Nitheesh NH

What’s the Story?

In this report, we look ahead to the trends and challenges that we expect to affect last-mile shipping in the run-up to the holiday season.Why It Matters

US retail enjoyed a strong holiday season overall in 2020, with online sales registering growth of 33.5% year over year in the holiday quarter (spanning October, November and December), according to Coresight Research. According to a Coresight Research survey conducted on September 6, 2021, around three-quarters of US consumers said they expect to shop online this holiday season. However, with a more open US economy, we anticipate the 2021 holiday shopping period will experience its own set of challenges. Offshore factory shutdowns, transportation backlogs, labor shortages and a resurgence of Covid-19 cases will continue to disrupt supply chains as we head into the fourth quarter. The last mile could prove to be more challenging for retailers on top of current supply chain disruptions. In its second-quarter earnings call held on July 2021, UPS said that package delivery demand during the 2021 peak season is forecasted to exceed capacity by about five million pieces per day. Guy Bloch, CEO of Bringg, a last-mile logistics and fulfillment solutions company, told Coresight Research that the 2021 holiday season will have its own challenges compared to 2020. Supply chain disruptions coupled with booming consumer demand will create shortages of products and raised prices. It is imperative that retailers draw up last-mile strategies to handle a holiday season that is subject to supply chain disruption and consumer shifts.US Last-Mile Delivery To See Peak Challenges: Coresight Research Analysis

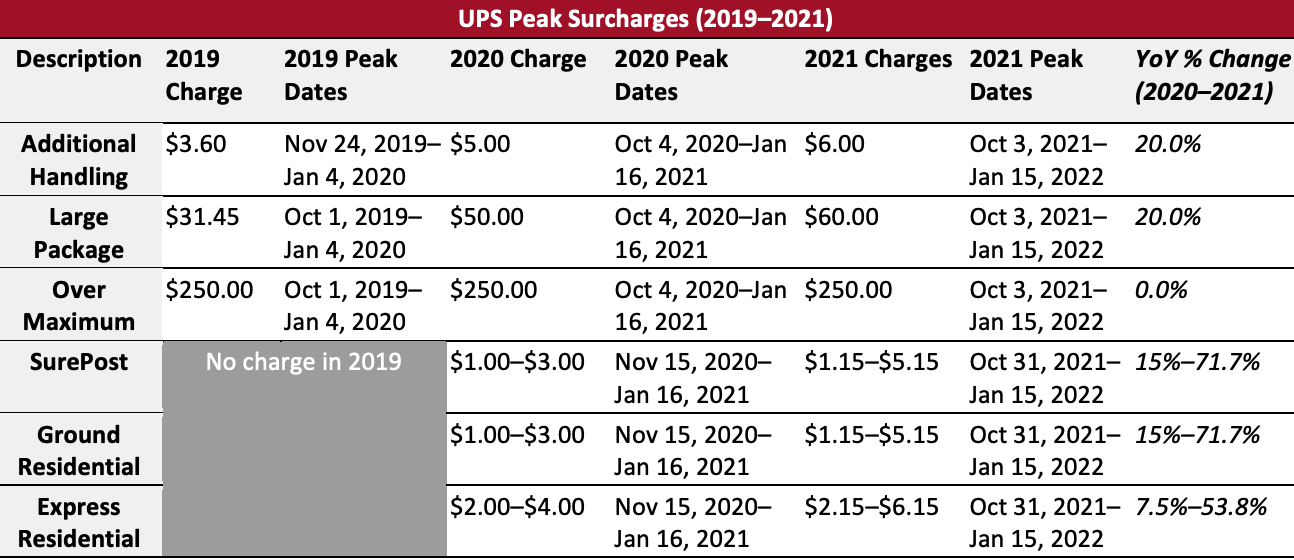

1. Rising Surcharges Will Hit Retailers’ Margins The three largest US shipping carriers—FedEx, UPS and USPS—have all announced peak shipping surcharges and fees as they prepare for another holiday shipping surge. The carriers have said that surcharges are necessary to keep service levels high in the face of increased demand for capacity and higher operating and material handling costs across their networks. Figures 1 and 2 (below) compare the history of UPS and FedEx peak surcharges from 2019 to 2021. As in 2020, UPS is seeking to limit the number of large packages in its network around the peak. Retailers that ship many Large Package, Additional Handling or Over Maximum shipments will again be subject to significant peak increases. In addition, retailers shipping high volumes of residential shipments will also incur aggressive peak surcharges from UPS.Figure 1. UPS Peak Surcharges [caption id="attachment_132971" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

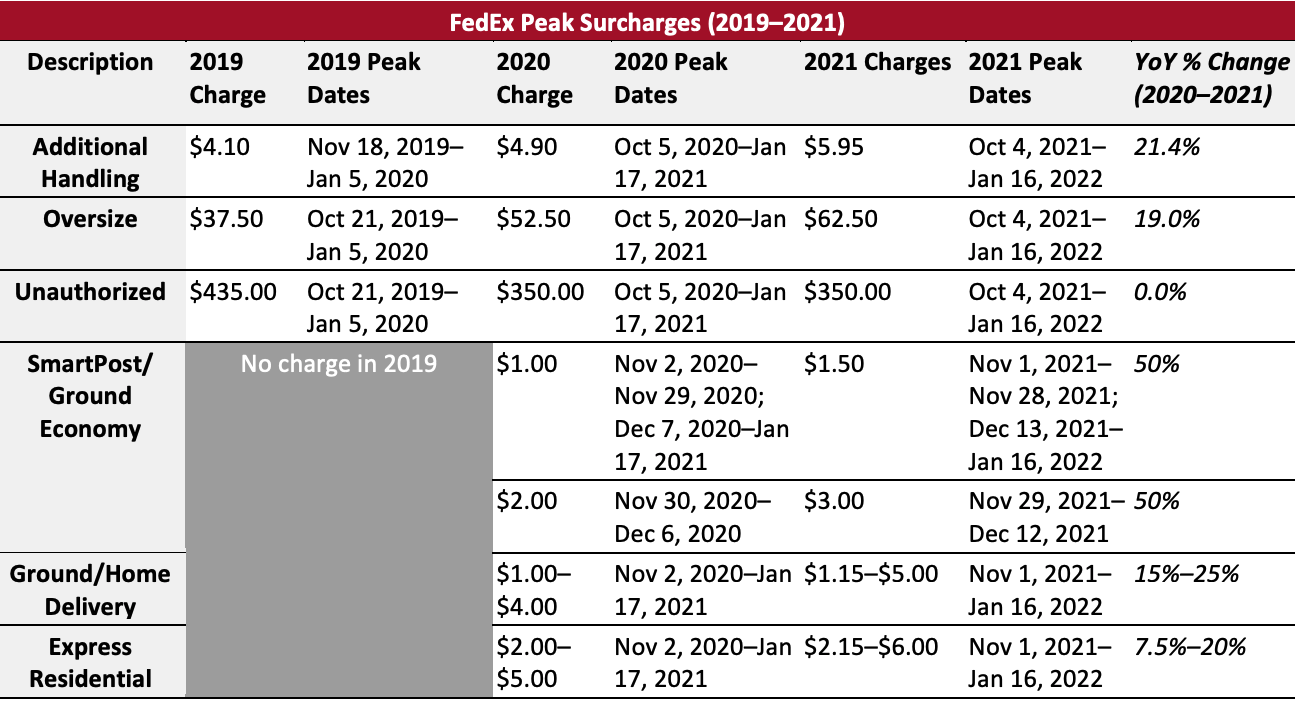

Similarly, 2021 FedEx peak surcharges will have the greatest adverse impact on businesses that ship larger packages that incur Additional Handling, Oversize and Unauthorized surcharges, as well as high-volume residential and FedEx Ground Economy (formerly SmartPost) shippers with average weekly volumes above 25,000 packages.

Source: Company reports/Coresight Research[/caption]

Similarly, 2021 FedEx peak surcharges will have the greatest adverse impact on businesses that ship larger packages that incur Additional Handling, Oversize and Unauthorized surcharges, as well as high-volume residential and FedEx Ground Economy (formerly SmartPost) shippers with average weekly volumes above 25,000 packages.

Figure 2. FedEx Peak Surcharges [caption id="attachment_132972" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Both FedEx and UPS have said that they are prioritizing more profitable shipments from small and medium-sized businesses and plan to impose higher fees on large shippers sending significantly more packages through their system during the holiday season.

USPS has also announced a price rise between $0.25–$5.00 depending on the product and weight. These surcharges will be in effect from October 3 until December 26.

These surcharges come as the retail sector deals with continuing pandemic-related supply chain challenges. The disruption has significantly slowed the delivery of inventory and made importing drastically more costly, contributing to stock shortfalls. The delivery surcharges by courier services will add additional financial pressure on retailers as they decide whether to absorb these price increases or pass them on to consumers.

With the Covid-19 Delta variant causing rising infections across the country, many consumers are rethinking their holiday plans, which will lead to another busy season for package deliveries, potentially stretching their capacity to its limit. In this context, we believe retailers that have strategically invested in bringing last-mile logistics in-house stand to gain from the e-commerce boom with minimal logistics challenges. In-house logistics infrastructure enables companies to control costs, build positive customer experiences, expand their delivery windows, expand their product offering and redirect orders in real time.

2. The Labor Shortfall Will Hamstring Attempts To Increase Capacity

The labor dynamics in the logistics and transportation sector have been strained by the e-commerce surge and increased demand caused by the reopening of the US economy. As the economy emerges from the crisis, the availability of labor has not kept up with the pace of recovery in consumer demand and businesses.

The latest data from the US Bureau of Labor Statistics (BLS) indicate that US job openings rose to 10.3 million in June 2021, up 6.6% month over month, while total hires increased by 5.2% to 7.7 million—indicating 2.7 million unfilled vacancies. Within transportation, warehousing and utilities, the shortfall stood at over 200,000 (as shown in Figure 3). Labor availability in the transportation sector has been volatile in the past 18 months, with the shortfall widening significantly since December 2020.

Source: Company reports/Coresight Research[/caption]

Both FedEx and UPS have said that they are prioritizing more profitable shipments from small and medium-sized businesses and plan to impose higher fees on large shippers sending significantly more packages through their system during the holiday season.

USPS has also announced a price rise between $0.25–$5.00 depending on the product and weight. These surcharges will be in effect from October 3 until December 26.

These surcharges come as the retail sector deals with continuing pandemic-related supply chain challenges. The disruption has significantly slowed the delivery of inventory and made importing drastically more costly, contributing to stock shortfalls. The delivery surcharges by courier services will add additional financial pressure on retailers as they decide whether to absorb these price increases or pass them on to consumers.

With the Covid-19 Delta variant causing rising infections across the country, many consumers are rethinking their holiday plans, which will lead to another busy season for package deliveries, potentially stretching their capacity to its limit. In this context, we believe retailers that have strategically invested in bringing last-mile logistics in-house stand to gain from the e-commerce boom with minimal logistics challenges. In-house logistics infrastructure enables companies to control costs, build positive customer experiences, expand their delivery windows, expand their product offering and redirect orders in real time.

2. The Labor Shortfall Will Hamstring Attempts To Increase Capacity

The labor dynamics in the logistics and transportation sector have been strained by the e-commerce surge and increased demand caused by the reopening of the US economy. As the economy emerges from the crisis, the availability of labor has not kept up with the pace of recovery in consumer demand and businesses.

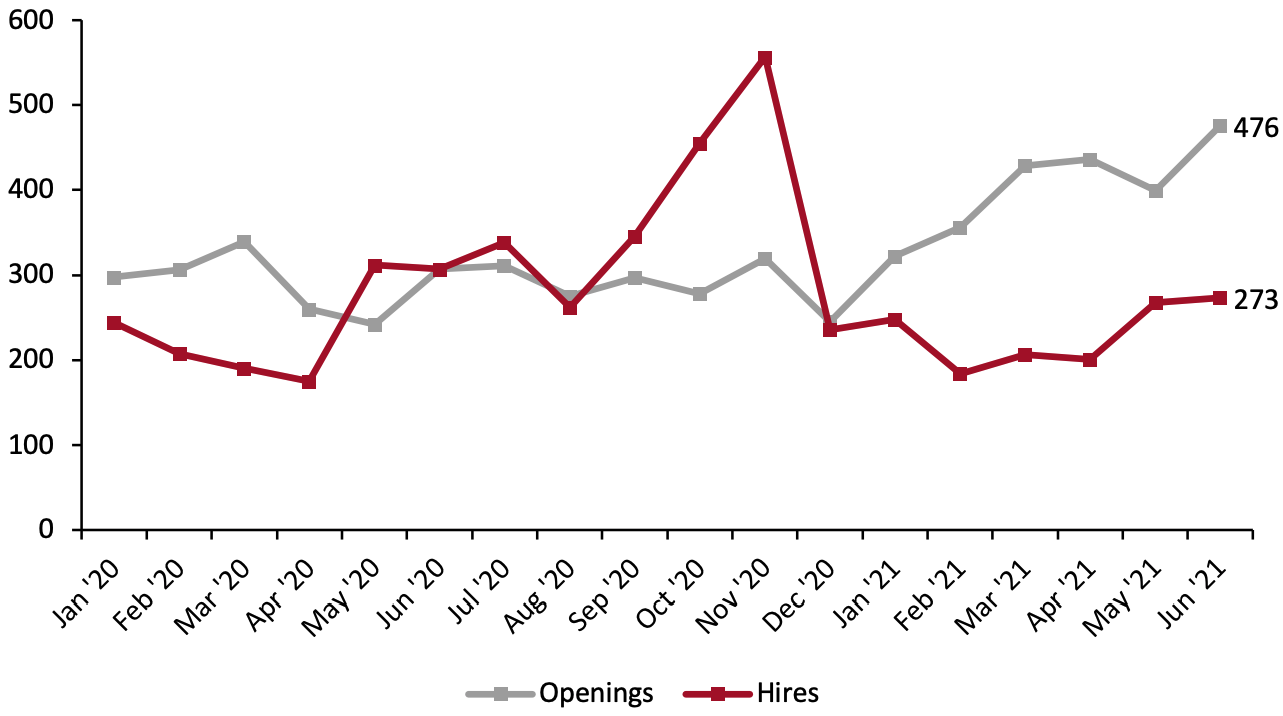

The latest data from the US Bureau of Labor Statistics (BLS) indicate that US job openings rose to 10.3 million in June 2021, up 6.6% month over month, while total hires increased by 5.2% to 7.7 million—indicating 2.7 million unfilled vacancies. Within transportation, warehousing and utilities, the shortfall stood at over 200,000 (as shown in Figure 3). Labor availability in the transportation sector has been volatile in the past 18 months, with the shortfall widening significantly since December 2020.

Figure 3. US: Openings and Hires in Retail Trade and Transportation, Warehousing and Utilities Sector (Thous.) [caption id="attachment_132973" align="aligncenter" width="700"]

Source: Scandit[/caption]

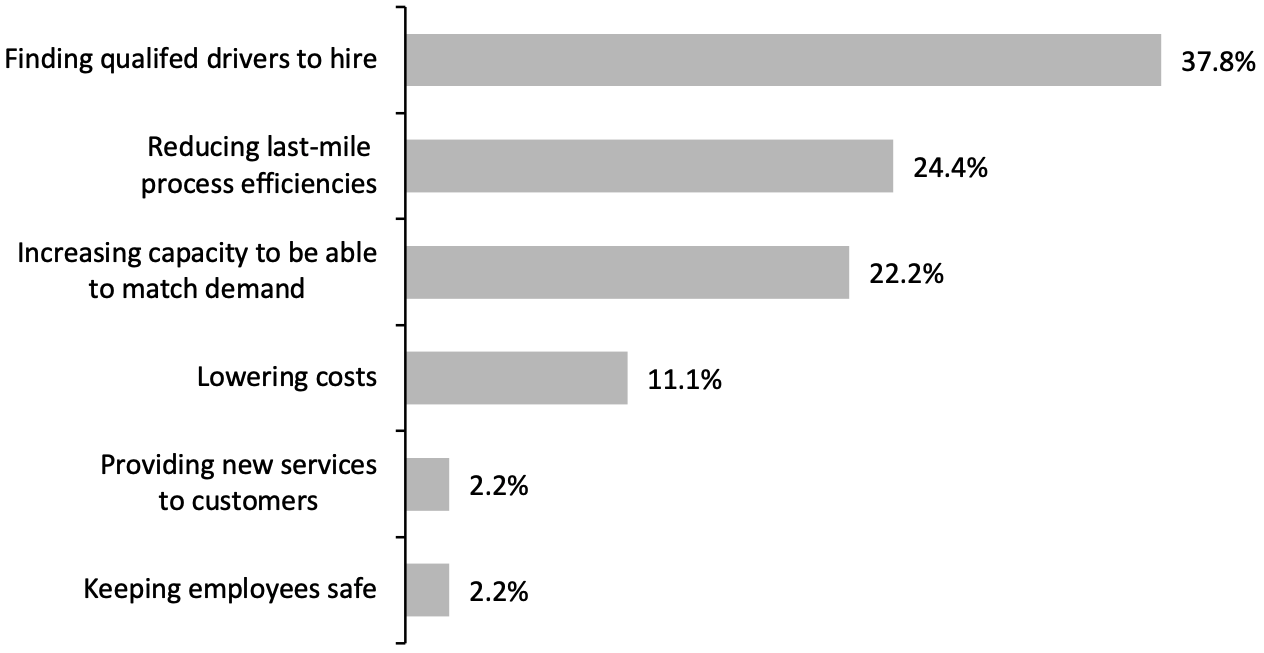

According to last-mile tech firm Scandit’s survey of executives at leading postal, parcel and logistics carriers in North America in spring 2021, 37.8% of respondents identified finding qualified drivers as their biggest delivery challenge. This far outpaced the second concern, reducing last-mile efficiencies, cited by 24.4% of respondents (see Figure 4).

Source: Scandit[/caption]

According to last-mile tech firm Scandit’s survey of executives at leading postal, parcel and logistics carriers in North America in spring 2021, 37.8% of respondents identified finding qualified drivers as their biggest delivery challenge. This far outpaced the second concern, reducing last-mile efficiencies, cited by 24.4% of respondents (see Figure 4).

Figure 4. All Respondents: Single Largest Last-Mile Delivery Challenge for Logistics and Postal Carrier Firms in North America (% of Respondents) [caption id="attachment_132974" align="aligncenter" width="700"]

Source: Scandit[/caption]

We could see a partial easing of labor shortages into the winter, as the impact of stimulus checks fades; however, if the threat of Covid-19 and the Delta variant rises, labor pressures will continue. Retailers and parcel carriers may have to increase wages to compete for a tighter labor pool as they look to increase capacity to meet holiday demand.

3. Customers Prefer Delivery, But BOPIS and Curbside Pickup Will Remain Popular

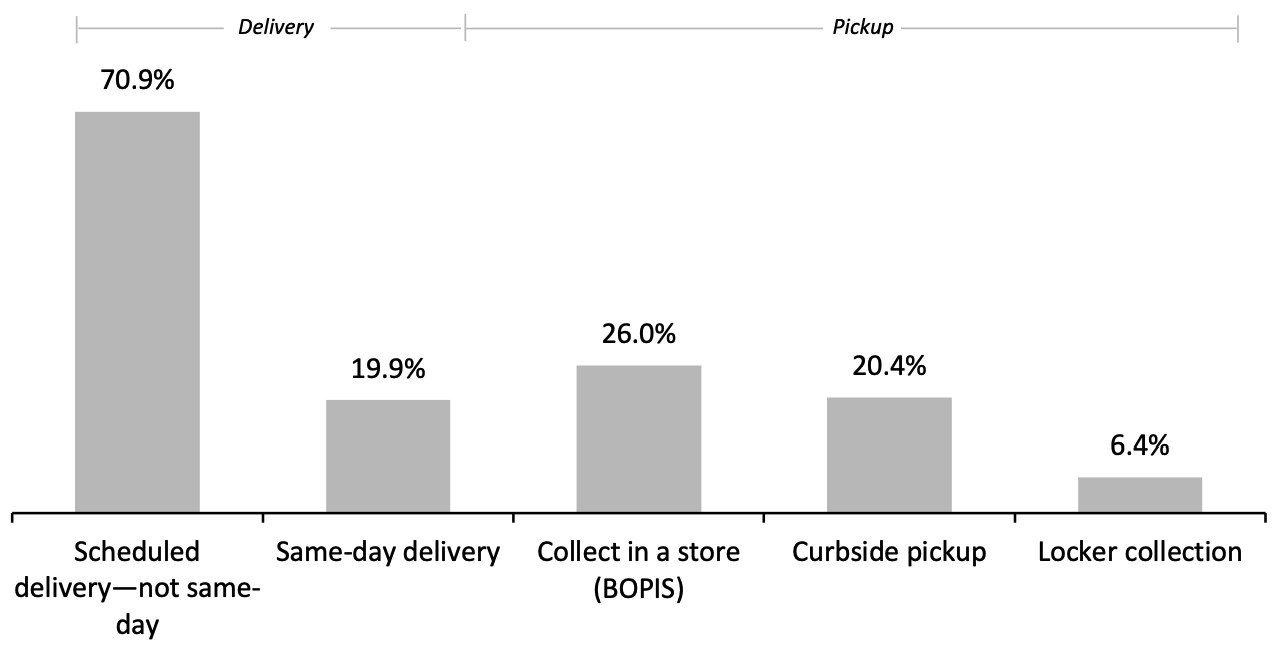

Coresight Research’s survey found that shoppers have a strong preference for delivery over pickup. Some 70.9% of respondents said they would use scheduled delivery to receive their purchases this holiday season, while 19.9% expect to use same-day delivery.

Source: Scandit[/caption]

We could see a partial easing of labor shortages into the winter, as the impact of stimulus checks fades; however, if the threat of Covid-19 and the Delta variant rises, labor pressures will continue. Retailers and parcel carriers may have to increase wages to compete for a tighter labor pool as they look to increase capacity to meet holiday demand.

3. Customers Prefer Delivery, But BOPIS and Curbside Pickup Will Remain Popular

Coresight Research’s survey found that shoppers have a strong preference for delivery over pickup. Some 70.9% of respondents said they would use scheduled delivery to receive their purchases this holiday season, while 19.9% expect to use same-day delivery.

Figure 5. Respondents Who Expect To Shop Online This Holiday Season: The Mode of Fulfillment They Expect To Use (% of Respondents) [caption id="attachment_132975" align="aligncenter" width="700"]

392 US respondents aged 18+ who will or may shop online in the 2021 holiday season

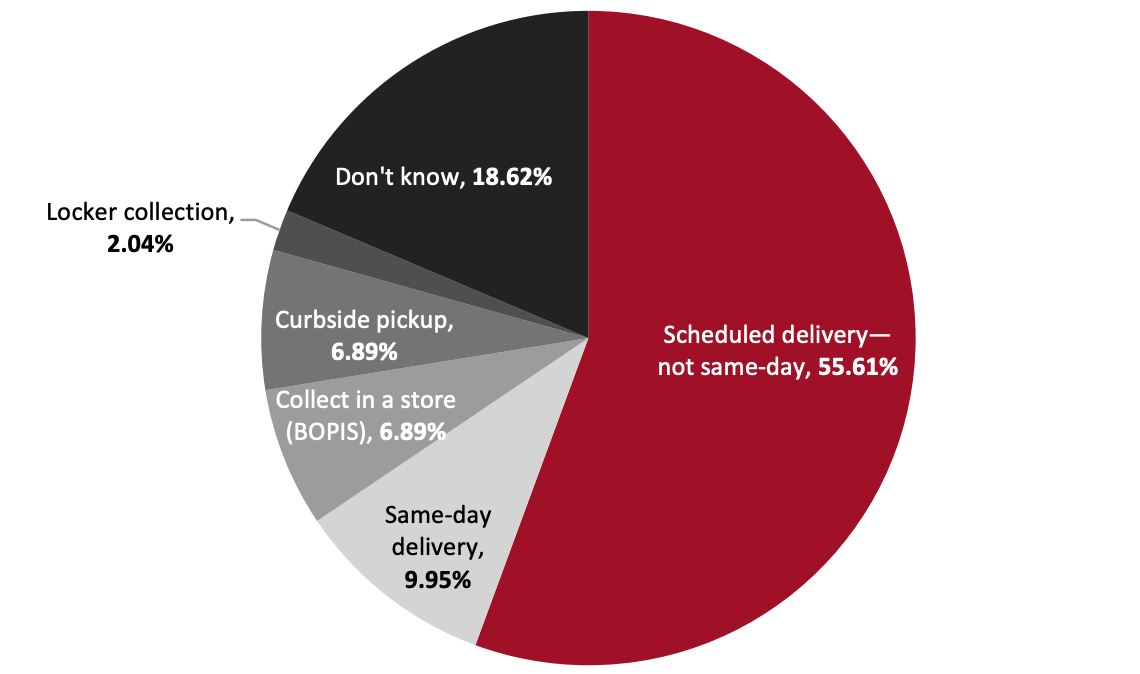

392 US respondents aged 18+ who will or may shop online in the 2021 holiday seasonSource: Coresight Research[/caption] Additionally, more than half of respondents who expect to use the above fulfillment methods said they would prefer scheduled delivery for their holiday purchases.

Figure 5. Respondents Who Expect To Shop Online This Holiday Season: Preferred Method To Receive Purchases This Holiday Season (% of Respondents) [caption id="attachment_132976" align="aligncenter" width="600"]

392 US respondents aged 18+ who will or may shop online in the 2021 holiday season

392 US respondents aged 18+ who will or may shop online in the 2021 holiday seasonSource: Coresight Research[/caption] Despite these survey results, retailers should not neglect pickup. Consumers used BOPIS and curbside pickup a great deal more in last year’s holiday shopping season, and despite their professed preferences we expect it to stay popular this holiday season as well; consumers’ survey responses underestimate the volume of unplanned and last-minute shopping that will take place. We expect alternatives to delivery will see higher adoption as consumers try to circumvent transportation delays and surcharges—factors they may not have foreseen when answering the survey. Retailers that did not perfect their BOPIS and curbside pickup services in time for last year’s holiday season have the opportunity until October to fine-tune their pickup services. To remain competitive in this space, retailers should leverage technology to refine their approaches to BOPIS and curbside pickup—such as by solving queuing and overcrowding issues at stores and decreasing wait times. 4. Alternative Delivery Providers Have an Opportunity To Impress As in 2020, retailers will rely on parcel carriers to deliver a large portion of their volume. The strained capacity of carriers has offered opportunities for alternative third-party delivery providers to emerge as viable options. Bloch advised that businesses should work with multiple delivery partners for the sake of flexibility as demand goes through peaks and troughs. Loads in excess of what a retailer’s fleet can manage can be sent automatically to third-party fleets. Ideally, and with enough forward planning, the retailer can assign loads to its in-house and third-party fleets according to its own business logic (for example, premium delivery options for subscribed customers) and operational needs. Launched in August 2021, The Frontdoor Collective (FDC) is a new network of franchised independent delivery service providers, offering its franchisees logistics and technological support, electric delivery vehicles and competitive returns. The company claims it can deliver over one million packages per day and offer same-day and next-day services. Most of the delivery companies that have joined FDC employ up to 120 drivers running 20–60 routes daily. The company claims to reach 90% of residences and businesses in the US and Canada and hopes to expand its network to around 300 franchisees by the end of 2021. It said that many retailers with last-mile delivery requirements had shown interest in the service. Walmart has introduced Walmart GoLocal, a new program that will allow small and medium-sized businesses to leverage the company’s robust logistics network and its Spark network of third-party drivers. The company said that its Spark Network covers more than 500 US cities and is “competitively priced.” Walmart will act as a white label service provider, using its clients’ branding. Retailers are also increasingly turning to on-demand delivery service providers such as Instacart and DoorDash, as well as Uber Direct (launched in January 2021 to offer last-mile package delivery), to shore up capacity. These on-demand services—many of which originally delivered groceries or takeout meals—started working with other categories of retailers during the pandemic. For example, in July 2021, home goods retailer Bed Bath & Beyond partnered with the crowdsourced delivery platform Roadie to make same-day deliveries for the retailer’s Bed Bath & Beyond and BuyBuyBaby.com brands. Their gig-workforce model offers a more agile delivery solution and helps to localize the supply chain even further.

What We Think

This year, retailers must prepare for another challenging holiday shopping season. As they navigate the unchartered territory of a post-pandemic marketplace, consumers’ holiday shopping behavior will be difficult to predict, as pandemic-driven and recovery-driven factors interact. Retailers that optimize their last-mile strategies now will be positioned to thrive this holiday season. Bloch recommends that retailers identify areas that can be automated and work to add transparency, optimize communications across the supply chain network and digitize inventory management (for improved visibility of inventory levels at each location), to meet customers’ new expectations of speed, price and availability. Implications for Retailers- Carrier diversity will be a key for retailers preparing for this year’s peak season. Retailers should look to regional carriers and alternative delivery providers to supplement their main carrier to take on additional shipping volumes.

- Retailers must ensure their delivery infrastructure is robust, as delivery is consumers’ preferred channel; however, we expect BOPIS and curbside pickup to see high adoption during the holiday season. Retailers may need to optimize store space and surrounding areas to better support these services.

- We expect small and medium-sized retailers as well as some large retailers to increasingly rely on companies such as Walmart that are offering delivery-as-a-service, especially amid a nationwide driver shortage and heightened demand.

- As in 2020, we expect to see more job openings for last-mile delivery, including rapid/same-day delivery and warehousing and logistics compared to traditional retail hires. Many retailers will likely shift their hiring to meet the demand posed by pandemic-driven online shopping.

- Technology vendors will need to work closely with retailers to ensure that routing optimization platforms are tuned and remain flexible in case of shifts in demand or shortages in the run up to the holiday season.

- Technology vendors can capitalize on retailers’ efforts to leverage innovation and technology in their last-mile logistics to keep up with pandemic-induced trends, improve their margins and retain customer loyalty.