total retail sales for holiday 2021. On top of a 9.2% increase last year, the 9.5% midpoint of our 2021 estimate implies two-year (compounded) growth of 19.6%. Such an increase would add a little over $100 billion to total retail sales versus 2020, taking total holiday-quarter sales in the US to $1.2 trillion. A strong holiday season would round off an exceptionally buoyant year for retail sales, as shown in Figure 1. In the second quarter of 2021, the year-over-year change was amplified by weakness early in the pandemic, one year prior. The more revealing sequential change, and indicator of underlying growth, is the two-year rate of expansion: A 19.6% rise versus 2019 for the holiday quarter would reflect a slight unwinding of two-year growth in the context of stimulus measures tailing off (the exception being the Child Tax Credit, which runs through December) yet it would be well above the pace of growth seen in the second half of 2020.Figure 1. US Retail Sales (ex. Automobiles and Gasoline): % Change, by Quarter [caption id="attachment_132886" align="aligncenter" width="724"]

Source: US Census Bureau/Coresight Research [/caption]

We expect sales expansion to be led by discretionary categories and sectors, supported by consumers’ stimulus payments. Coresight Research calculates that across 2020 and 2021, a total of $1.66 trillion will have been paid to consumers through stimulus measures. In theory, that $1.66 trillion covers the estimated 2021 holiday-quarter spending of $1.2 trillion—with almost half a trillion dollars left over.

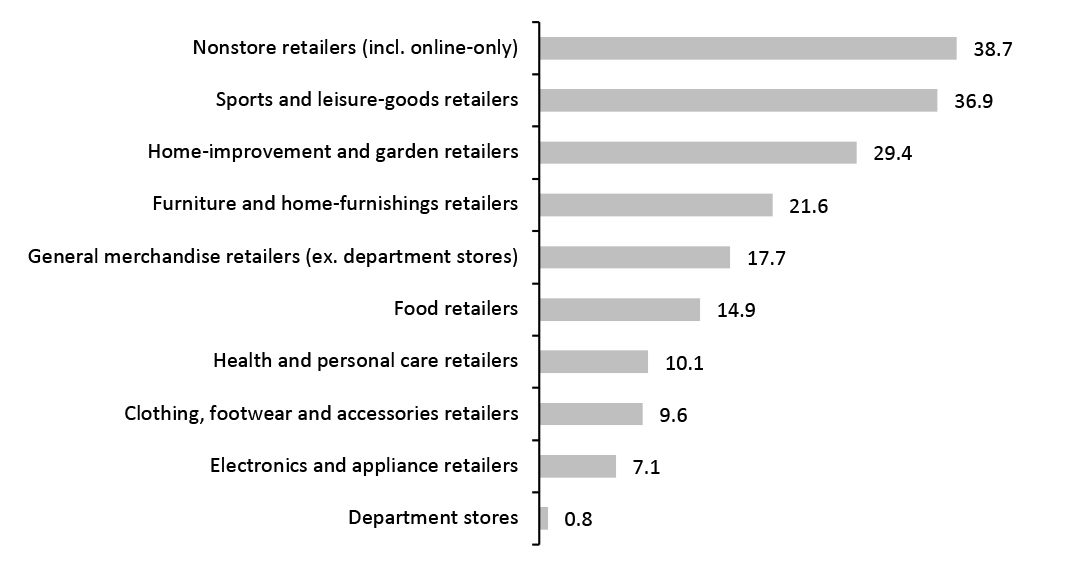

As shown in Figure 2, two-year growth for the year to date through August 2021 (latest), has proved very strong across several sectors. Even sales in structurally challenged sectors such as department stores, which were declining before the pandemic, have almost recovered to pre-crisis levels. We focus on two-year growth to remove the distorting effects of changing demand amid the pandemic in 2020.

We anticipate a degree of support for holiday retail sales from food retail, which has proved surprisingly resilient through the year so far, despite cycling the very strong growth from 2020 and amid some return to food service. Food retail is likely to be further supported by an apparent consumer retreat from public places such as restaurants in the face of the spread of the Covid-19 Delta variant (we discuss this trend in more detail later in the report).

Source: US Census Bureau/Coresight Research [/caption]

We expect sales expansion to be led by discretionary categories and sectors, supported by consumers’ stimulus payments. Coresight Research calculates that across 2020 and 2021, a total of $1.66 trillion will have been paid to consumers through stimulus measures. In theory, that $1.66 trillion covers the estimated 2021 holiday-quarter spending of $1.2 trillion—with almost half a trillion dollars left over.

As shown in Figure 2, two-year growth for the year to date through August 2021 (latest), has proved very strong across several sectors. Even sales in structurally challenged sectors such as department stores, which were declining before the pandemic, have almost recovered to pre-crisis levels. We focus on two-year growth to remove the distorting effects of changing demand amid the pandemic in 2020.

We anticipate a degree of support for holiday retail sales from food retail, which has proved surprisingly resilient through the year so far, despite cycling the very strong growth from 2020 and amid some return to food service. Food retail is likely to be further supported by an apparent consumer retreat from public places such as restaurants in the face of the spread of the Covid-19 Delta variant (we discuss this trend in more detail later in the report).

Figure 2. US Retail Sales: Two-Year % Change, YTD Through August 2021 (Latest) [caption id="attachment_132887" align="aligncenter" width="725"]

Source: US Census Bureau/Coresight Research [/caption]

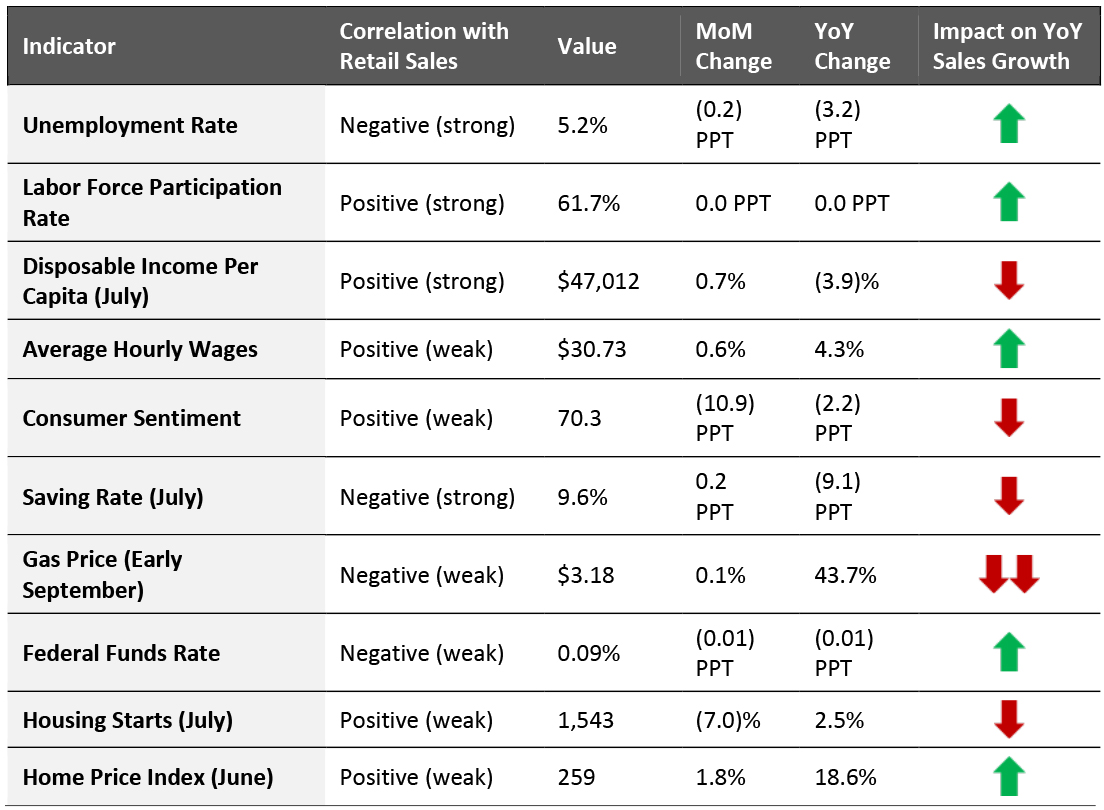

As charted in Figure 3, in year-over-year terms, we see a relatively even balance between negative indicators (red arrows) and positive indicators (green arrows). This supports our expectations for a slight moderation in the two-year pace of change in retail in later 2021.

Likewise, our monthly temperature check on consumers’ holiday expectations is finding some moderation in expectations for total spending, although this may reflect an unwinding of plans to spend in nonretail categories such as services amid the spread of the Delta variant, which we discuss below.

Source: US Census Bureau/Coresight Research [/caption]

As charted in Figure 3, in year-over-year terms, we see a relatively even balance between negative indicators (red arrows) and positive indicators (green arrows). This supports our expectations for a slight moderation in the two-year pace of change in retail in later 2021.

Likewise, our monthly temperature check on consumers’ holiday expectations is finding some moderation in expectations for total spending, although this may reflect an unwinding of plans to spend in nonretail categories such as services amid the spread of the Delta variant, which we discuss below.

Figure 3. US: Leading Indicators of Retail Sales [caption id="attachment_132888" align="aligncenter" width="725"]

Latest available data from August unless otherwise indicated

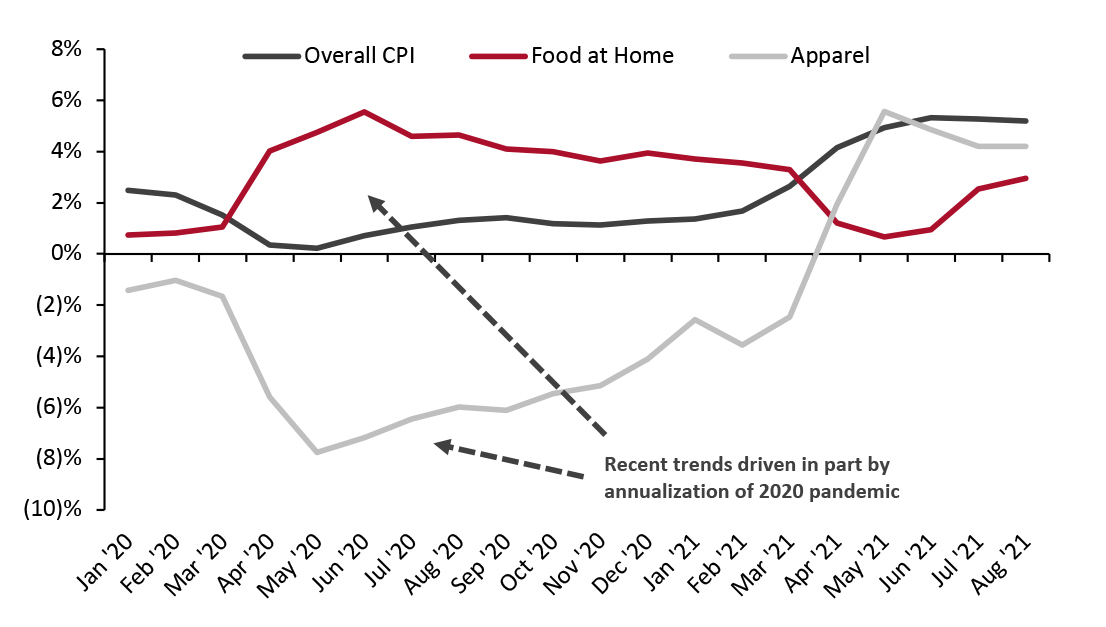

Latest available data from August unless otherwise indicated Source: BEA/BLS/Federal Reserve Board of Governors/S&P/University of Michigan/US Energy Information Administration/Coresight Research [/caption] 2. An “IOS” Holiday Looks Possible: Inflationary Pressures, Out-of-Stocks and Staying at Home More We are likely to be heading for an “IOS” holiday season, meaning one characterized by inflationary pressures, out-of-stock products and consumers spending more time at home. Inflation Reflecting strong global demand and supply chain constraints, producer price indices and import price indices are rising—but consumer price inflation (CPI) is tending to outpace both, fueled by rising domestic operating costs in addition to the cost of goods sold. Prices are rising in core retail categories such as food and apparel, as measured on a year-over-year basis. In the cases of some discretionary goods such as apparel, however, this partly reflects an annualizing of deflation amid depressed demand in 2020—and that means there is the prospect of some moderation in the year-over-year change once that annualization effect falls away. The rise in overall inflation is being driven by energy costs, including gasoline, and other nonretail categories such as air tickets and vehicles.

Figure 4. US Consumer Price Index: YoY % Change [caption id="attachment_132889" align="aligncenter" width="725"]

Source: Bureau of Labor Statistics/Coresight Research[/caption]

Consumers are attuned to price rises: Our latest weekly US Consumer Tracker survey, publishing next week, found that almost four in every 10 (39.0%) holiday shoppers were concerned about inflation on holiday purchases. However, stimulus payments have provided a buffer for shoppers to absorb some price rises.

As we discuss below, consumer behavior is changing. Should the shape of demand shift meaningfully, CPI trends are likely to respond.

Out-of-Stock Products

Strong demand and constrained supply equates to more out-of-stock products, and US shoppers are becoming more familiar with empty store shelves. With the risk of stockouts continuing through the fall and into the holiday peak, the very biggest retailers have ramped up their inventories and shipping capabilities to try to minimize the impacts.

While some major retailers have downplayed the risk of empty retail shelves, we have tracked retail and supply chain companies reporting shortages in the categories listed in Figure 5. Shortages of toys and semiconductor chips may particularly affect the holiday season.

Source: Bureau of Labor Statistics/Coresight Research[/caption]

Consumers are attuned to price rises: Our latest weekly US Consumer Tracker survey, publishing next week, found that almost four in every 10 (39.0%) holiday shoppers were concerned about inflation on holiday purchases. However, stimulus payments have provided a buffer for shoppers to absorb some price rises.

As we discuss below, consumer behavior is changing. Should the shape of demand shift meaningfully, CPI trends are likely to respond.

Out-of-Stock Products

Strong demand and constrained supply equates to more out-of-stock products, and US shoppers are becoming more familiar with empty store shelves. With the risk of stockouts continuing through the fall and into the holiday peak, the very biggest retailers have ramped up their inventories and shipping capabilities to try to minimize the impacts.

While some major retailers have downplayed the risk of empty retail shelves, we have tracked retail and supply chain companies reporting shortages in the categories listed in Figure 5. Shortages of toys and semiconductor chips may particularly affect the holiday season.

Figure 5. Tracked Consumer Goods Shortages [wpdatatable id=1272 table_view=regular]

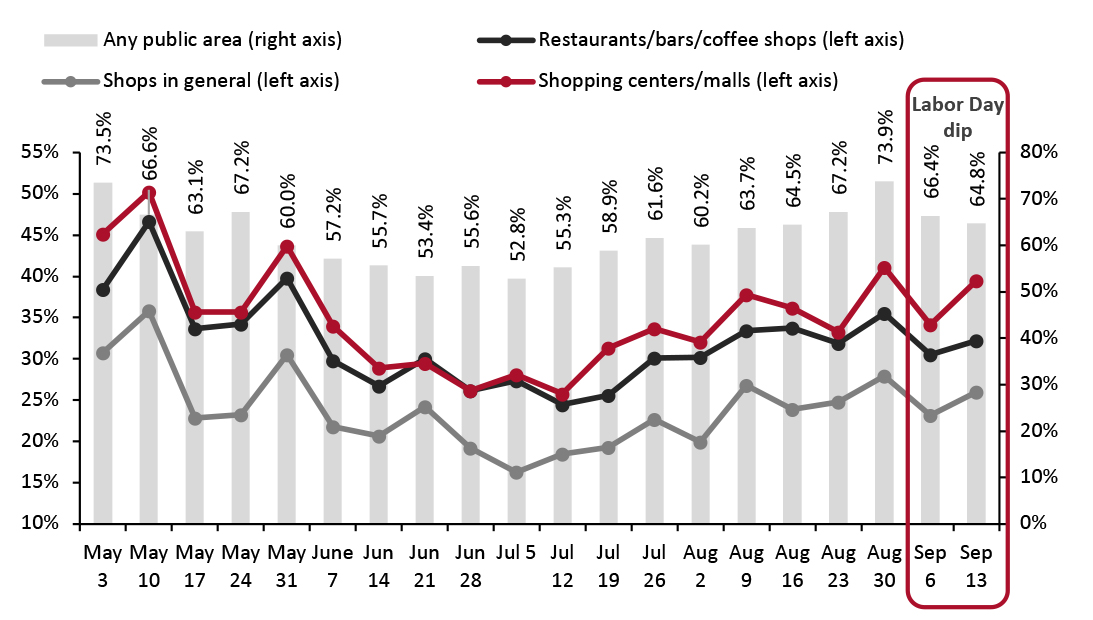

Source: Company reports/Coresight Research Moreover, our latest weekly US Consumer Tracker survey found that around one-third (32.3%) of holiday shoppers were concerned about holiday products being out of stock. Staying at Home More Since early July, US consumers have been retreating from public places such as shops, malls, restaurants and public transport. As of September 13, 64.8% of all respondents in our weekly survey said that they were avoiding any kind of public place; this metric is up 11.9 percentage points from its July 5 low. In addition, our latest survey found that 39.5% of respondents were avoiding shopping centers and malls, up 13.7 percentage points from its July 12 low, while 26.0% were avoiding shops in general, up 9.7 percentage points from its record low on the same date. Avoidance, both overall and for these specific places, had been increasing prior to the September 6 Labor Day weekend, with overall avoidance peaking at almost three-quarters of consumers in our August 30 survey. We could well see a return to more avoidance once the Labor Day holiday falls out of the survey period. These trends suggest that we will not see a steady return to ever-greater levels of normality, which would have shifted demand from food retail to food service, from spending on the home to spending on leisure services and from athleisure to more formal clothing. Should current patterns continue into the holiday peak, we expect retail to see a net gain as spending shifts from services, albeit probably with pockets of sequentially softening demand—such as within apparel and footwear. Intra-season movements in category demand would heighten inventory challenges for retailers of at-home categories. Any sustained avoidance of retail stores will once again strengthen e-commerce and could drive a consolidation of shopping trips, supporting general merchandise retailers, such as mass merchants and others that combine essentials and discretionary goods.

Figure 6. US Consumers’ Avoidance of Public Places, Selected Options (% of Respondents) [caption id="attachment_132890" align="aligncenter" width="725"]

Base: US respondents aged 18+

Base: US respondents aged 18+ Source: Coresight Research [/caption]